- The DeFi market cap at the time of writing was $67 billion.

- With Bernstein’s prediction, the market capitalization could rise and come close to the previous high.

According to a recent report from Bernstein, Decentralized Finance (DeFi) is poised to attract more attention from traders in the coming weeks.

While the sector is still recovering from the 2022 lows, recent data shows promising growth in Total Value Locked (TVL).

As traders prepare for a shift in market dynamics, key assets like Chainlink are also important [LINK] and Lido Staked Ether continue to lead the market.

DeFi will attract more traders

A recent report from Bernstein suggests that Decentralized Finance (DeFi) could see increased interest from traders in the coming weeks.

AAccording to analysts Gautam Chhugani, Mahika Sapra and Sanskar Chindalia, the potential for rate cuts by the US Federal Reserve – ranging from 25 to 50 basis points on Wednesday – could make DeFi yields more attractive.

While the total value (TVL) in DeFi is still only half of its 2021 peak, it has doubled from its 2022 low, reaching $77 billion. Furthermore, monthly users have increased three to four times since the market bottom.

Stablecoins have also regained momentum, with values around $178 billion, and monthly active wallets remain steady at around 30 million.

DeFi market cap sees decline, but…

According to data from Coin geckothe current market capitalization of the DeFi sector is approximately $68 billion.

Further analysis revealed that the market had experienced a significant decline since April, when the market capitalization was approximately $116 billion. Since then there have been significant losses.

However, based on Bernstein’s recent predictions, a recovery in DeFi market capitalization could be imminent.

As interest in DeFi grows and favorable conditions arise, such as possible interest rate cuts by the US Federal Reserve, the market may recover in the coming months.

Chainlink leads the asset market

According to data from CoinGecko, LINK had the second largest market capitalization among DeFi assets, after Lido Staked Ether.

Lido Staked Ether leads with a market cap of over $22 billion, while LINK has a market cap of over $6.4 billion. At the time of writing, LINK was trading at around $10.60, reflecting an increase of 0.8%.

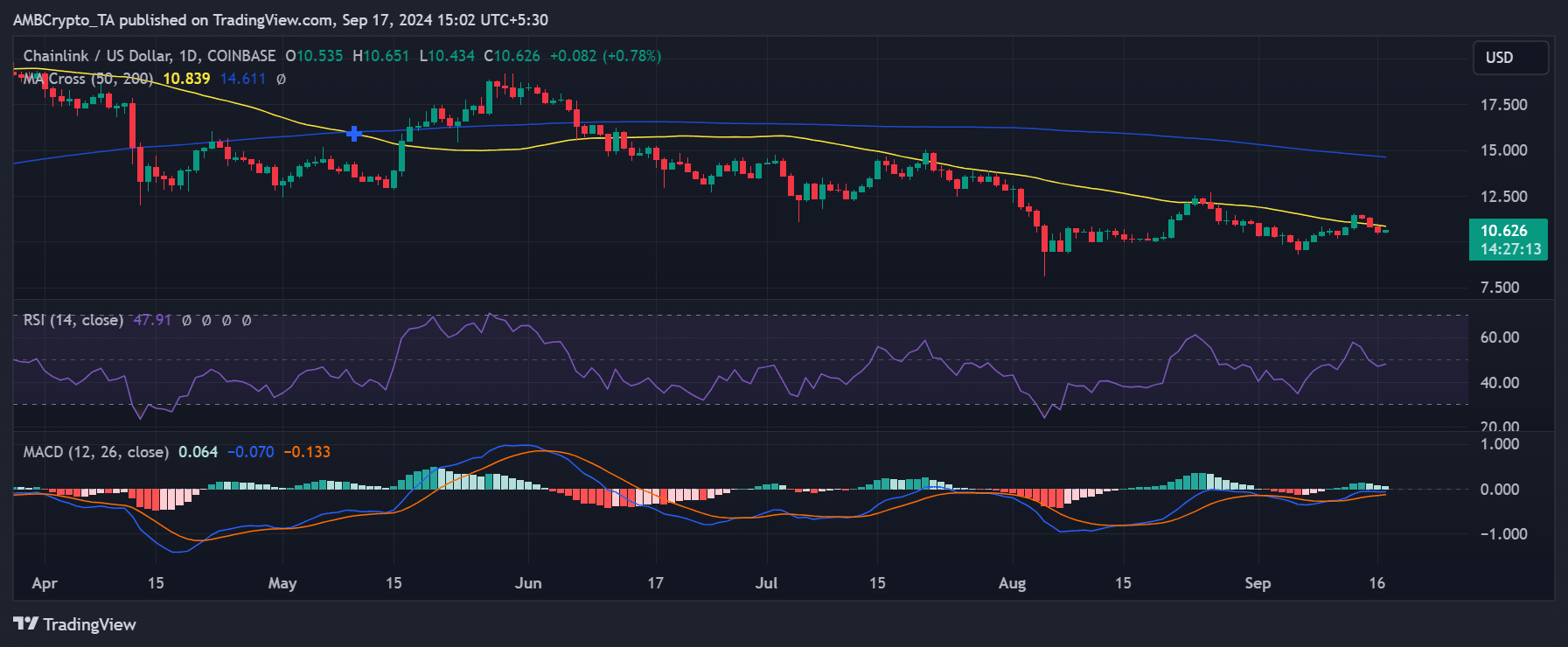

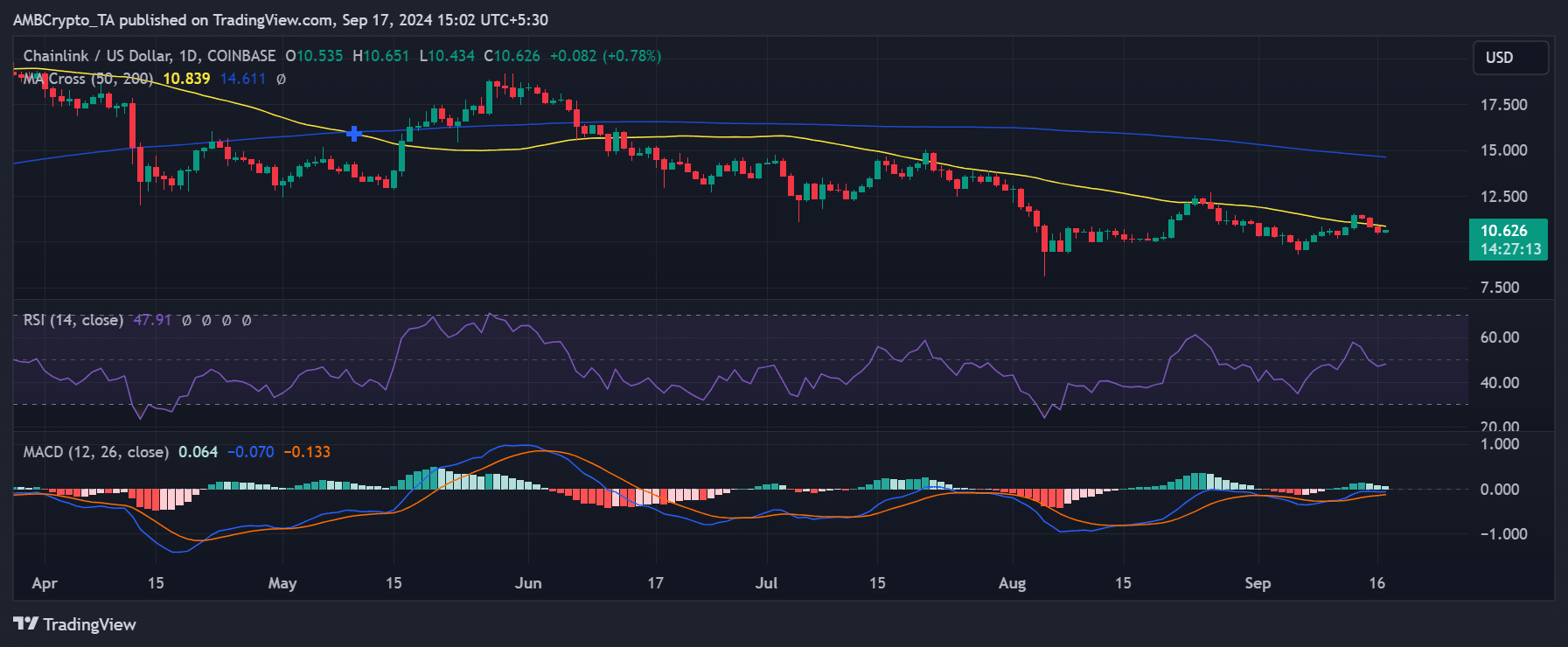

Source: TradingView

Despite recent gains, LINK previously experienced consecutive declines that put it below its short-term moving average (shown by the yellow line).

Although it briefly broke above this resistance level on September 13, it was unable to maintain the uptrend and fell back below the moving average.

As DeFi prepares for renewed interest from traders, fueled by potential rate cuts and attractive returns, the sector appears poised for a recovery.

Although the market capitalization has fallen significantly since April, positive trends such as the doubling of TVL and stable user activity indicate a potential recovery.