- Dogecoin broke out of a bullish pennant, with analysts eyeing a potential price target of $2.77.

- Whale activity peaked with 588 trades over $1 million, indicating increased interest and near-term price volatility.

Dogecoin [DOGE] waIt shows strong market activity, supported by rising large trades and bullish technical patterns.

DOGE gained attention after the Department of Government Efficiency, led by Elon Musk, added Dogecoin’s logo to its official website. During Trump’s inauguration, Musk reiterated his support for the cryptocurrency, saying, “We’re taking DOGE to Mars.”

DOGE is up 2.01% in the past 24 hours to $0.3778, with a rise of 9.57% over the past seven days.

Dogecoin’s market capitalization now stands at $55.98 billion, supported by a circulating supply of 150 billion coins and a 24-hour trading volume of $9.93 billion.

Whale activity and network growth

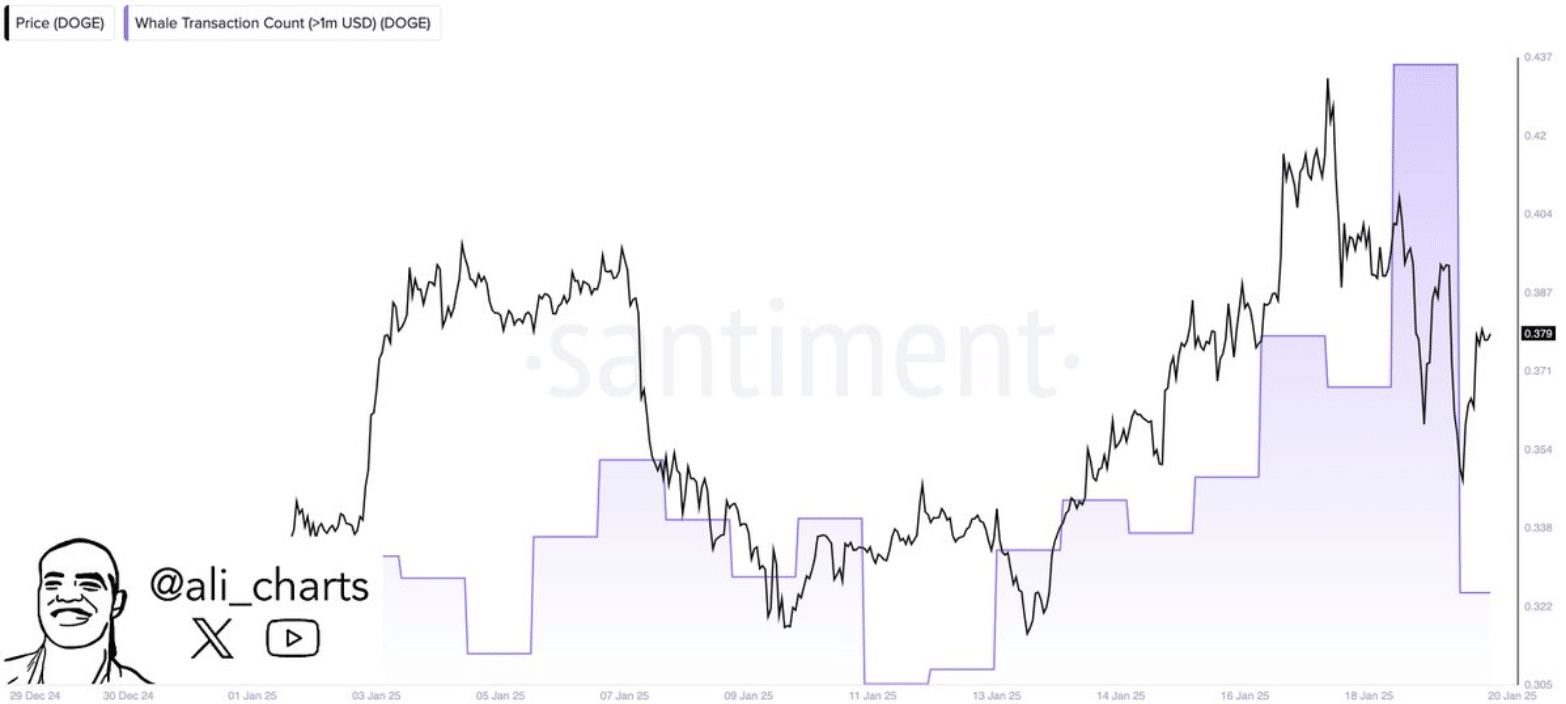

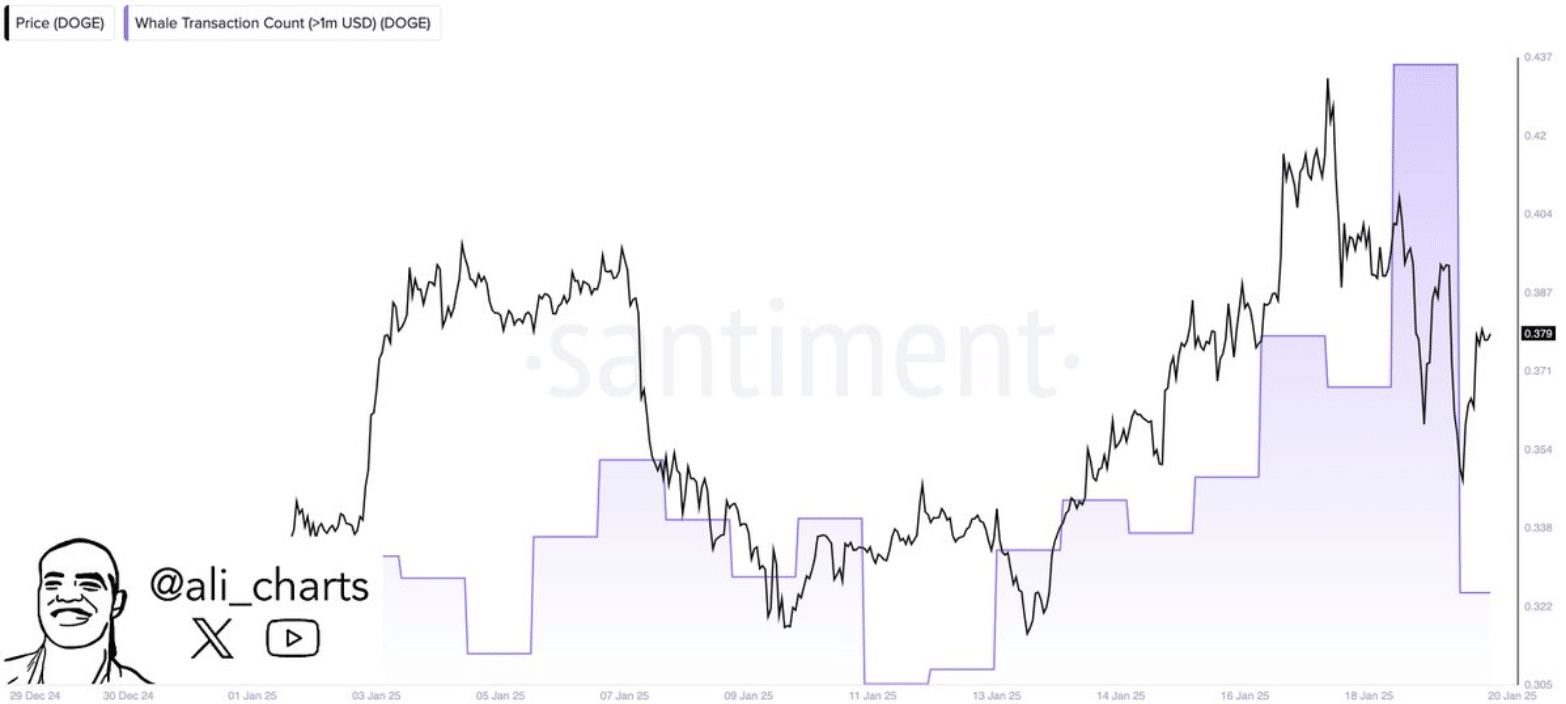

Whale transactions have soared on the Dogecoin network, with 588 transactions of more than $1 million recorded in the past 24 hours, according analyst Ali.

This uptick indicates increased interest from large-scale investors and traders.

Source: Ali/X

However, Whale Alert reported a transaction of 400 million DOGE, worth approximately $137 million, which will be transferred to Binance.

Historically, such transfers to exchanges can signal potential sell-offs, leading to market caution among participants.

Traders will be watching these developments closely to gauge potential near-term price movements.

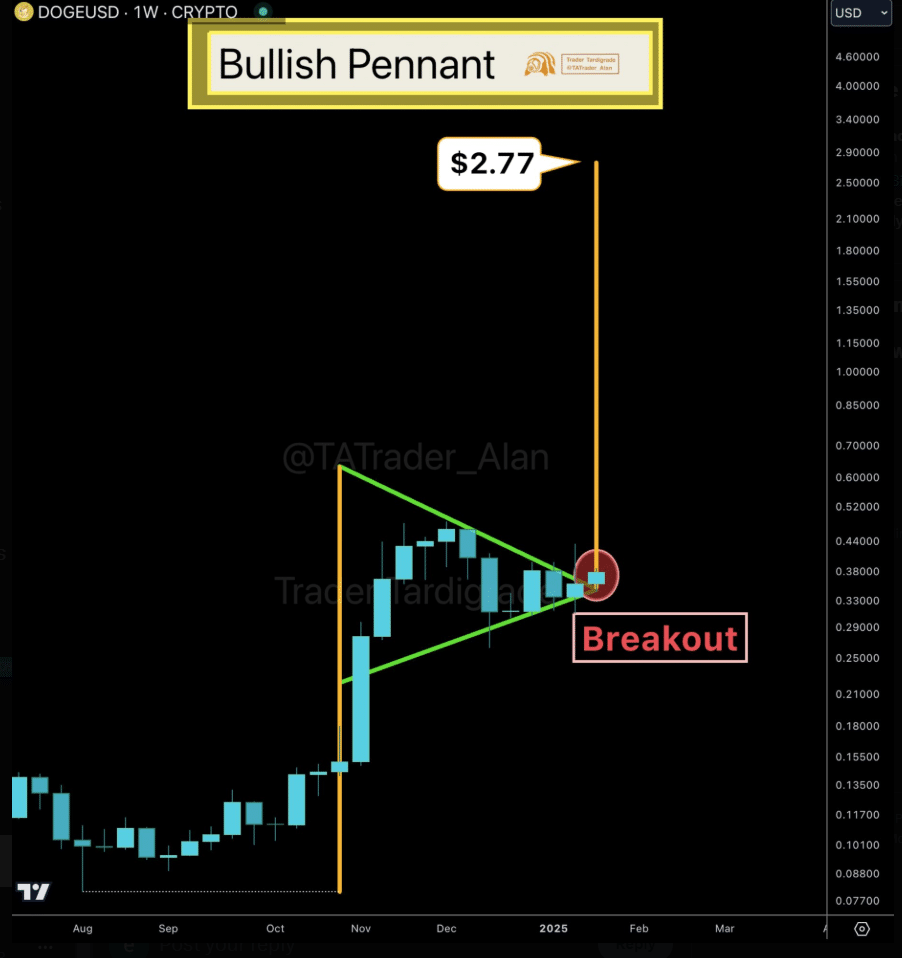

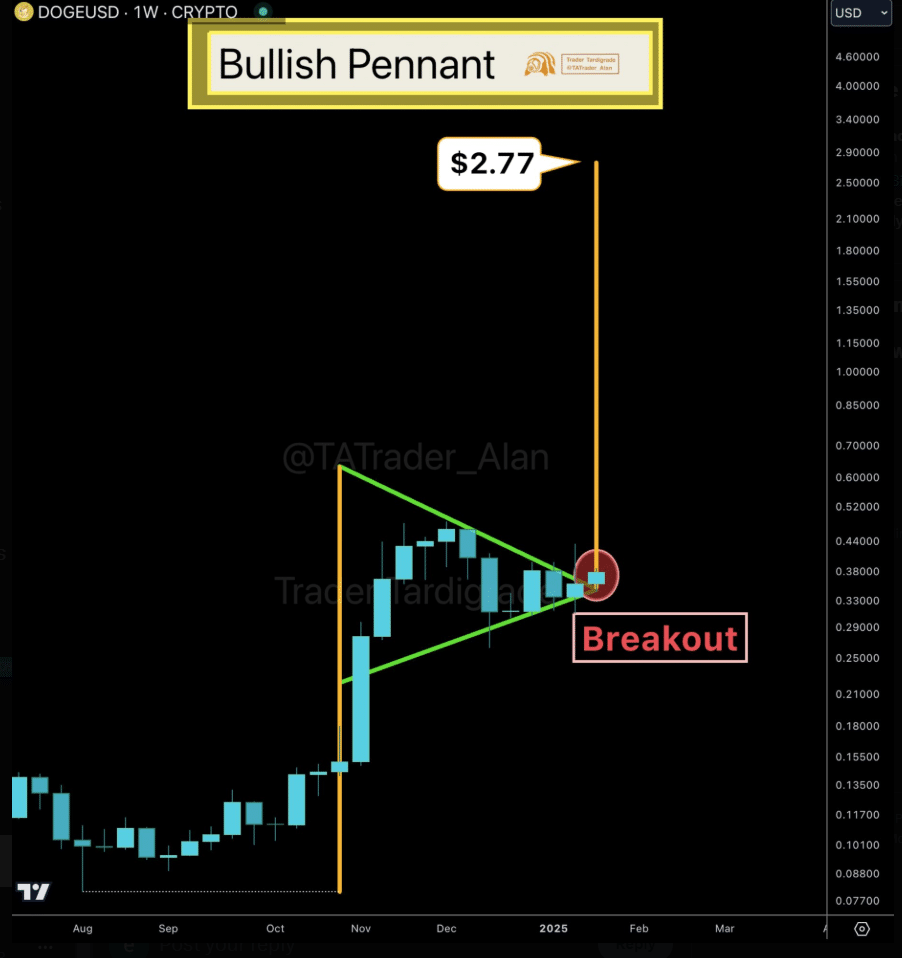

The bullish pennant breakout signals further upside potential

On the weekly chart, Dogecoin has broken the bullish pennant pattern, indicating a possible continuation of the uptrend.

According to Trader TardigradeThe pattern’s measured target is $2.77, which represents major upside potential from current levels.

Source: Trader Tardigrade/X

The breakout has confirmed the bullish momentum, with the earlier rally providing the pennant’s flagpole. Sustained volume is critical to validate this breakout and hit the price target.

Short-term price movements and key levels

The DOGE/USD 4-hour chart shows the price trading near the lower Bollinger Band at $0.3754, indicating oversold conditions.

The Money Flow Index (MFI) at 35.10 supports this view as it approaches the oversold zone.

Source: TradingView

Immediate resistance is at the centerline of the Bollinger Bands at $0.37679 and the upper band at $0.41346. Clearing these levels is critical for DOGE to regain bullish momentum.

If the price fails to hold the current support, it could test the lower Bollinger Band at $0.34. A move above $0.41 could reignite upside momentum.

Future prospects for Dogecoin

Dogecoin’s network and price activity reflects increasing momentum driven by large trades and bullish technical outlook.

Realistic or not, here is DOGE’s market cap in BTC terms

While whale activity brings some caution, analysts are optimistic about the long-term trajectory, with a possible price target of $2.77 if bullish patterns continue.

Traders see the $0.41 resistance and whale behavior as critical indicators of the cryptocurrency’s next move.