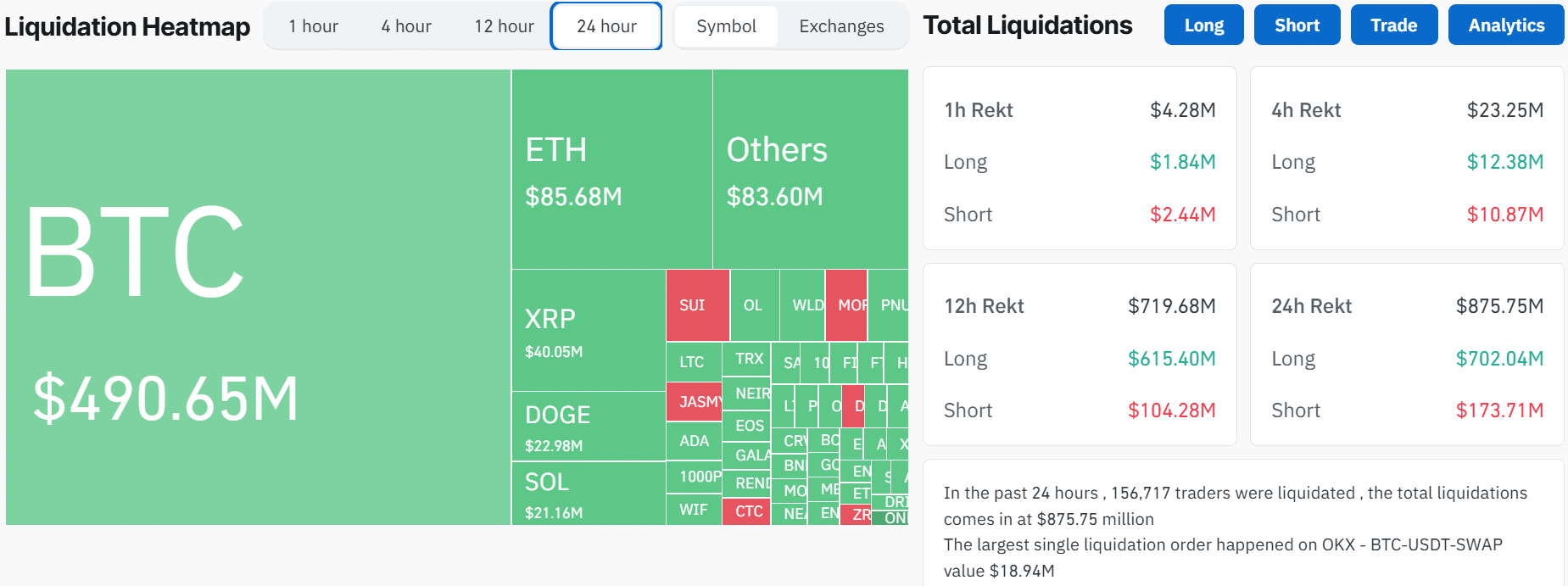

- Total liquidations in the crypto market exceeded $875 million after Bitcoin fell below $100,000.

- Bitcoin long liquidations also rose to an all-time high of $416 million.

The cryptocurrency market recorded a massive surge in liquidations over the past 24 hours, wiping out more than $875 million in leveraged long and short positions, marking the highest number of liquidations since 2021.

According to Coinglass data, long liquidations totaled $702 million, while short liquidations totaled $173 million. These liquidations affected more than 157,000 traders.

Source: Coinglass

Traders bet on Bitcoin [BTC] furthermore, it recorded the most losses, with long BTC liquidations reaching $416 million. These positions were closed after the king coin experienced a sudden spike in volatility, causing its price to fall from above $100,000 to $92,000 in less than four hours.

Altcoins also saw a slight spike in volatility. Ethereum [ETH] the price fluctuated between $3,600 and $3,900, leading to $85 million in liquidations. XRP [XRP] saw the third highest level of liquidations at $40 million while Dogecoin [DOGE] recorded $22 million in liquidations.

This sudden increase in liquidated trades and volatility may have been a forced correction after over-indebtedness caused a market imbalance.

The number of liquidations is increasing due to an over-indebted market

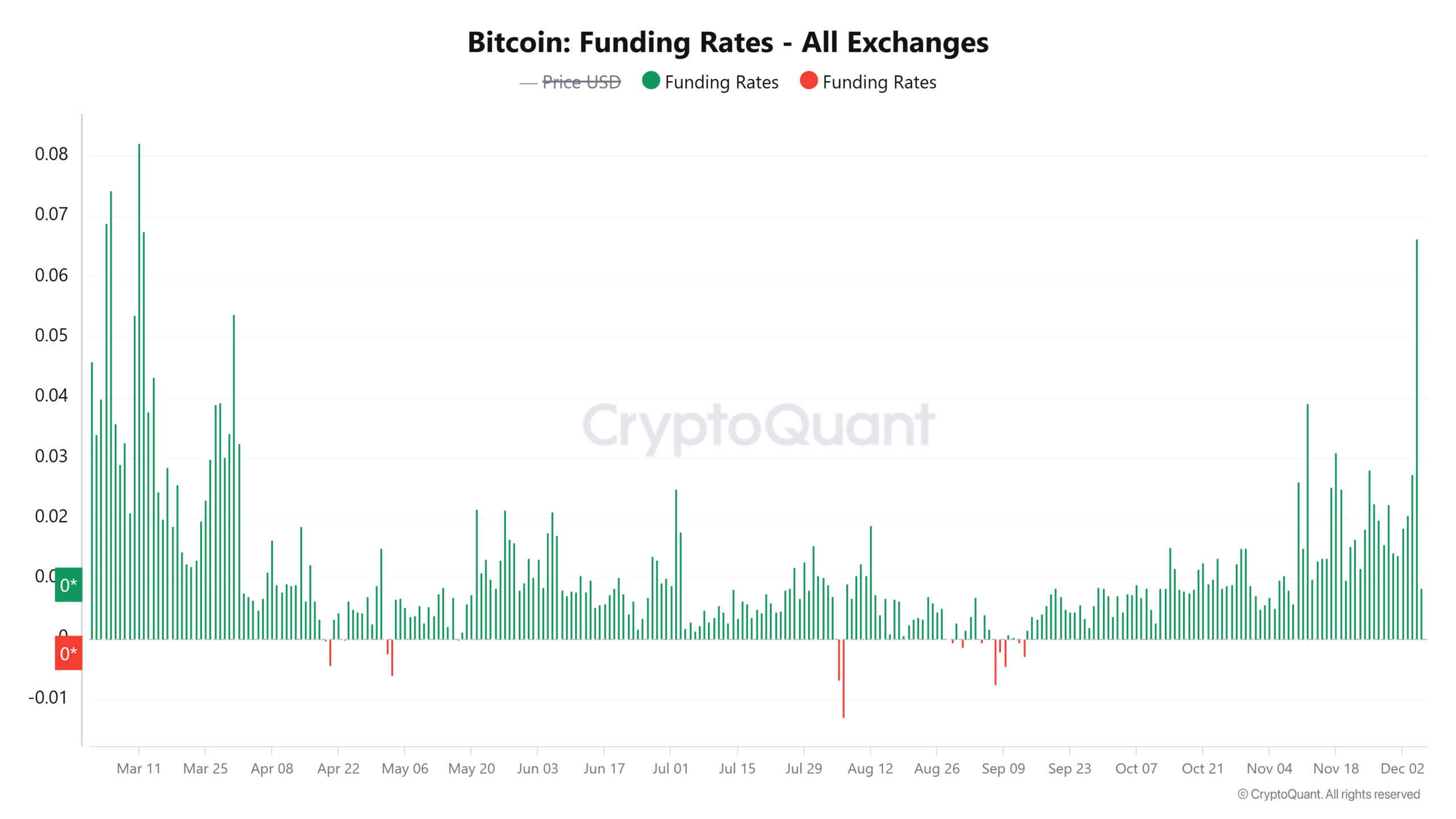

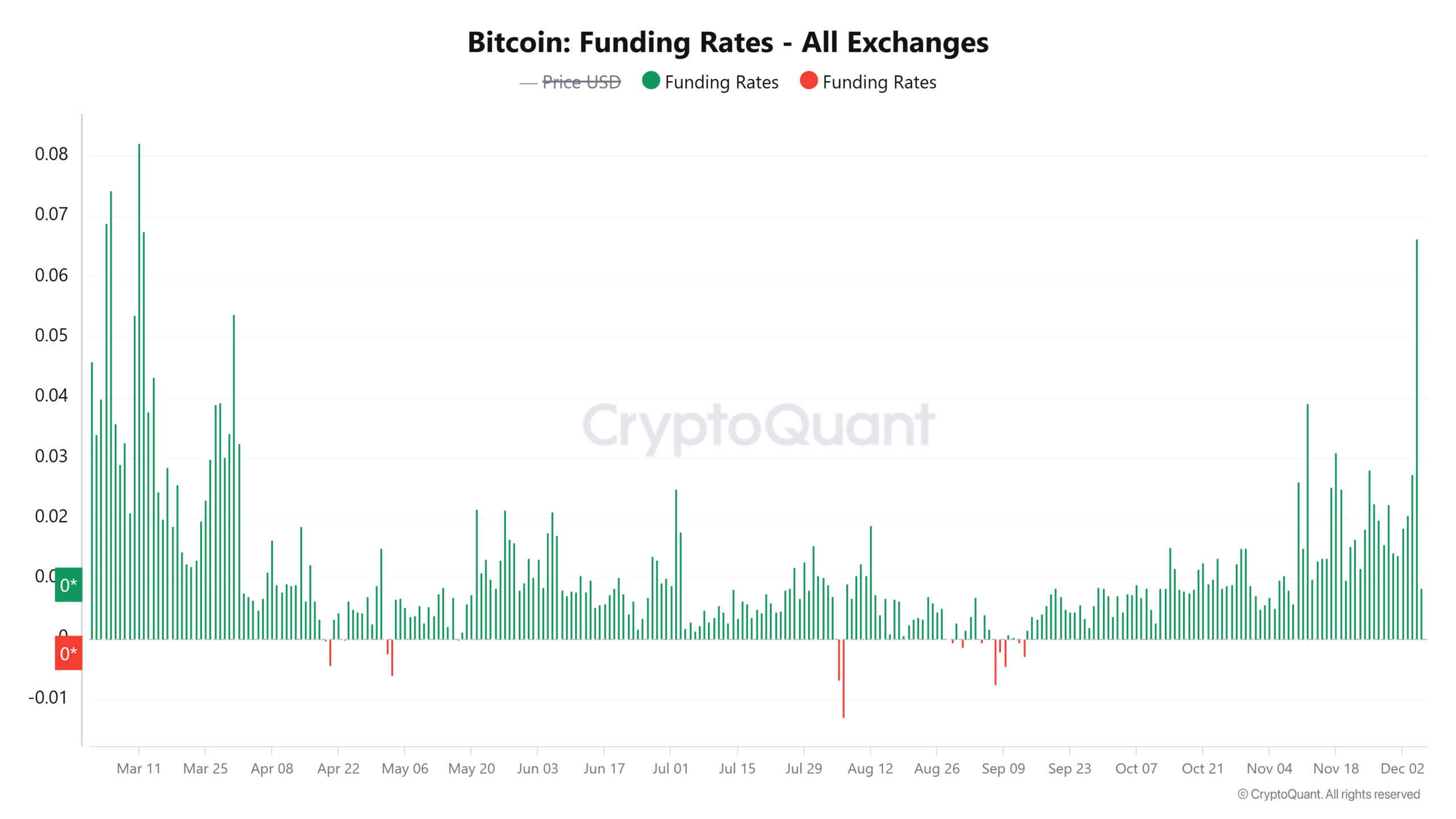

According to CryptoQuant, Bitcoin funding rates hit a multi-month high of 0.0663 on December 5, indicating that long positions were becoming increasingly dominant.

Whenever financing rates reach an extreme level, it often precedes a sharp move in the opposite direction in which traders expect the price to go.

Therefore, after building up long positions, a long squeeze followed, leading to forced sales and a decline in financing rates.

Source: CryptoQuant

The estimated leverage ratio clearly shows the market correction. This metric recorded a sharp one to get up to a seven-day high as traders increased their influence on Bitcoin. Later, the price fell as over-indebted positions were closed.

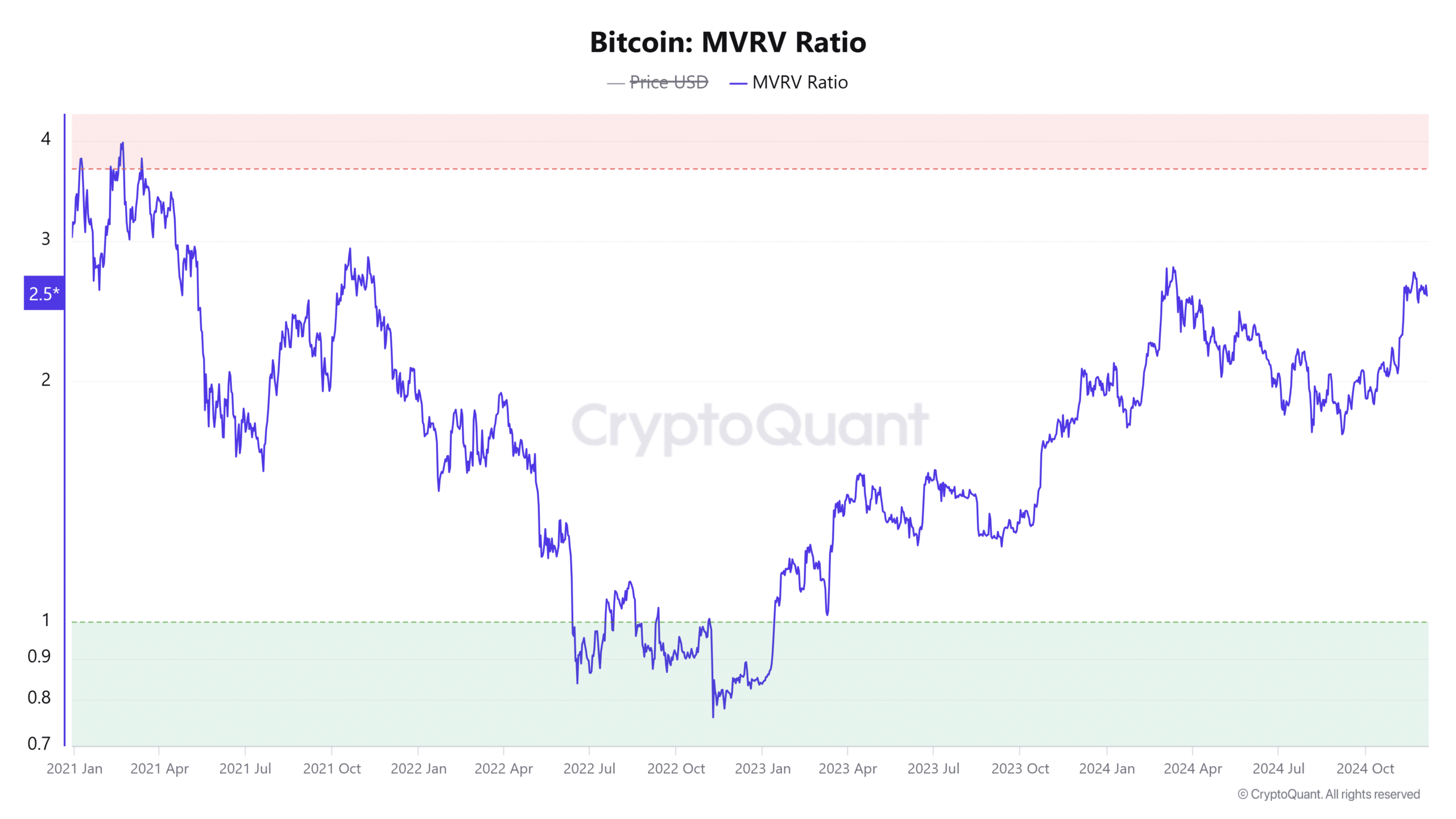

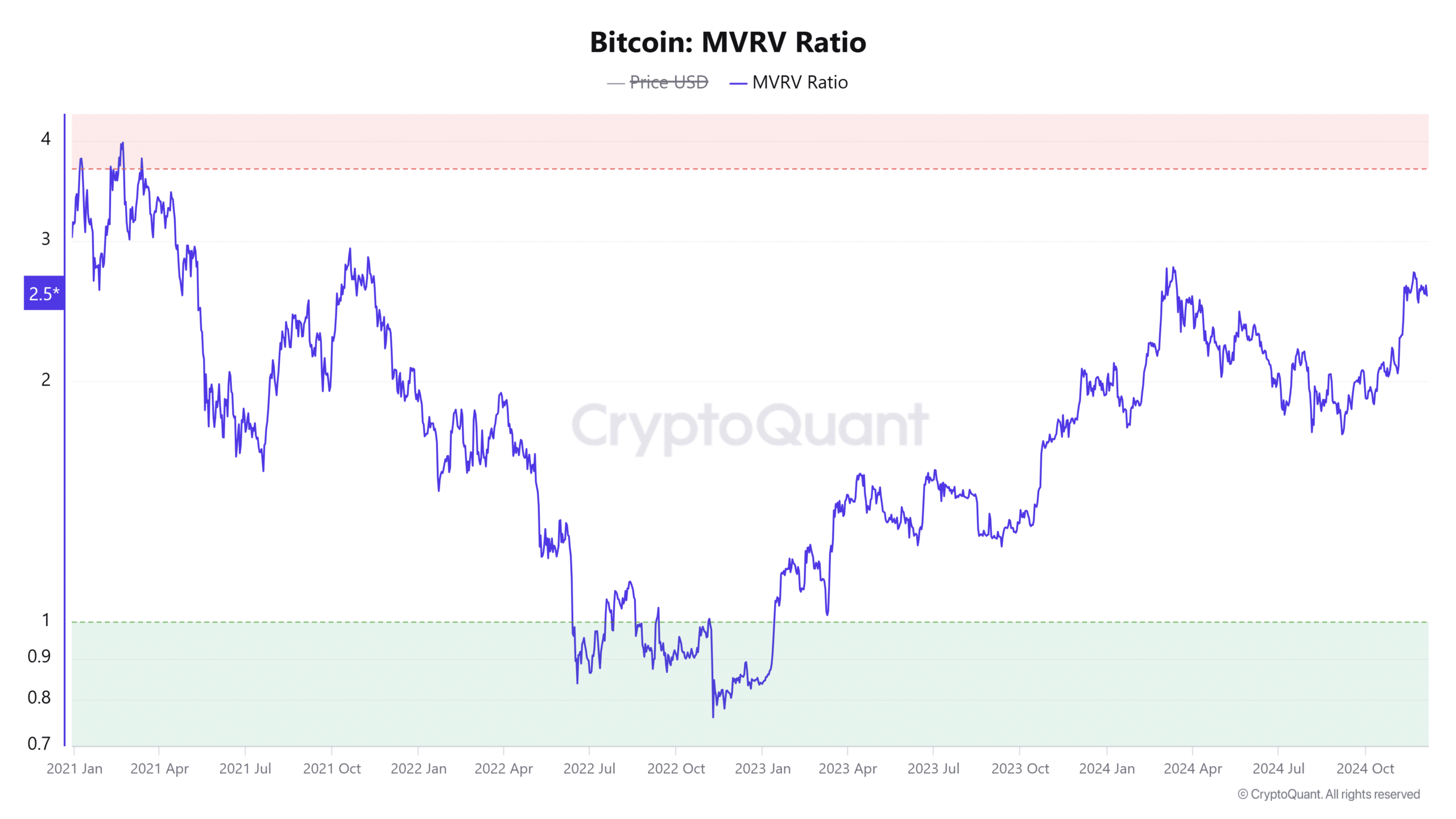

The MVRV ratio shows that there is still room for more gains

Bitcoin’s market value to realized value (MVRV) ratio shows that BTC has yet to reach its local top despite the recent correction.

Read Bitcoin’s [BTC] Price forecast 2024-25

The MVRV ratio stood at 2.5 at the time of writing, indicating the asset was still reasonably priced. Over the past three months, Bitcoin’s MVRV ratio has increased from 1.72 as profitability for holders increased.

Source: CryptoQuant

A rise in the MVRV ratio above 3.5 will signal that Bitcoin has reached a local top. Therefore, traders should beware of a further rise in this measure to overvalued levels.