In a recent commentary on His insights are especially relevant as the market approaches several major economic releases that could significantly impact the trajectory of major cryptocurrencies like Bitcoin (BTC) and Solana (SOL).

History repeating itself for the crypto market?

Yans analysis began with an overview of the current market recovery, noting that both BTC and SOL are “now grinding nicely at key technical levels,” suggesting a possible setup for a breakout similar to the situation in early June. During that period, Bitcoin challenged a major resistance level at $71,500, driven by positive personal consumption expenditure (PCE) data and weaker-than-expected employment change data at ADP, fueling optimism about a potential dovish stance from the Federal Reserve.

Related reading

However, Yan drew attention to the volatility that followed, as a stronger-than-expected Non-Farm Payroll (NFP) report reversed bullish sentiment, sending Bitcoin down from a high of $72,000 to around $58,000 within two weeks. He highlighted this pattern to warn investors of the potential for similar market reactions in the current context.

Looking ahead, Yan expressed a generally optimistic outlook for the third quarter of 2023, citing improving liquidity conditions and the resolution of the Mount Gox case, which has been hanging over the market for years. Still, he remains wary of the short-term effects of the upcoming NFP release, scheduled for this Friday. “I’ll be cautious heading into the NFP on Friday – a similar first half pattern could emerge,” he warned.

Yan also pointed to the CPI release as the next crucial data point, with the Cleveland Fed providing modest estimates for June but less favorable projections for July. He highlighted the impact of summer energy prices on inflation rates, noting that rising crude oil and gas prices since early June are likely to impact both headline CPI and PCE directly, and core inflation rates indirectly.

“A core CPI forecast of 0.3% month-over-month is already bad, imagine it getting worse,” he noted, underscoring the potential for these figures to positively exceed expectations, boosting would further complicate the Fed’s inflation management efforts.

Related reading

The immediate focus for Yan and many in the crypto community is Fed Chairman Jerome Powell’s speech at the European Central Bank tonight. His comments are eagerly awaited as hints at how the Fed views current macroeconomic conditions and its possible near-term policy actions. “Let’s see what he thinks about the current macroeconomic situation,” Yan said, indicating the significant market-changing potential of Powell’s speech.

Bitcoin Breakout needs confirmation

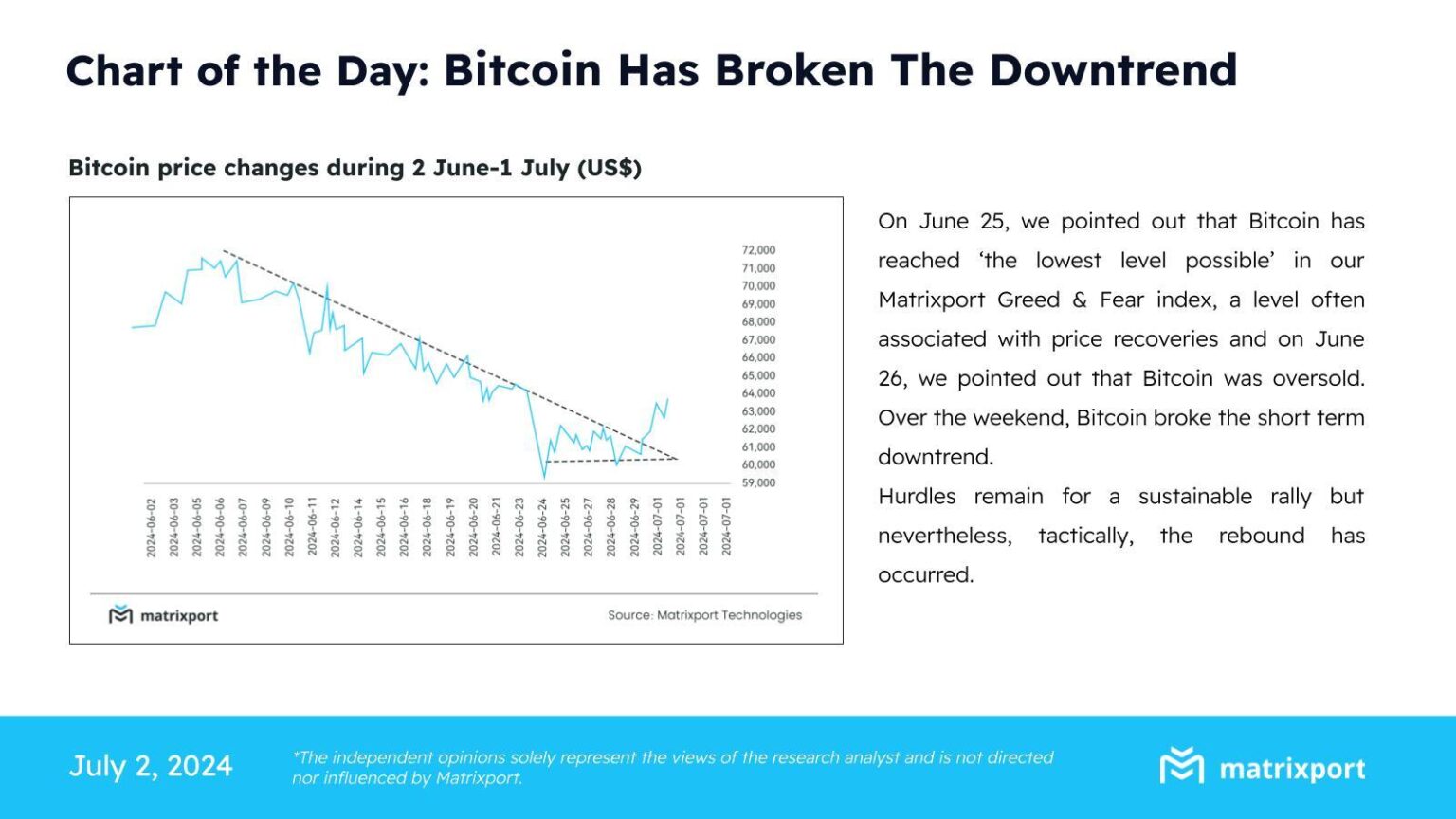

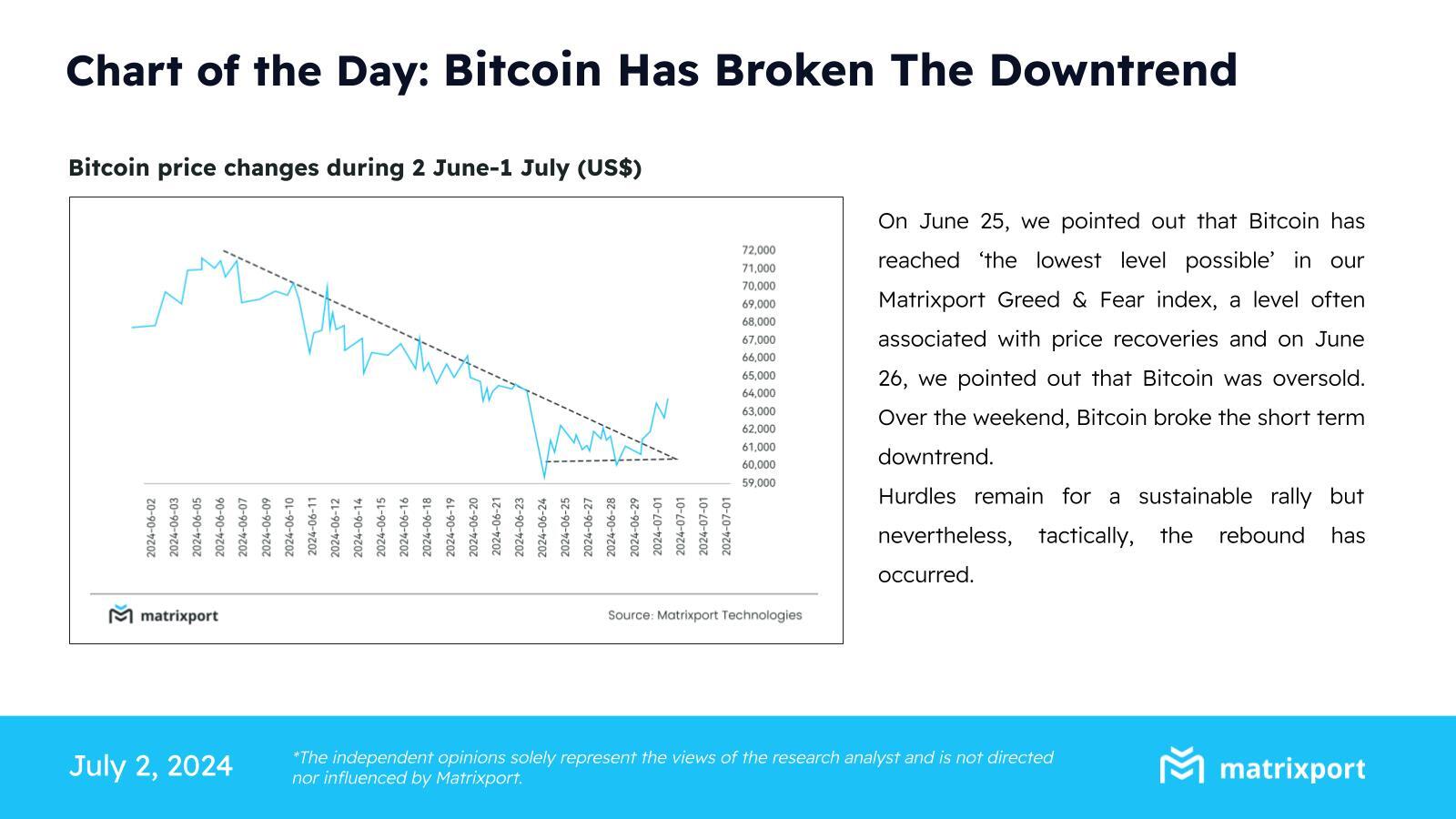

Matrix gate issued a “Chart of the Day” showing Bitcoin price movements from June 2 to July 1, highlighting the cryptocurrency’s recent breakout from a short-term downward trend. After signaling a bottom on June 25 on their Matrixport Greed & Fear index – a tool often used to predict potential reversals – Bitcoin showed signs of an oversold condition, which typically precedes a price recovery. Bitcoin’s price began to tactically recover this weekend, overcoming some of the immediate technical hurdles.

While the market appears to be gearing up for a potential rally, Yan’s analysis and upcoming economic updates suggest investors should brace for potential swings. As these events unfold, the crypto market’s response to economic indicators and central bank communications will be critical in shaping its near-term direction.

At the time of writing, BTC was trading at $62,802.

Featured image created with DALL·E, chart from TradingView.com