- Overwhelming long positions increased liquidation risks, indicating potential for market correction.

- Technical levels and the MVRV ratio have indicated that Dogecoin can have trouble increasing in the short term.

The market sentiment around Dogecoin [DOGE] Bullish remains, with 76.65% of traders on Binance Futures that holds long positions. This suggests that many expect the price to rise in the short term.

A high concentration of long positions can indicate recklessness on the market.

However, if Dogecoin falls short of the expectations of traders, this could cause forced liquidations, adding further downward pressure.

As a result, the market can, despite the optimistic view, experience increased volatility.

What does the technical graph say?

At the time of the press, Dogecoin traded at $ 0.1809, which showed a decrease of 7.96% in the last 24 hours. The price action suggests that Dogecoin is testing a critical support zone around this level.

If this support applies, Dogecoin can break through the resistance at $ 0.208 and start a potential rally.

However, if the price does not retain the support, it can be deeper. That is why traders must keep a close eye on this key level, because it will determine whether the price trend bullish remains or whether a bearish is reversed.

Source: TradingView

What suggest Dogecoin’s network statistics?

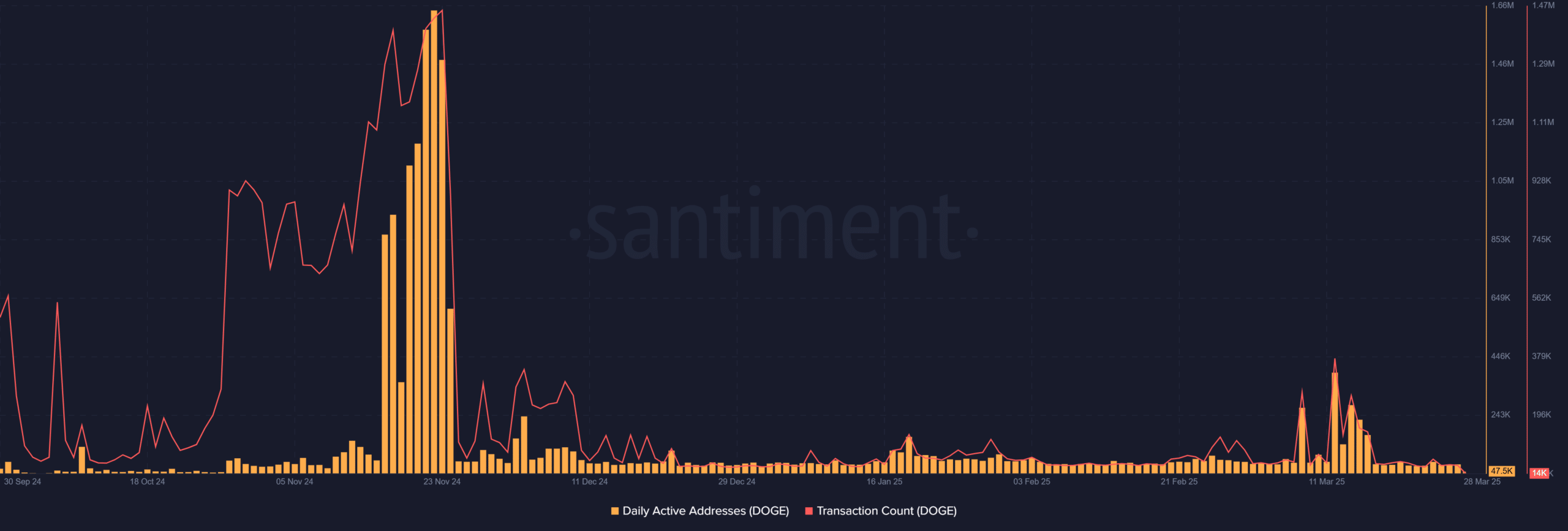

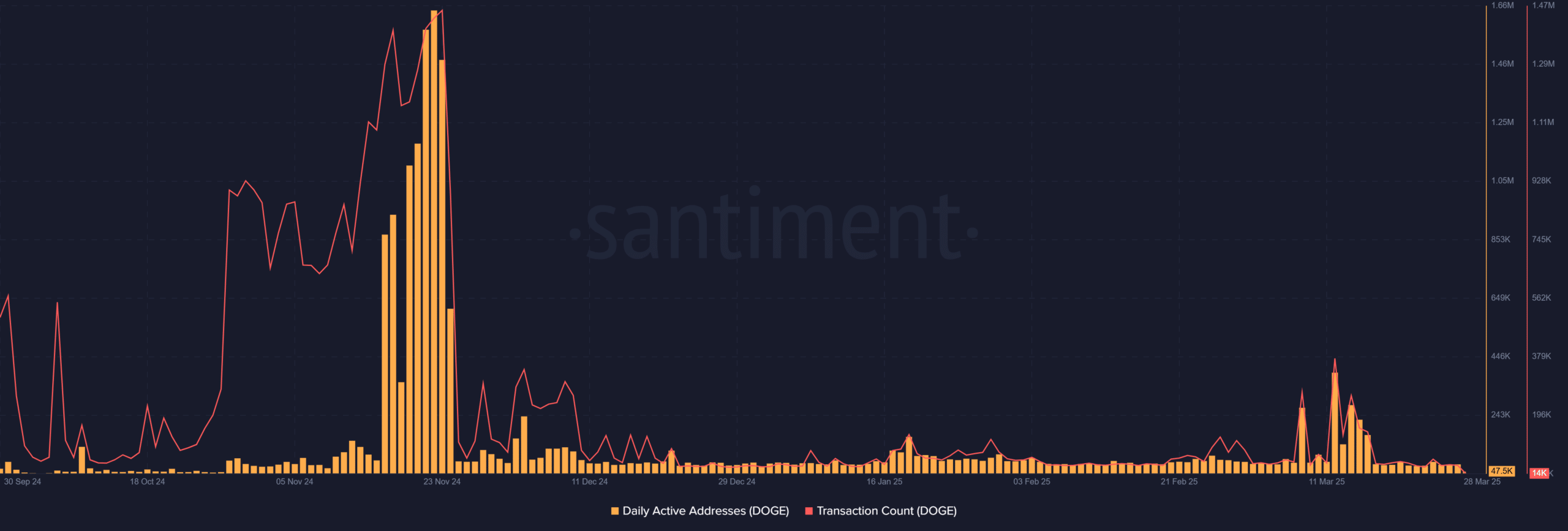

Looking at Dogecoin’s network activity, the daily active addresses and the number of transactions remain relatively low. From March 28, 2025, the network shows 47,577 active addresses and only 14,020 transactions.

This indicates that user involvement is not particularly strong at the moment, which can limit the potential for persistent price growth.

That is why Dogecoin may have difficulty get rid of the current reach without increased question or activity, despite the bullish expectations in the futures market.

Source: Santiment

Which positions dominate liquidations – long or short?

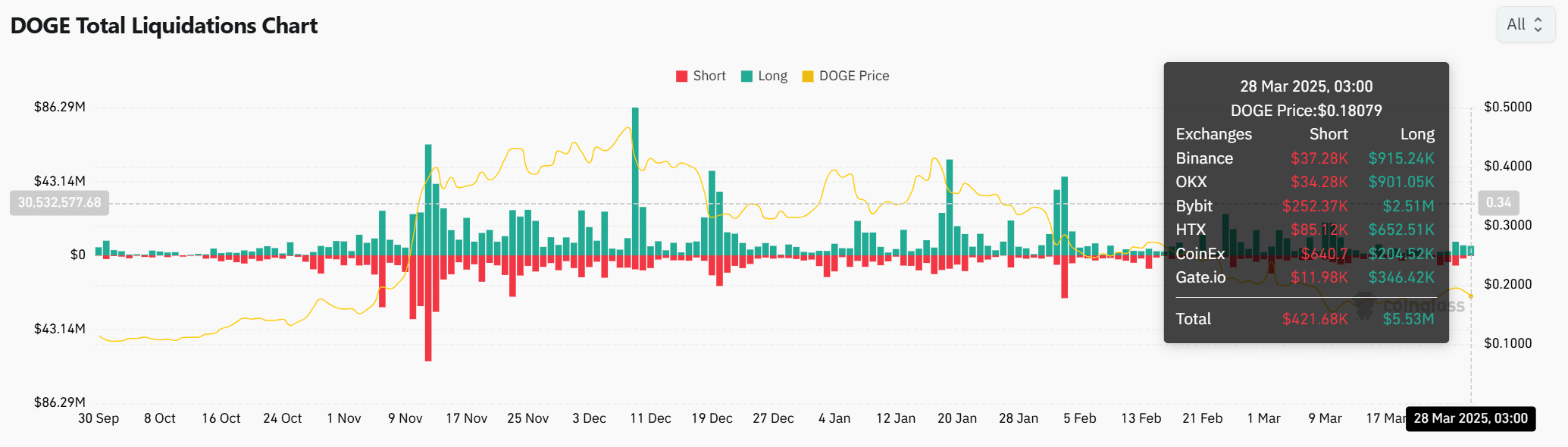

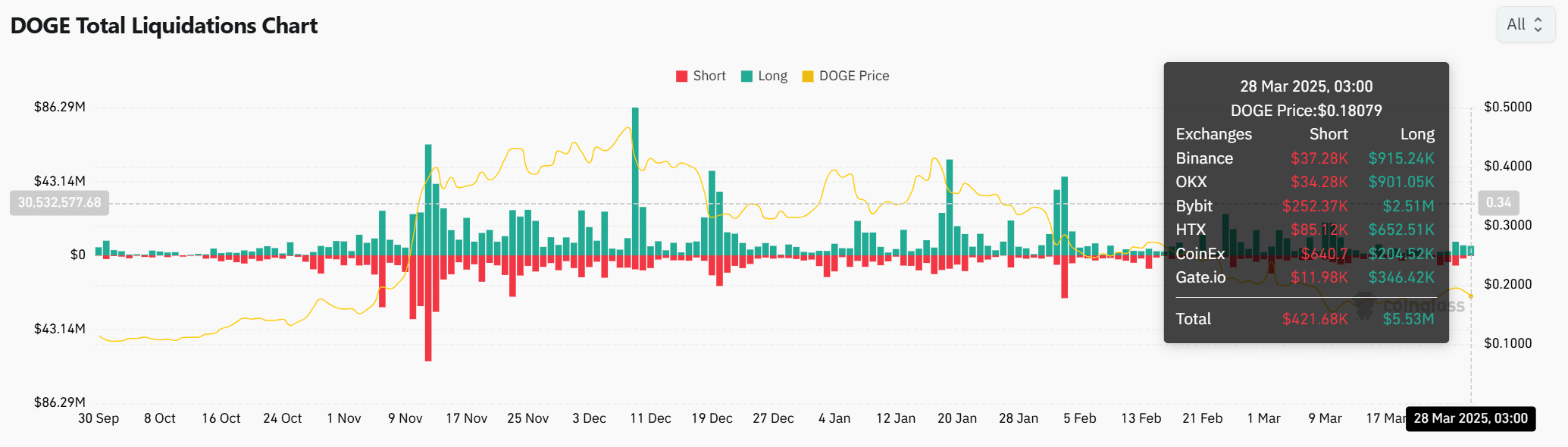

The liquidation data shows that long positions dominate the liquidations. At the time of writing, $ 5.53 million were liquidated in long positions compared to just $ 421,680 in short positions.

This indicates that the market is under pressure, where long traders are confronted with forced outputs as the price has difficulty rising.

The dominance of long liquidations suggests that the market is more vulnerable for a further decrease instead of an increase in the short term.

Source: Coinglass

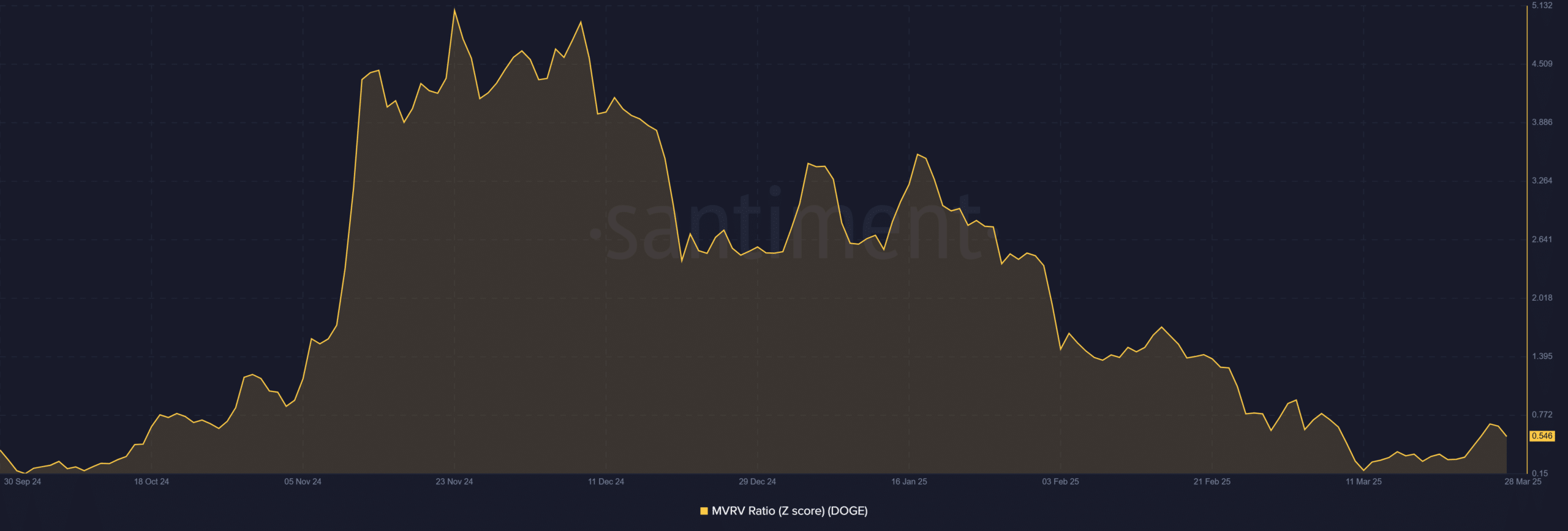

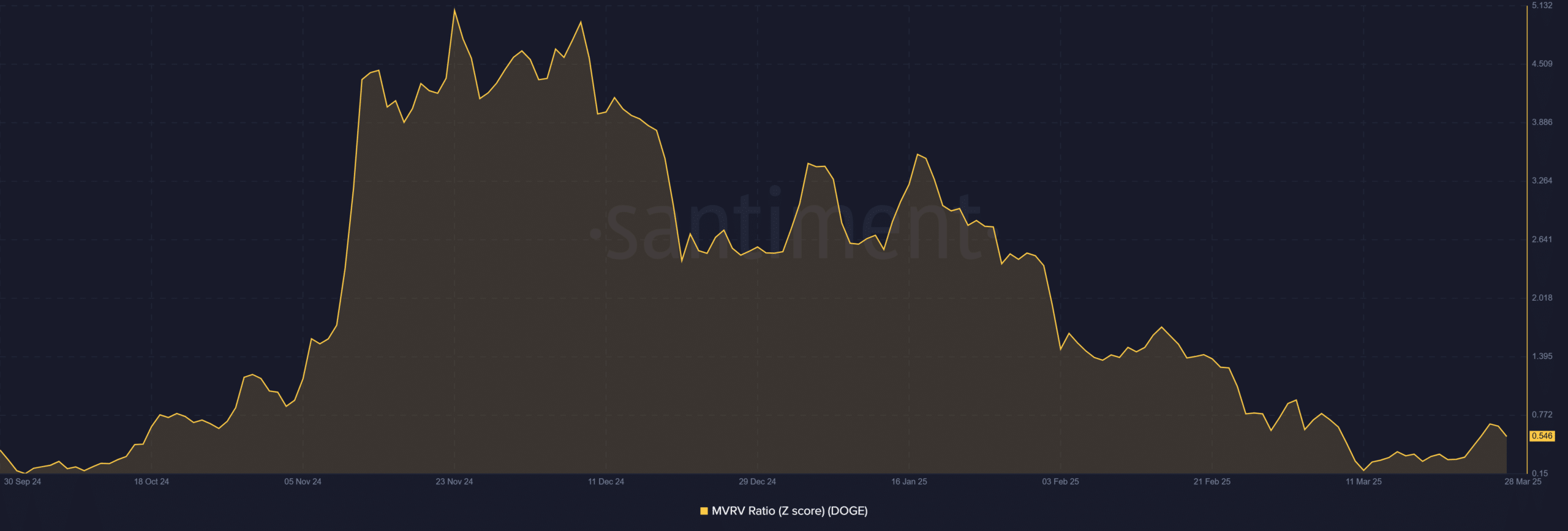

What does the MVRV ratio tell us about Dogecoin’s price potential?

The MVRV ratio for Dogecoin was at 0.546, indicating that the market price is somewhat overvalued compared to the realized value.

This suggests that the price can struggle to rise considerably without an increase in demand.

Without new catalysts or raised investor interests, Dogecoin can be confronted with resistance at higher price levels. Therefore, unless there is a shift in market sentiment, the price can therefore continue to consolidate or experience downward pressure.

Source: Santiment

What for doo

Despite the bullish sentiment that is reflected in the long-to-korter ratio, the substantial liquidation of long positions points to increased bearish.

The current technical levels, in combination with the overvaluation indicated by the MVRV ratio, suggest that Dogecoin can have difficulty rising in price.

Although the market sentiment is largely optimistic, the significant liquidation of long positions and weak market involvement suggests that Dogecoin’s price is unlikely in the immediate term.