- The price of Dogecoin has risen by more than 14% in the past seven days.

- Market indicators and some metrics looked bearish for DOGE.

Dogecoin [DOGE] Bulls have continued their play as the world’s largest memecoin hit a 34-day high. This became possible thanks to the double-digit price increase over the past week.

Let’s take a look at the current state of the memecoin to see if a further price increase is possible in the coming days.

Dogecoin’s latest achievement

CoinMarketCaps facts revealed that the price of Dogecoin has risen by more than 14% in the past seven days. The bullish price trend also continued over the past 24 hours, with the value rising by more than 4%.

At the time of writing, DOGE was trading at $0.1369 with a market cap of over $19.88 billion, making it the 8th largest crypto.

Thanks to the bulls, DOGE’s price hit a 34-day high. The bullish price action also had a positive impact on Dogecoin’s social metrics.

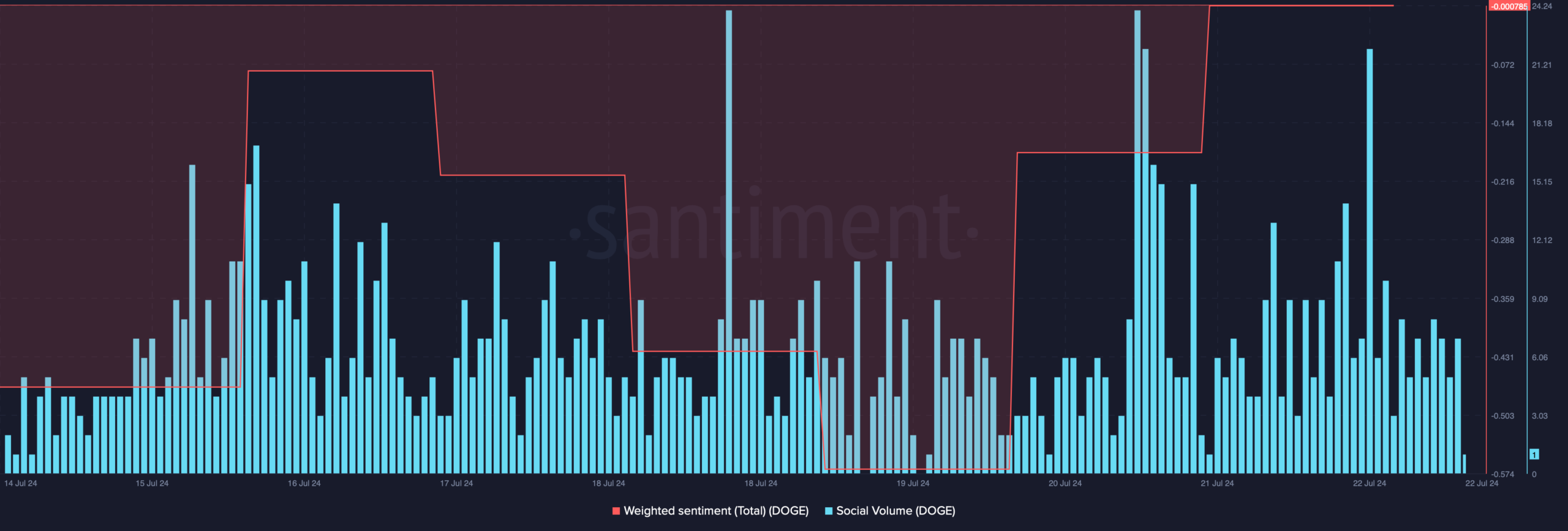

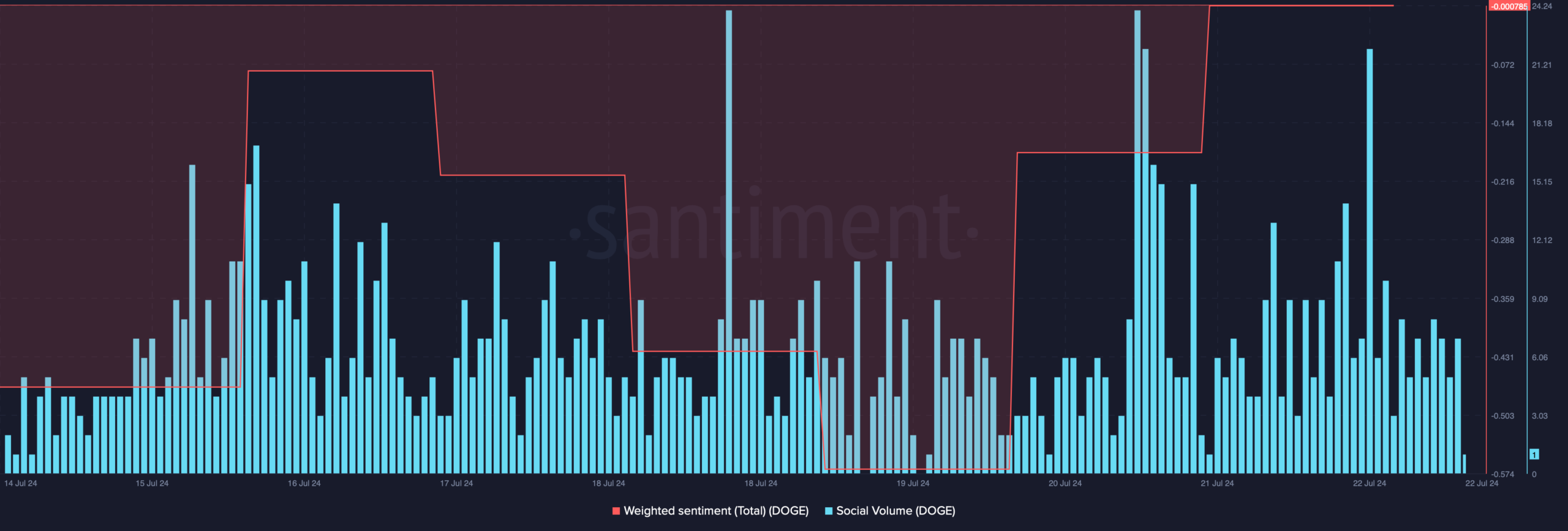

For example, social volume increased, reflecting a rise in popularity. Furthermore, weighted sentiment improved, meaning bullish sentiment around the coin increased in recent days.

Apart from this, IntoTheBlock’s facts revealed that almost 50 million Dogecoin addresses made profits, which accounted for 77% of the total number of addresses.

Source: Santiment

Will the DOGE bull rally continue?

AMBCrypto then checked Dogecoin’s on-chain metrics to see if they hinted at a continued price increase, which could allow DOGE to reach new milestones.

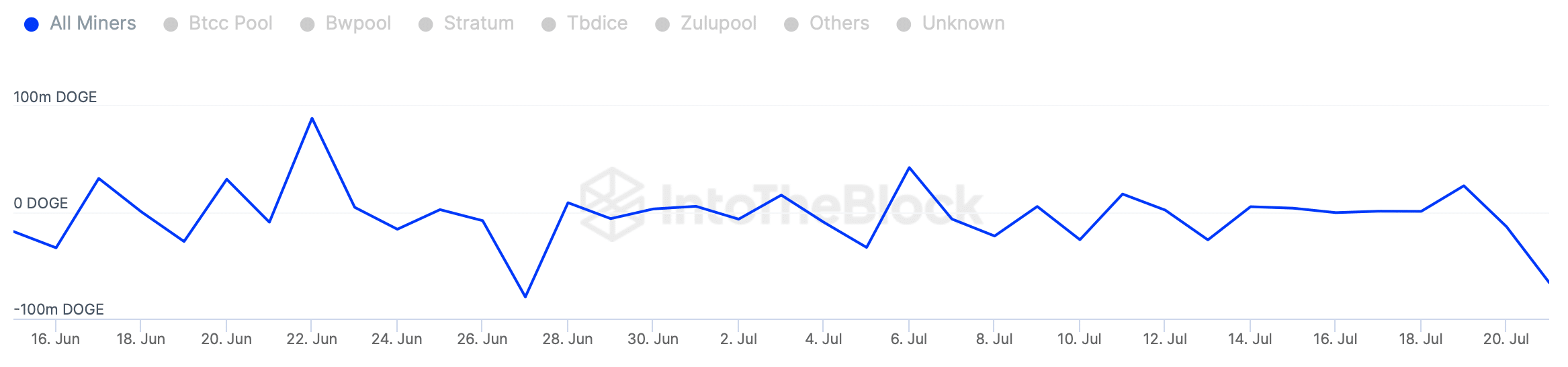

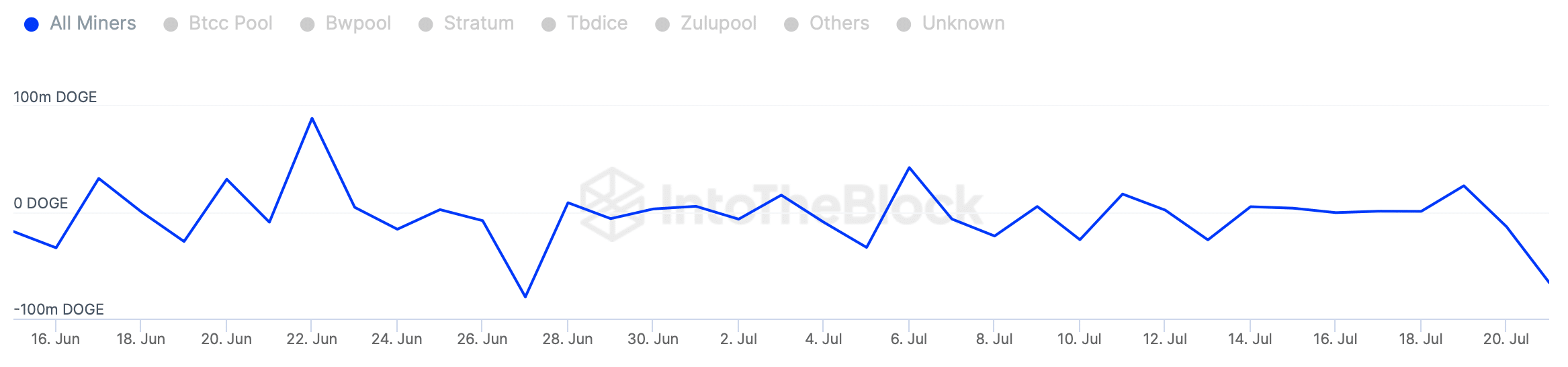

We found that DOGE miners had doubts about the memecoin. This appeared to be the case as DOGE’s miner netflow suggested a sell-off.

Source: IntoTheBlock

The memecoin’s derivatives metrics also looked quite worrying. For example, according to our look at Coinglass’ factsDogecoin’s long/short ratio registered a sharp decline.

A decline in the measure means that there were more short positions in the market than long positions, indicating that bearish sentiment is rising.

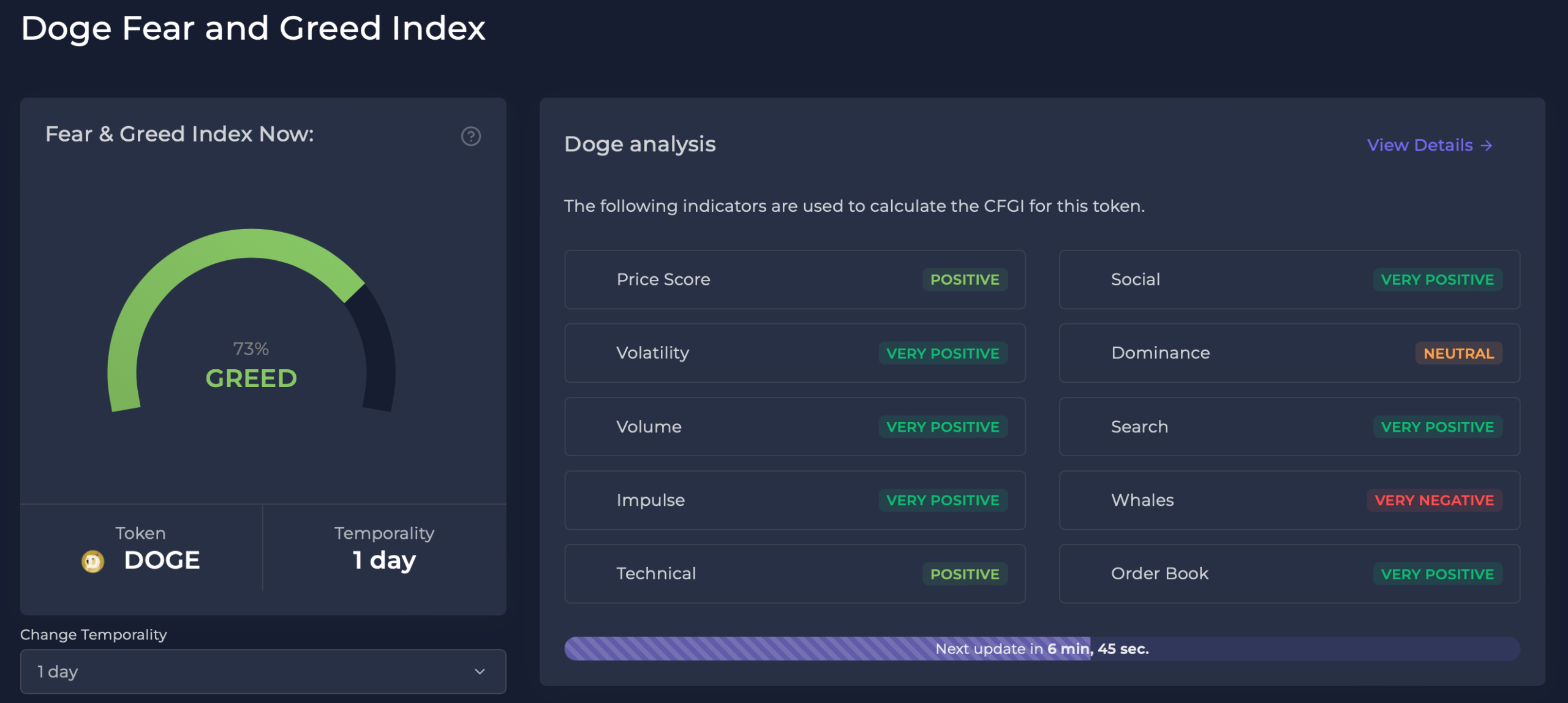

At the time of writing, DOGE’s fear and greed index was at 73%, meaning the market was in a greed phase.

When the measure reaches this level, it suggests that the likelihood of a price correction is high.

Source: CFGI.io

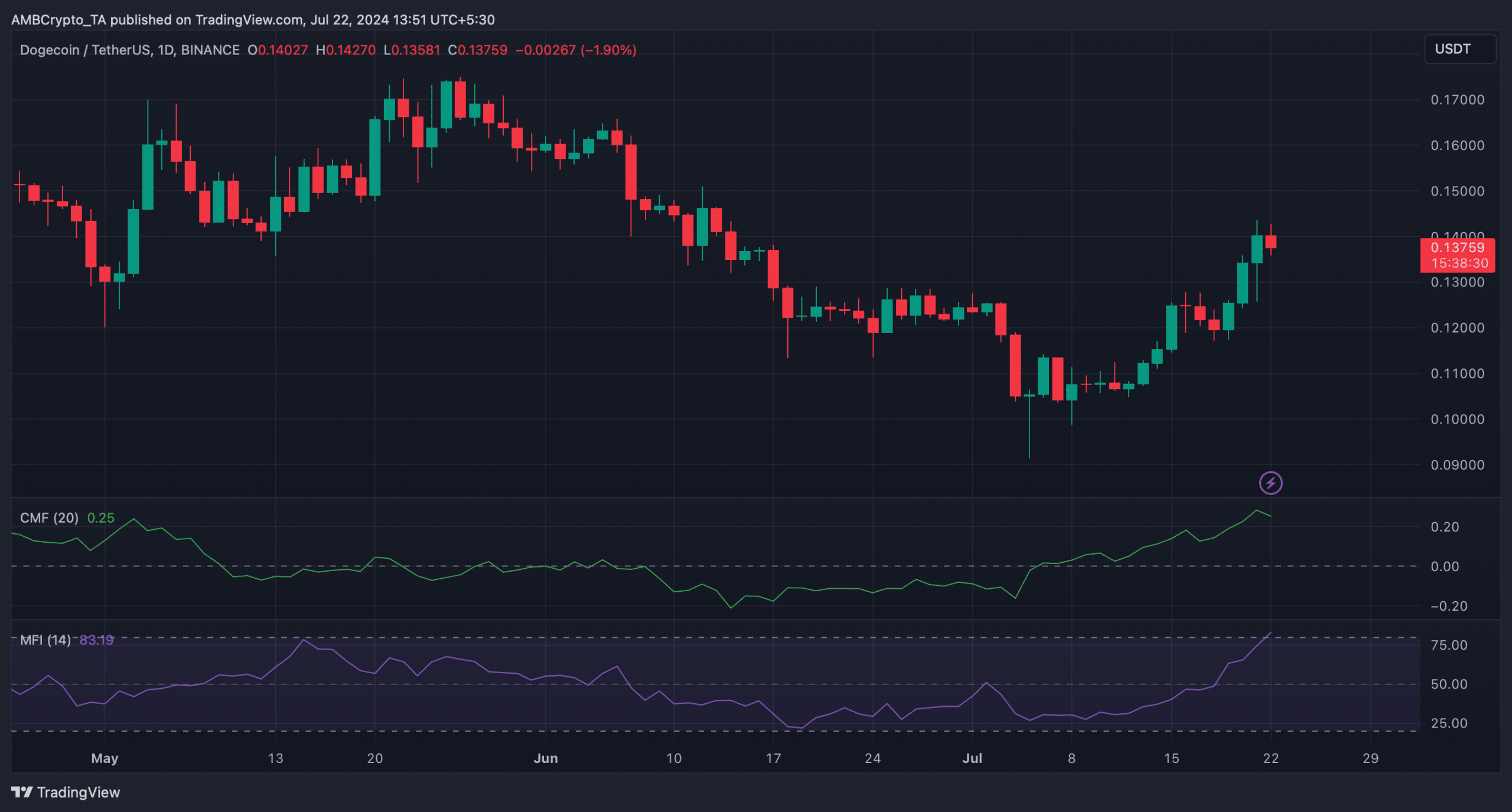

We then looked at DOGE’s daily chart to better understand whether it would experience a price correction soon.

Read Dogecoins [DOGE] Price prediction 2024-25

Our analysis showed that DOGE’s Chaikin Money Flow (CMF) registered a decline after a sharp increase.

Furthermore, the coin’s Money Flow Index (MFI) entered the overbought zone. This could increase selling pressure on DOGE and in turn drive the price lower in the coming days.

Source: TradingView