HD: How Trump’s pro-crypto stance could fuel Bitcoin’s rise

HD: Bitcoin breaks through the $67,000 mark as market sentiment shifts

- BTC has risen to the price position of $67,000.

- Long positions now dominate the market with the current price movements.

Bitcoin in recent weeks [BTC]has seen a notable improvement in reputation and sentiment, alongside the broader cryptocurrency market.

This positive shift was reflected in several key indicators, especially in the dynamics of BTC’s long and short positions and the recent price trends.

Bitcoin is moving towards the $67,000 zone

AMBCrypto’s analysis of Bitcoin’s daily timeframe showed positive momentum over the past 24 hours.

BTC closed the trading session on July 25 with a modest gain of less than 1%, bringing its price to around $65,795.

Since then, the price has continued its upward trajectory, rising to over $67,000 after rising about 2%.

The $63,000 price level has been identified as a confirmed support area, reinforced by the short moving average (yellow line).

This support level indicated a strong presence of buyers at and above this price, preventing further declines and maintaining upward pressure.

Source: TradingView

The Relative Strength Index (RSI) suggested that Bitcoin was in a bullish trend at the time of writing.

An RSI reading around 60 indicated that the market was neither overbought nor oversold, supporting a stable continuation of the current uptrend.

Long positions dominate the Bitcoin market

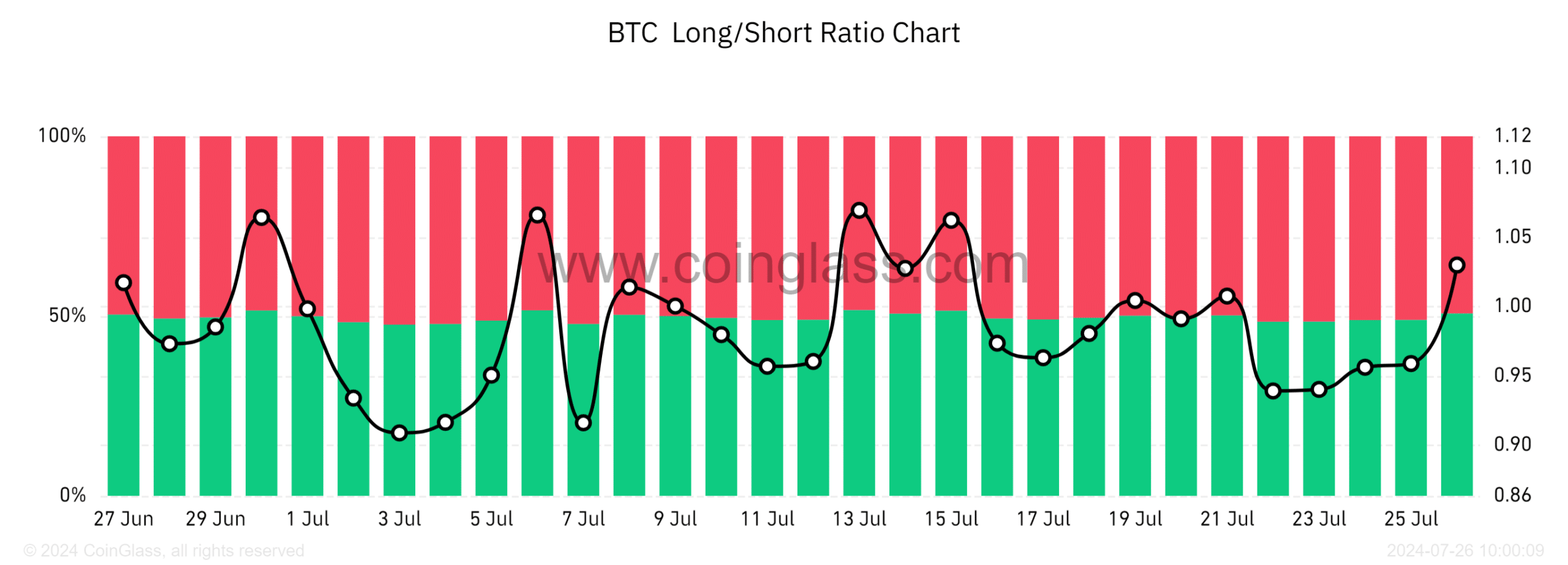

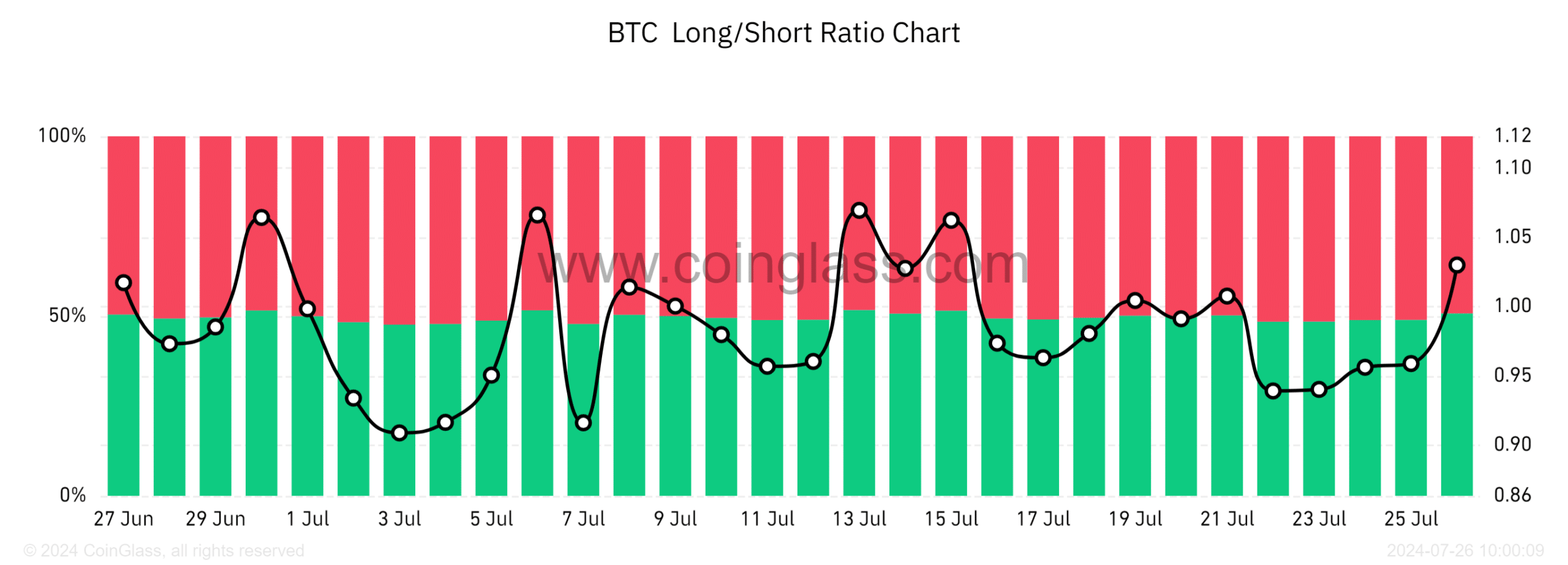

Bitcoin’s recent price movement has provoked mixed reactions among traders, which is reflected in the dynamics of long and short positions.

Despite the recent rise in the price of Bitcoin, the… Long/short ratio graph showed notable volume in short positions. This meant that many traders were betting on a possible decline in the price of Bitcoin.

However, at the time of writing there was a shift, with long positions slightly outweighing shorts at 50.7%, compared to 49.2% for shorts.

This slight dominance of long positions indicated that more traders were optimistic about BTC’s future price appreciation. However, the margin was tight, underlining somewhat divided sentiment within the market.

Source: Coinglass

Financing rates, which were above zero at the time of writing, further supported this optimistic outlook.

A positive funding rate usually means that holders of long positions are paying shorts, which often occurs in markets where there is a general expectation that prices will rise.

The Trump effect?

Weeks ago there was an assassination attempt on Donald Trump, a candidate in the American presidential race. After this event, the price of Bitcoin experienced a sharp increase.

This positive price movement can be partially attributed to the perception of Trump as a pro-cryptocurrency figure.

His increased visibility and perceived support for the crypto sector following the assassination attempt seemingly boosted investor confidence.

Since Trump will speak at a cryptocurrency conference on July 27, BTC continued to show positive price trends.

Read Bitcoin’s [BTC] Price forecast 2024-25

The anticipation surrounding his appearance at the event may contribute to the bullish sentiment in the cryptocurrency markets.

Participants speculate on possible positive endorsements or supporting statements that could further legitimize or promote digital currency adoption.