This article is available in Spanish.

Demand for US Bitcoin ETFs has increased significantly as we enter 2025, marking a notable turnaround after a lackluster start to the year.

Related reading

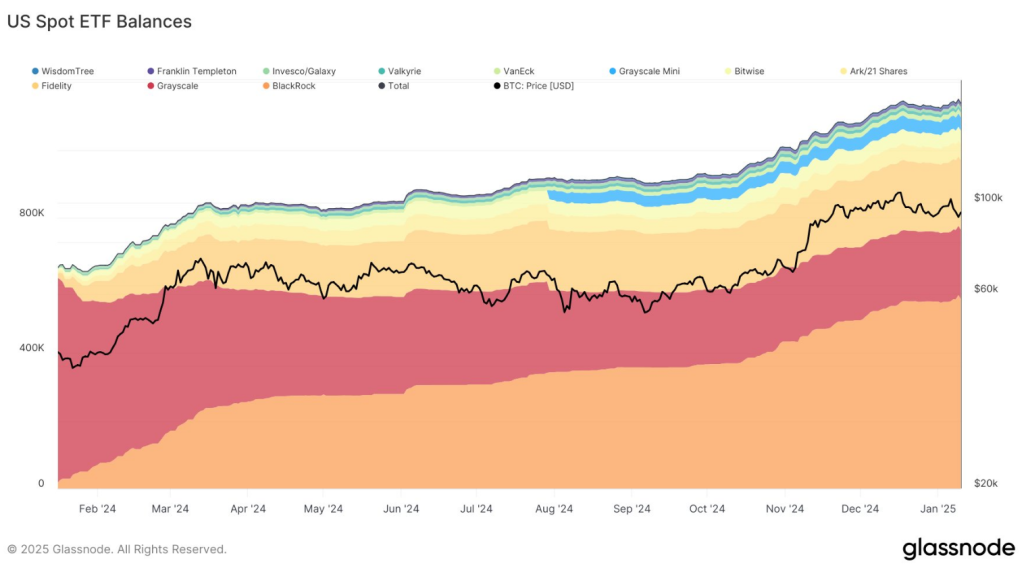

Based on recent figures from Glassnode, net inflows for the week ending January 6 were 17,567 BTC, equivalent to approximately $1.7 billion.

This increase exceeds the weekly average inflow of 15,900 BTC documented in the last quarter of 2024 and signals a revival of investor enthusiasm.

A turbulent journey of influx

The inflow into Bitcoin ETFs shows an erratic pattern. This inflow showed notable fluctuations at the end of 2024. There was a significant decline in September Bitcoin prices fell below $64,000, leading to large withdrawals.

Nevertheless, things began to change in October. The influx increased dramatically; within weeks they reached the 24,000 BTC mark. While the average weekly inflow was around 15,900 BTC, the increase continued in November and December, demonstrating the high demand for Bitcoin investments.

After a slow start to the year, demand for American spot has increased #Bitcoin ETFs are normalized. In the week of January 6, the influx was 17,567 #BTC ($1.7 billion), which is slightly higher than the weekly average of 15.9 thousand $BTC ($1.35 billion) from October to December 2024: https://t.co/0Cpfm8lpak pic.twitter.com/u4FksOSLuZ

— glassnode (@glassnode) January 13, 2025

As the price of Bitcoin rose, so did ETF inflows. In December 2024, the world’s most popular digital asset reached an all-time high of $108,135.

This association suggests that as more people switched to exchange-traded funds, investor confidence in Bitcoin’s value grew, leading to positive market sentiment.

Bitcoin ETFs: Who Owns the Most?

The total holdings of American spot Bitcoin ETFs as of early January 2025, there are approximately 1.13 million BTC. Grayscale has 204,300 BTC, Fidelity has 205,488 BTC and BlackRock has 559,673 BTC, making it the largest holding.

By 2024, Bitcoin ETF from BlackRock (IBIT) turned heads by amassing $37.25 billion in assets during its first year, securing the third position on the Top 20 ETF Leaderboard for the year. This significant increase highlights the rising institutional demand for cryptocurrency-backed financial solutions.

Will 2025 be a good year for ETFs?

It looks like Bitcoin ETFs will do well in 2025. Experts in the field believe that many new, innovative offerings may hit the market this year.

According to Nate Geraci of the ETF Store, at least 50 new bitcoin ETFs will appear this year. These will cover a wide range of strategies such as covered call ETFs and Bitcoin-denominated stock ETFs.

Moreover, it is suspected that Bitcoin spot ETFs will soon surpass physical ones gold ETFs in terms of asset size. This would represent a crucial advance in the development of digital assets as conventional investment instruments.

Such a change would highlight increasing confidence in Bitcoin as a valid store of value and investment instrument, challenging the long-held view of gold as the best hedge.

Related reading

As financial institutions like Vanguard explore cryptocurrency ETF alternatives, this underlines a broader trend of adoption and integration of cryptocurrencies into established financial systems.

Featured image from Reuters, chart from TradingView