- More than $300 million was liquidated from the crypto market as prices retreated from the weekend rally.

- Bitcoin fell from $62,000 to below $59,000 before staging a slight recovery.

The cryptocurrency market bled today, with derivatives traders taking a big hit. Per Mint glassAt the time of writing, the futures market saw $320 million in liquidations. Traders with long positions suffered the most losses, with $285 million liquidated.

This comes amid a drastic price drop that saw the total cryptocurrency market capitalization fall by 6.7%. All top 50 cryptos by market cap were also in the red.

Bitcoin [BTC)] fell 6%, hitting a weekly low of around $58,000. The price has recovered somewhat and stands at $59,430 at the time of writing.

Ethereum [ETH] had a steeper decline of 7.8%, meanwhile trading at $2,430 Solana [SOL] fell 6.8% to $148. XRP and Dogecoin [DOGE] also recorded declines of 3.7% and 6% respectively.

What caused the liquidations?

On-chain analytics platform Santiment attributed the liquidations to market greed after longs added to their positions following the August 25 recovery. This caused a huge spike in financing rates, which were doomed to liquidation.

Source:

Macro factors can also be behind the volatility. Nvidia is about to release what’s colloquially called “key tech earnings.” Per CNBCNvidia’s results will “set the tone” for the markets ahead of the release of other key economic data next month.

Nvidia’s earnings tend to drive market volatility. If the chipmaker beats expectations on second-quarter earnings, it could fuel a rally in the crypto market. However, if the company falls short, it could cause further declines.

Will BTC Price Recover?

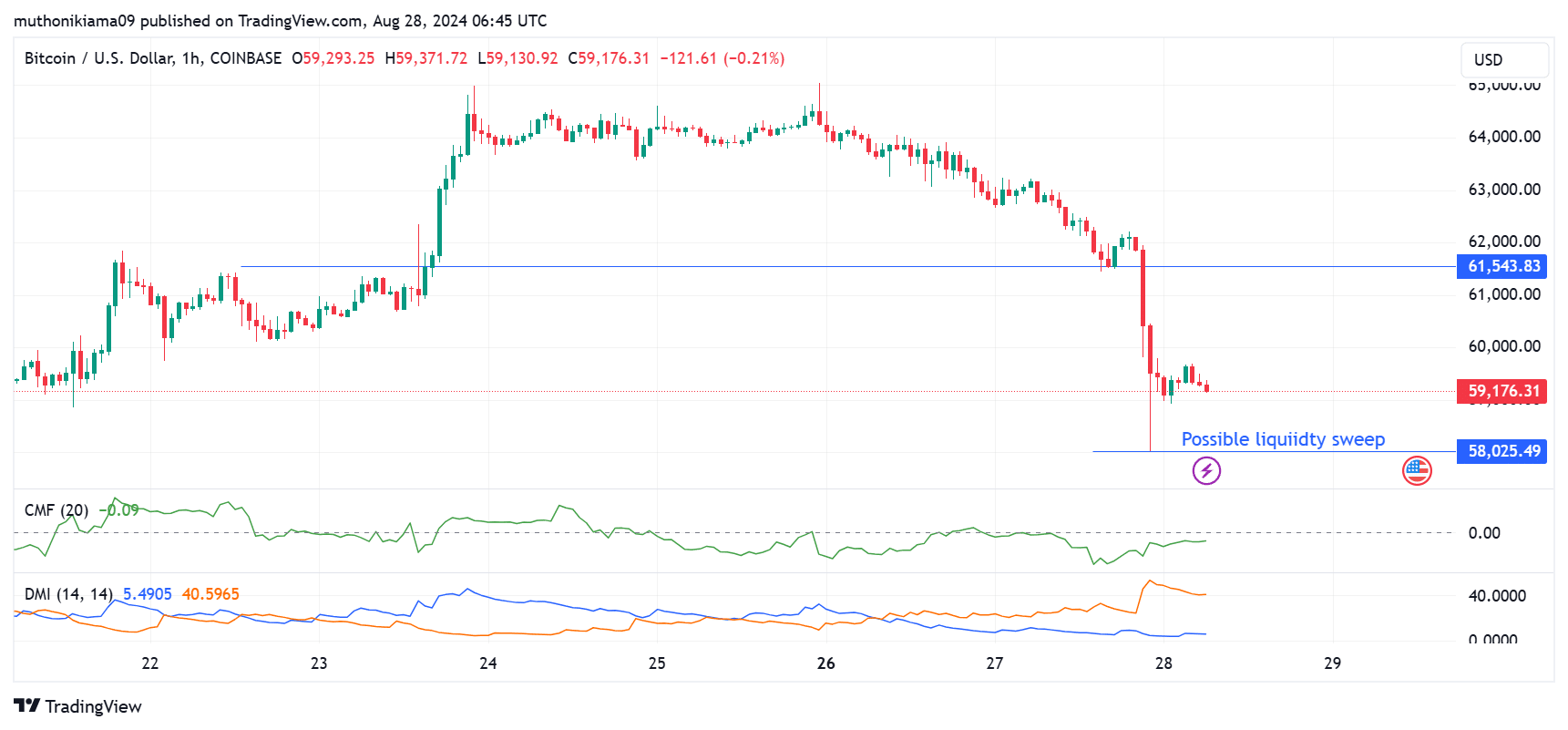

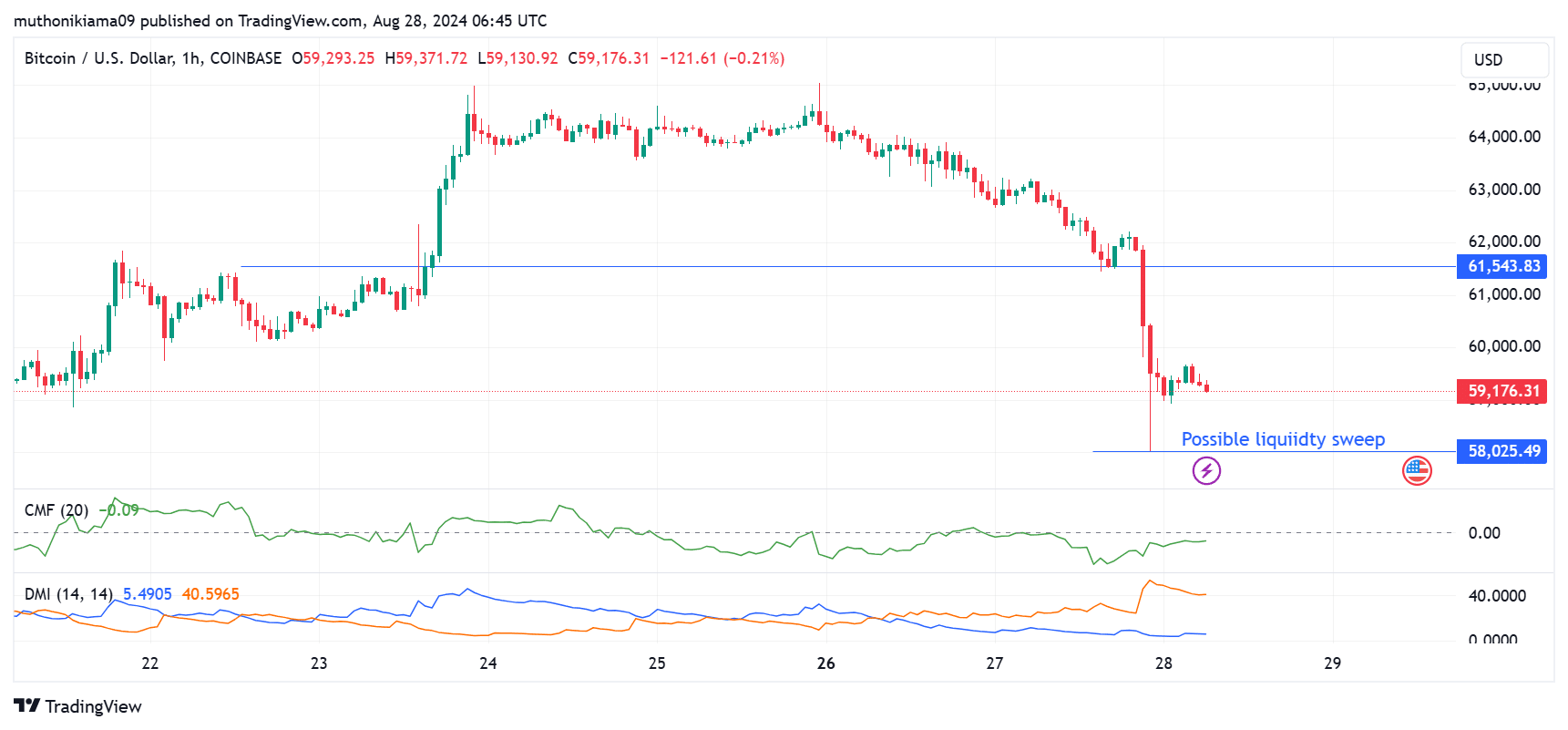

Bitcoin price failed to hold a support level above $61,500, causing a sharp price drop. Since August 23, BTC has been trading above this level, and holding the support supported the uptrend.

Chaikin cash flow was negative at the time of writing, indicating selling pressure. The CMF showed buying pressure starting to weaken after the weekend rally. Therefore, there have not been enough buyers to drive the price action.

Source: Tradingview

The bearish thesis is further confirmed by the Directional Movement Indicators (DMI). The positive DI is well below the negative DI, showing that the bearish trend is stronger than the bullish trend.

Traders should also beware of a possible liquidity surge at the $58K level.

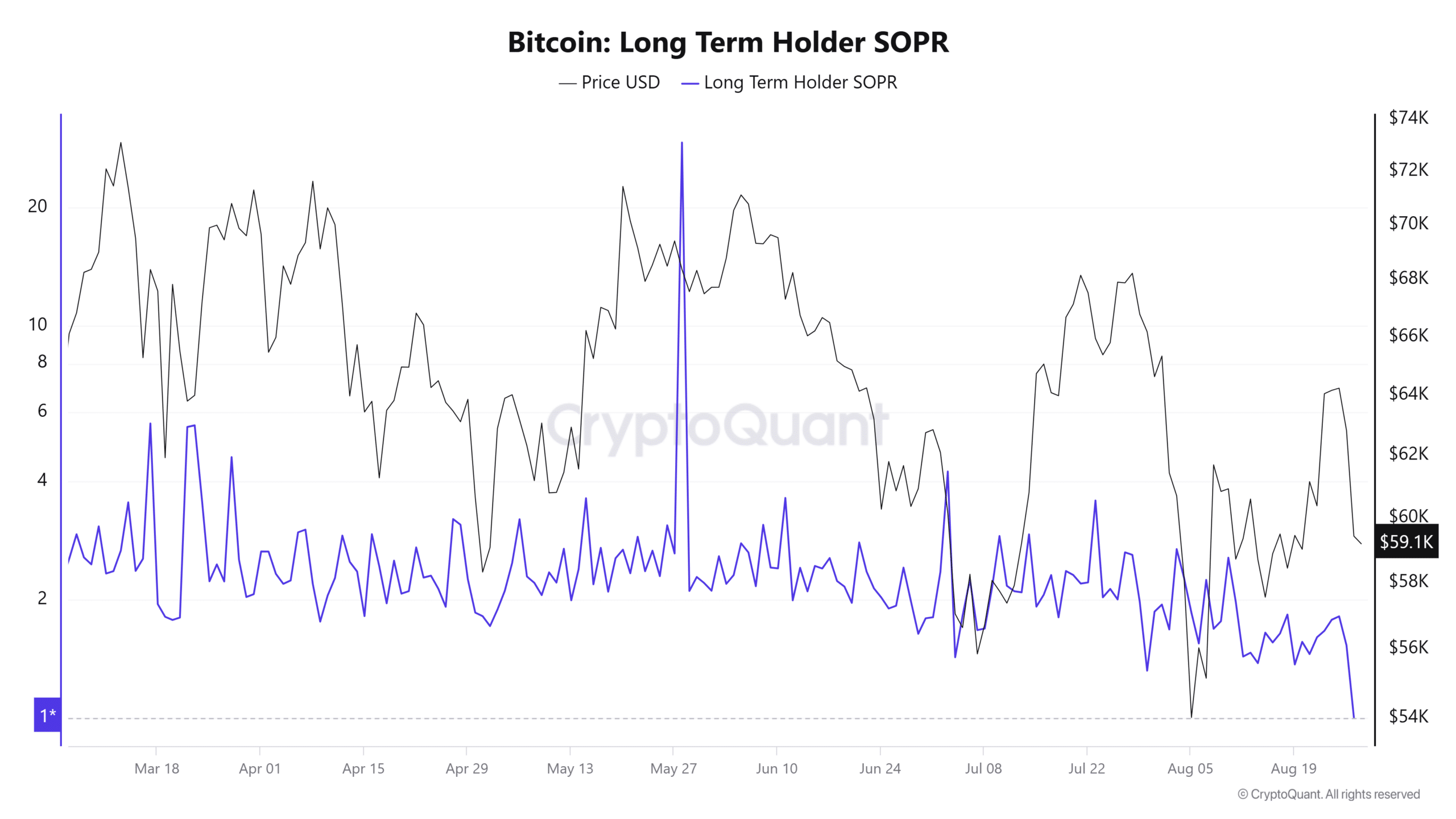

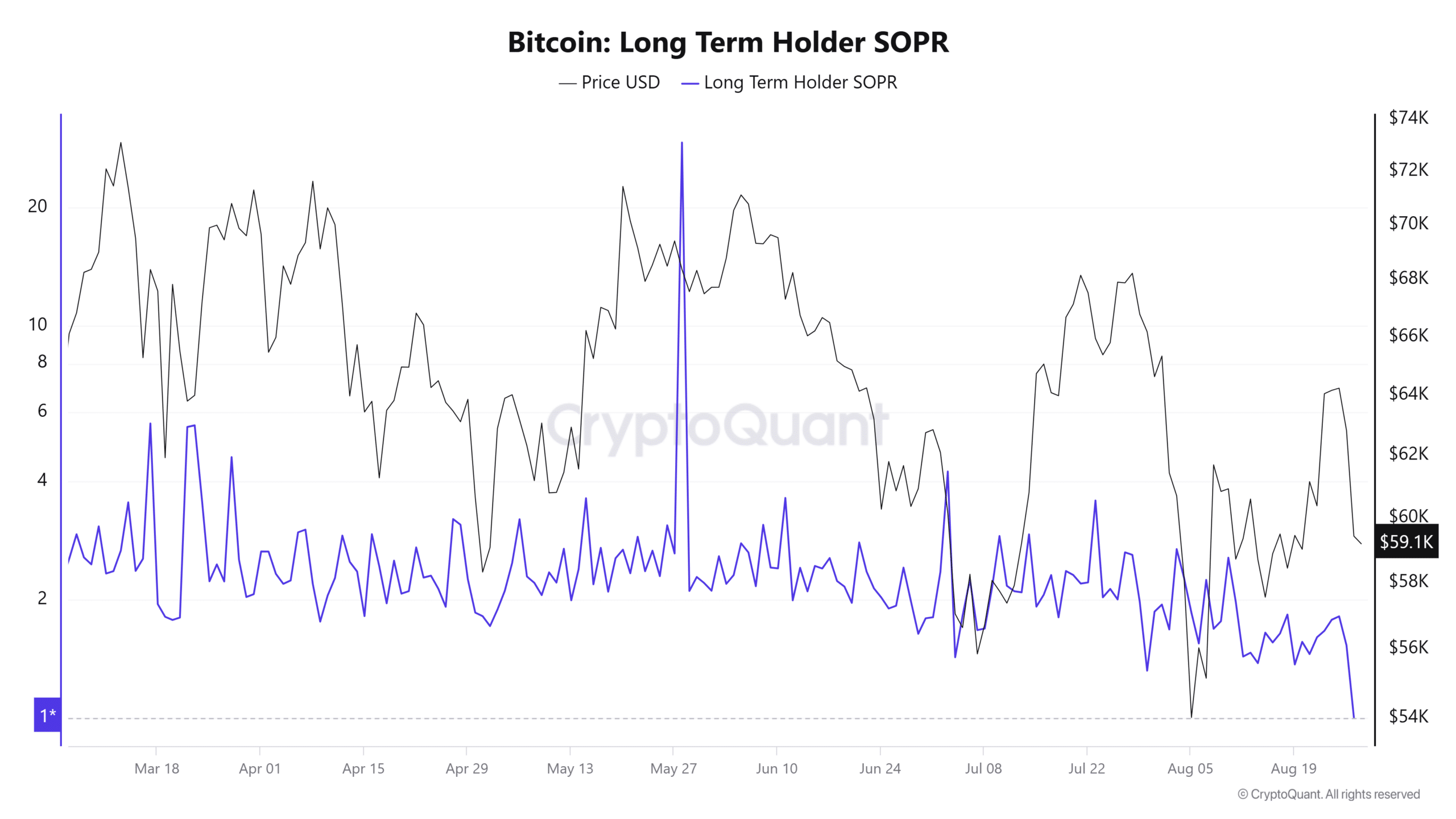

On-chain indicators show that the recent decline has pushed long-term bonds to a breakeven point. The last time this cohort was at this point was on August 5, after which the price made a strong positive correction.

This measure could indicate that the recent decline marked a local low, indicating that the price could rise.

Source: CryptoQuant

Data from InTheBlok showed that more than $3 million addresses bought BTC for between $58,000 and $62,000. Therefore, $62,355 could act as a crucial resistance level if BTC resumes the uptrend.