- On July 15, there was a positive movement on the traditional market.

- Crypto stocks had a more positive start to the week.

Crypto stocks have seen significant gains over the past 24 hours, reflecting similar gains to Bitcoin [BTC] and other cryptocurrencies. This rise in crypto-related stocks is mainly related to the recent assassination attempt on Donald Trump, a presidential candidate who is seen as positive towards cryptocurrencies.

Good day for crypto stocks?

The stock market has recently seen strong performance from crypto-related stocks, signaling a robust outing for the sector. Companies like Riot Platforms, Coinbase, and MicroStrategy all ended the latest trading session with double-digit gains.

Such strong performance by these companies, which are deeply intertwined with cryptocurrency markets, underlines the growing influence and integration of digital currencies into mainstream financial portfolios.

How Major Crypto Stocks Evolved

The recent performance of MicroStrategy (MSTR) shares has been remarkably strong, starting the week with a significant gain. On July 15, the stock opened at around $1,515 and closed at around $1,611, marking an impressive gain of over 15%.

Source: TradingView

As the largest corporate holder of Bitcoin, MicroStrategy shares are up more than 150% this year, reflecting the robust health of its investment strategy in a favorable crypto market environment.

Similarly, Coinbase (COIN) also showed strong performance, with its stock price rising 11.42% on July 15. The stock rose from about $229 to more than $242 at the end of trading.

Notably, Bitcoin transactions represented 33% of trading volume on Coinbase in the first quarter, while Ethereum transactions made up 13%.

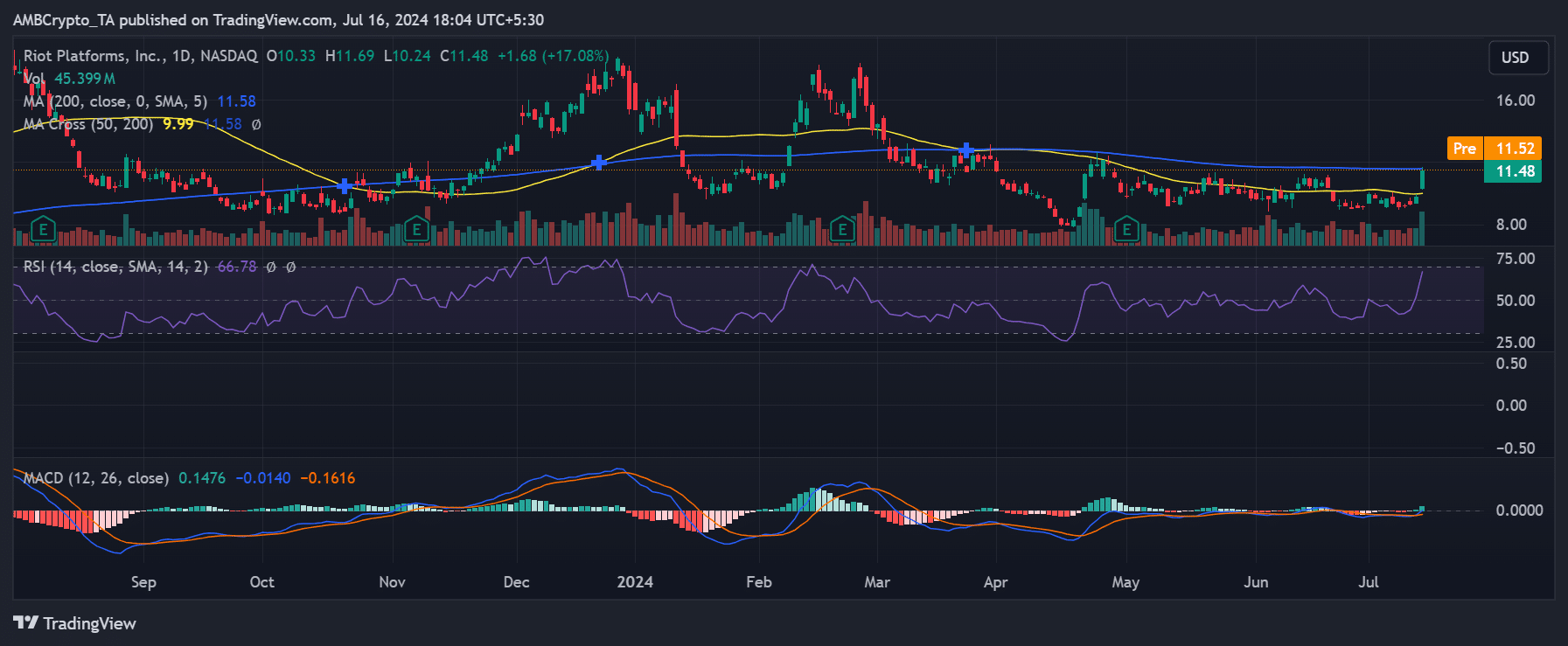

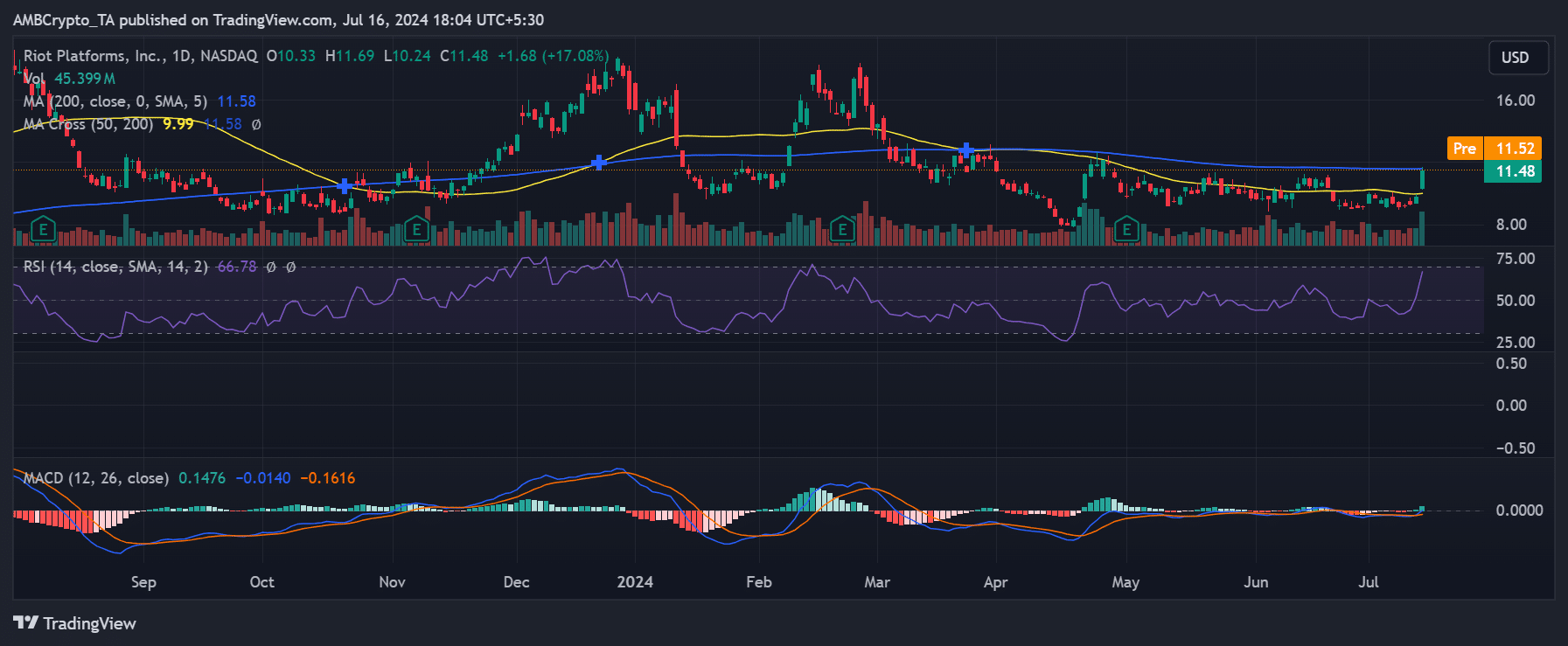

Moreover, Riot Platforms, a Bitcoin mining company, also saw a notable rise in its shares. The stock price rose by more than 17%, from about $10.3 to more than $11.4.

The rise in Bitcoin prices generally benefits mining operations like Riot Platforms as it increases the value of the Bitcoin they mine, increasing the overall profitability of their operations.

Source: TradingView

Bitcoin is moving the rest of the market

Analysis of Bitcoin on a daily time frame revealed a significant price increase on July 15. The value of the cryptocurrency increased by 6.49%, from approximately $60,804 to $64,747.

This marks a return to price levels not seen since June 22, when BTC was trading around $64,235.

The current value of BTC’s Relative Strength Index (RSI) was also above the neutral line, indicating strong bullish momentum.

An RSI reading above the neutral 50 generally indicates that buying pressure has exceeded selling pressure, supporting a bullish trend in the market.