- Hayes urged aggressive investment amid market downturn.

- Hayes saw Bitcoin as a hedge amid negative real returns, despite skepticism.

Well, the most talked about topic in and around the cryptocurrency space has been: is Bitcoin [BTC] a hedge against fiat currency devaluation?

While Bitcoin’s halving has been the talk of the town for quite some time, Arthur Hayes, the former CEO of crypto exchange BitMEX, offered insights into a strengthening trend that could fuel BTC’s continued rise.

Arthur Hayes’ left curve approach

In his recent essay Titled “Left Curve,” Hayes not only shared investment strategies but also critiqued traditional financial wisdom, urging investors to adopt more aggressive strategies to maximize returns.

He said,

“Bull markets don’t happen often; it’s a travesty if you make the right choice but don’t maximize your profit potential.”

Furthermore, Hayes emphasized the importance of maximizing profits during bull markets and criticized the selling of crypto for fiat money:

“If you sell sh*tcoins for fiat that you don’t immediately need for living expenses, then you are the king.”

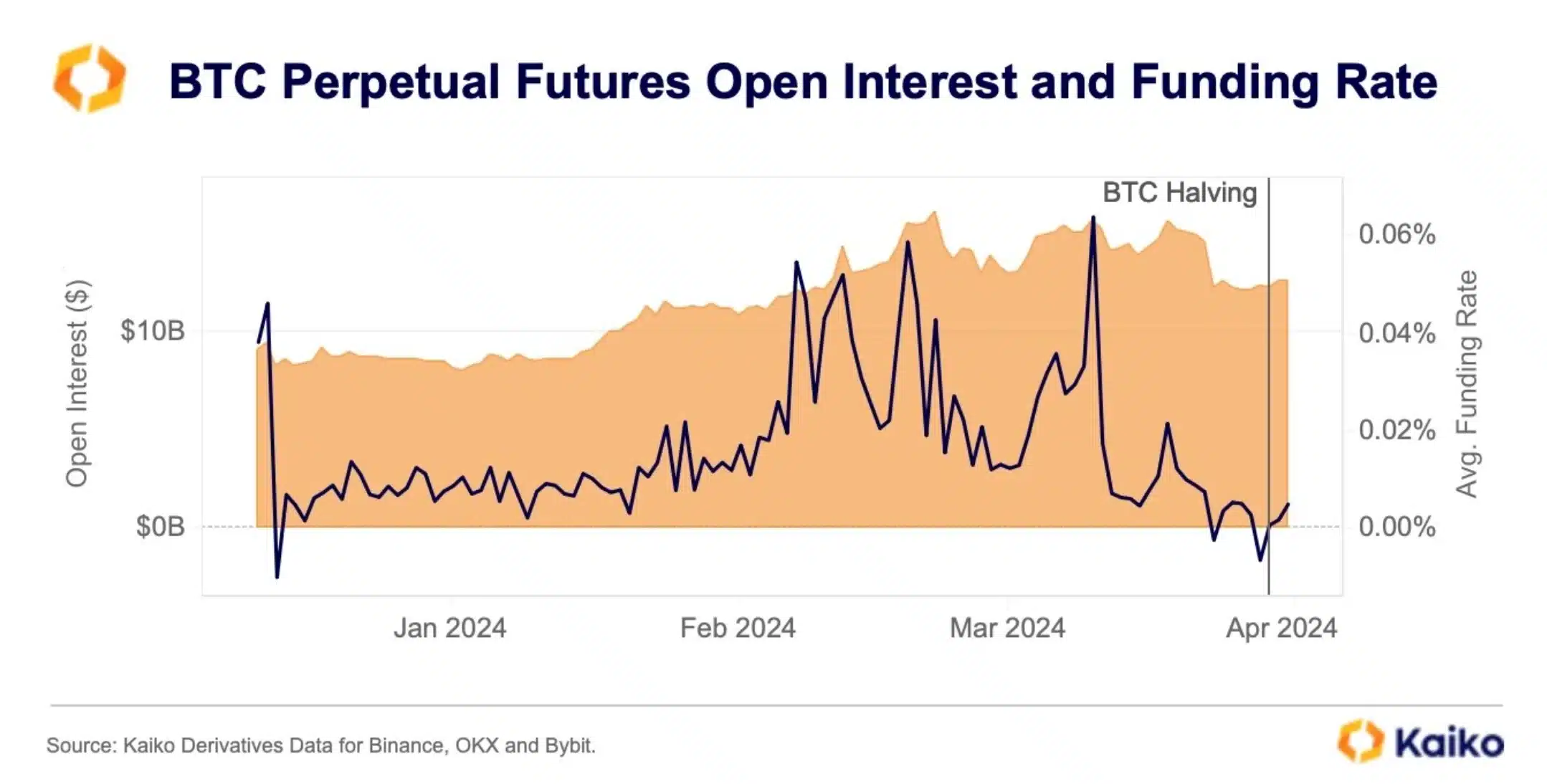

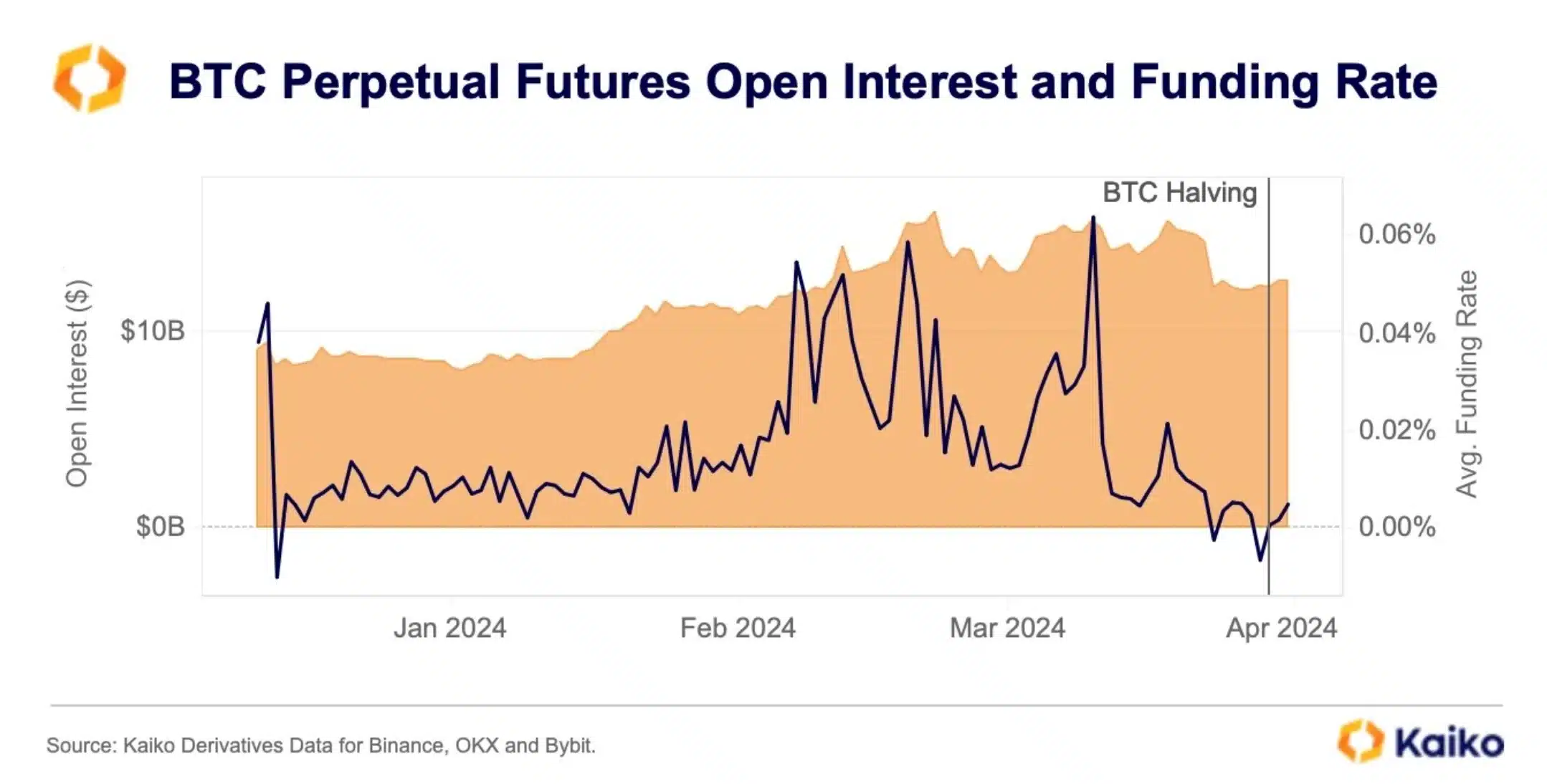

By also shedding light on investor behavior, Kaiko noted,

“Funding rates for $BTC offenders turned negative for the first time since late 2023 ahead of the halving.”

Source: Kaiko/Twitter

This suggested that there was more selling pressure in the market and that traders were willing to pay a premium to borrow BTC for short positions.

Bitcoin stands the test of time

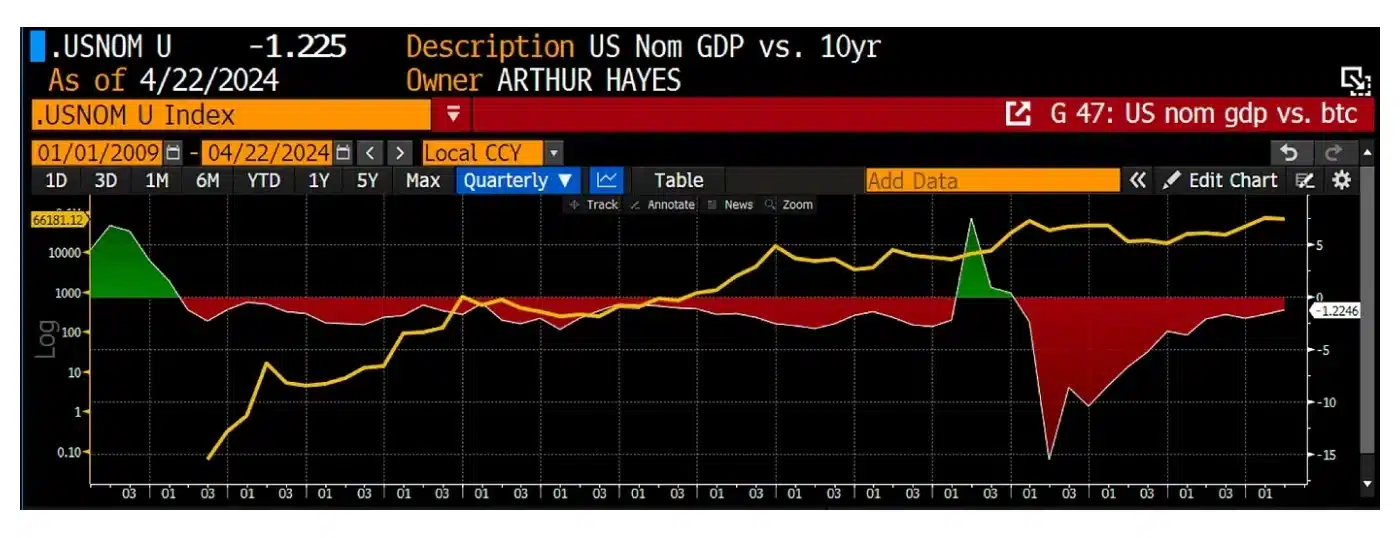

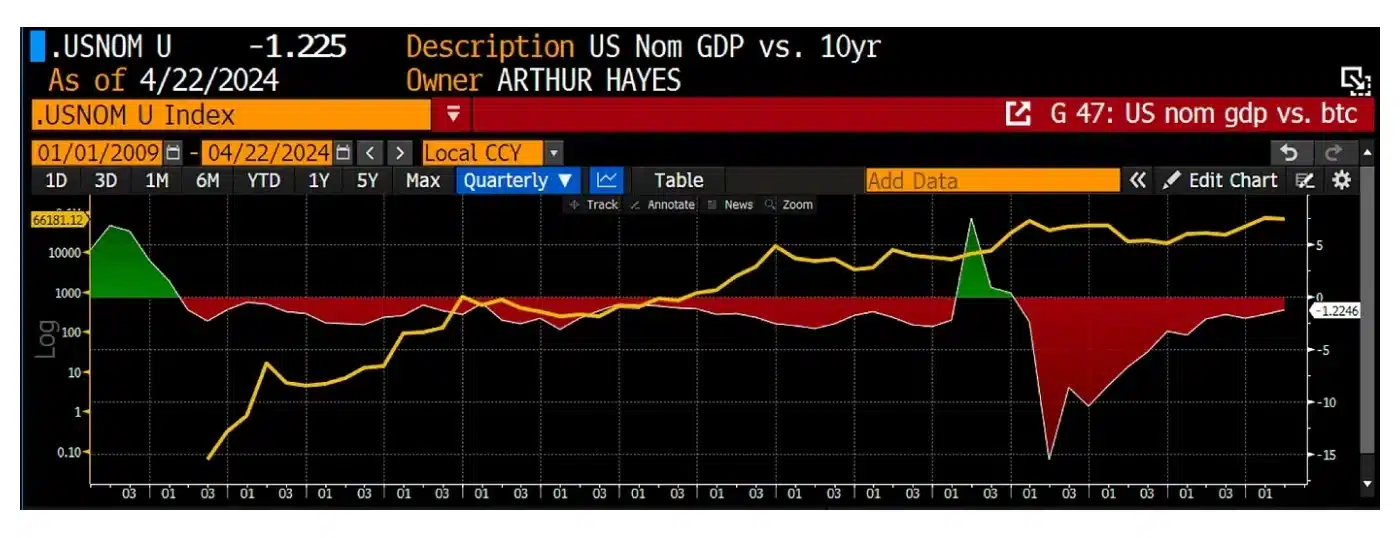

Hayes also analyzed the relationship between real bond yields and the Federal Reserve’s balance sheet, and how economic shocks affect interest rates.

Source: Arthur Hayes/Medium

He proposed,

“Bitco rises in a non-linear manner on a log chart. The rise of Bitcoin is purely a function of an asset having a finite quantity priced in depreciating fiat dollars.”

This highlighted that BTC has emerged as an alternative investment during periods of negative real returns, providing a hedge against the depreciation of fiat currencies.

However, since we are skeptical about Bitcoin’s investment optimism, Peter BrandtCEO of Factor LLC, processed,

“It is extremely interesting to note that the price of Bitcoin $BTC (adjusted for inflation) has not reached a new high in three years, despite the halving and Bitcoin ETFs.”

Despite such criticism, Hayes was still confident, suggesting that as we move into the summer months, we should expect crypto volatility to subside.

“Now is the perfect time to take advantage of the recent crypto dip and slowly add positions.”