- BNB closed above resistance on June 3.

- This confirms a peak in purchasing pressure.

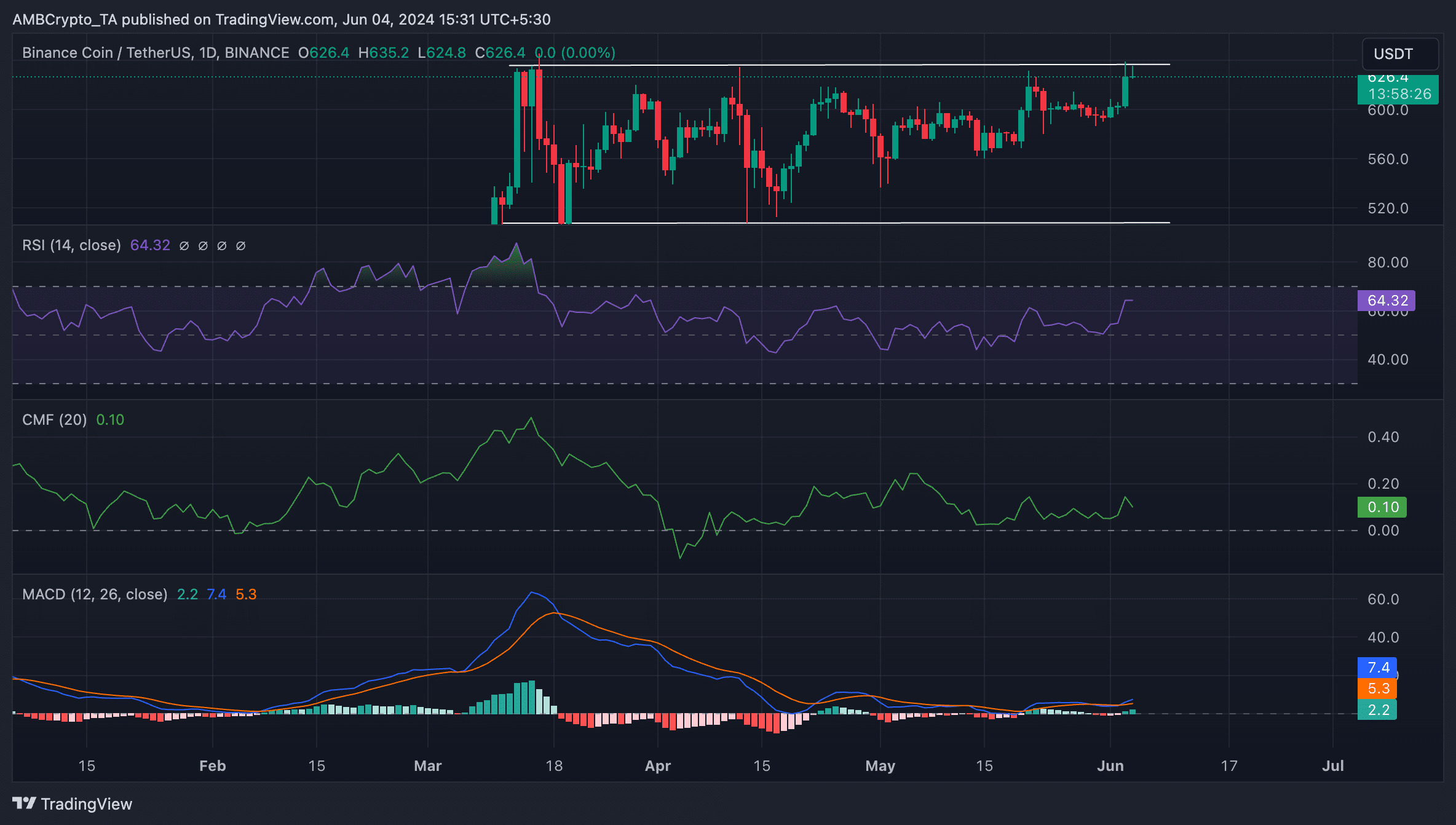

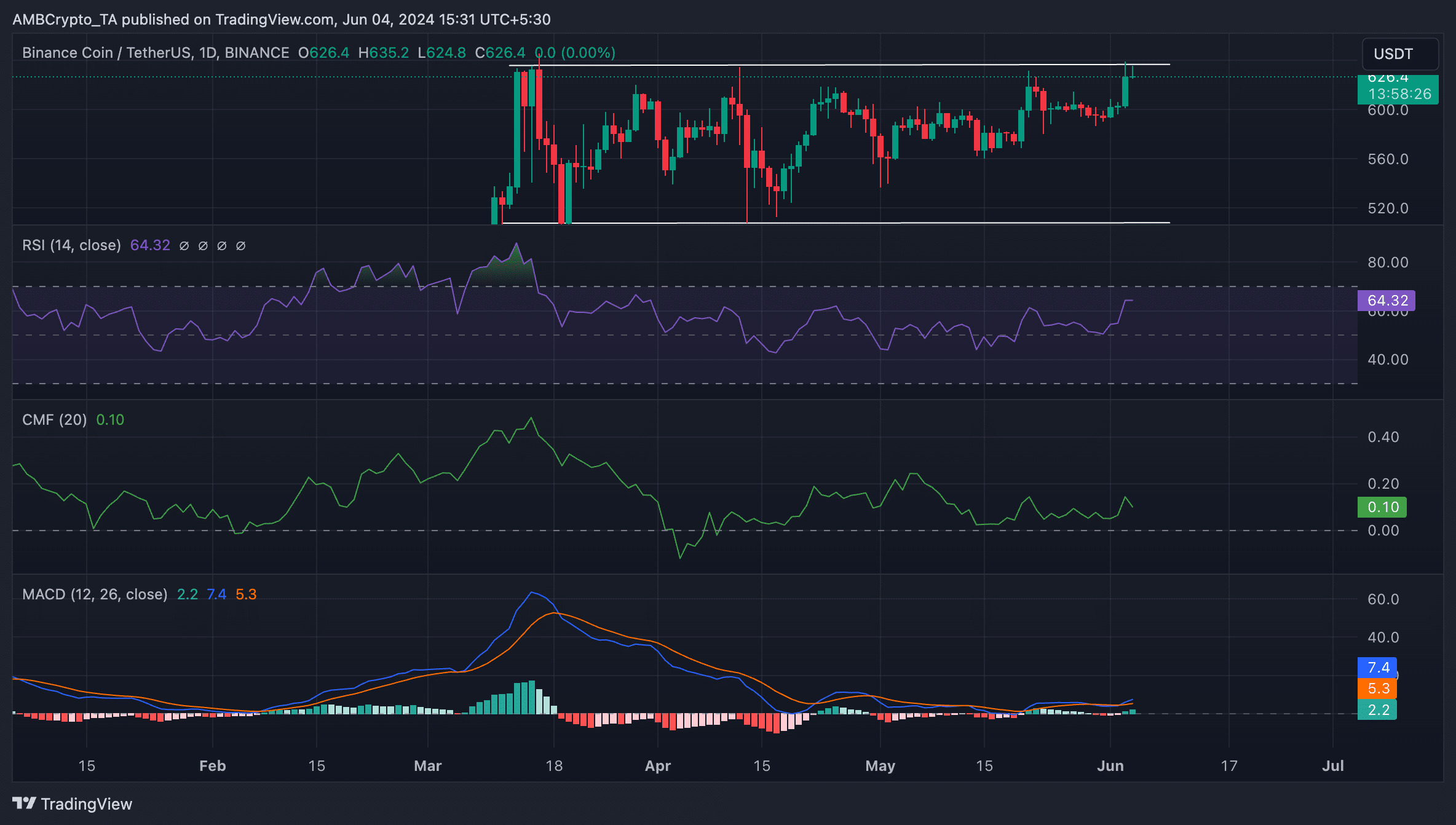

Binance coin [BNB] closed above the top line of the horizontal channel on June 3, signaling strong buying pressure.

An asset develops within a horizontal channel when its price consolidates within a certain range over a period of time. It happens when there is a relative balance between buying and selling pressure.

The channel has an upper line, which represents resistance, and a lower line, which represents support. BNB has faced resistance at $636.9 and found support at $508.6.

The rally above the top line of the horizontal channel, within which the price has been trading since March 13, represents a rally beyond the resistance level.

Will the upward trend continue?

AMBCrypto reviewed some of BNB’s key technical indicators on a one-day chart and noted a resurgence of bullish bias towards the altcoin.

For example, the Relative Strength Index (RSI) showed an upward trend, reaching 65.54 at the time of writing. This indicated a peak in purchasing pressure. It indicates that market participants preferred the accumulation of BNB over selling their assets.

BNB’s positive Chaikin Money Flow (CMF) also confirmed the revival in demand for the altcoin. This indicator tracks the flow of money into and out of the BNB market. A positive value above zero indicates market strength, indicating an influx of liquidity into the market.

At the time of writing, BNB’s CMF was 0.12.

Furthermore, the values of the coin’s Moving Average Convergence/Divergence (MACD) indicator on June 3 showed a bullish crossover between the MACD line (orange) and the signal line (orange).

This upward crossing suggested that BNB’s short-term average was above its long-term average. It is a bullish signal that traders interpret as a sign to go long and exit long positions.

Source: BNB/USDT on TradingView

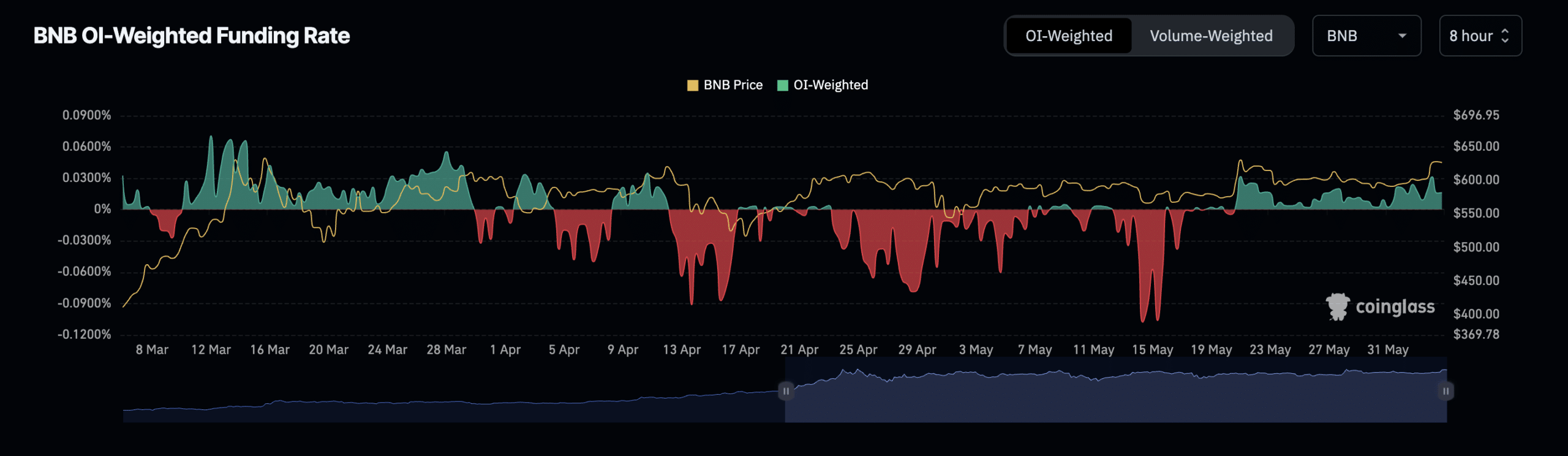

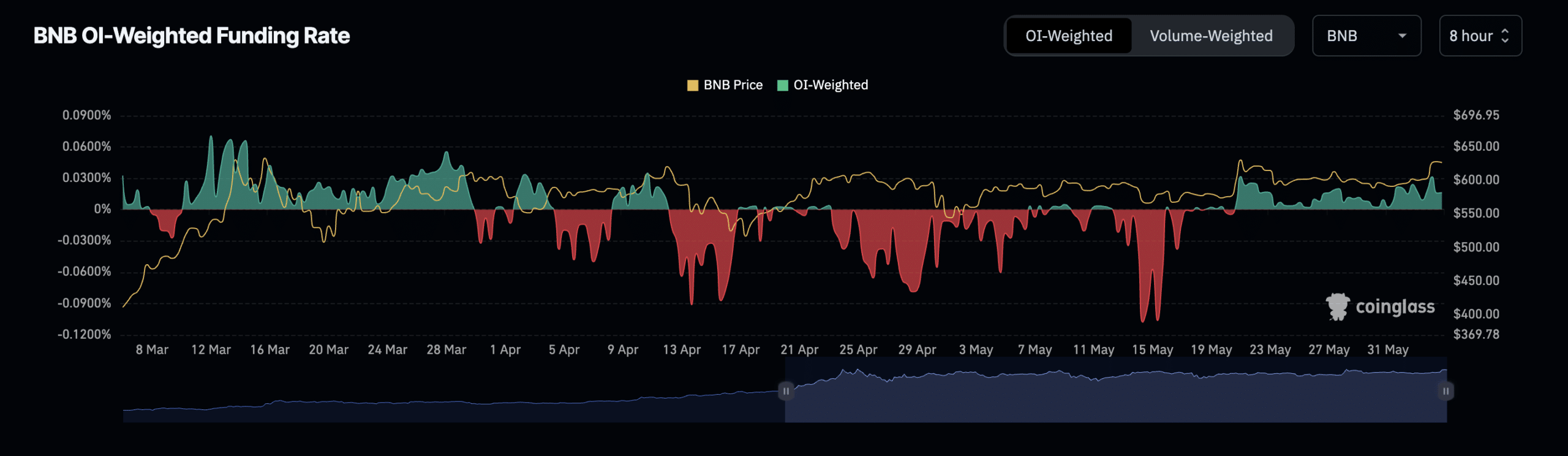

Confirming the current bullish trend, BNB’s funding rate on the cryptocurrency exchanges was positive at the time of writing. For context, it has been positive since May 21.

Before that day, May was predominantly characterized by negative financing rates.

Source: Coinglass

Realistic or not, here is BNB’s market cap in BTC terms

Perpetual futures contracts use financing rates to ensure that the contract price remains close to the spot price.

When these rise, it indicates strong demand for long positions. It is considered a bullish signal.