- DEGEN crypto has a bearish structure and bearish momentum in the short term.

- The price is expected to bounce from the nearby Fibonacci support level.

Epee [DEGEN] saw a significant increase in prices in October. The unofficial sign which started as a memecoin on the Base network now has a market cap of $124.6 million.

Despite the 28% price drop since October 14 highs, the token is still up 128.5% this month.

Technical analyzes show that more profits can be expected. The $0.008 region is a key support level in the coming days. The response to that would be a good indication of the strength of the buyers.

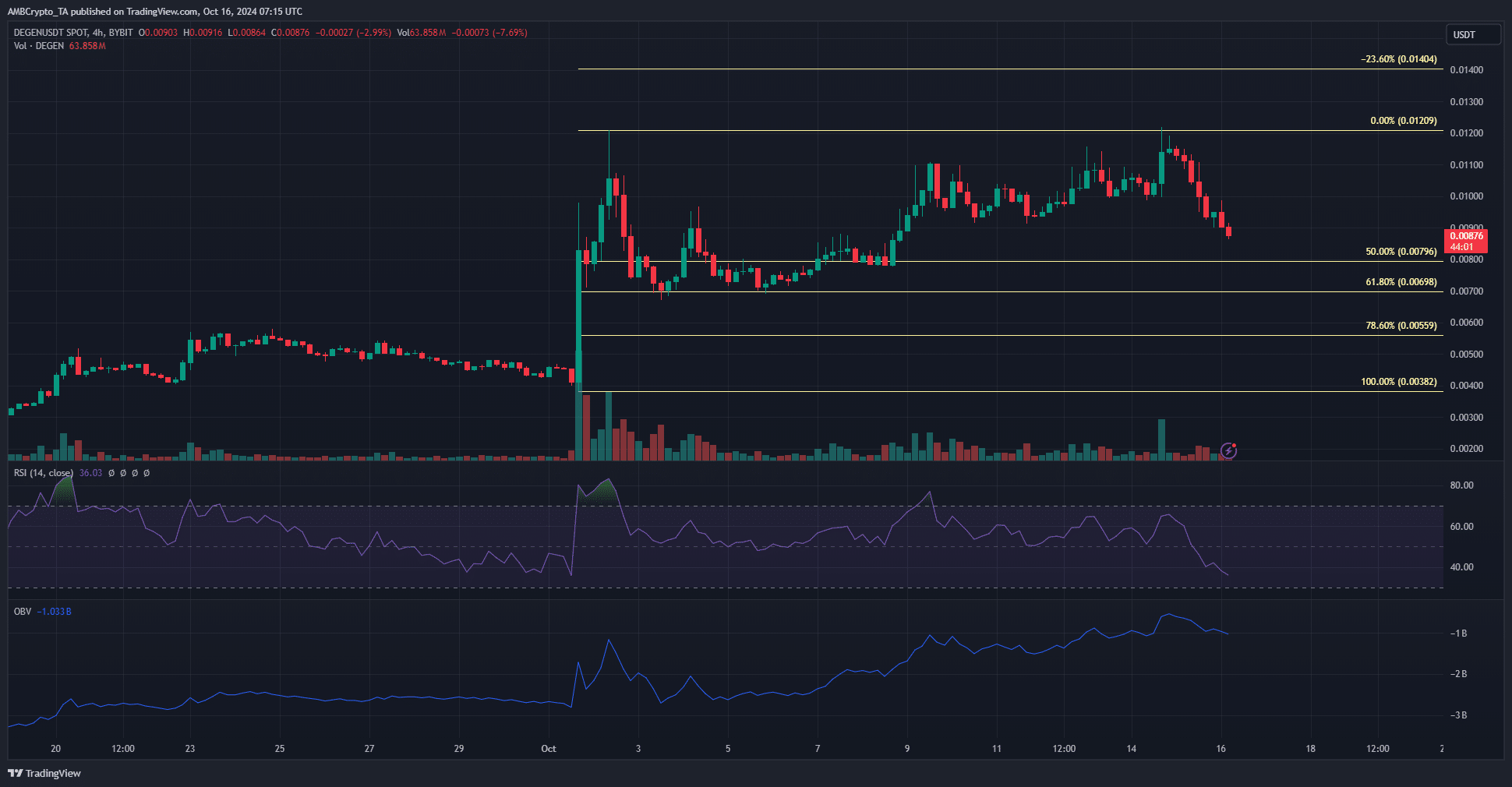

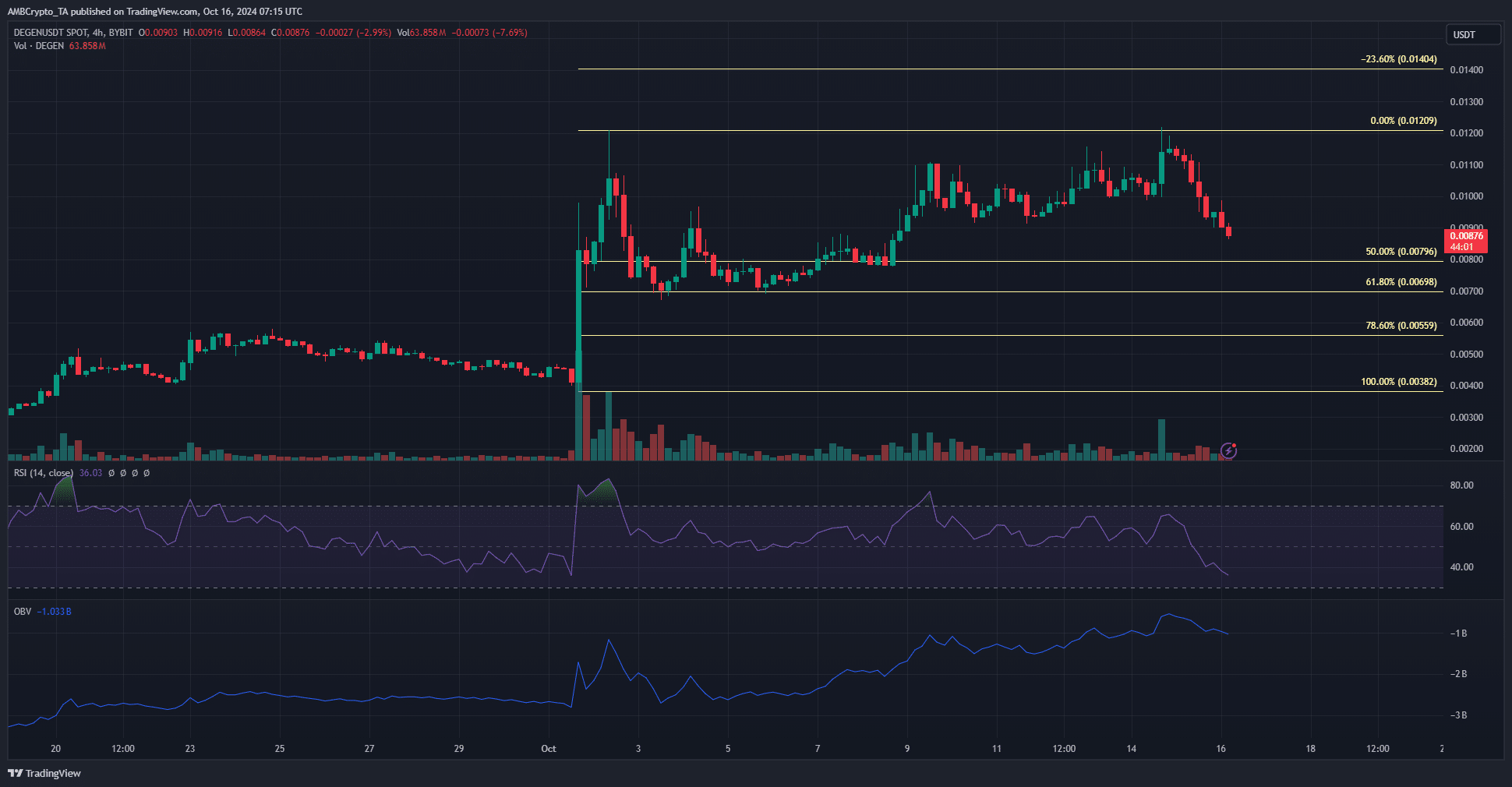

The retracement phase for DEGEN crypto is underway

Source: DEGEN/USDT on TradingView

On the 4-hour chart, the market structure turned bearish on Tuesday, October 15. The trend, which has been bullish so far, could slide into a bearish trend in the short term, which would mark a retracement phase for DEGEN.

The RSI has fallen below the neutral 50, indicating that momentum was on the sellers’ side. Yet the OBV disagreed with these findings.

The sales volume of the past few days, which forced a correction of almost 25%, did not have any notable volume behind it.

The Fibonacci retracement levels outlined the key support levels. Given the reduced selling pressure, it is likely that the 50% level at $0.0796 would act as support and push prices higher.

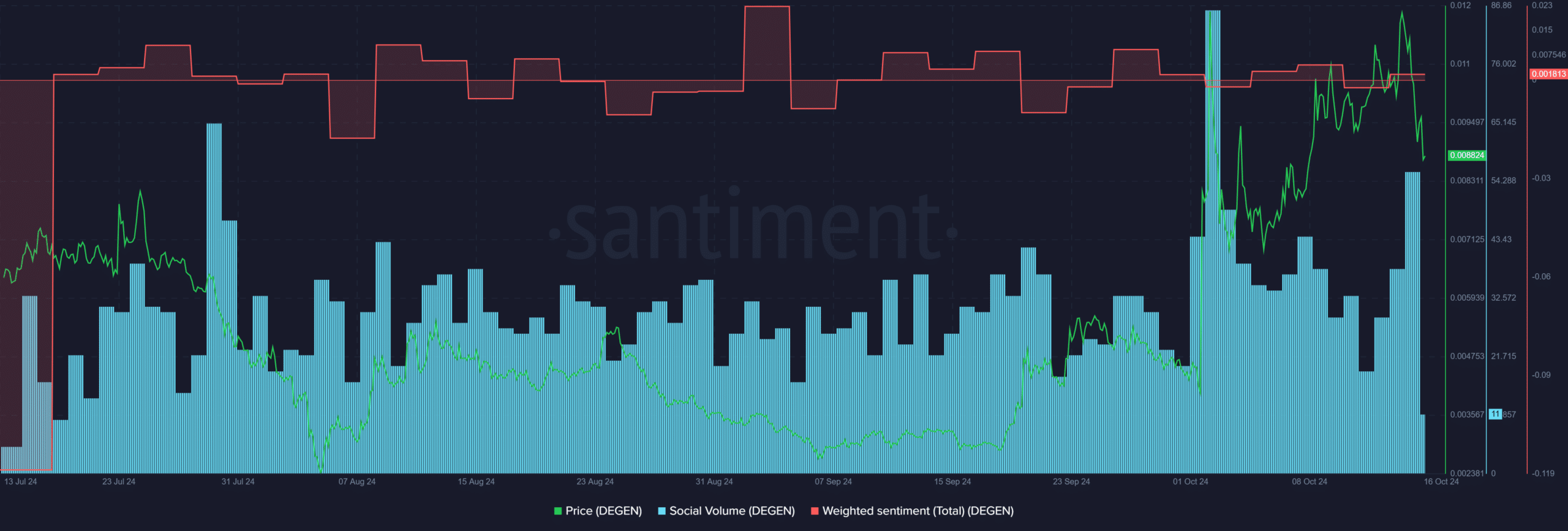

Sentiment bullish after recent gains

The social volume behind DEGEN rose higher on October 2, but has fallen slightly since then. Weighted sentiment was also slightly bullish.

Together they showed the optimistic expectations of the participants on social media.

Is your portfolio green? View the DEGEN Profit Calculator

Coinglass’ Open Interest data showed rising OI alongside prices. This positive belief in the derivatives market was a positive sign.

The volatility surrounding Bitcoin [BTC] During the open day in New York on Tuesday, DEGEN’s OI fell, but the chances of recovery seemed good.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer