- Bitcoin and Ethereum were likely on their way to their local highs this week.

- The sub-$70,000 resistance band could pose a substantial hurdle for buyers.

Bitcoin [BTC] managed to climb past the resistance zone at $60k-$61k and was trading a few dollars below $63k at the time of writing. Traders have taken this as a sign that Bitcoin is heading towards its all-time high at $73.7k.

Selling pressure on BTC from the German government had subsided and spot ETF inflows last week were strongly positive, creating a nice environment for a price rebound.

This sentiment saw a positive rebound on Monday, but here’s what’s likely in store next.

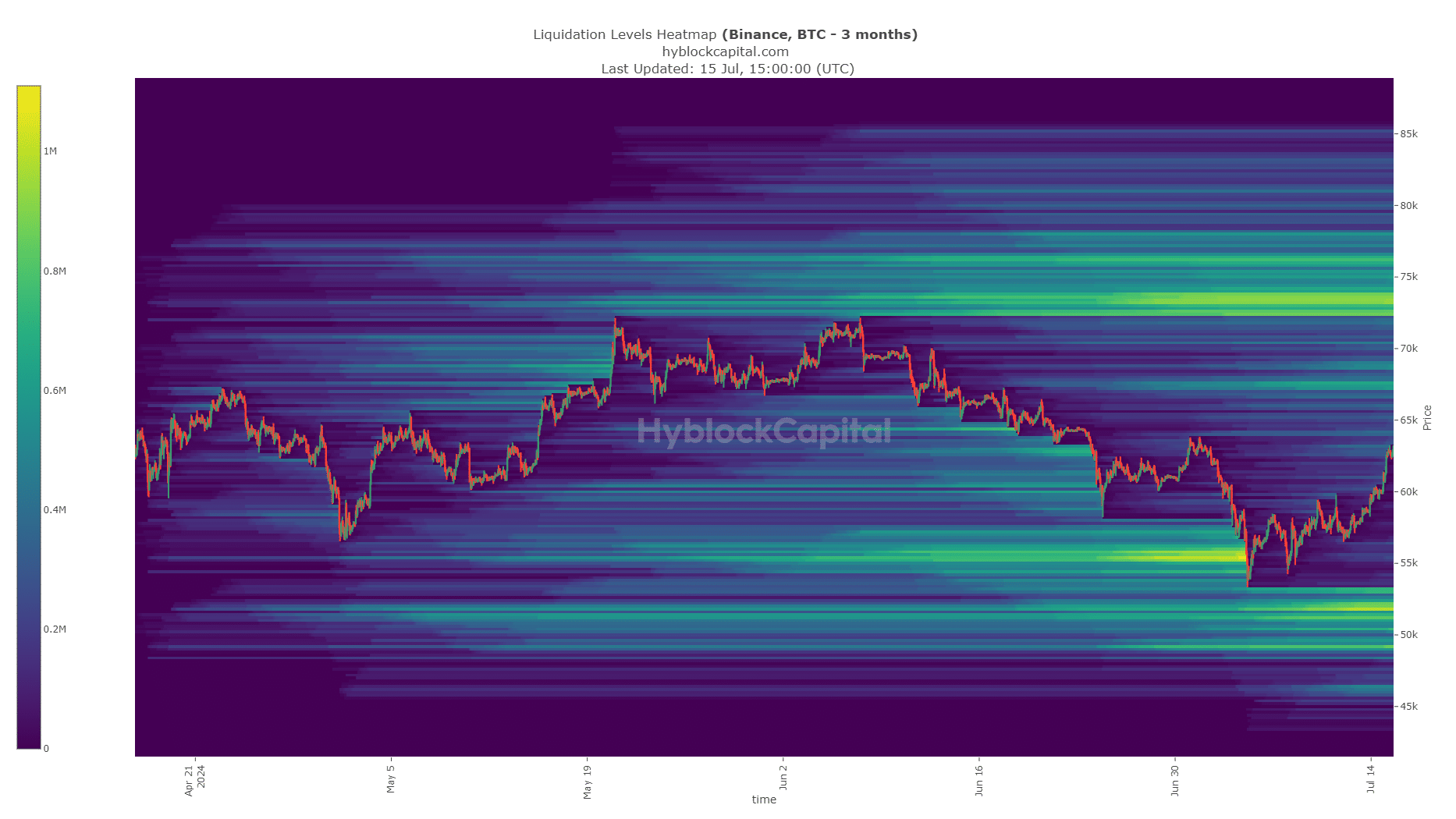

Use the liquidation tables as a compass

In a post on X (formerly Twitter) crypto analyst CrypNuevo marked two scenarios for Bitcoin in the coming days. One was voided, rejecting previous lows of $60,000.

The other was that the $60.6k resistance zone reversed to support and was retested before prices moved higher towards the $68,000 and $73,000 resistance zones.

These are the two liquidity pools to watch for at higher amounts, with $76.4k being another zone that could trigger a large number of short liquidations.

This expectation came as the market structure would turn bullish in the lower timeframe, and liquidity levels in the North would be the next target after chasing the $55k zone earlier this month.

A retest of the $61k-$62k region could be a trigger for bullish traders to take long positions targeting the $72k-$73k zone.

An increase of $3.4 billion in Open Interest since July 13 indicated bullish sentiment. Therefore, traders can expect a positive crypto week.

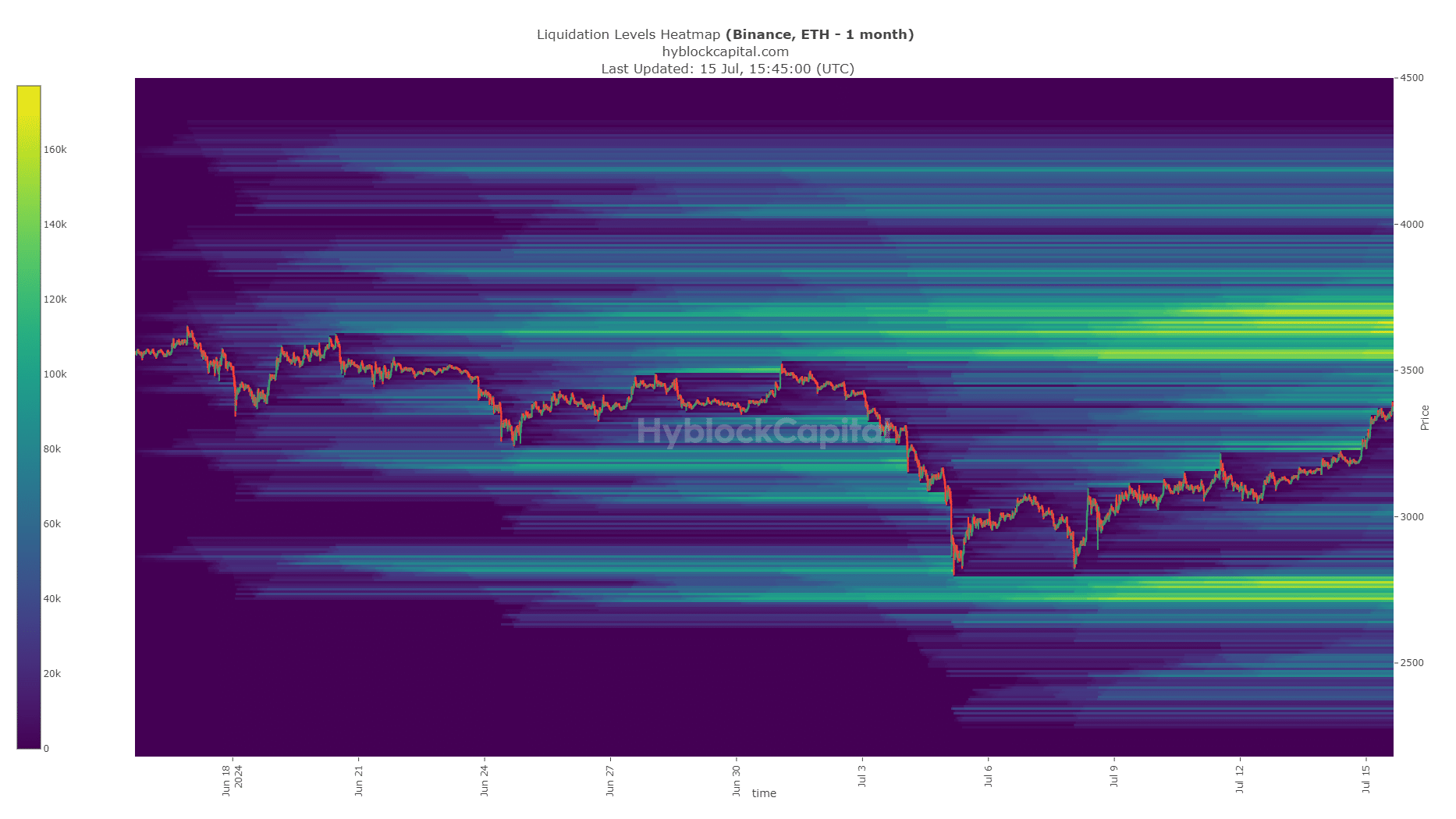

Ethereum is also focusing on the local highs

The heatmap of Ethereum’s liquidation showed that the $3.5k-$3.7k range is likely to be revisited soon.

Read Bitcoin’s [BTC] Price forecast 2024-25

This was another positive development as ETH bulls defended the $2.9k level, the 61.8% Fibonacci retracement level, and initiated a recovery from there.

A move towards $3.7k and even $4k was possible in the coming weeks. Over the next week, a move to $68k for Bitcoin and $3.7k for Ethereum was likely based on the available evidence.