Dogecoin (DOGE) has been on a rather rough ride recently. Dogecoin’s daily chart was overly bearish, with trading volumes lagging and investor sentiment growing negative.

In light of the recent downturn in Dogecoin’s fortunes, many investors are grappling with whether it’s time to cut their losses and move on.

The bearish trend in the Dogecoin daily chart has cast a cloud of uncertainty over the future of this once-popular cryptocurrency.

As the popular meme coin struggles to regain a foothold, investors must be wondering what factors contributed to its decline.

Uncertainty looms as Dogecoin faces a price drop

DOGE has experienced a bearish breakout from its previous price consolidation range since May 8, according to Trade view. This comes after DOGE hit the price cap near $0.1000 on April 18, after which it experienced a price drop.

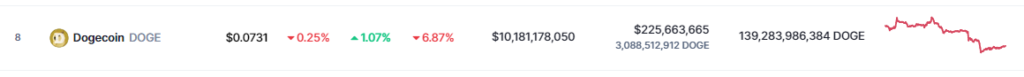

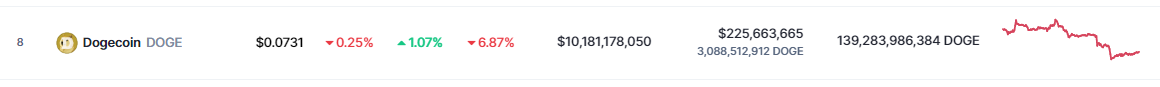

The current DOGE price of $0.0731 at CoinGecko suggests a mixed bag of fortunes, with a slight rise of 1.07% in the past 24 hours and a slump of 6.8% in the past seven days.

Source: CoinMarketCap

However, the overall trend points to a decline in value of more than 20% since the second half of April.

Investors are now wondering if the price drop is temporary or a sign of more trouble for the meme-inspired cryptocurrency.

Source: Coingecko

DOGE has always been a volatile investment option, with the price going through several cycles of ups and downs.

However, the recent drop in the coin’s price is particularly concerning, as it appears to be part of a larger trend of bearishness in the cryptocurrency market.

On low trading volumes and sudden price swings

The recent bearish breakout and price drop of Dogecoin has left traders wondering what lies ahead. With the cryptocurrency market in flux, it is important to keep a close eye on the factors that could influence DOGE’s price movements in the coming days and weeks.

An important factor to pay attention to is the trading volume. Low trading volumes can make DOGE vulnerable to sudden price swings, which can cause a sharp rise or fall in price.

In addition, negative sentiment towards DOGE could exacerbate the current bearish trend as more traders become hesitant to invest in a cryptocurrency that appears to be losing momentum.

DOGE total market cap slightly above the $10 billion level. Chart: TradingView.com

Another factor to consider is the broader cryptocurrency market. DOGE’s performance is often close to each other linked to general market sentimentso major changes in the market can have a significant impact on the coin’s price movements.

In particular, news or developments related to major cryptocurrencies such as Bitcoin and Ethereum could affect DOGE’s price trends.

While DOGE always has the potential to bounce back, sellers could gain more ground if low trading volumes and bearish sentiment continue in the days and weeks to come.

-Featured image from PetHelpful