A popular crypto analyst warns that Bitcoin could suddenly collapse if BTC loses a key support level.

Crypto trader Ali Martinez tells According to its 104,000 followers on social media platform

The crypto analyst uses the Unspent Transaction Output (UTXO) Realized Price Distribution (URPD) model to determine key support levels. UTXO keeps track of the number of existing coins that last moved within a certain price range.

“From an on-chain perspective, a Bitcoin price correction to $70,000 is possible, with the understanding that below $93,806 it is virtually open sky all the way up to $70,085.”

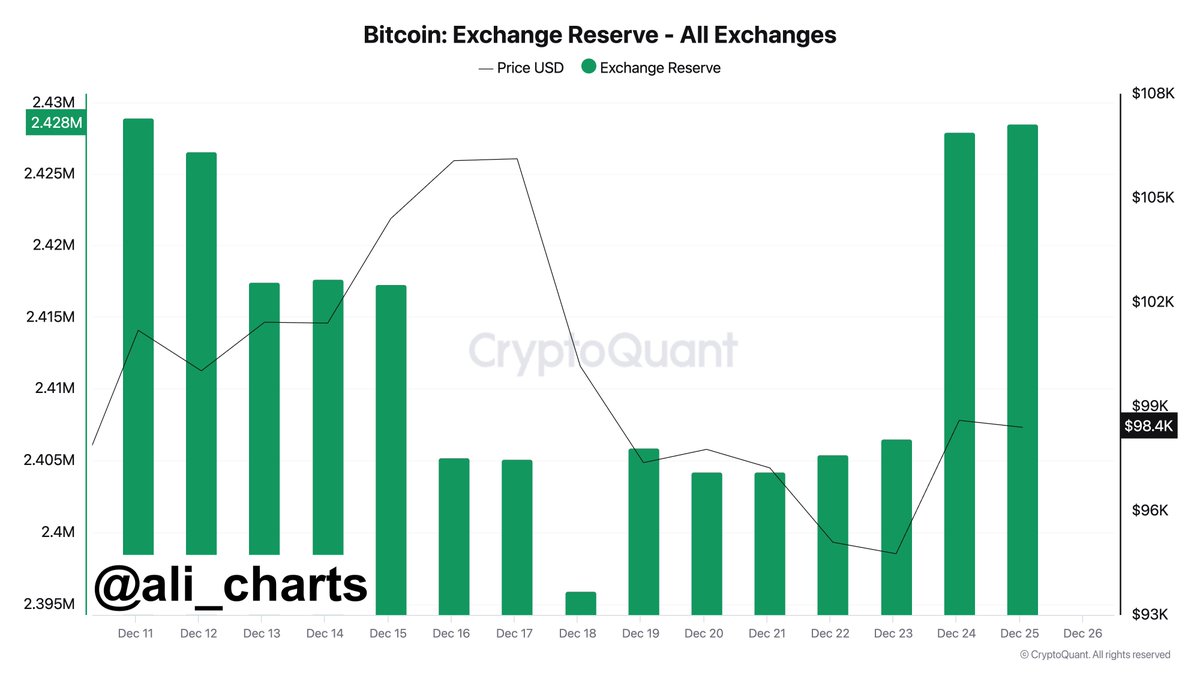

The analyst believes some investors are suddenly preparing for a bearish trend by sending their BTC to exchanges for possible selling.

“Some smart investors seem to be aware of such a bearish scenario, and they have sent over 33,000 Bitcoin to exchanges in the past week, worth over $3.23 billion!”

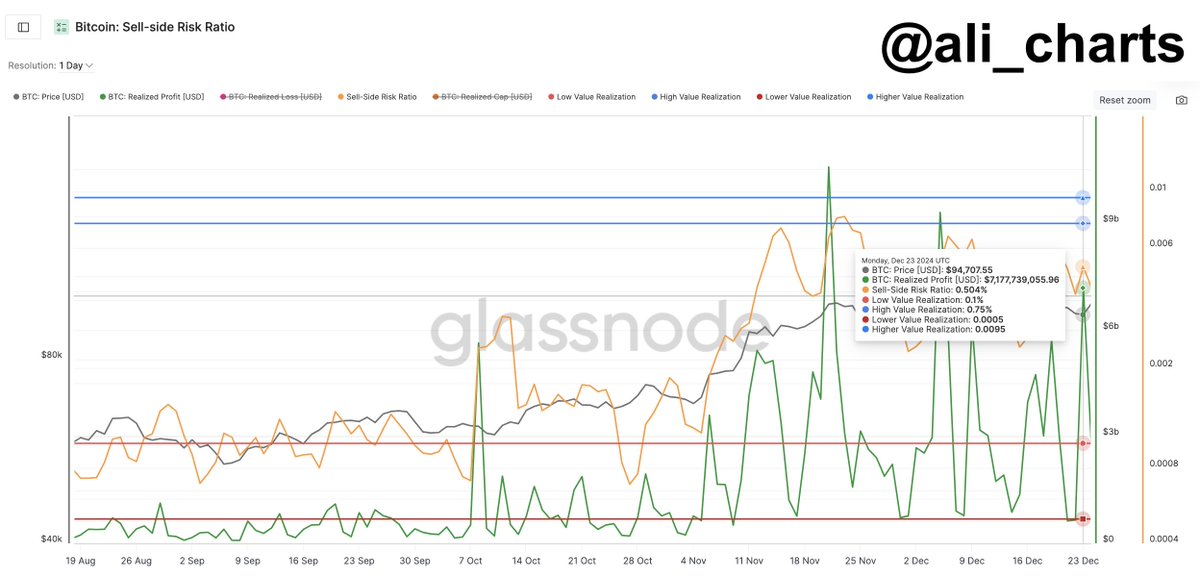

He too say other investors are already selling in anticipation of a possible collapse.

“Others are also making gains. For example, on December 23 alone, more than $7.17 billion in Bitcoin profits were made.”

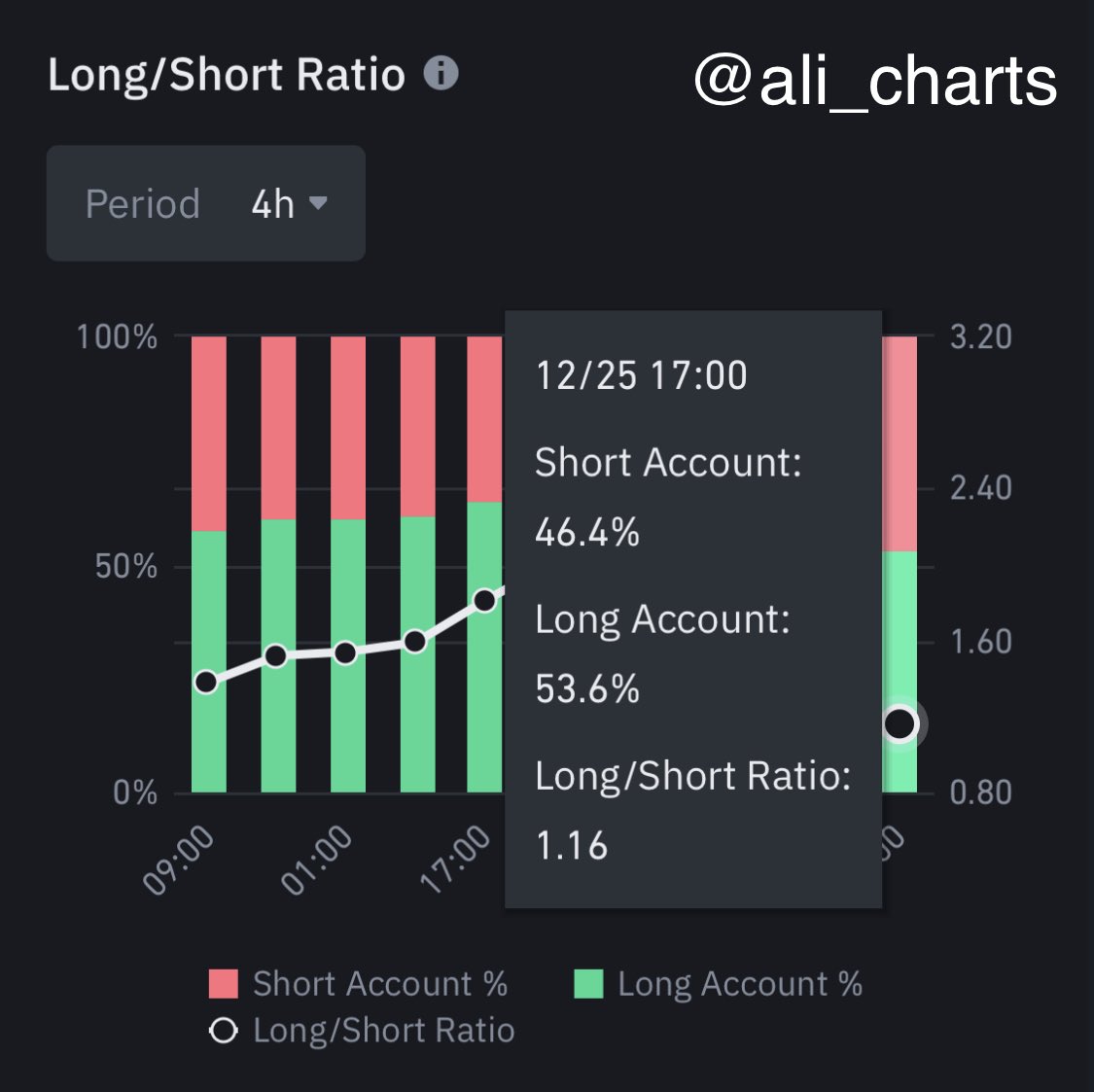

He say The bearish sentiment is further evidenced by a drop of over 13% in the number of traders betting on Bitcoin rally using top crypto exchange Binance.

“Additionally, the percentage of traders on Binance with open Bitcoin long positions recently dropped from 66.73% to 53.60%.”

The analyst wants the bearish outlook to become bullish say Bitcoin needs to convincingly reclaim $100,000 as support on the daily chart based on the In/Out of the Money Around Price (IOMAP) metric.

The IOMAP classifies crypto addresses as profitable, breakeven, or money-losing to determine support and resistance levels.

“Bitcoin recently broke below one of its key support zones at $97,300. So to negate the bearish outlook, BTC must regain this critical support area and, more importantly, maintain a daily close above $100,000!”

However, the analyst say a reignited Bitcoin rally could send the flagship crypto asset to $168,500 based on the Mayer Multiple, an oscillator that uses different ratios between the price and the 200-day moving average.

“If Bitcoin can sustain a daily close above $100,000, we could be looking at another move towards $168,500.”

Bitcoin is trading at $95,855 at the time of writing, down 2.3% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney