- The cryptocurrency market has seen a $1.44 billion increase, led by Bitcoin and Ethereum.

- BTC spot ETFs and expected ETHs spot ETFs caught the attention of investors.

In recent months, the cryptocurrency markets have experienced significant volatility.

Despite the market fluctuations, the crypto industry has continued to attract investors, with new entrants and increased investment among existing holdings.

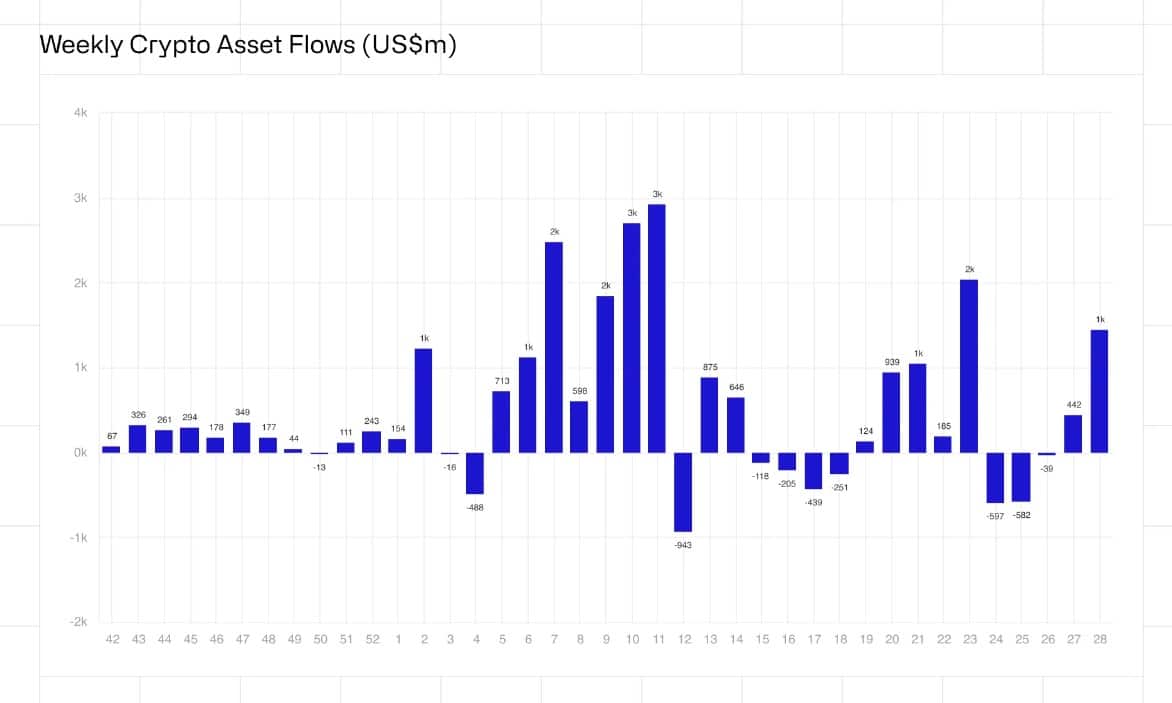

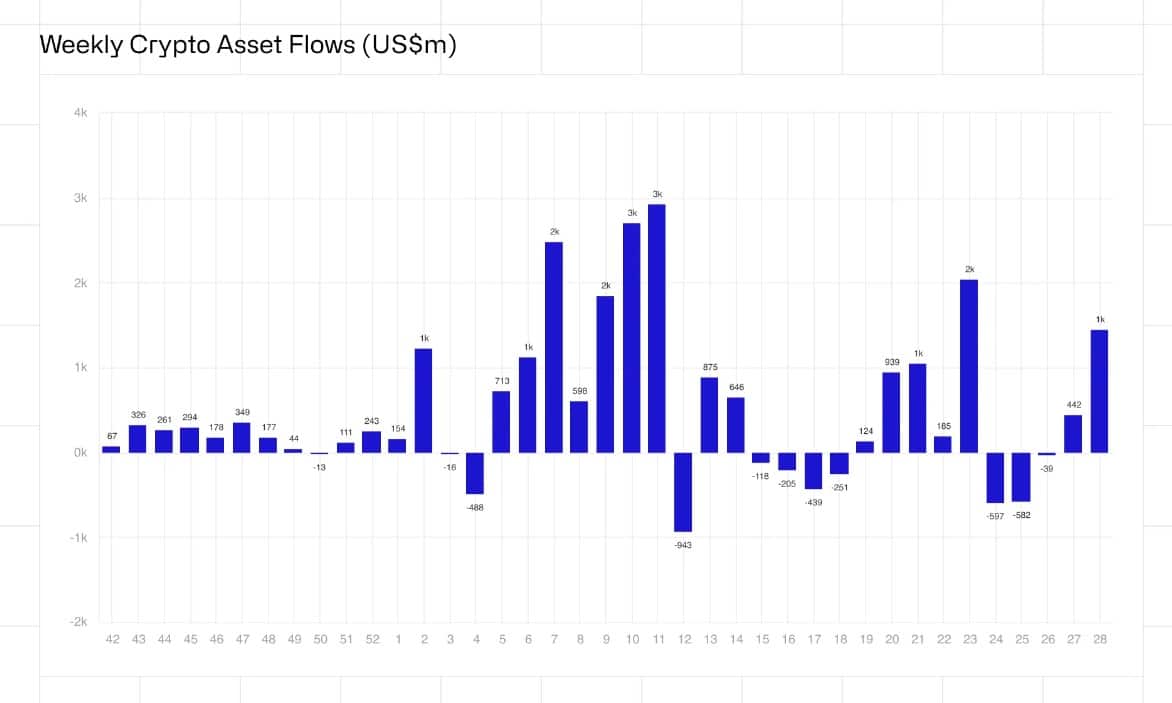

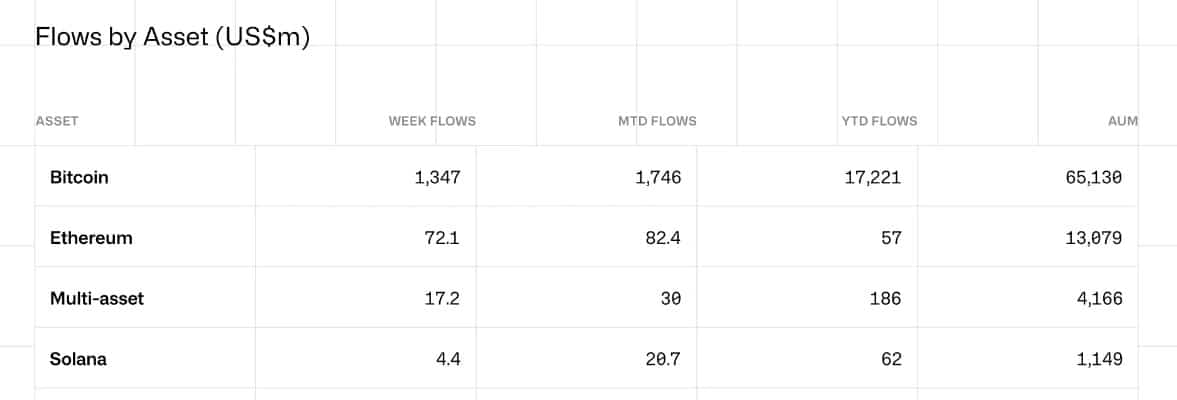

Recent data from Coinshare showed a net inflow of $1.4 billion into the crypto market over the past week.

Increase the inflow

According to the report, inflows into the crypto market have risen to a record high of $17.8 billion over the past year. Similarly, inflows have increased to $1.44 billion on the weekly charts.

Increased inflows on the YTD charts have surpassed 2021’s record $10.6 billion. The increase in inflows was mainly driven by increased institutional investments in crypto through spot ETFs.

The approval of BTC spot ETFs in January, followed by the approval in May of ETH spot ETFs, changed the crypto world.

Source: CoinShare

BTC leads with record high inflows

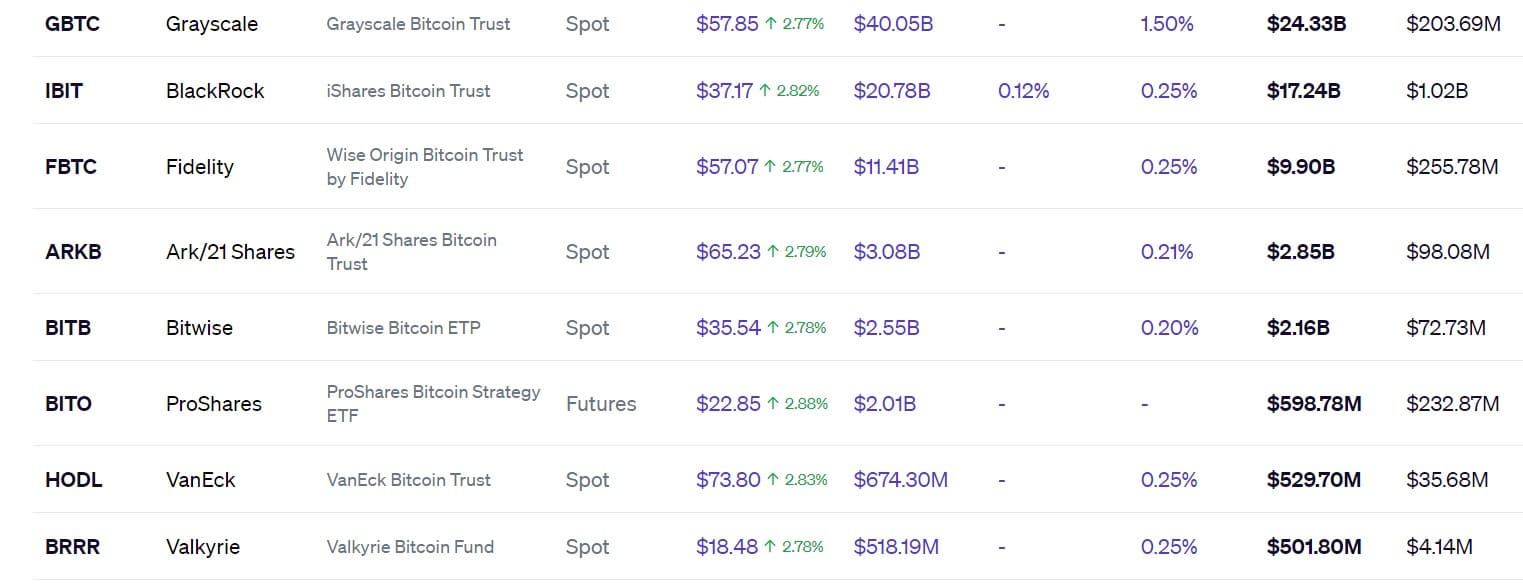

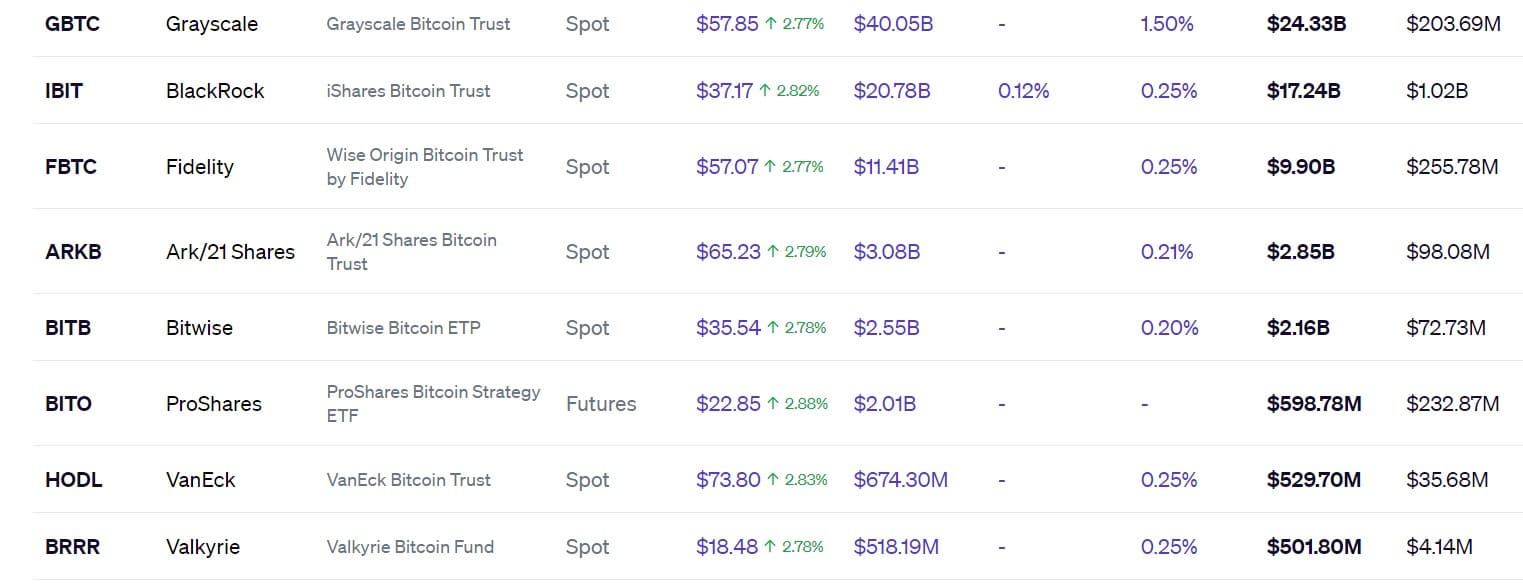

While market inflows continued to rise, Bitcoin remained [BTC] recorded the highest inflow on the weekly charts at $1.35 billion. The increase in BTC inflows was due to increased institutional investments in BTC through spot ETFs.

For example, BlackRock’s IBIT registered $117.25 after seven days of consecutive inflows, with a trading volume of $1.2 billion. IBIT continued to dominate.

Similarly, ARK Invests and 21shared’s ARKB attracted massive inflows of $117.19 million while enjoying a trading volume of $98.8 million. Other majors such as Fidelity and BITB recorded huge inflows of $15.24 million and $7.93 million.

However, over the past week, BTC short holdings have seen high outflows following sales by the German government and Mt. Gox transactions.

Source: Blokwerken

ETH leads the altcoins

Despite Bitcoin’s continued dominance, altcoins such as Ethereum [ETH] and Solana [SOL] were surging and were ready to challenge BTC.

As reported by AMBCypto, market trends favor ETH over BTC following the launch of spot ETFs. So, ETH has experienced increased inflows of $72 million over the past week as investors anticipate the launch of an ETF.

ETH’s rise is the biggest since March as crypto market sentiment shifts towards ETFs.

Source: CoinShare

Read Bitcoin’s [BTC] Price forecast 2024-25

Similarly, Solana saw an increase in premium income to $4.4 million, which is a record high after months of decline. This trend shows that investor interest in crypto is continuously increasing, despite increased market volatility.

With the expected approval of multiple ETH spot ETFs later this month and the filing of SOL ETFs, the altcoins and crypto market is positioned for continued expansion.