- DWF Labs recently moved 2 million CRVs to an exchange.

- The negative CRV sentiment continues as prices continue to fall.

The Curve [CRV] The episode’s potential impact on the DeFi industry drew more attention to the project. While the situation appeared to be under control, concerns remained about possible negative effects on CRV.

These concerns stemmed from certain measures taken to prevent its decline when the platform was hacked weeks ago.

– How much are 1,10,100 CRVs worth today?

DWF Labs Moves Curve to Binance

In a recent statement from Andrew Grachev, the leader of DWF Labs revealed that he transferred a significant amount of CRV to Binance. He clarified that he had floated 2 million CRVs on the stock exchange and may send further amounts.

He emphasized that these tokens were not intended for liquidation but for trading purposes.

2m sent $CRV on Binance, and will likely ship more. Not for liquidation purposes (it would be stupid to sell it now), but for trading purposes.

When we have executed our plan, we withdraw $CRV back to onchat

Cheers and enjoy the roller coaster 🎢 pic.twitter.com/Kdds4DQrP6— Andrei Grachev (@ag_dwf) August 22, 2023

A backstory to the Curve post

Andrei Grachev’s post mentioned above was prompted by speculation about the purpose behind DWF’s transfer of CRV to Binance. Rumors circulated about possible market manipulation, which led to the need for clarification.

Grachev himself played a role as one of the parties involved in an over-the-counter (OTC) agreement with Michael Egorov. This arrangement was made in response to the problems arising from Egorov’s debt position following the hacking incident.

After a series of exploits targeting multiple pools within decentralized exchange Curve Finance, CRV’s value fell sharply. Consequently, this drop put considerable pressure on Egorov’s position.

Egorov had significant outstanding debt, over $110 million, spanning several DeFi protocols. CRV was used as collateral for these loans, exposing them to liquidation risk.

In addition, Egorov conducted a series of over-the-counter transactions to avoid the liquidation of his enterprise position. Some of the parties involved in these OTC transactions were reportedly Justin Sun, Jeffrey Huang, and DWF Labs.

Here lies the problem

While Egorov managed to accumulate enough stablecoins by selling on the Curve platform to cover his positions, this move introduced an additional element of risk. Speculation arose about the lock-up period of about six months associated with the over-the-counter (OTC) sales. However, there were no clear indications as to how this lock-up period would be enforced.

This situation raised concerns that if the parties chose to sell their CRV interests, it could cause a significant decline in the value of CRV. In addition, it remained uncertain how sales would take place after this period, assuming that each counterparty adhered to the waiting period.

This scenario implied a potential for a substantial sell-off once the waiting period was over, which would have a significant negative impact on CRV’s value. Consequently, the fate of the CRV token appeared to be affected by these counterparties, posing challenges to the token’s prospects.

A negative curve

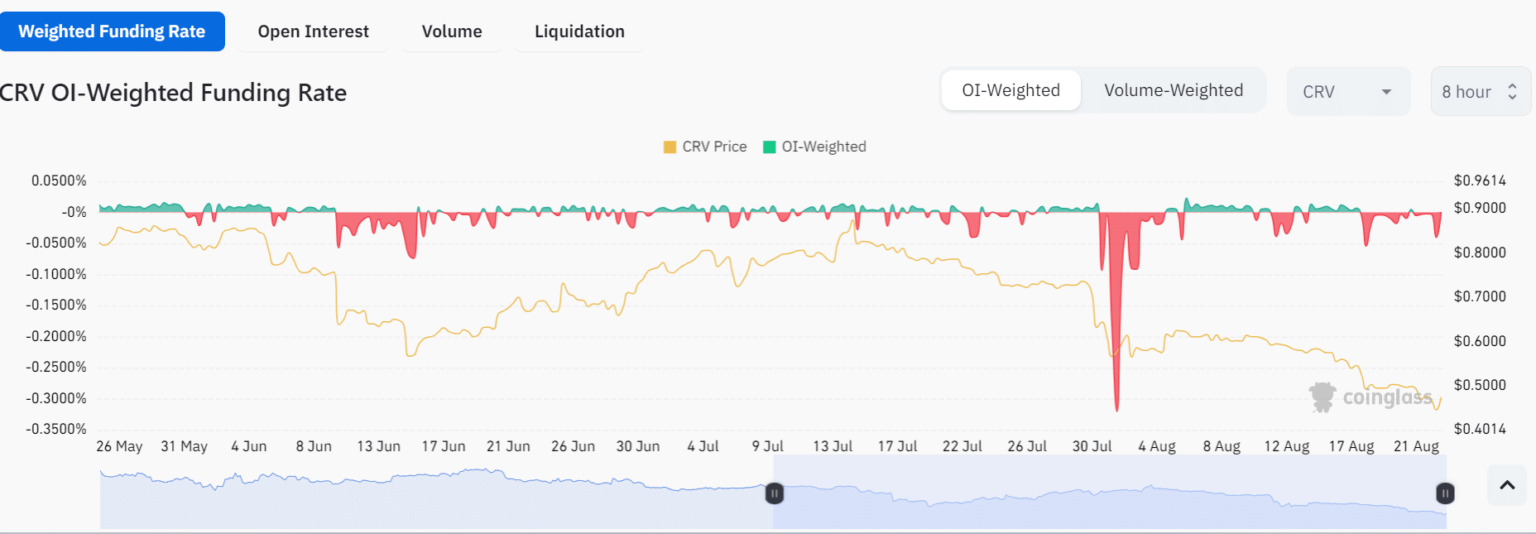

The fall in the price of the Curve token and the prevailing uncertainty seemed to have affected the overall market sentiment. According to data from Coinglass, CRV has been dealing with negative funding rates continuously for the past few days.

On August 22, the weighted funding rate had fallen to -0.04. At the time of writing, however, there was a slight improvement, with the weighted funding percentage rising slightly to 0.0006.

Source: Coinglass

This trend suggested that traders generally took mostly short positions, indicating that they were betting on the token’s price drop.

CRV continues to slide

Analysis of Curve’s daily timeframe chart revealed a temporary pause in the decline on August 18 and 19. Nevertheless, the downward trend continued as the previous upward momentum proved unsustainable.

At the time of writing, CRV was trading around $0.4, representing a drop in value of over 1%. This prolonged price decline has now driven the token into the oversold zone according to the Relative Strength Index (RSI).

Source: TradingView

– Read Curve DAO (CRV) price forecast 2023-24

The situation with Curve is distinctive and characterized by its uniqueness, and the events that unfold are still ongoing. The story surrounding Curve remains eventful and remains unsolved.