- The bullish sentiment surrounding DOGE disappeared as the price fell.

- DOGE could rise to $0.09 if the bulls capitalize on the rising buying momentum.

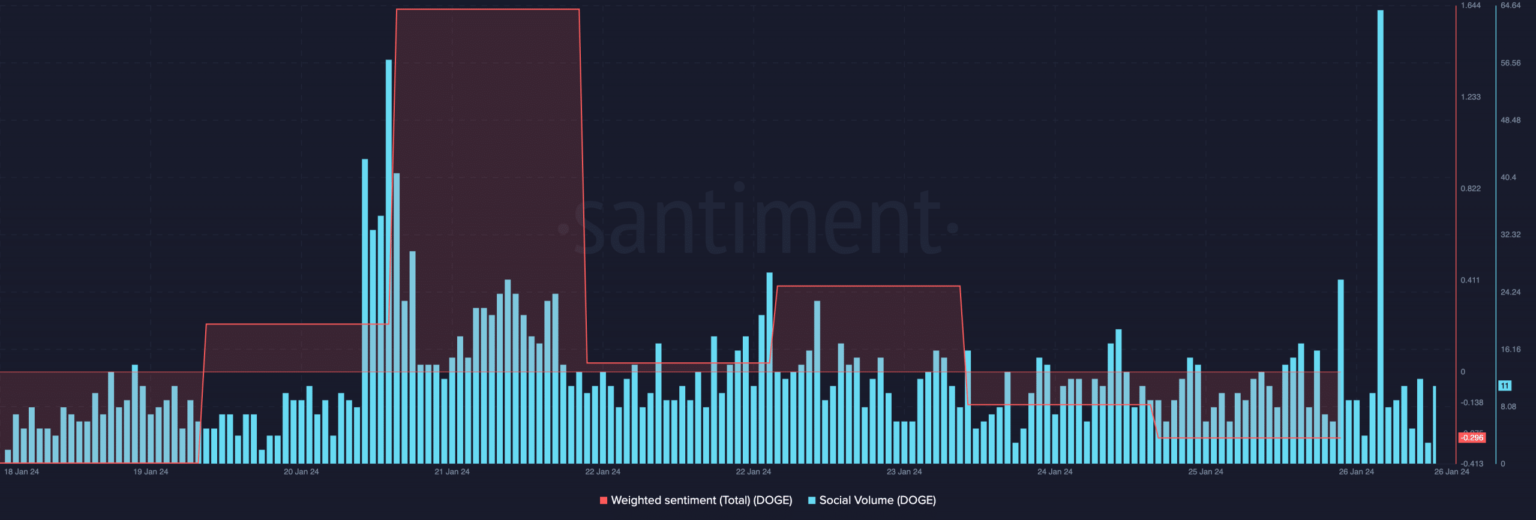

Unlike what happened earlier this week, Dogecoins [DOGE] social volume fell to the lowest level, according to Santiment data showed. By January 25, the social volume had increased to 63.80. This initial increase implied that searches for DOGE were increasing and rampant in the market.

However, the decline at the time of going to press indicates that interest in the coin has waned. But AMBCrypto found that social volume wasn’t the only thing in this regard.

There are no more bulls

According to on-chain data analyzed by Santiment, weighted sentiment also fell. On January 21, Dogecoin’s weighted sentiment was as high as 1.62.

This means that the broader market was bullish on the cryptocurrency. But recent comments and texts show that that was no longer the case.

Source: Santiment

However, the price drop did not just happen, with price being the biggest problem. At the time of writing, DOGE’s share price was $0.079, down 13.72% year-on-year (YTD).

AMBCrypto’s analysis of the 4-hour chart showed that DOGE could potentially continue trading in the same region. This was clear from the indications that the Accumulation/Distribution (A/D) showed.

At the time of writing, A/D had been stranded in the same area since January 20. This stalemate means that Dogecoin has not experienced any significant buying pressure recently.

If things continue like this, the coin price could move between $0.07 and $0.08. While there may not be a significant increase, the currency may also fail to take a nosedive.

However, the Relative Strength Index (RSI) stood at 50.70, indicating that bearish momentum has waned. So it’s possible that DOGE’s price won’t drop as much as it has since the start of 2024.

Source: TradingView

If bulls can capitalize on the buying momentum, DOGE could rise towards $0.09. If not, the price may fall or continue to move sideways movement.

Meanwhile, Dogecoin Open Interest fell to $387.47 million, Coinglass data showed. Open interest (OI) refers to the total of all open positions in a contract.

With the OI, there is a buyer for every seller. So longs (traders predicting a higher price) and shorts (those predicting a lower price) are usually 50-50.

However, the decline in OI suggests that traders close their positions, as in the case of DOGE. But if it had risen, it would have implied a strong increase in net positioning.

Source: Coinglass

Read Dogecoins [DOGE] Price prediction 2024-2025

From a trading perspective, the drop in OI implies that DOGE’s current direction became weak. If the OI continues to decline alongside the price action, the price may reverse to the upside.

If this is the case, sentiment around DOGE could change as the price tries to approach $0.09.