- The US SEC could approve spot Solana ETFs next month, according to Nate Geraci.

- WIF, BONK, JUP, and MEW are Solana-based tokens that could yield significant gains if the SEC approves a Solana ETF.

Current market sentiment appears optimistic following US President Joe Biden’s decision to withdraw from the re-election race.

Nate Geraci talks about Solana ETFs

Following Biden’s announcement, Nate Geraci, the president of The ETF Store, posted on X (formerly Twitter) hinting at a possible endorsement of spot Solana [SOL] Exchange Traded Fund (ETF).

Geraci predicted that ETF issuers such as BlackRock, Fidelity, VanEck and others will soon apply for a combined spot Bitcoin [BTC]Ethereum [ETH]And Solana ETF in the next months.

Currently, ETF traders only trade Bitcoin ETF and there is a good chance that the US Securities and Exchange Commission (SEC) will approve Ethereum ETF within the next month.

While only two of the eleven ETF issuers (VanEck and 21Shares) have filed 19b-4 filings with the SEC, more filings could follow in the coming days.

However, Geraci’s post signaled a possible endorsement of Solana ETF in the coming month.

If this prediction proves to be accurate and the US SEC approves the spot Solana ETF, we could see a huge positive impact on the price of Solana and the memecoins on its ecosystem.

This includes dog hat [WIF]Bonk [BONK]Jupiter [JUP]and cat in a dog’s world [MEW].

What’s next for Solana?

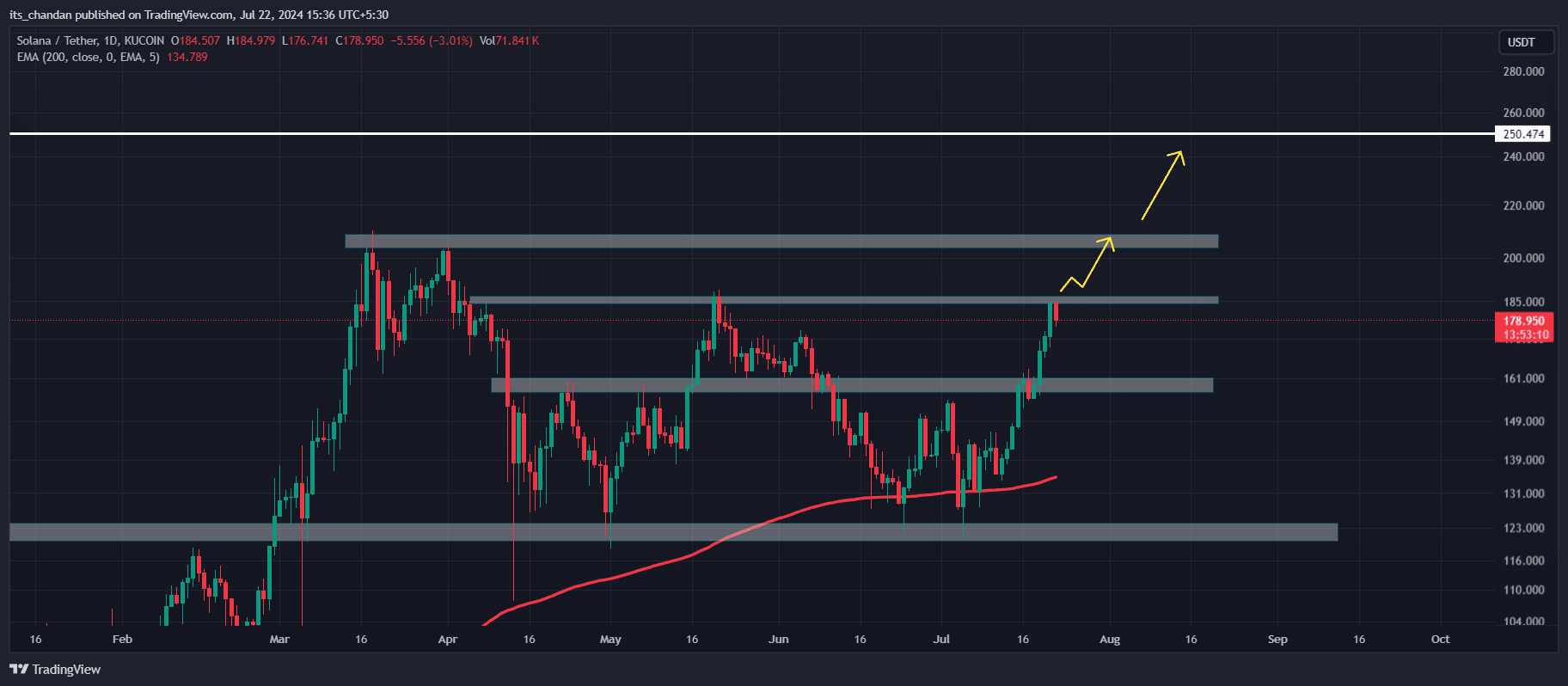

According to expert technical analysis, Solana was looking bullish at the time of writing as SOL was moving above the 200 Exponential Moving Average (EMA) on a daily time frame.

Despite this bullish trend, the price faced strong resistance around the $186 level.

Source: TradingView

Current market sentiment and investor interest indicate that SOL could break through this resistance level. If this indeed happens, we may see upside momentum towards the $200 level or even higher.

Solana’s main liquidation level

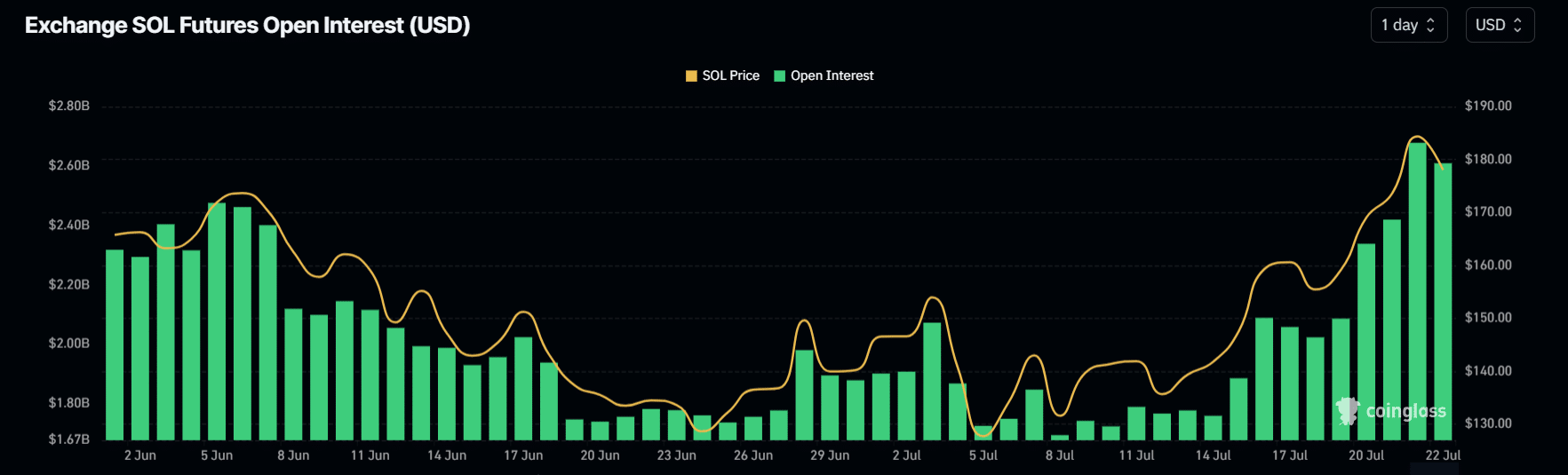

Moreover, the interest and confidence of investors and traders is constantly increasing.

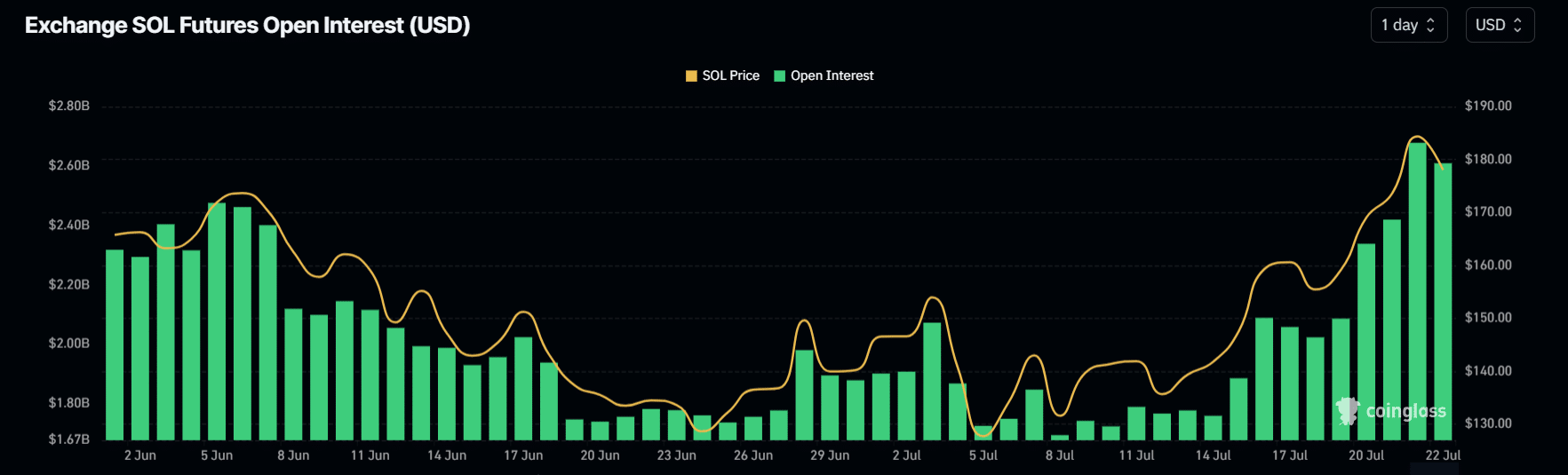

According to on-chain analytics firm CoinGlass, SOL’s Open Interest has risen more than 9% in the past 24 hours, reaching its highest level since June 2024.

Source: Coinglass

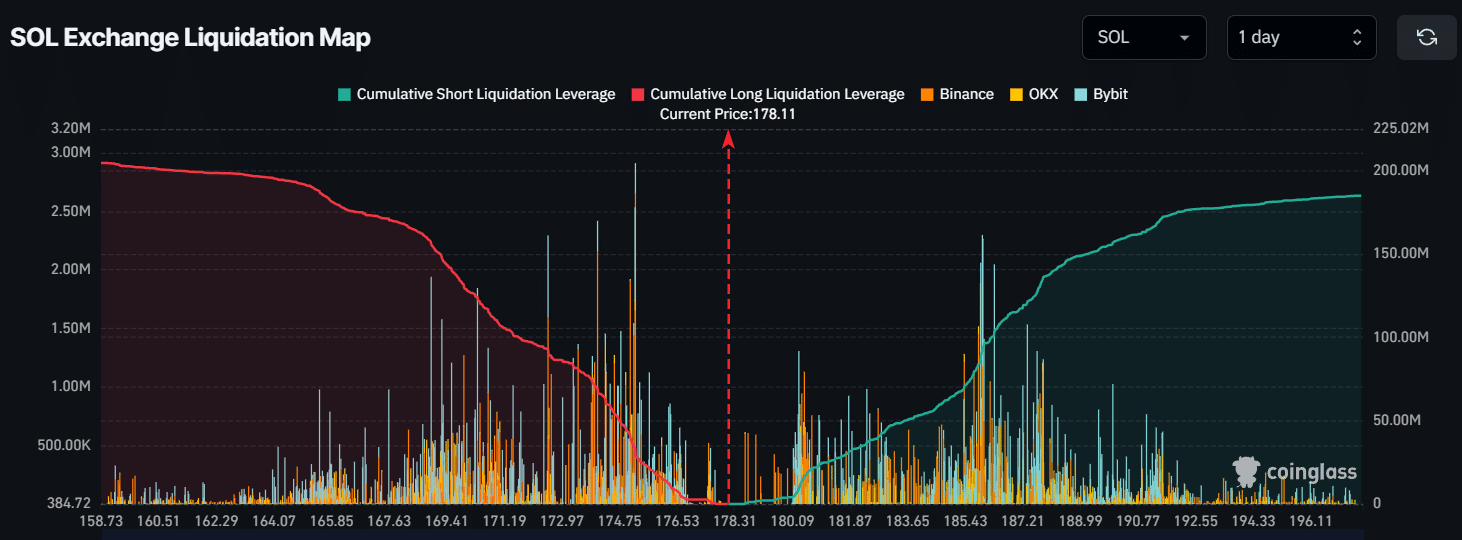

Liquidation data shows that bulls’ long positions are more important than short sellers’ positions. Moreover, short sellers believed that SOL price would not cross the $186.5 level.

According to Coinglass, $108 million worth of short positions have been built up at the $186.5 level.

Source: CoinGlass

Is your portfolio green? View the SOL Profit Calculator

At the time of writing, SOL was trading around $179 and has experienced an impressive price increase of over 4% in the past 24 hours. It also hit an intraday high of $185.

In the long term, SOL is up over 18% over the past seven days and has outperformed top assets like Bitcoin and Ethereum.