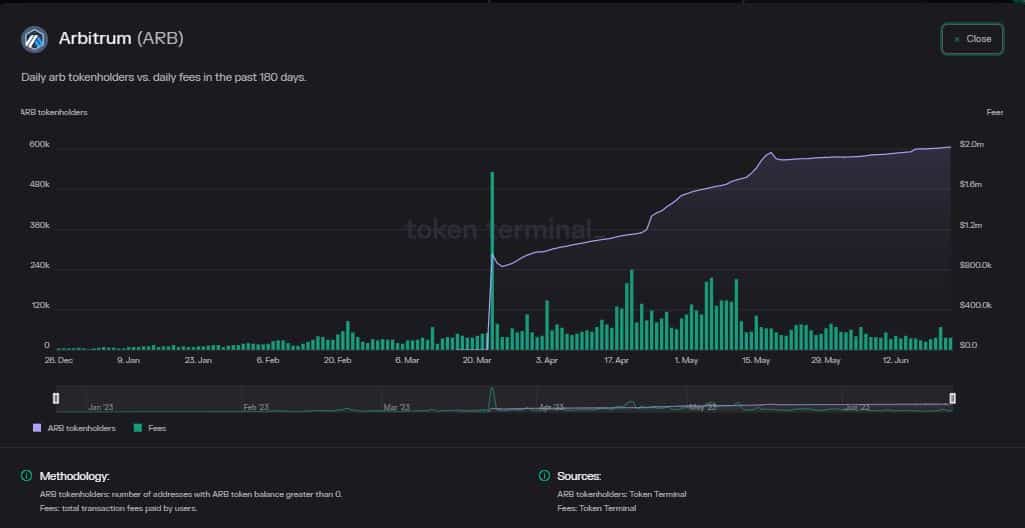

- Demand for ARB continued to rise as the number of holders increased.

- Transaction costs on the network reached a plateau, indicating a lull in trading activity.

The recent market rally fueled by institutional interest in cryptocurrencies has injected optimism into the popular layer-2 (L2) rollup token, Arbitrum [ARB] also. The token gained more than 5% since the rally according to CoinMarketCap data, which brought relief from the gloom that has reigned since the onslaught of US regulators.

Realistic or not, here is ARB’s market cap in BTC terms

Fees, income plateau

The token has received a lot of attention since the highly publicized AirDrop event in March, witnessing a steady increase in daily active wallets and the creation of new wallets. This was also followed by a popular one Twitter user which regularly analyzes trends in the crypto space.

According to the tweet, the number of addresses with an ARB token balance has been on an upward trend since launch. What stood out, however, was the stagnation of transaction fees paid on the network and, as a result, protocol revenue.

Source: Token Terminal

This was largely in the expected manner, as ARB still functioned as a governance token.

Will EIP-4488 make a difference?

The Twitter user highlighted the dip in Arbitrum transaction fees to bring up the upcoming Ethereum Improvement Proposal (EIP)-4488.

Proposed by Ethereum co-founder Vitalik Buterin, the main goal of EIP-4488 was to reduce the cost of uploading off-chain data (from the rollups) to on-chain (Ethereum base layer) without compromising to the security aspect. While L2 rollups have undoubtedly jumped at the opportunity to address Ethereum’s scalability issues, the high cost of uploading L2 data at the base tier has been a major drag.

With EIP-4488, this fee is reduced by 80%, further reducing gas costs for the end user. The upgrade was expected for a full production launch by the end of 2023.

According to L2Fees, the cost of sending one ETH on Arbitrum was $0.05, a fraction of the cost of Ethereum, but higher than other optimistic combinations like Optimism [OP].

Is your wallet green? Check out the ARB Profit Calculator

TVL observes growth

The market rally led to a recovery of the chain’s liquidity. This happened as the Total Value Locked (TVL) rose more than 8% over the past week.

Arbitrum had assets of over $2.72 billion at the time of publication, making it the fourth largest blockchain. It was also the largest L2 solution in terms of TVL.

Source: DeFiLlama