- DAI surpassed BUSD in market cap due to legal issues faced by Binance.

- The integration of rETH as collateral and the increased debt ceiling contributed to DAI’s growth and stability.

DAI, the stablecoin released by MakerDAO [MKR], has long held the fourth position by market capitalization. BUSD, the stablecoin issued by Binance [BNB], ranked number three. However, the SEC’s recent lawsuit against Binance has caused many investors to lose faith in BUSD.

Realistic or not, here is MKR’s market cap in terms of BTC

DAI takes the lead

As a result of declining confidence in BUSD, the market cap experienced a significant drop, paving the way for DAI to claim the third position. At the time of writing, DAI’s market cap is around $4.94 billion, according to CoinMarketCap data.

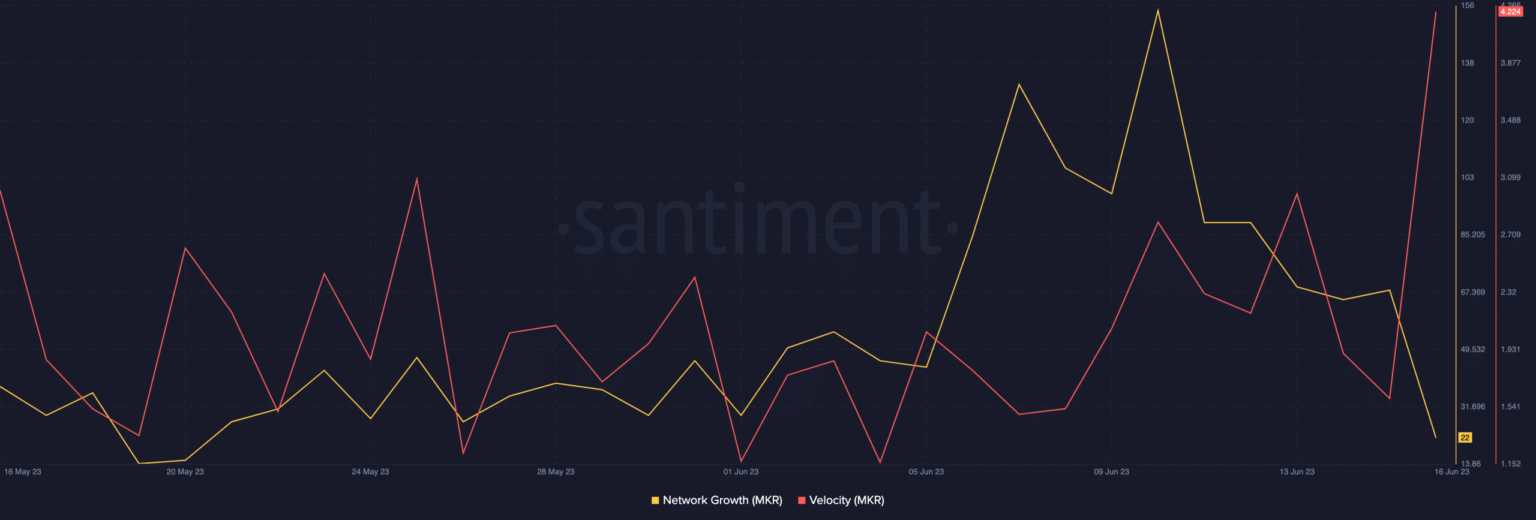

In addition, DAI has witnessed remarkable network growth, indicating increased interest from new users and addresses. In addition, the rate of stablecoins also increased, indicating an increase in the frequency of DAI transfers.

Source: Sentiment

DAI’s growth is poised to expand further as a result of recent collaborations initiated by MakerDAO. In accordance with the latest Executive Vote, the integration process of rETH (Rocket_Pool staked ETH) as new collateral in Spark Protocol was underway.

The integration of rETH into Spark Protocol is expected to have a positive impact on DAI. This development allows rETH holders to access DAI loans at very favorable interest rates, which is likely to boost demand for DAI. This increased demand will contribute to improved liquidity and stability for DAI, ultimately increasing DAI’s value and market position.

In addition, the Spark protocol has been actively raising the D3M debt ceiling from 5 million DAI to 20 million DAI. This adjustment provides additional liquidity capacity of DAI 15 million, which can be borrowed via Spark’s lending platform.

By extending the D3M debt ceiling to DAI 20 million, the Spark protocol contributes to DAI’s liquidity improvement while meeting the growing demand for loans. This expansion further strengthens the stability and usability of DAI within the ecosystem.

⚡ rETH is coming to Spark ⚡

reTH (@Rocket_Pool staked ETH) will be boarded Spark Protocol as a new collateral, according to the latest Executive Vote.

RETH holders can increase their holdings by borrowing DAI at the best rates https://t.co/SgPD7uamCM.

— Maker (@MakerDAO) June 15, 2023

Is your wallet green? Check out the MakerDAO Profit Calculator

Will MKR holders ‘make it’?

The growing dominance of DAI may also affect the status of the MakerDAO protocol. According to data from Token Terminal, Maker-generated fees saw a significant increase of 62.3% over the past month. However, the total value locked (TVL) in Maker continued to drop, posing potential challenges for the protocol.

Source: Token Terminal

Meanwhile, the MKR token, MakerDAO’s native governance token, has witnessed a price increase over the past week. This price increase has caught the attention of major investors, commonly referred to as whales, indicating their strong interest and confidence in the token.

Source: Sentiment