- Dogecoin bulls caused a bullish market structure break.

- The lower time frame could push DOGE towards the nearby Fibonacci level.

Dogecoin [DOGE] recently saw a positive performance in the crypto markets. The 7.3% rise on Friday, August 23 was a sign of bullish intent and meant another 8%-18% move could come soon.

An increasing number of Dogecoin wallets were cashed in. Since the market trend has been bearish since May, this indicated that profit-taking could emerge and hinder Dogecoin’s progress.

Dogecoin reclaims the local resistance zone as support

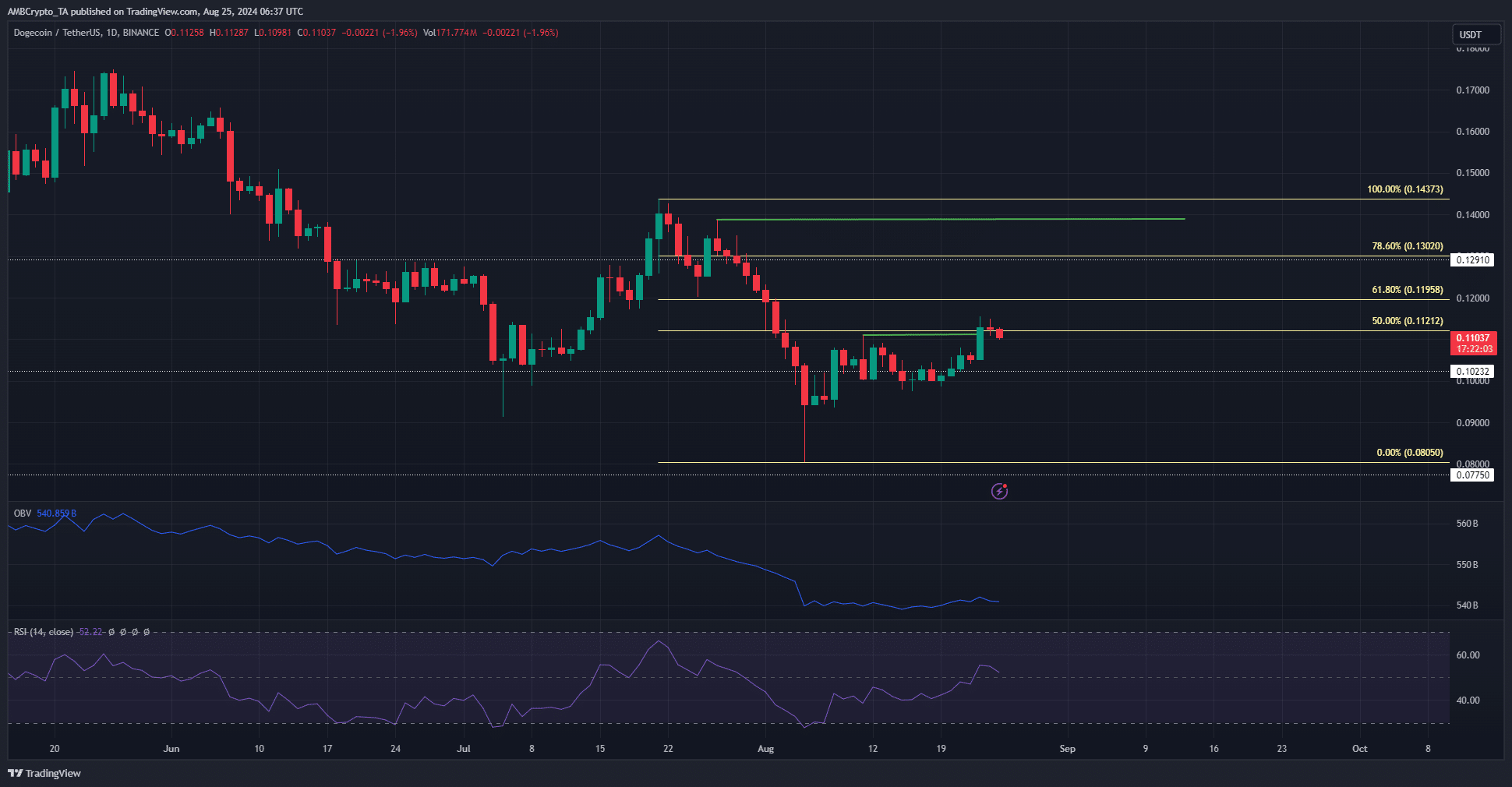

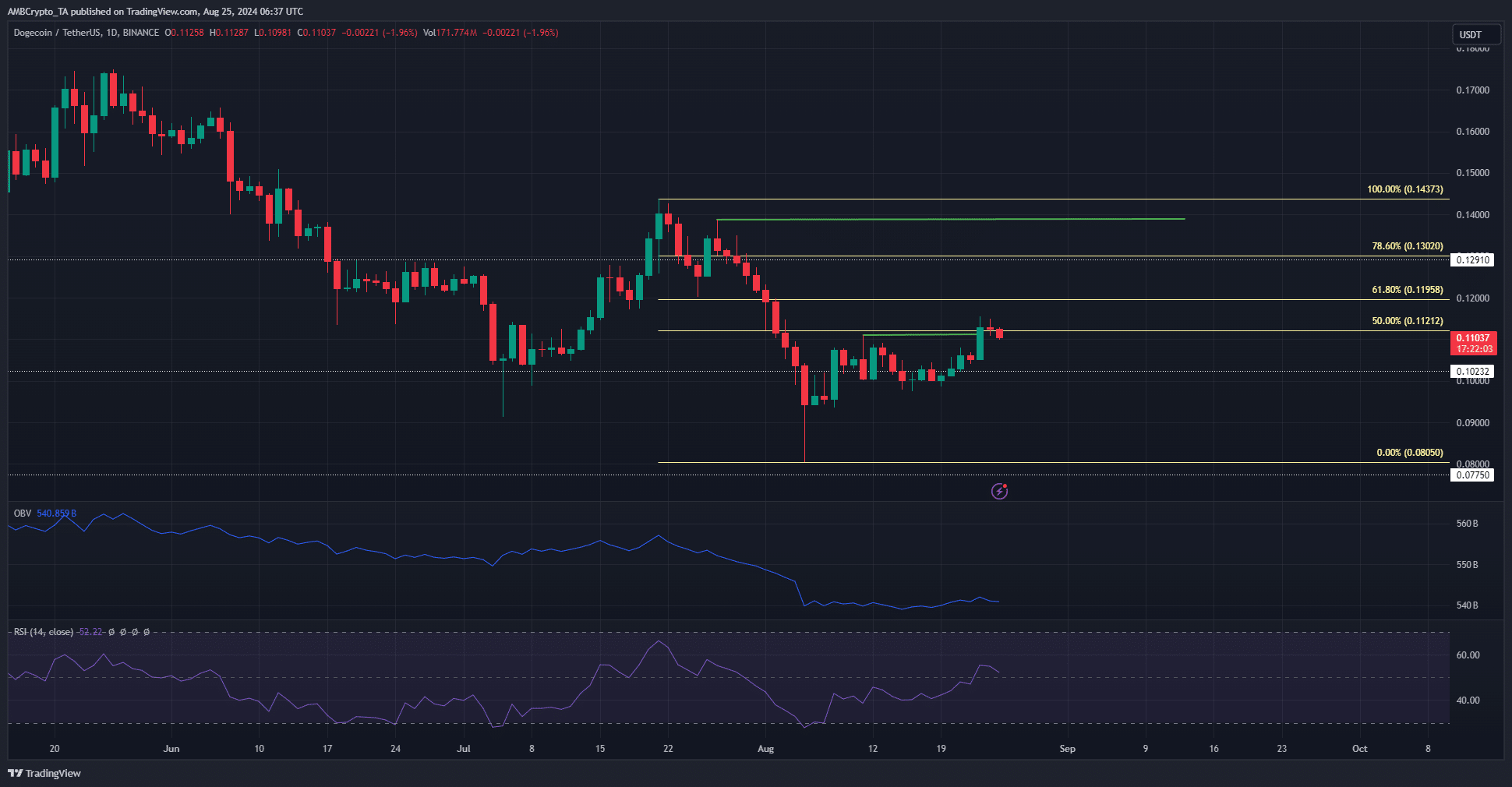

Source: DOGE/USDT on TradingView

The market structure on the daily chart was bullish after the daily session closed above $0.111 on August 23. However, the longer-term trend has been bearish, with occasional bullish structures in between, such as the recent development.

The Fibonacci retracement levels, based on the past month’s price decline, pointed to the $0.1196 and $0.13 levels as the next resistance zones. Given the bullish structure, Dogecoin is likely to reach one or both of these levels.

The daily RSI was above the neutral 50, indicating bullishness. However, the OBV could not rise significantly higher. While momentum was shifting, the lack of demand meant DOGE’s gains were easy to reverse.

Bullish in the short term, not so hopeful in the long term

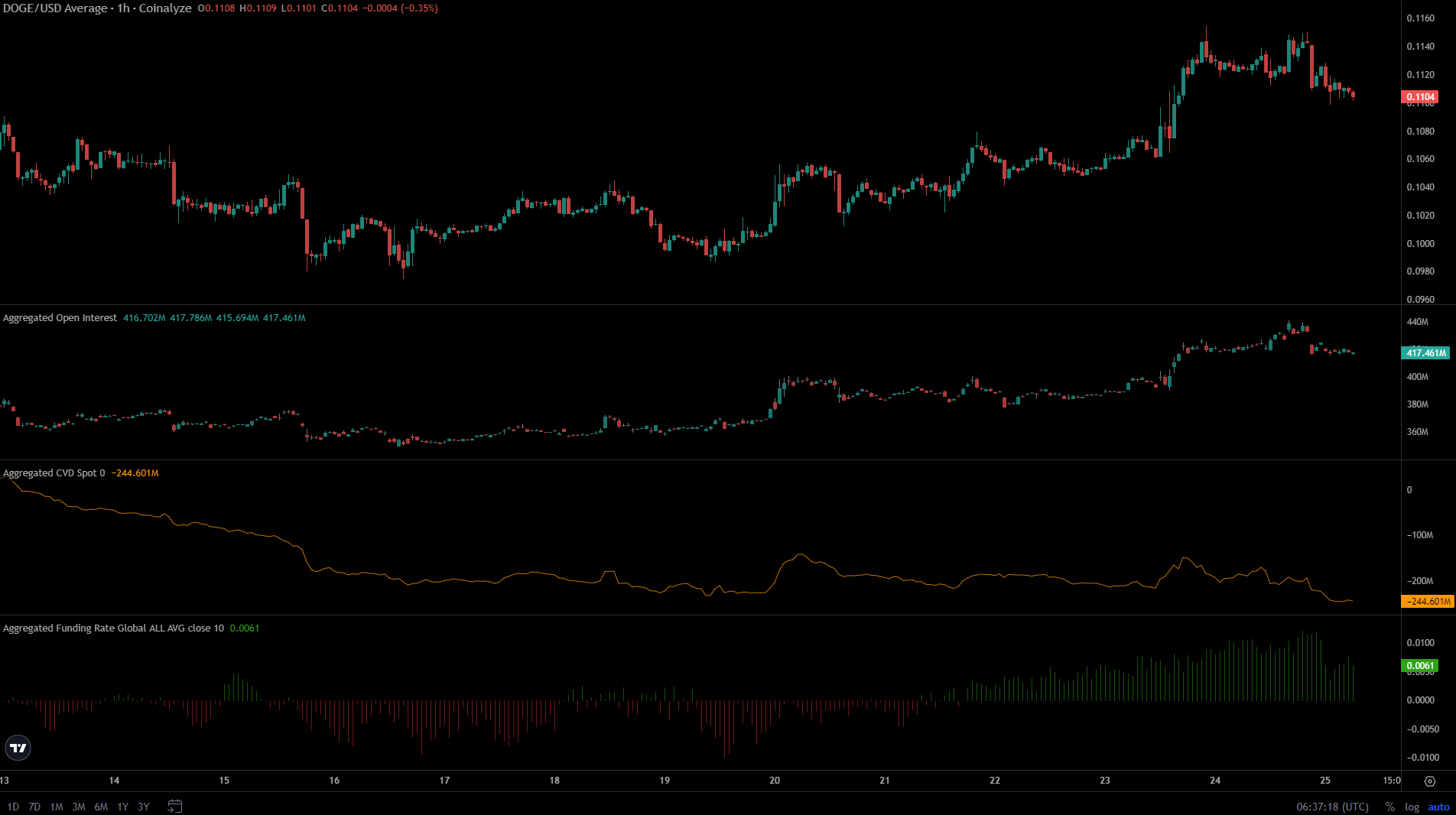

The funding rate behind DOGE has fallen in recent days but remained positive. The Open Interest rose alongside the price to indicate bullish momentum, although it saw a small dip in the last 24 hours.

During this time, Dogecoin fell just over 4% from $0.1149 to $0.11.

Read Dogecoins [DOGE] Price forecast 2024-25

While futures data showed speculators willing to go long, spot CVD began to trend down again.

It showed weak buying activity in the spot markets and reinforced the idea that Dogecoin’s gains could easily be wiped out if bearish sentiment takes control.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer