- BTC sees a price drop.

- The decline has not stopped whaling from proliferating.

Crypto whale accumulation of Bitcoin [BTC] has increased significantly over the past month.

Data indicated that these large holders have accumulated a significant volume of BTC, leading to an increase in the value of their holdings.

This trend suggested that wealthy investors are showing renewed confidence in Bitcoin, possibly anticipating future price increases.

Crypto whale benefits from price drops

According to data from Kijkonchain, a certain crypto whale address intensified Bitcoin accumulation just as the previous month was coming to an end.

In two days, this whale collected a total of 5,800 Bitcoin, worth almost $400 million.

Specifically, the address withdrew 1,300 BTC on July 31, after withdrawing 4,500 BTC the day before. This accumulation occurred during a period when Bitcoin’s price experienced consecutive declines.

From July 29 to 31, the BTC price chart showed a downward trend. Despite this decline, the whale’s significant accumulation indicates a bullish attitude from large-scale investors.

The value of crypto whale assets is increasing

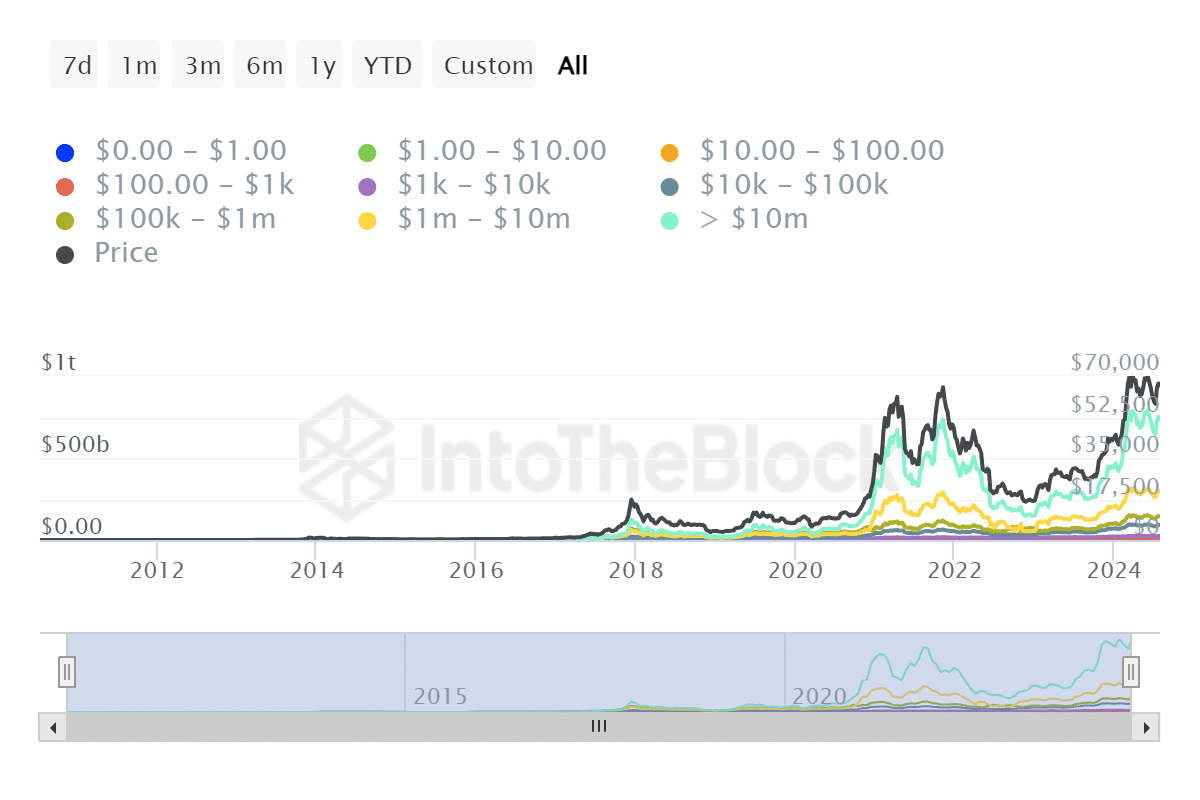

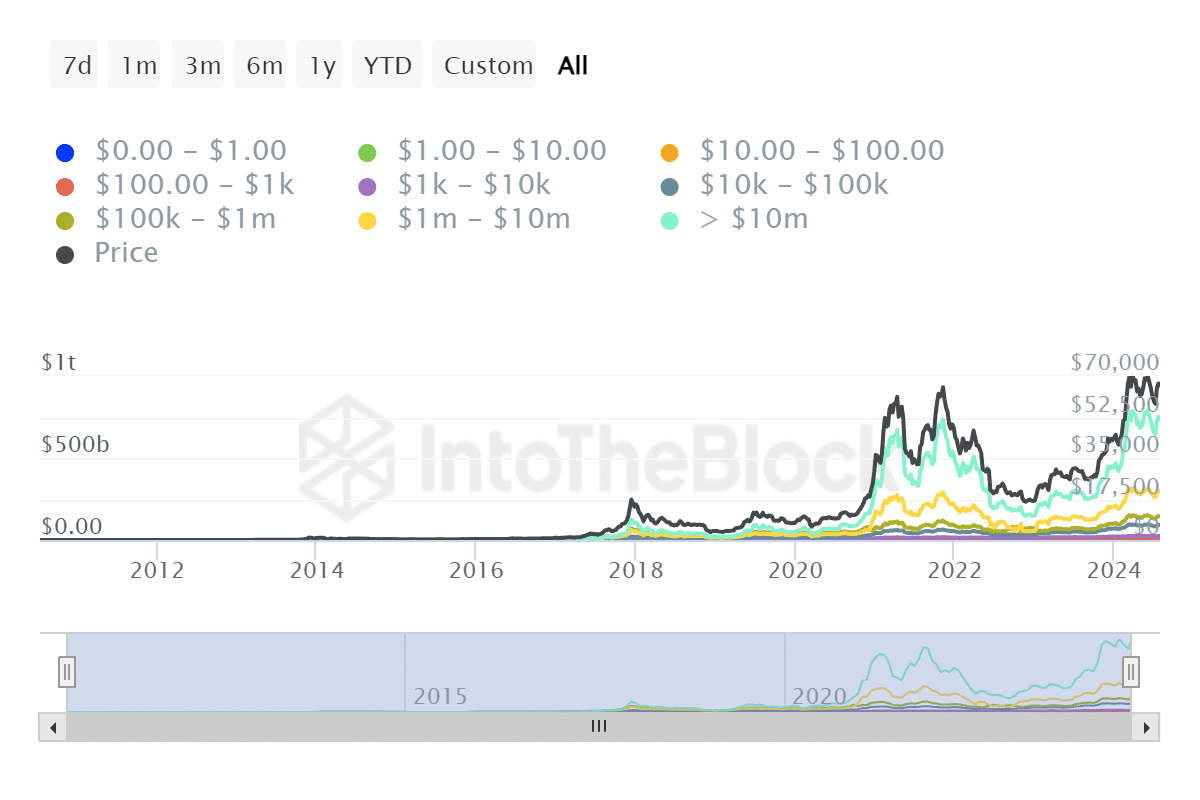

According to data from InHetBlokJuly saw a significant increase in Bitcoin ownership by crypto whales, marking a notable period of accumulation.

Specifically, addresses holding at least 0.1% of the circulating supply of BTC added more than 84,000 BTC to their holdings.

This accumulation represents the largest monthly figure in BTC terms since October 2014, indicating a substantial increase in whale activity.

Source: IntoTheBlock

Further analysis revealed that accounts with more than $10 million in BTC have also seen an increase in the value of their holdings in recent months.

The increase culminated in a significant increase at the end of last month.

As a result, the assets of these addresses have now reached almost $800 billion.

This figure accounts for more than half of Bitcoin’s current market capitalization, underscoring the substantial influence these large holders have on the market.

This trend of whale accumulation may indicate bullish sentiment among key market participants as they may expect higher prices in the future or view current levels as undervalued.

Whales have a 1% advantage

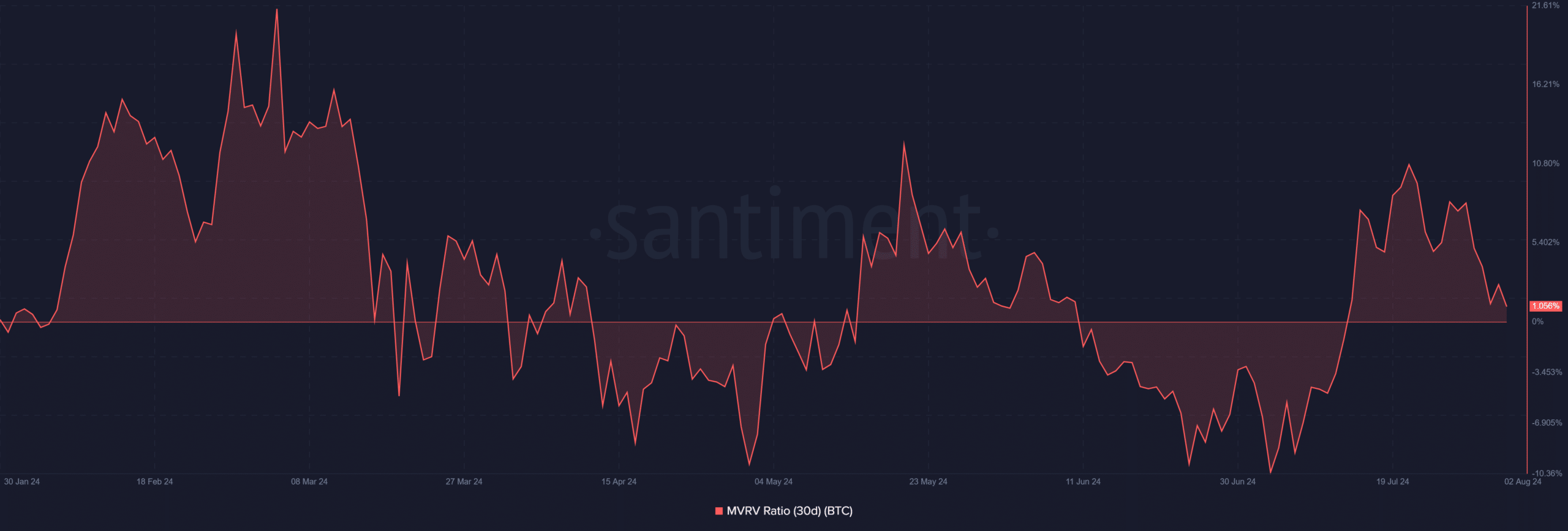

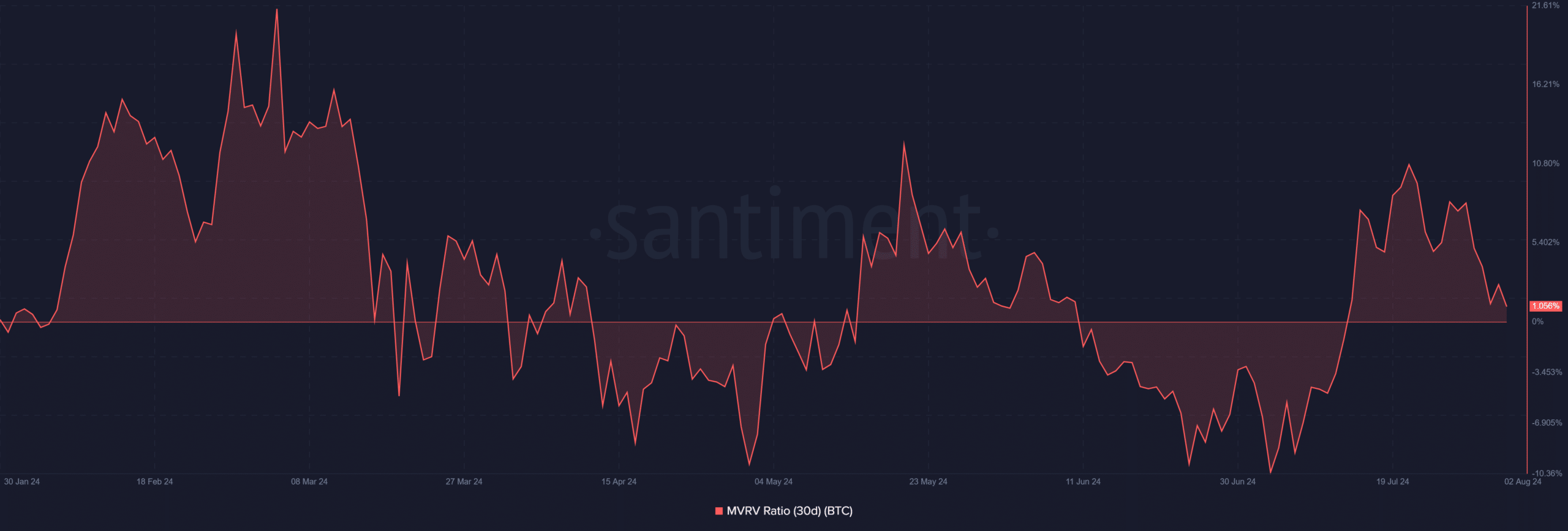

The analysis of the Bitcoin Market Value to Realized Value (MVRV) ratio showed a slight increase to just over 1% at this time.

A recent deep dive into the data indicated that while the MVRV ratio had seen a stronger figure, it has seen a decline recently.

Read Bitcoin’s [BTC] Price forecast 2024-25

However, it is notable that the ratio started the month below 1% and then rose, reaching a peak of 10.75% at the highest point this month before falling.

Source: Santiment

Since the MVRV ratio was above 1% at the time of writing, it indicated that crypto whales who recently accumulated Bitcoin were still, on average, holding their investments with a profit margin of more than 1%.