- The price of Dogecoin struggled at $ 0.18 support – Whales and network activity can indicate a breakout.

- MacD and RSI showed Bearish trends – if Doge does not break $ 0.29, further decreases are likely.

Dogecoin [DOGE] Recently shown mixed price promotion, after a correction that has wiped out his earlier profit.

Priced $ 0.1681 At the time of the press, Dogecoin has a 24 -hour trade volume of $ 844 million, which reflects a change of -0.43% in the last 24 hours, but an increase of 3.24% compared to the past week.

Although the Dogecoin price has recently fallen, there is careful optimism that it could bring itself back to $ 0.29. These prospects are supported by important technical levels and market dynamics.

Dogecoin has confronted several corrections and withdrawn from his recent highlights. However, analysts believe that $ 0.29 can be feasible in the short term.

The prediction depends on the proximity of doge to the 20-day exponential advancing average (EMA), which could act as a support level for future price movement.

Traders keep a close eye on this level for signs of stability, which can indicate a potential rally. However, if Doge does not break above the EMA, further falls could follow.

According to Igor BondarenkoIf Doge is struggling to win at this level, the prize can fall to $ 0.10 and present a bearish scenario for the cryptocurrency.

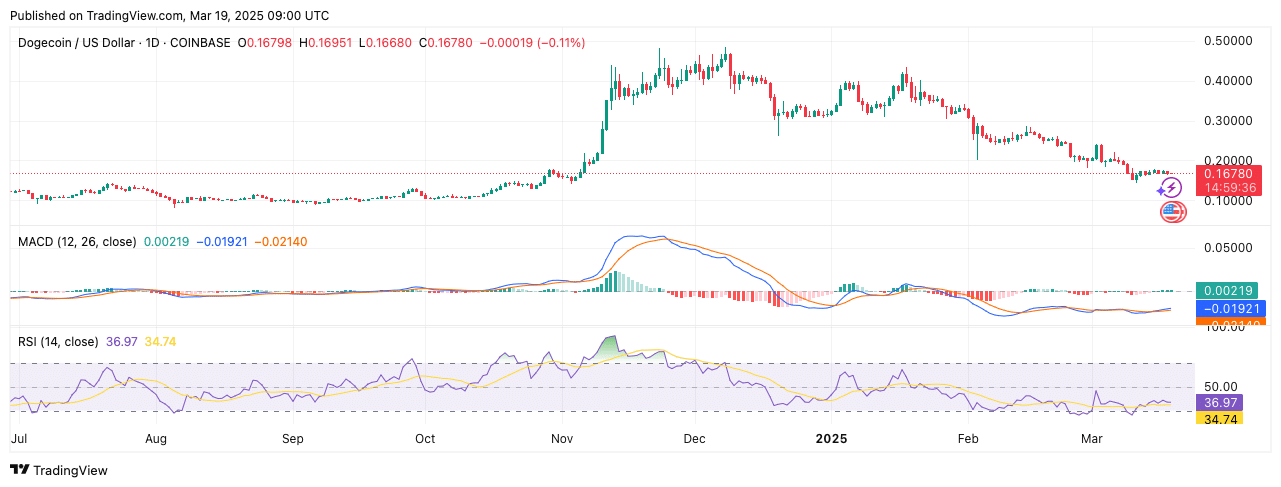

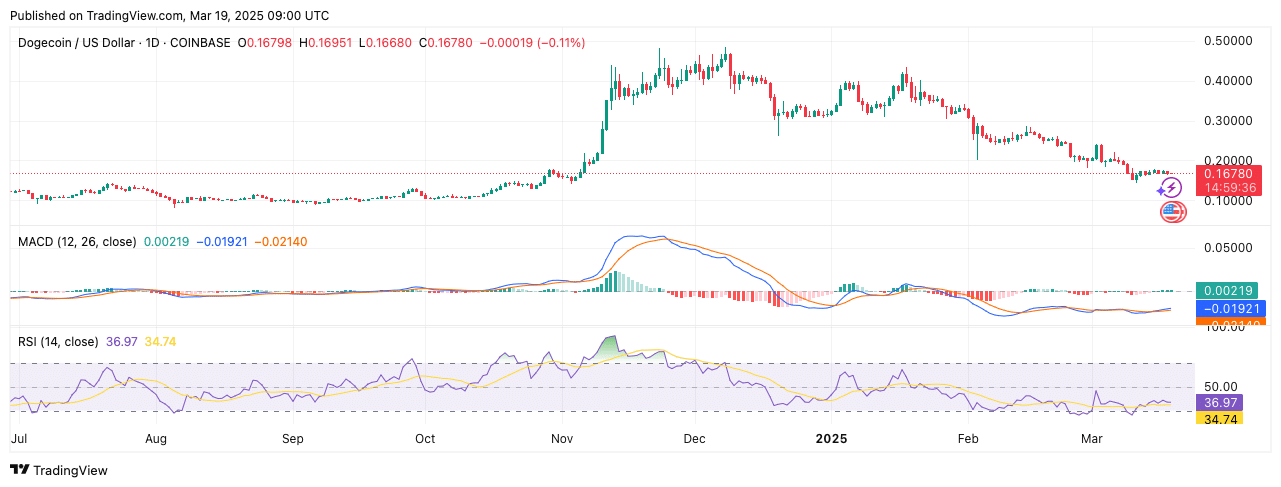

Beerarish Momentum in MacD and RSI

At the time of writing, the MACD indicator showed a bearish trend for Dogecoin. The MACD line (blue) was under the signal line (orange), which suggests a lack of upward momentum.

Moreover, the histogram usually remains negative, which strengthens the prevailing weakness in the market.

Source: TradingView

The RSI was at 36.97, just below the neutral 50 marking. This level suggests that Doge is located in the over -sold area, which can indicate further sales pressure if it continues to fall below 30.

If the RSI is younger than 40, the market may experience continuous weakness, which may lead to further corrections.

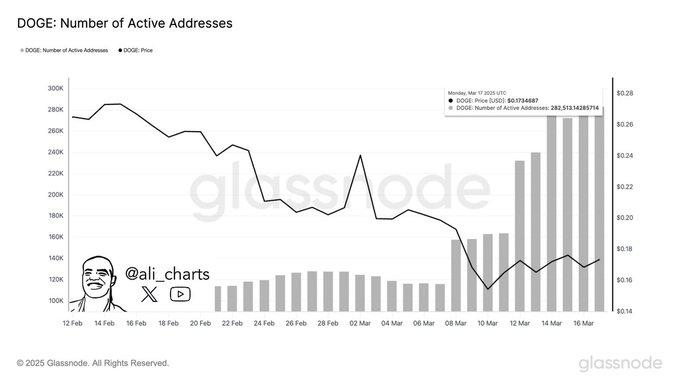

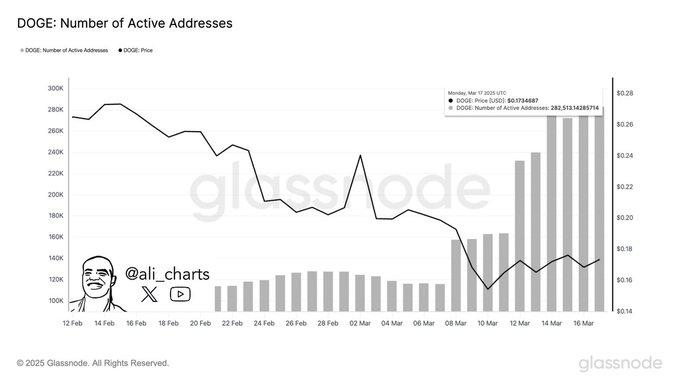

Whale activity and network participation

Despite the Bearish signals, the Dogecoin network has demonstrated an increased activity. According to Crypto Analyst Ali MartinezThere has been a remarkable increase in active addresses, which rises from 150,000 on 12 March to more than 280,000 by 14 March.

Source: X

The peak in activity coincided with a price increase from $ 0.16 to $ 0.26, which suggests that higher network participation yielded demand.

However, the price retrieved later, indicating that the first enthusiasm decreased.

Moreover, large transactions were purchased within a week as whales bought more than 110 million doge. This inflow of major players supported a bullish trend in the short term, but also hinted that some purchasing pressure was temporary.

The subsequent price racement suggests that taking profit or market corrections may have influenced the recession.

Source: X

Resistance and support levels

While Dogecoin goes through this phase of uncertainty, there are important resistance and support levels crucial. The price reached $ 0.202 on March 6, which remains a strong resistance level.

A interruption above this level may indicate a continuation of the Bullish TrendBut not doing this can lead to further consolidation or falls.

On the other hand, $ 0.18 emerged as a critical level for Dogecoin. If the price breaks below this level, this can suggest a Bearish market shift and lead to further downward pressure.

Finally, because the market remains volatile, in the coming days will be crucial in determining the next major Dogecoin movement.