- DMM Bitcoin lost 4,502.9 BTC to hackers and planned a significant buyback to cover losses.

- AMBCrypto analyzed the possible impact of this purchase on the Bitcoin market

On May 31, DMM Bitcoin, a prominent Japanese cryptocurrency exchange, encountered a significant security breach that resulted in the loss of approximately 48 billion yen ($305 million) worth of Bitcoin [BTC] .

The breach led to 4,502.9 BTC being illegally transferred from the exchange’s reserves, as reported by Blocksec security analysts. Analysts noted that stolen funds were split into batches of 500 BTC in ten different wallets.

DMM Bitcoin’s plan to undo a hacker’s payday

In response to this substantial financial hit, DMM Bitcoin has done just that initiated a comprehensive recovery strategy aimed at compensating affected customers without disrupting the broader Bitcoin market.

The platform announced plans to secure 50 billion yen ($321 million) to buy Bitcoin at a loss. This move is part of a broader initiative to stabilize the exchange’s operations and restore user confidence.

Notably, the hack, ranked as the seventh largest crypto theft by Chainalysis, led to immediate regulatory action.

The Japanese Financial Services Agency has asked DMM Bitcoin to thoroughly investigate the incident. A report was also requested on the origins of the breach and the company’s customer compensation strategy.

Meanwhile, Finance Minister Shunichi Suzuki has committed to strengthening preventive measures against future security breaches in the cryptocurrency sector.

So far, the company has secured a loan of 5 billion yen. The country is in the process of a significant capital increase of 48 billion yen.

Possible impact

While it may seem remarkable that a cryptocurrency exchange is about to buy millions in Bitcoin, the reality is that DMM’s planned $320 million investment is unlikely to significantly shake the market.

This purchase will only account for approximately 4,500 BTC, according to Coingecko, just 0.023% of the current circulating supply of approximately 19.7 million coins. facts.

By comparison, US spot Bitcoin ETFs are making profits purchases over $500 million, which actually affects Bitcoin’s price dynamics.

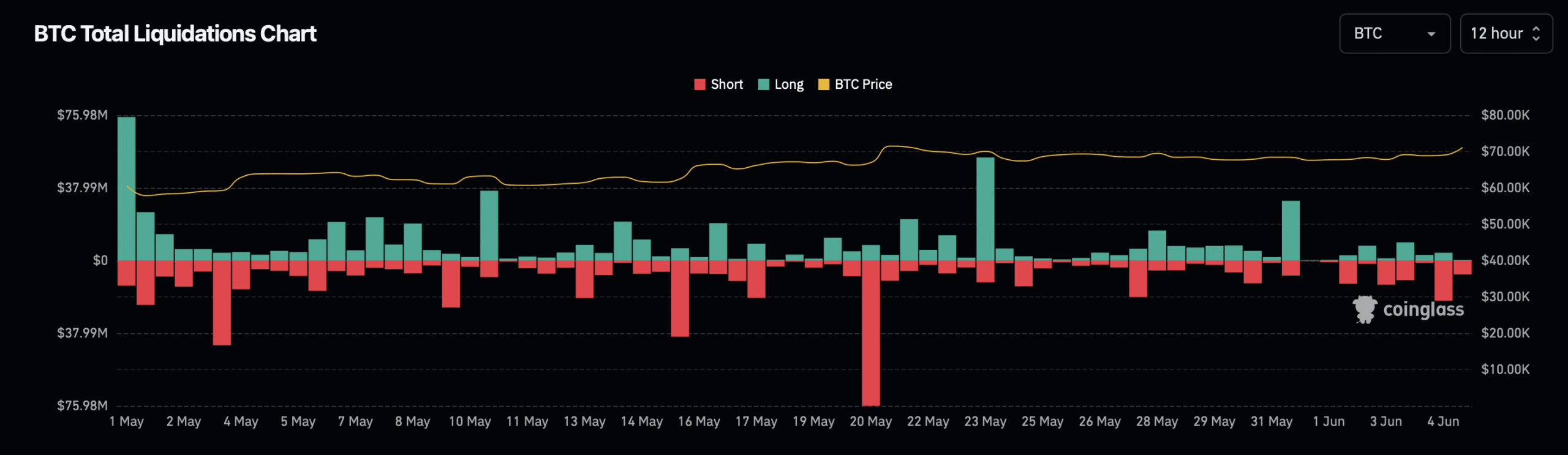

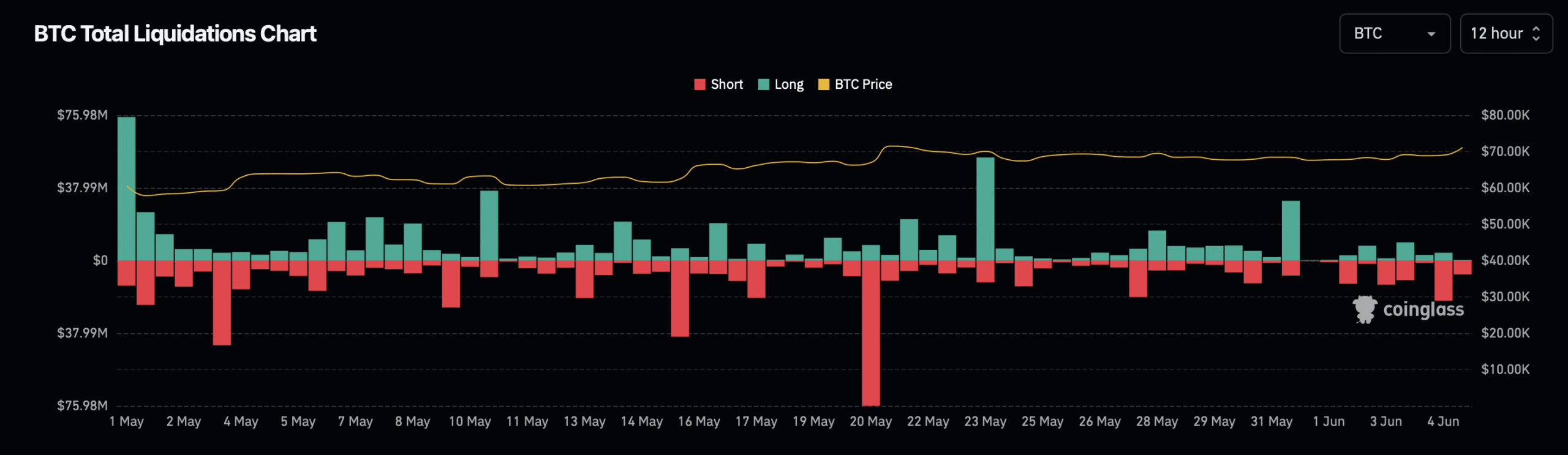

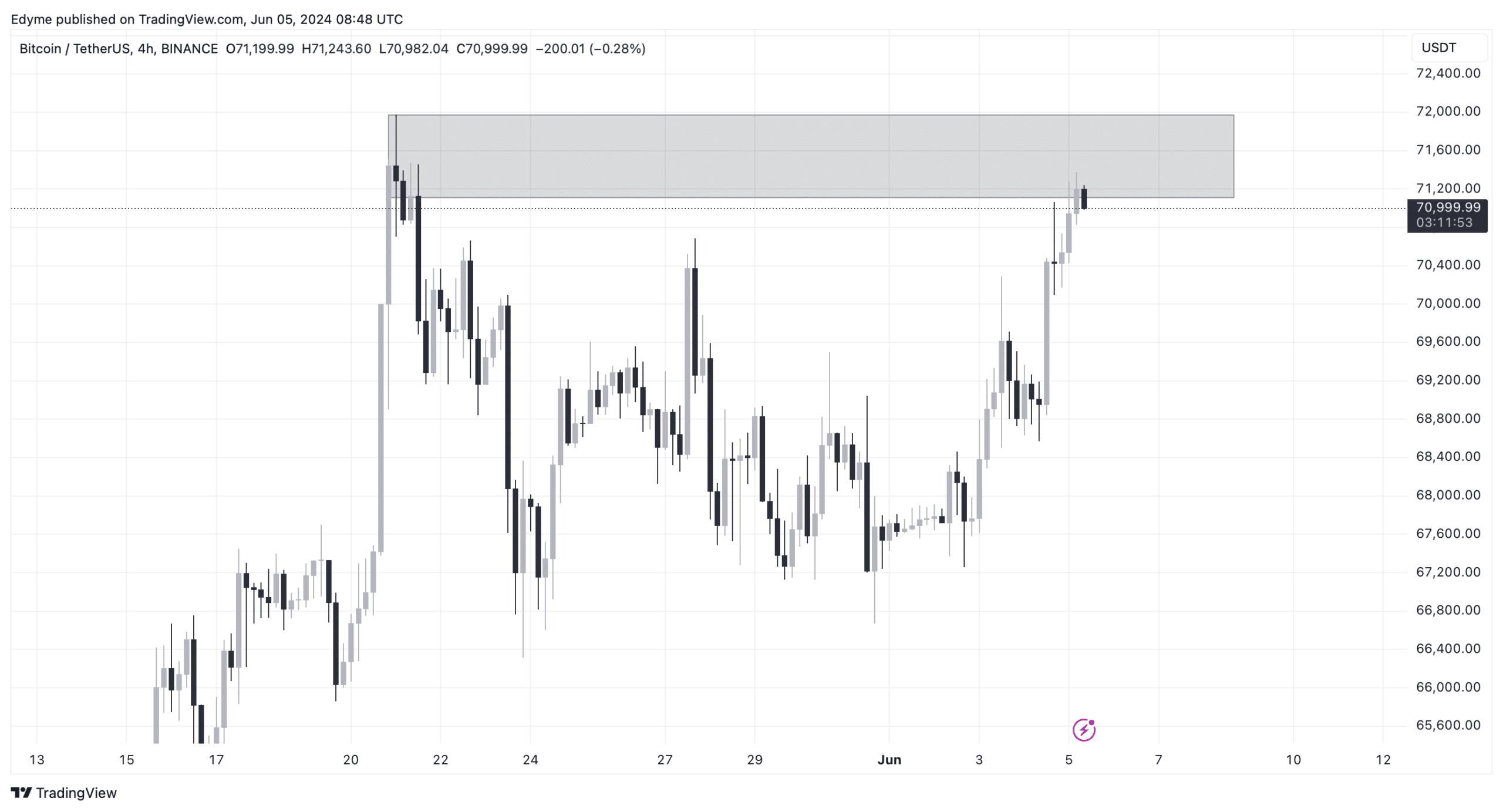

Currently, the price of Bitcoin is just above $71,000. BTC rose 2.9% in the past day and 4.6% in the past week. Despite these gains, the surge has led to more than $30 million in liquidations on the market, according to Coinglass.

Source: Coinglass

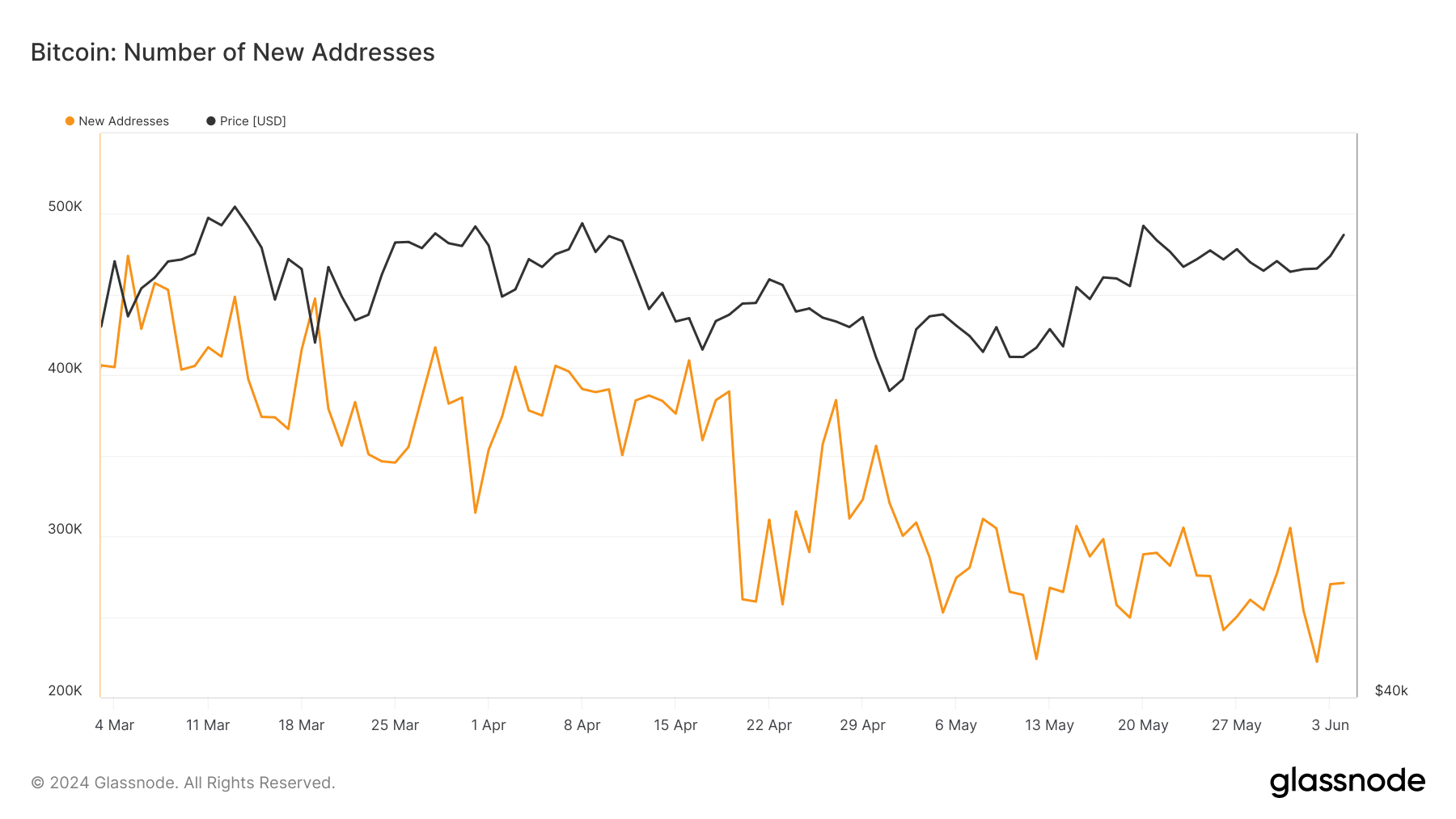

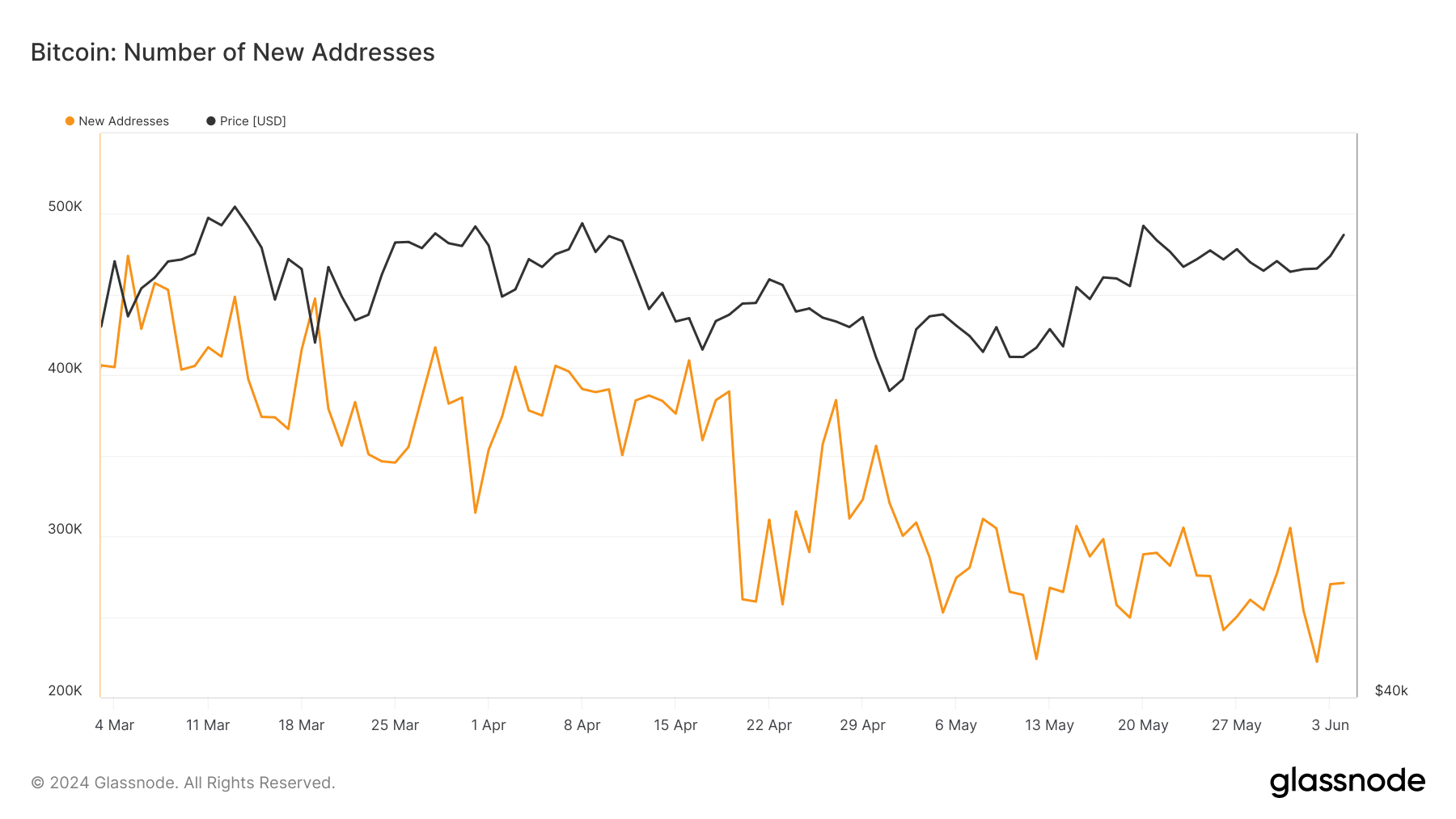

This price increase is associated with a noticeable increase in the number of new Bitcoin addresses listed facts from Glassnode, indicating renewed interest and possibly higher future valuation.

Source: Glassnode

Moreover, current technical analysis indicates that Bitcoin is trying to break a significant resistance level on the daily chart. A successful breach could potentially trigger a major rally, catapulting the asset’s price to new heights.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2024-2025

In another analysis, AMBCrypto reports that the ratio between network value and transactions, the market capitalization divided by the volume traded, shows an increasing trend.

This metric suggests that BTC may currently be overvalued based on its transaction capabilities.