- Bitcoin has held firmly above $60,000 since mid-July.

- There are several positive catalysts lined up. Will BTC Climb Higher?

After remaining below $60,000 in the first half of July, Bitcoin [BTC] regained the psychological level and previous low, partly caused by the Trump attack.

The mid-week recovery continued, posting gains of more than 8%, but hit a roadblock near $65,000. At the time of writing, the recovery has cooled and fallen below $64,000.

‘Trump Trade’ to Boost Bitcoin?

According to Charles Edwards, founder of crypto hedge fund Capriole Investment, BTC stuck almost $65K as the NASDAQ price fell.

“Bitcoin has fallen because the NASDAQ has fallen. But the NASDAQ is down due to the upcoming easing and an AI revenue plateau. The latter has no impact on BTC, and the former is bullish BTC.”

NASDAQ is heavily focused on technology stocks. Investors, however, have been Reportedly replacing big tech stocks with small-cap stocks to capitalize on a likely Trump victory. Market experts called it “Trump trading.”

According to some market analysts, Trump’s pro-crypto stance could strengthen the bullish scenario for BTC. For example, QCP Capital analysts Viewed Trump’s VP pick, JD Vance, as a positive catalyst for BTC.

“Trump chooses JD Vance as his vice president, providing another positive catalyst. Vance owns BTC and we expect him to lobby for crypto-friendly regulations if Trump is elected.”

The company added that the upcoming launch of Ethereum [ETH] ETF, which is expected to take place on July 23, was another bullish catalyst. On-chain metrics also confirmed the bullish outlook.

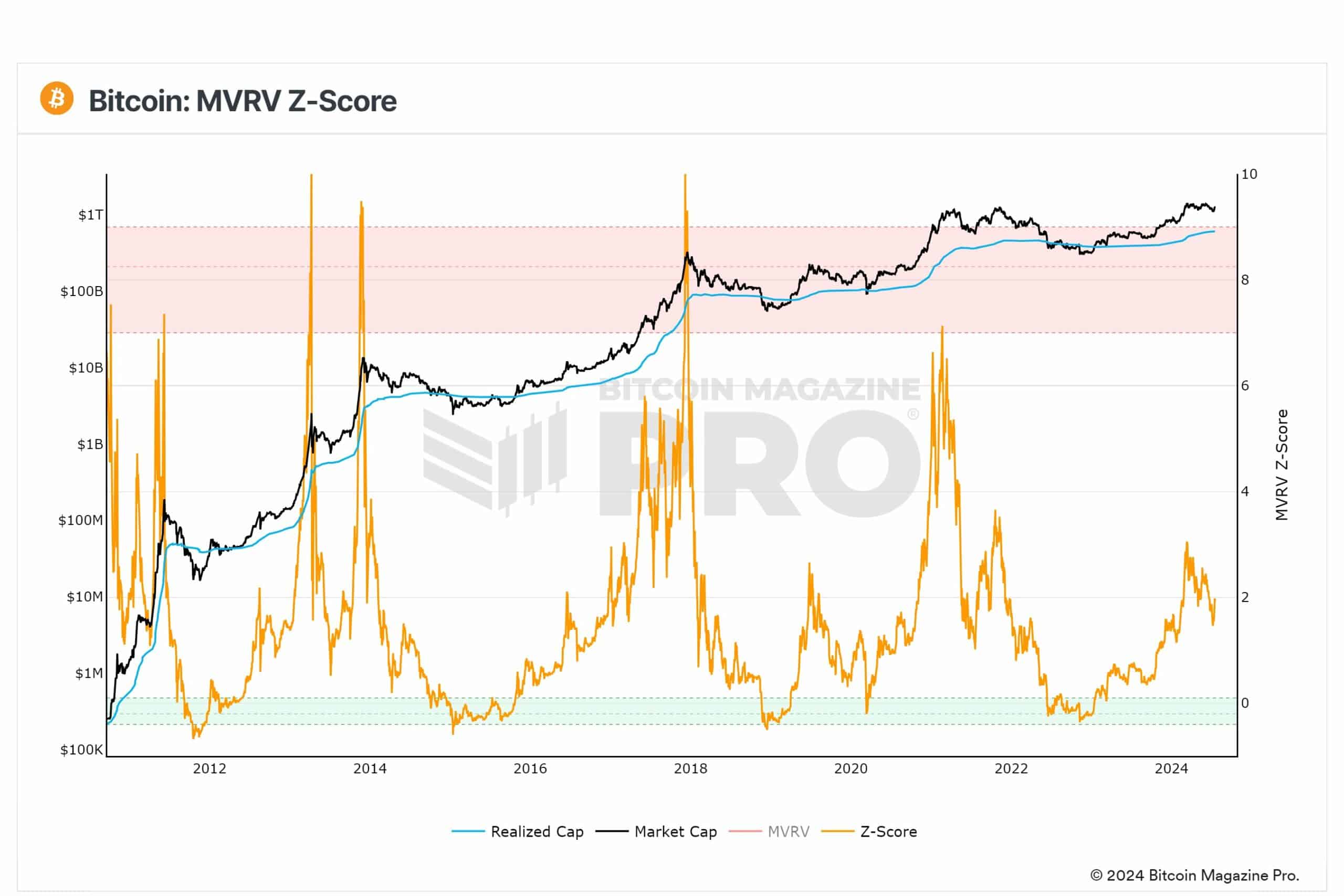

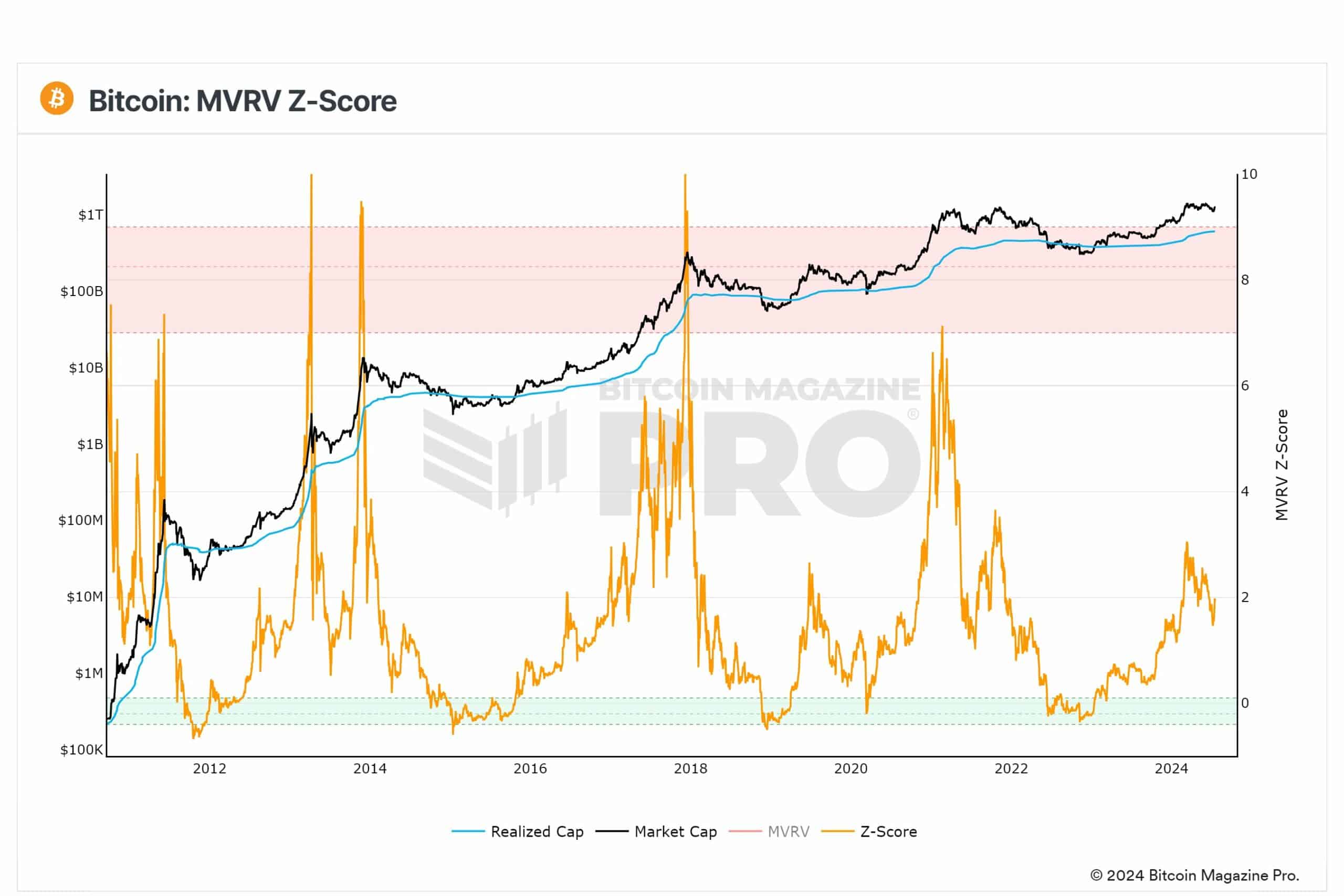

The MVRV-Z score indicates more upside potential

Source:

Philip Swift, founder of Look Into Bitcoin, which has been rebranded as Bitcoin Magazine Pro, noted that BTC bears were in disbelief when the MVRV-Z score recovered.

“MVRV Z-Score: There is so much more to come from this bull cycle. The Z-score has now risen again to 2. We remain in disbelief.”

The MVRV (Market Value to Realized Value)-Z score is a top and bottom indicator for the BTC market cycle. It has accurately predicted past market highs (>7) and lows (0).

However, the metric was not overheated and did not indicate a market top at the time of writing. That meant more room for BTC.

Also, crypto options According to Deribit data, the loans worth $1.8 billion expire on July 19. The maximum pain for both BTC and ETH due to the looming options expiration was $62K and $3.15K respectively.

It meant that a general decline in BTC and ETH towards the maximum pain points could be expected. However, a rise could not be reversed given the likely launch of ETH ETF next week.