- The US Senate has proposed a new law that could limit the growth of DeFi in the country.

- DeFi protocols remained unaffected and tokens did not witness any drop in price.

In the past quarter, the DeFi sector experienced limited growth, with most protocols showing disappointing performance. Liquid Staking emerged as an exception, showing stronger results compared to the vast majority of other protocols.

Realistic or not, here is UNI’s market cap in terms of BTC

However, things could get much worse for the DeFi sector in the future due to the recent news from the US Senate proposal.

What is the US Senate up to?

The US Senate has introduced a new bill that supposedly aims to combat money laundering, crypto-facilitated crime and sanctions violations. The legislation aims to subject DeFi services to similar money laundering (AML) compliance requirements and economic sanctions as other financial entities, such as centralized crypto trading platforms, casinos and even pawnshops.

The goal is to bring more accountability and security to the crypto industry while curbing illegal activities related to cryptocurrencies.

The proposal highlights the US government’s concern that DeFi has become a favored way for bad actors, including criminals, drug traffickers and hostile state actors like North Korea, to transfer and launder illicit funds.

Under the proposal, these entities have expressed a keen interest in exploiting the decentralized nature of DeFi to facilitate illicit activities such as cross-border trafficking of fentanyl and funding the development of weapons of mass destruction.

The bill will be called the Crypto-Asset National Security Enhancement and Enforcement (CANSEE) Act and will be used to crack down on money laundering and sanctions evasion involving DeFi.

How will these sanctions work?

The legislation specifies that if a sanctioned individual, such as a Russian oligarch, uses a DeFi service to circumvent US sanctions, the individuals controlling the project will be held responsible for facilitating such a breach.

In cases where no centralized control exists, any entity investing more than $25 million in the development of the DeFi project will assume responsibility for these compliance obligations.

In addition, the CANSEE Act would require operators of crypto kiosks (crypto ATMs) to improve traceability of funds by verifying the identity of all parties involved in each transaction.

According to the proposal, addressing these vulnerabilities is essential to prevent criminals from misusing crypto kiosks for money laundering related to drug trafficking, human trafficking, scams and other illegitimate activities.

The people respond

The crypto space did not take the US Senate bill lightly. Many crypto and DeFi enthusiasts took to Twitter to criticize the proposal.

The Crypto Council for Innovation (CCI) was one of the first to speak on this topic. The organization claimed that the proposal lacks a practical framework to effectively address illicit financing within these sectors.

1/ Today, @SenJackReed, @SenatorRounds @SenatorWarner And @SenatorRomney introduce a bill to apply AML and sanctions obligations to “supporters” and “facilitators” in the DeFi space, along with new and onerous requirements for crypto ATMs.

— Crypto Innovation Council (@crypto_council) July 19, 2023

The CCI believed that the proposal placed legal obligations on individuals who have no real means of influencing protocols once implemented and fails to take into account the distinctive features of blockchain-backed systems.

As a result, the proposal is considered insufficient to address the specific challenges of decentralized and blockchain technologies.

The proposed legislation contains some additional details that have raised concerns with the CCI. One of those concerns was the ambiguity surrounding the definition of “control.”

Under the proposal, the Treasury will have the power to decide what constitutes “control” of a DeFi project, making its determination seemingly separate from established legal frameworks. This lack of clarity can potentially lead to confusion and legal uncertainty for those involved in DeFi services.

Another bone of contention is the inclusion of the $25 million arbitrary valuation threshold. The proposal did not contain a clear rationale or methodology for determining this specific amount.

According to the CCI, it remains uncertain why this specific valuation was chosen and how it ties in with the objectives of the legislation.

How is the DeFi sector doing?

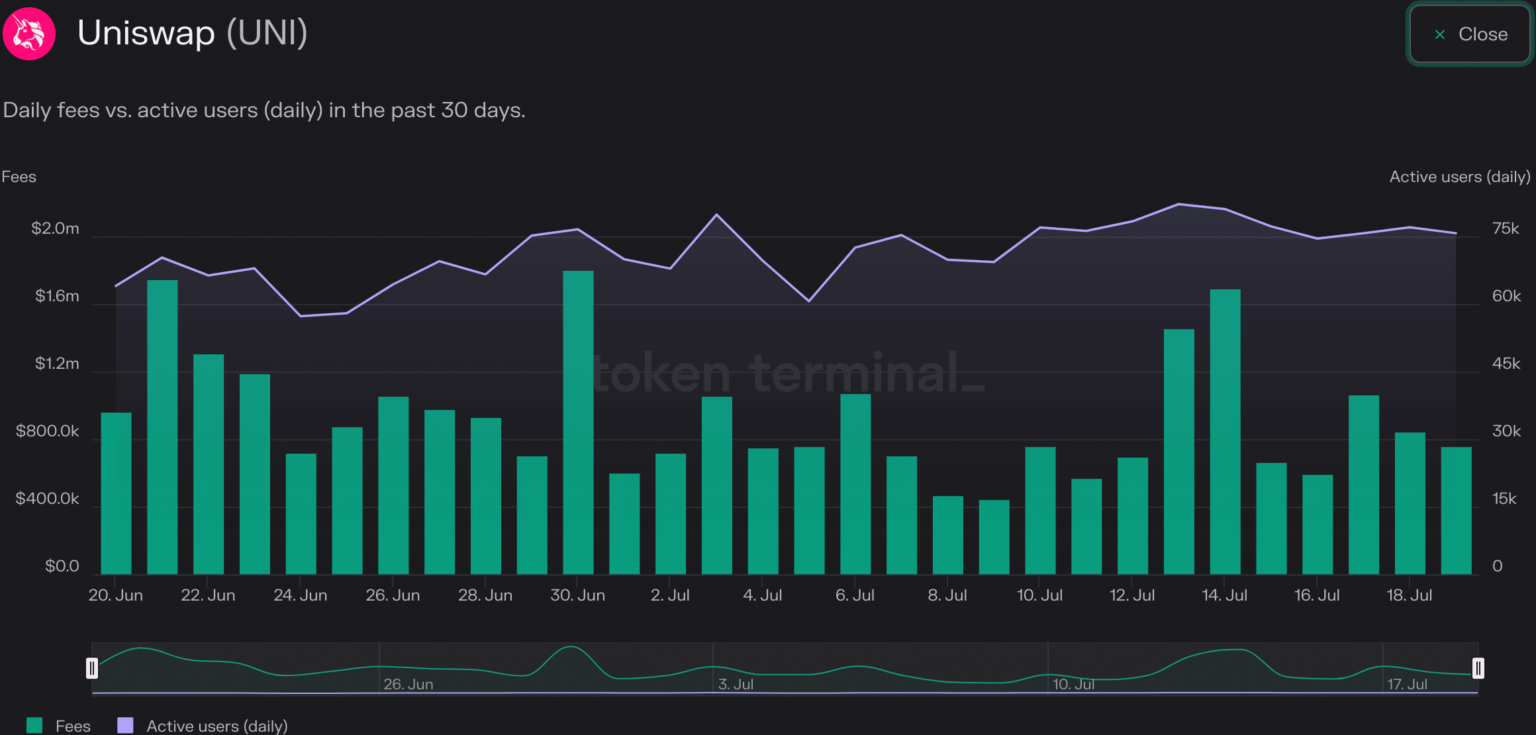

At the time of writing, there was not much volatility in the DeFi protocols across industries. According to Token Terminal, activity on Uniswap [UNI]MakerDAO [MKR]and lido [LDO] remained relatively stable over the past 24 hours.

Source: Token Terminal

Read Lidos [LDO] Price forecast 2023-2024

The news of the recent Senate proposal also did not have a major impact on the tokens of these protocols. UNI, MKR and LDO prices have not fallen, according to Santiment data.

However, the network growth of all these tokens has declined in recent days, indicating that new users have started to lose interest in these tokens.

Source: Token Terminal