In recent days, Bitcoin has shown signs of a potential change, whereby the cryptocurrency mapped three consecutive green daily candles. The last time such a pattern was observed was at the beginning of July and between Central and at the end of June, when Bitcoin rose from slightly less than $ 25,000 to more than $ 31,000. This shift in price dynamics has led to a change in the market sentiment, where the Bearish prospects slowly gave way to a more bullish perspective.

Although Bitcoin is currently successfully averted a double top to the 1-week graph, this price promotion has fueled discussions among analysts about the possibility that Bitcoin is a double bottom pattern, an important technical indicator.

Bitcoin Double bottom in the making?

Een dubbele bodem is een klassiek technisch analysepatroon dat een potentiële trendomkering van bearish naar bullish op de markten aangeeft. It is characterized by two clear valleys or lows in the price chart, separated by a peak or a small highlight in between. The pattern looks like the letter ‘W’, where the first low point indicates a significant low point, followed by a temporary recovery, and then a second low point, usually near the same price level as the first. A valid double bottom is confirmed when the price above the peak or resistance level between the two lows, which indicates a possible upward trend removal.

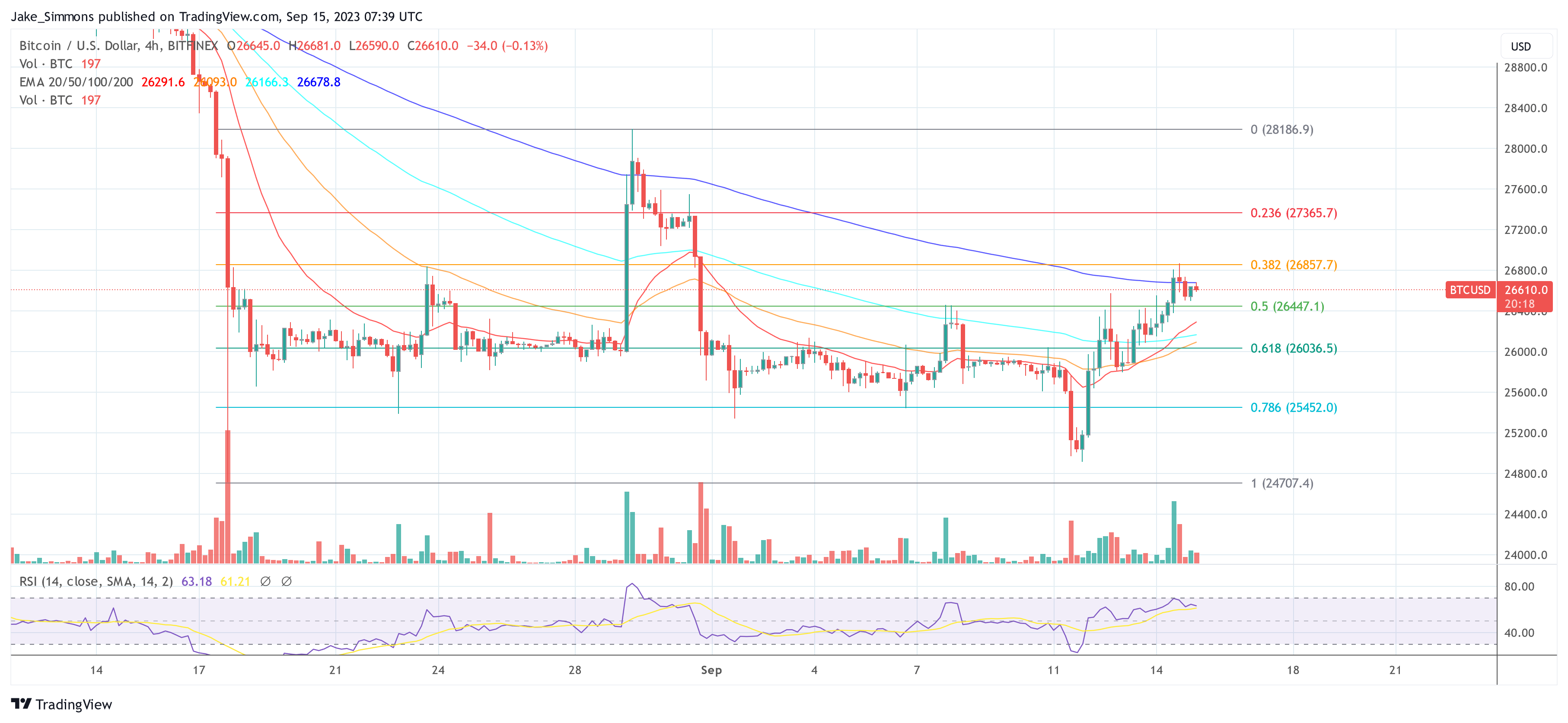

shared His insights suggest that the current price pattern of Bitcoin in the weekly graph looks like a double top, which usually indicates a bearish reversal. This pattern is characterized by a ‘m’ shape. Om dit echter te bevestigen, zou de prijs moeten worden afgebroken van de steun van $26.000. Op het moment van schrijven handelde Bitcoin op $26.618, waarmee hij op dit moment met succes de dubbele topvalidatie afweerde.

On the other hand, a double bottom, which forms a ‘W’ shape, would require Bitcoin to recover from the $ 26,000 border and tweeted today: “Could this BTC Double Top actually be a double bottom? En het simpele antwoord is: technisch gezien wel. […] But to have BTC form a double bottom, it should recover from $ 26,000 and rise to $ 30.6,000 (which is the validation point).

He also emphasized the challenges that Bitcoin is confronted with, and pointed to the uncertainty surrounding the support level of $ 26k and the numerous convenient resistors that are ahead that could hinder the completion of the double soil formation. Capital stretches deeper into the meaning of the level of $ 26,000 and tweet: “It seems that BTC may first choose the ‘Relief Rally’ route in an attempt to turn old support into new resistance. Het zwarte maandelijkse niveau (~$27.200) komt ook ongeveer overeen met de ondersteuningsband van de Bull Market.”

He also pointed to Bitcoin’s recent BEARISH monthly candle closure for August, in which he emphasized that Bitcoin closed under $ 27,150, with which he confirmed that this was a lost support. That is why he warns that Bitcoin’s current price movement could only be a relief to confirm the $ 27,150 as a new resistance before it falls into the $ 23,000 region.

[…]

More resistance levels for BTC price

It is therefore clear that BTC must break a large resistance level of $ 27,150 before the bulls can even dream of attaching a double bottom pattern. But there are also other important resistors that must be overcome before the $ 30,600 can be broken and the double bottom can be attached.

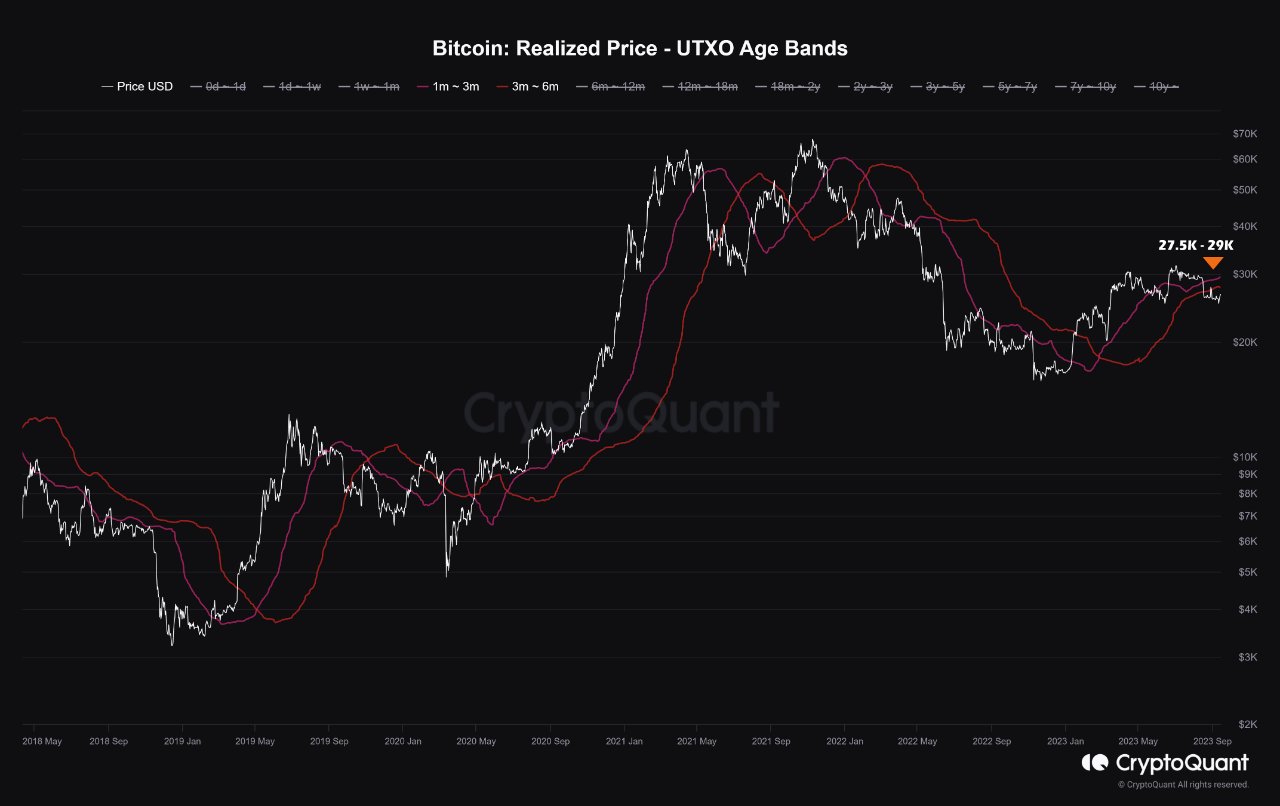

On-chain analysis company cryptoquant emphasized de rol van Bitcoin-houders op de korte termijn, die vaak de liquiditeit verschaffen voor aanzienlijke prijsbewegingen. Volgens hun gegevens ligt de break-even prijs voor deze houders tussen de $27.500 en $29.000. If Bitcoin stays among these levels for a longer period of time, these holders can be stimulated to sell, which may exert downward pressure on the price:

The more time we spend below these price levels, the more incentive there will be to leave the liquidity from the market, and the basic condition for the return of the upward trend of Bitcoin depends on the price jump above the prices realized in the short term.

Within a period of four hours, BTC has to overcome three major resistors: $ 26,857 (38.2% Fibonacci racement level), $ 27,365 (23.6% Fibonacci-Retracement level) and $ 28,186 (post-gray values high from 29 August).