- Leading coins BTC and ETH registered inflows last week.

- In contrast, Short BTC and Short ETH posted outflows.

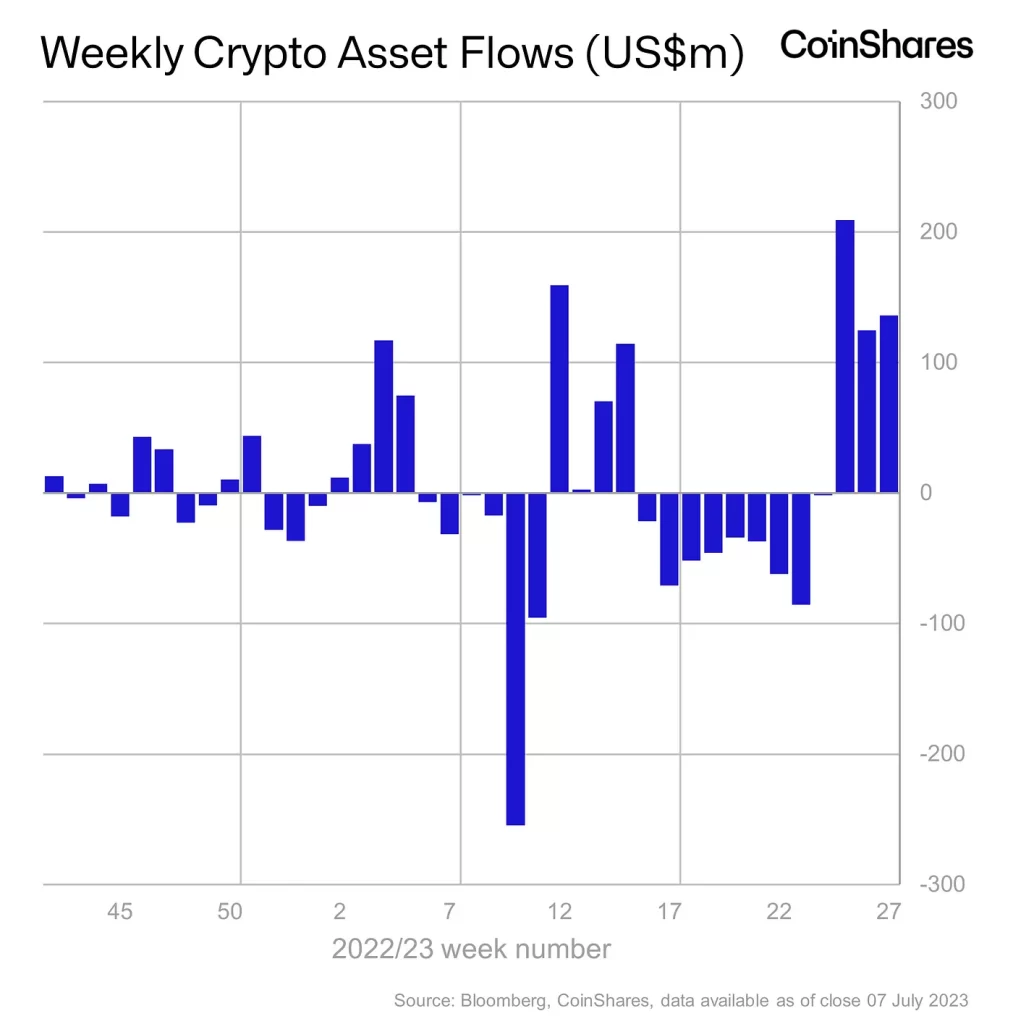

Digital asset investment product inflows topped $136 million last week, marking its third consecutive week of inflows at $470 million, CoinShares found in a new report.

According to the digital asset investment firm, the past three weeks of consecutive inflows have successfully offset the previous nine weeks of outflows, which totaled $423 million. This brought year-to-date flows to a net positive $231 million.

Source: Coinshares

Interestingly, despite last week’s inflows, the period was marked by a drop in trading turnover. Found CoinShares:

“Trade turnover has slowed, however, with investment products totaling $1 billion this week compared to the $2.5 billion average in the previous 2 weeks. These lower volumes may be due to seasonal effects, with lower volumes typically seen in July and August.”

Bitcoin takes the top spot

For the third straight week, Bitcoin [BTC] remained “the focus among investors” as the king coin recorded inflows last week, totaling $133 million. This accounted for 98% of total premium income in that period.

While BTC remained within a narrow price range during that period, there was an 8% increase in digital asset inflows last week.

The additional $133 million inflow brought the leading coin’s YTD net inflows to $290 million, with $25 billion in assets under management (AuM).

This represented the second week in which BTC recorded net inflows YTD, three weeks ago in a net outflow position of $171 million.

On the other hand, short Bitcoin investment products saw outflows of $1.18 million last week, representing 11 weeks of consecutive outflows. However, despite this recent bearishness for short Bitcoin, it remained the second best performing asset in terms of inflows YTD at $58 million, data from the report showed.

Source: Coinshares

Ethereum Recorded Inflows, But At What Price?

As he led altcoin Ethereum [ETH] posting inflows totaling $2.9 million, CoinShares noted that the coin has “benefited only marginally from the improved investor sentiment.” The report stated:

“The inflows of the last 3 weeks represent only 0.2% of total assets under management (AuM) compared to Bitcoin’s 1.9%, remaining in a negative net flow position year-to-date of US$63 million. “

Source: Coinshares

As for other altcoins, Solana [SOL]Wrinkle [XRP]Polygon [MATIC]and Litecoin [LTC] recorded inflows of $1.2 million, $900,000, $800,000, $500,000 respectively, while Cosmos [ATOM] and Cardano [ADA] saw small outflow.