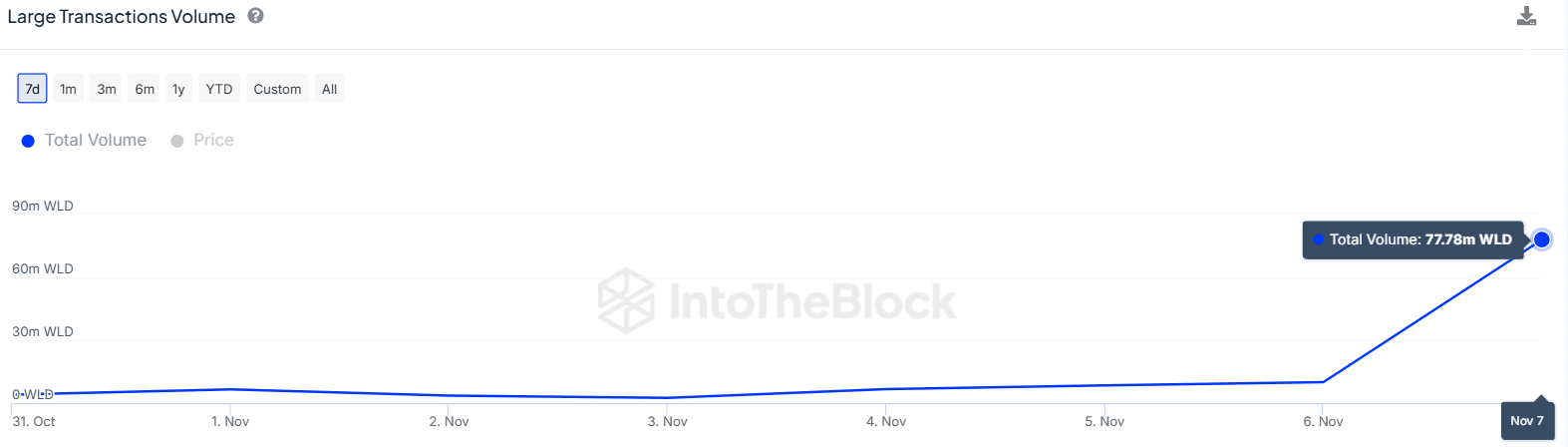

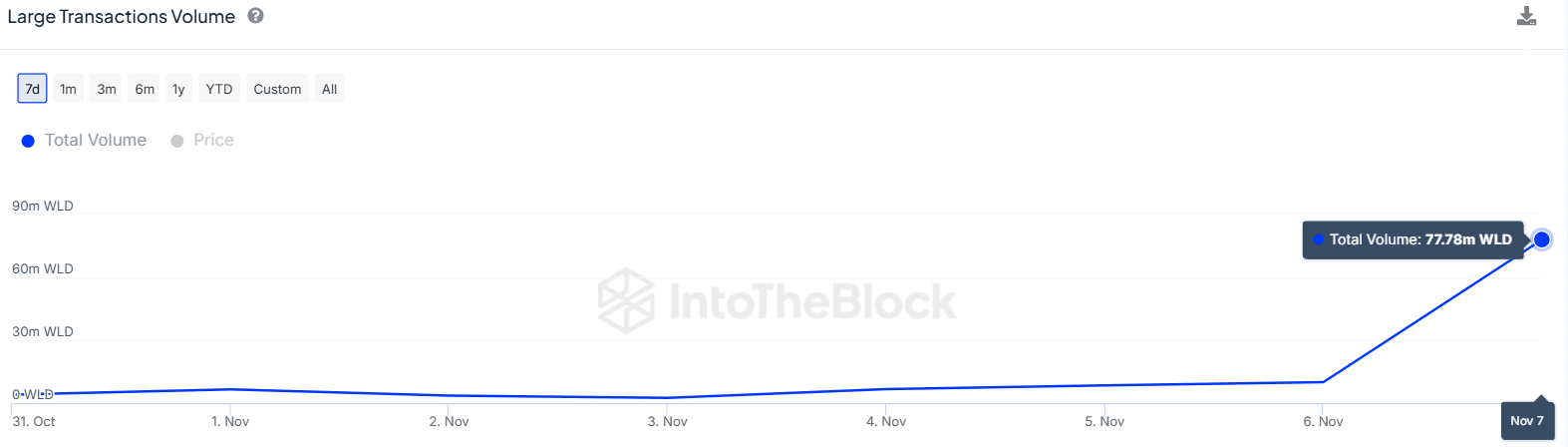

- Worldcoin’s high transaction volumes increased 600% from 9.98 million to 77.78 million in 24 hours.

- Despite this increase in whale activity, the WLD price has failed to make significant gains.

World currency [WLD] posted slight gains earlier this week as Bitcoin [BTC] and the broader cryptocurrency market recovered. However, at the time of writing, WLD had lost some of these gains, after falling slightly by 0.35%, to trade at $1.98.

Despite the choppy price movements, a look at the on-chain metrics suggests that WLD is at an inflection point where a trend reversal is likely.

Whale volumes are increasing

Whale activity around Worldcoin has increased significantly. In just 24 hours, volumes for large transactions worth over $100,000 worth of WLD tokens increased from 9.98 million to 77.78 million.

Source: IntoTheBlock

Whale activity could play a role in WLD breaking out of bearish trends. This is because whales make up 84% of Worldcoin’s supply.

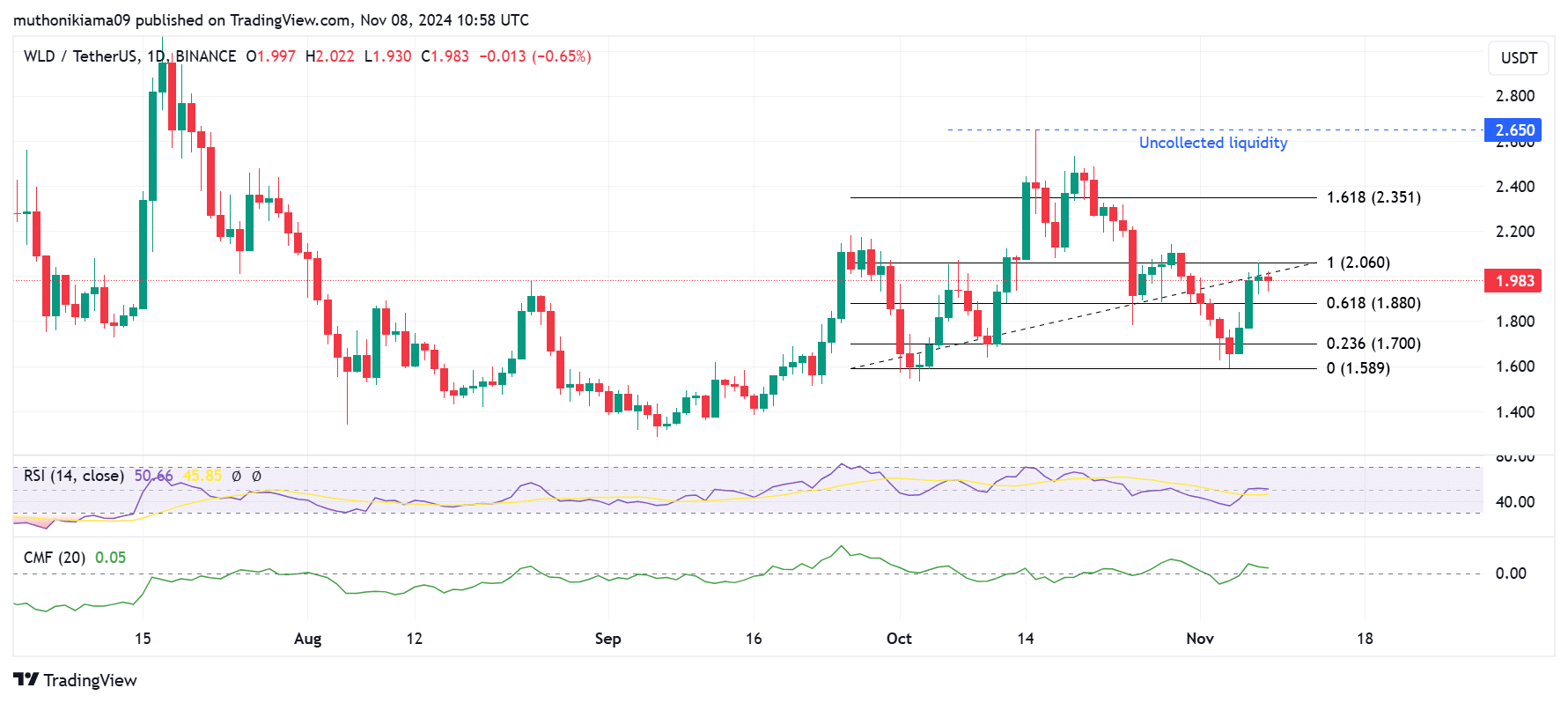

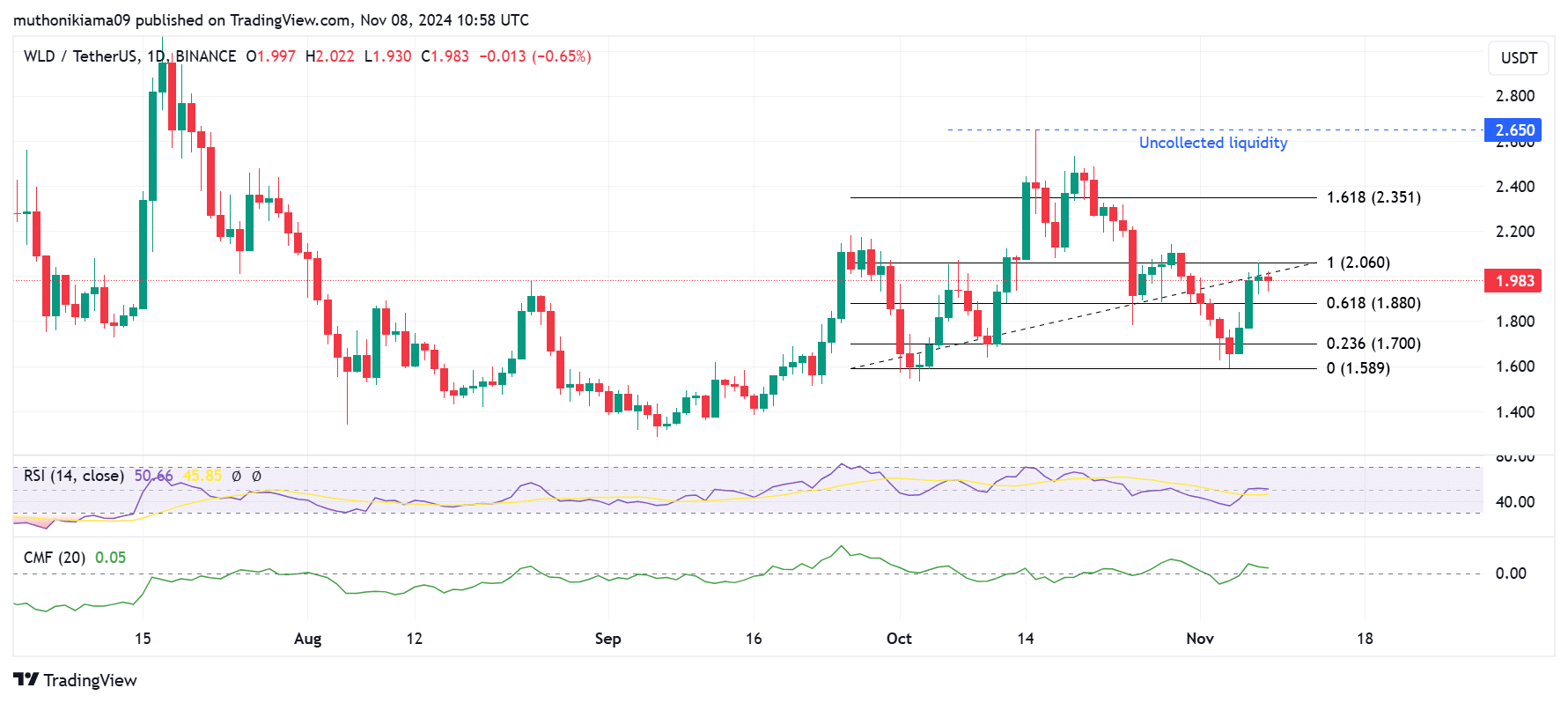

In order for WLD to rise due to whale activity, this cohort must purchase the token. The Relative Strength Index (RSI) on the one-day chart was at a neutral level of 50, indicating that sellers and buyers have equal control.

However, the RSI line was above the signal line, indicating that bullish momentum was rising.

At the same time, the Chaikin Money Flow (CMF) with a value of 0.05 is indicative of buying activity. However, additional buying pressure is needed to strengthen the upward trend.

Source: Tradingview

If this uptrend continues, $2.35 is the immediate resistance level. Traders should also watch out for a liquidity trap at $2.65. The uncollected liquidity at this price could act as a magnet that could push prices higher.

If the bullish trend fails due to a lack of sufficient buying pressure, WLD could fall towards the $1.58 support level.

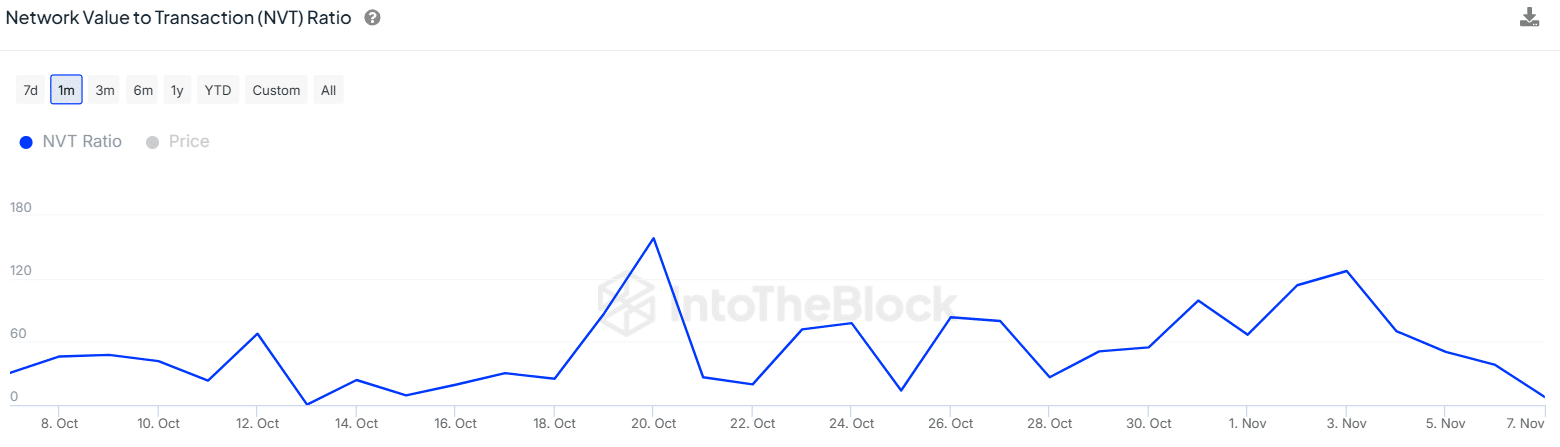

Analysis of Worldcoin’s NVT ratio

The Network Value to Transaction (NVT) ratio shows that Worldcoin may be undervalued. This metric has fallen as it was at its lowest level in three weeks at the time of writing.

Source: IntoTheBlock

A declining NVT ratio shows that there is a lot of on-chain activity around Worldcoin, which is a bullish sign for WLD.

If the network is experiencing growth that is not reflected in the price, this could indicate that WLD is undervalued. This could pave the way for upside potential.

Realistic or not, here is the WLD market cap in terms of BTC

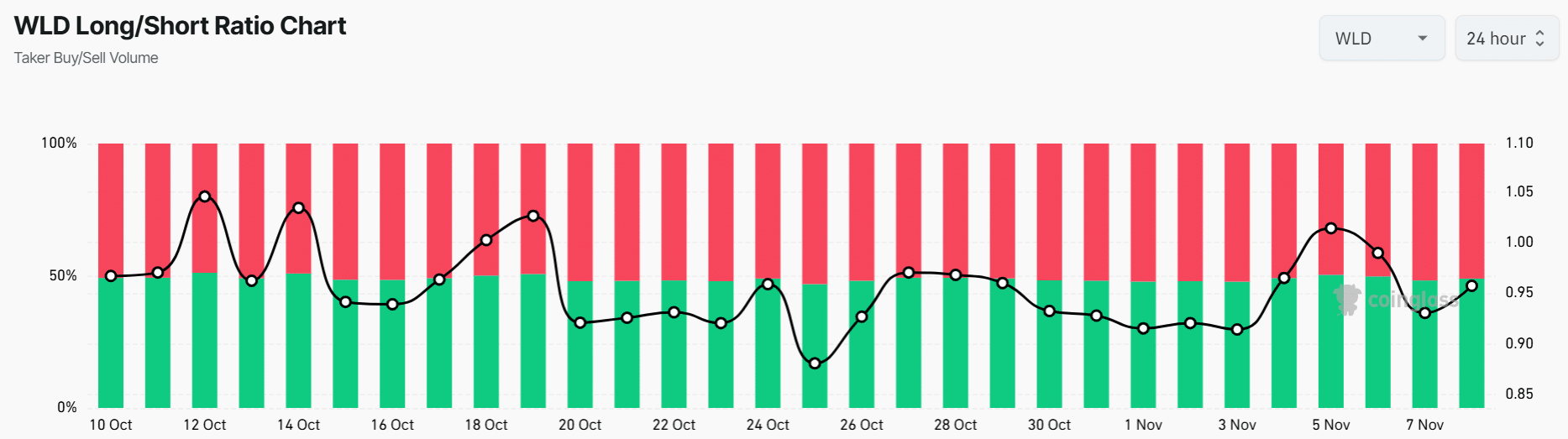

Despite WLD showing signs of undervaluation, derivatives traders continue to bet against the altcoin.

The long/short ratio has been below 1 for the past three consecutive days, indicating that short sellers are more than traders who take long positions. This indicates bearish market sentiment.

Source: Coinglass