- Uniswap Labs opposes SEC rule change to expand definition of “exchange.”

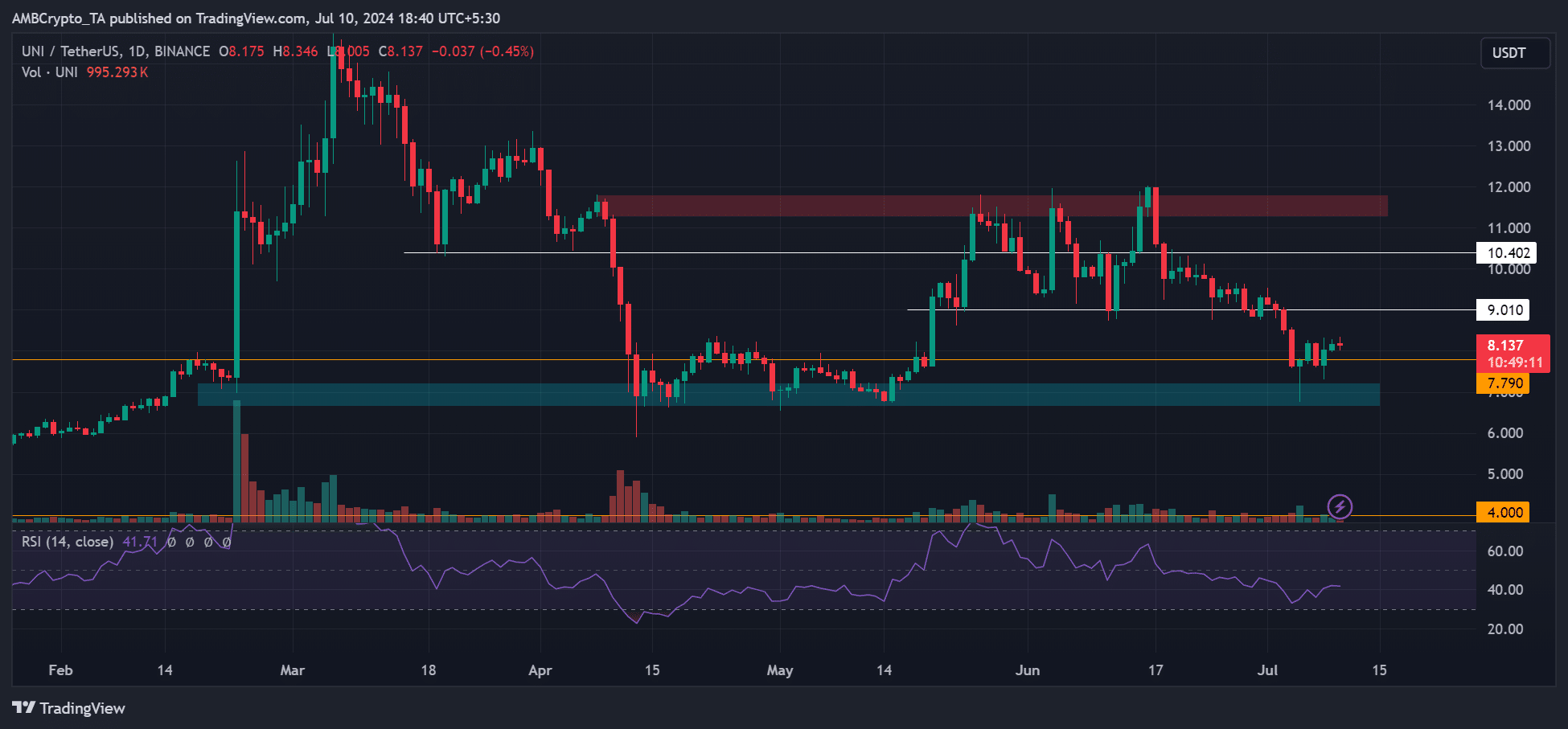

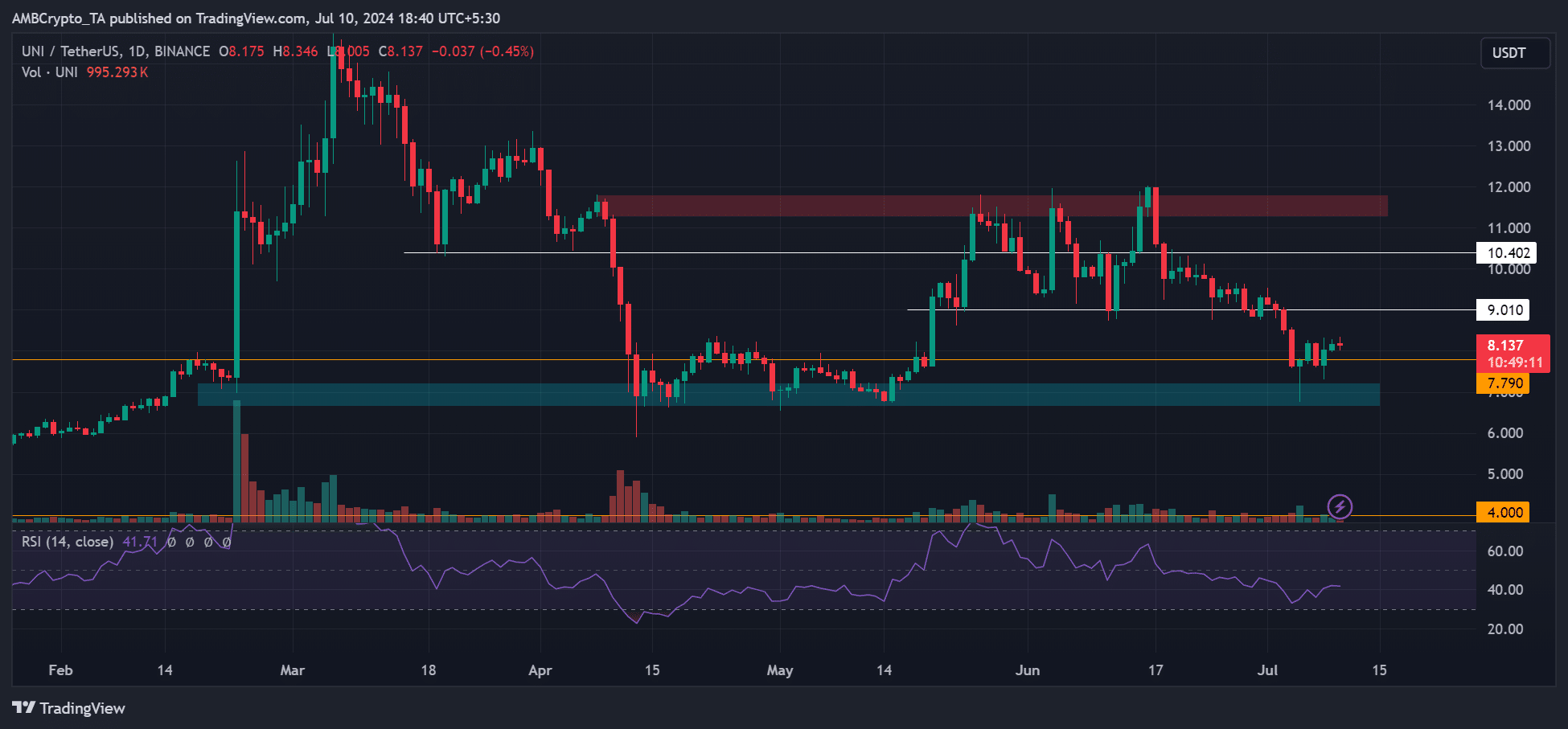

- UNI has fluctuated between $6 and $12 since April

Uniswap labs [UNI] has expressed reservations about the US SEC’s proposed amendments, which could expand the definition of ‘exchange’ and the agency’s mandate regarding DeFi (Decentralized Finance).

Katherin Minarik, Chief Legal Officer of the company behind Uniswap, sheds light on the SEC’s move. said,

“Today, Uniswap Labs urged the SEC not to proceed with proposed regulations that would dramatically and inappropriately expand the definition of an ‘exchange’ to include DeFi and more.”

The agency has attempted to expand the definition of an exchange as set out in the Exchange Act of 1934. Apparently, the SEC has attempted to cover DeFi within this expansion, according to the proposed changes. issued in April 2023.

It means that, if passed, even DeFi would fall within the agency’s purview. According to Uniswap Labs, the SEC’s expansion of the term “exchange” is unnecessary because the agency does not have the authority to make such blanket interpretations.

“The SEC and the industry have better ways to spend their resources than on litigation over an illegal rule.”

Finally, also Uniswap Labs claimed that such a move would allow the SEC to continue to regulate through enforcement, something that has upset the industry.

UNI’s price promotion

Source: UNI/USDT, TradingView

Since receiving a Wells Notice from the SEC in April 2024, the altcoin has lost more than 40% of its value. The price fell from around $12 to just above $6, with the main demand zone highlighted by cyan.

Greater regulatory clarity in the US helped the country bounce back from the demand zone and regain the $12 barrier. However, the overall negative sentiment saw the economy return to the demand zone in July.

Hence the question: will UNI retest the supply zone (red) around $12?

The Relative Strength Index (RSI) improved on the charts. While this can be seen as a sign of increasing buying pressure, the indicator appeared to be below the neutral level. This could further delay the recovery in the short term.

By the way, recent whale sale could further hinder UNI’s recovery and delay the bulls’ journey to the $12 mark.