The market has experienced a strong increase in liquidations, with Bitcoin, Ethereum and Dogecoin most affected. In the last 24 hours, the total liquidations amounted to $ 614.63 million, with more than 224,000 traders.

Bitcoin is good for the largest share, with $ 236.87 million in liquidations, followed by Ethereum at $ 106.85 million.

Source: X

Dogecoin has suffered the most under the top 10 cryptocurrencies, with $ 21.79 million in liquidations after a price drop of 13%. The largest order to a single liquidation, valued at $ 32.09 million, took place on Binance in the BTCUSDT -PAAR.

Uncertainty about the order of Bitcoin Reserve and wider market conditions of Trump has kept traders sharp, which expect further volatility.

BTC, ETH and Doge-Windings

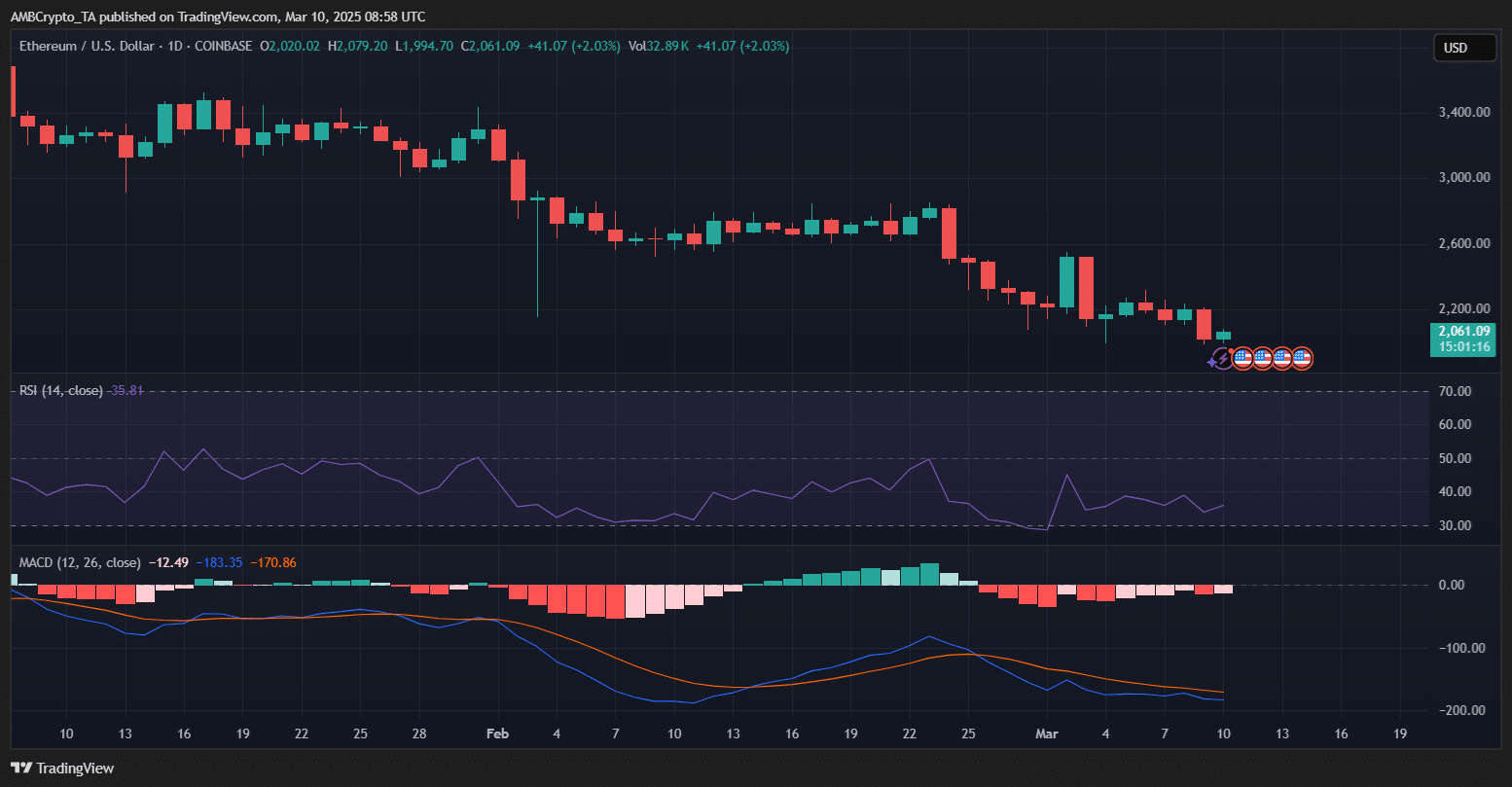

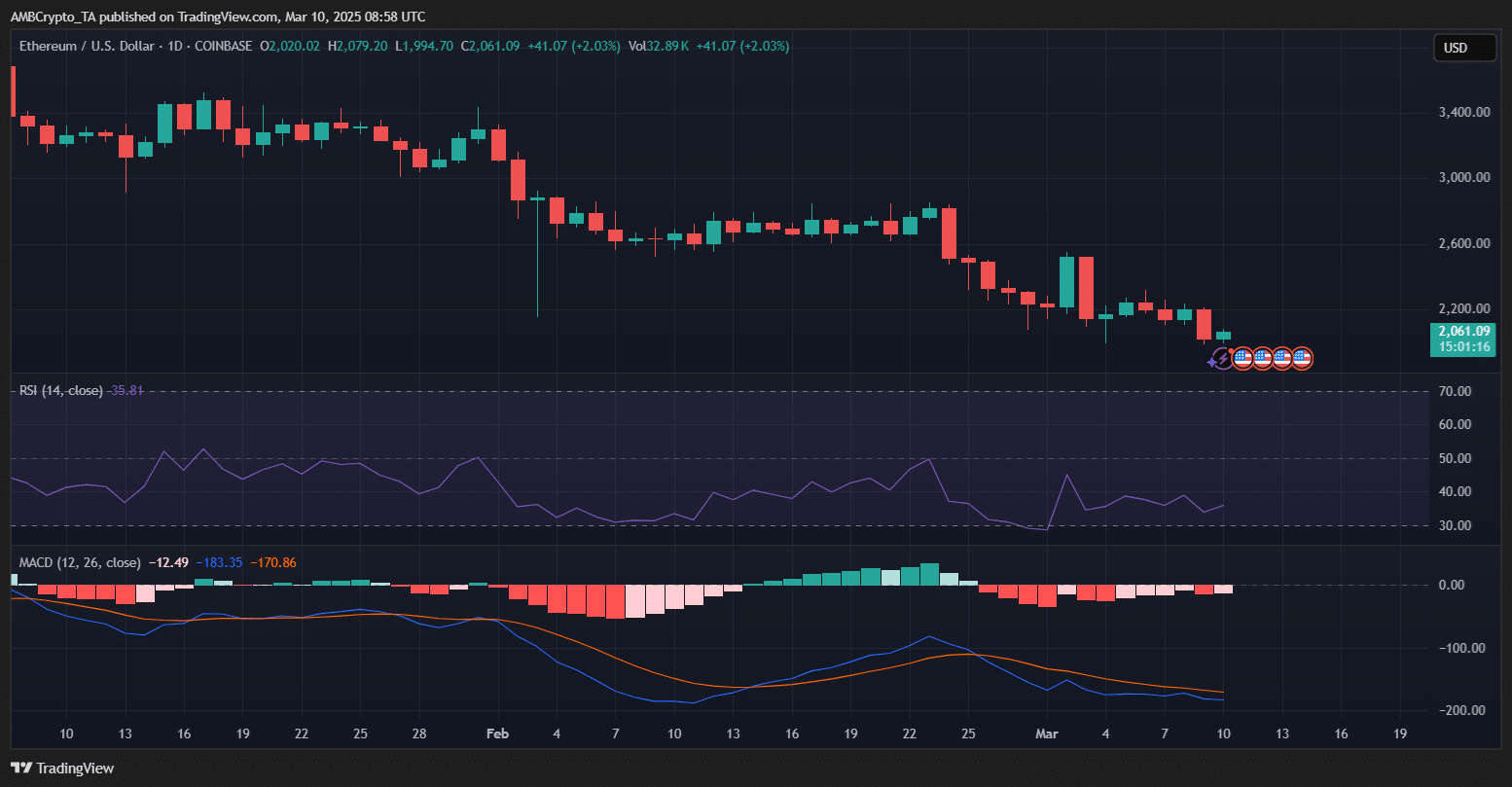

After these wave of liquidations, large cryptocurrencies try to stabilize, but Bearishrum remains strong.

Source: TradingView

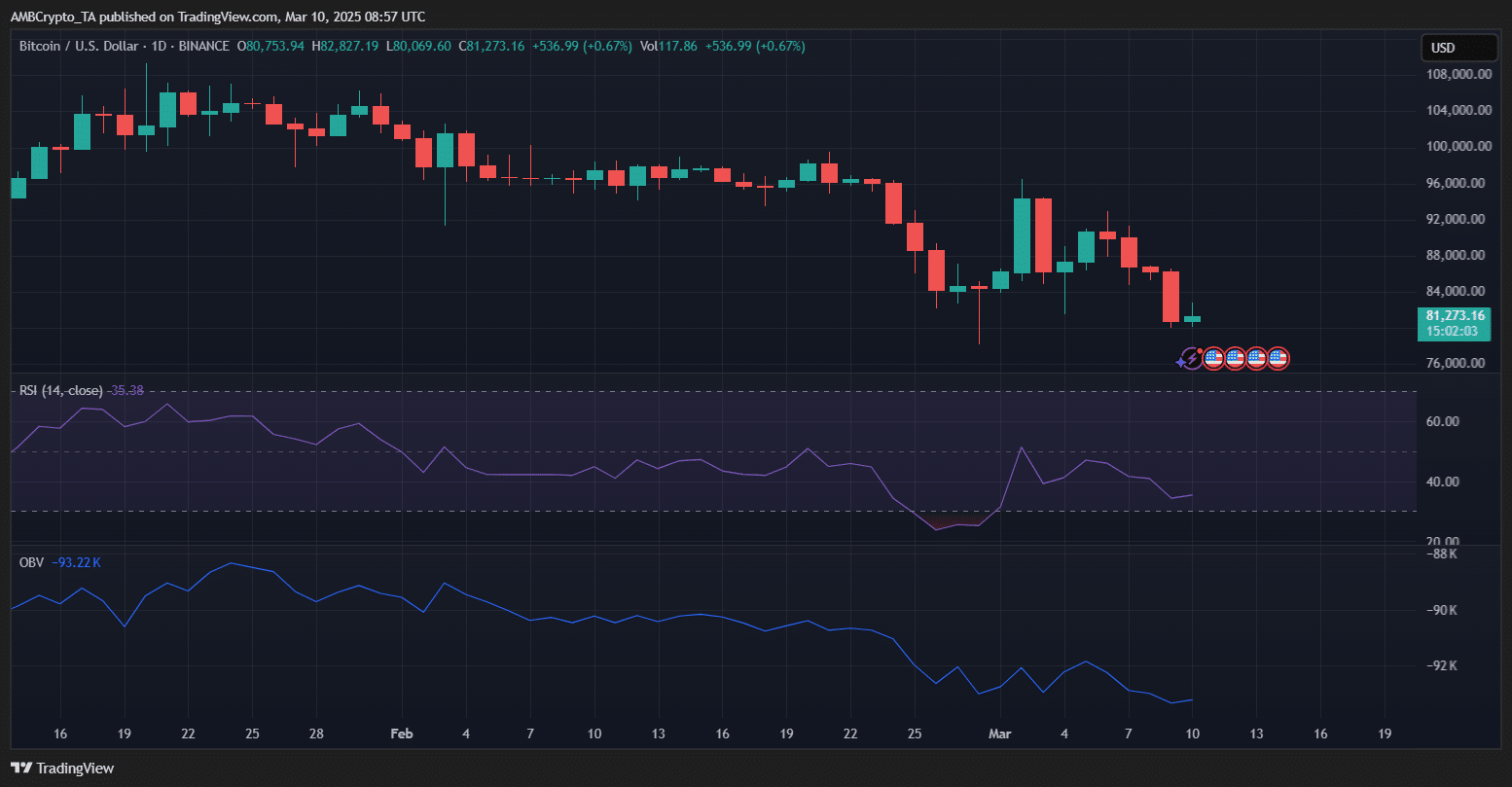

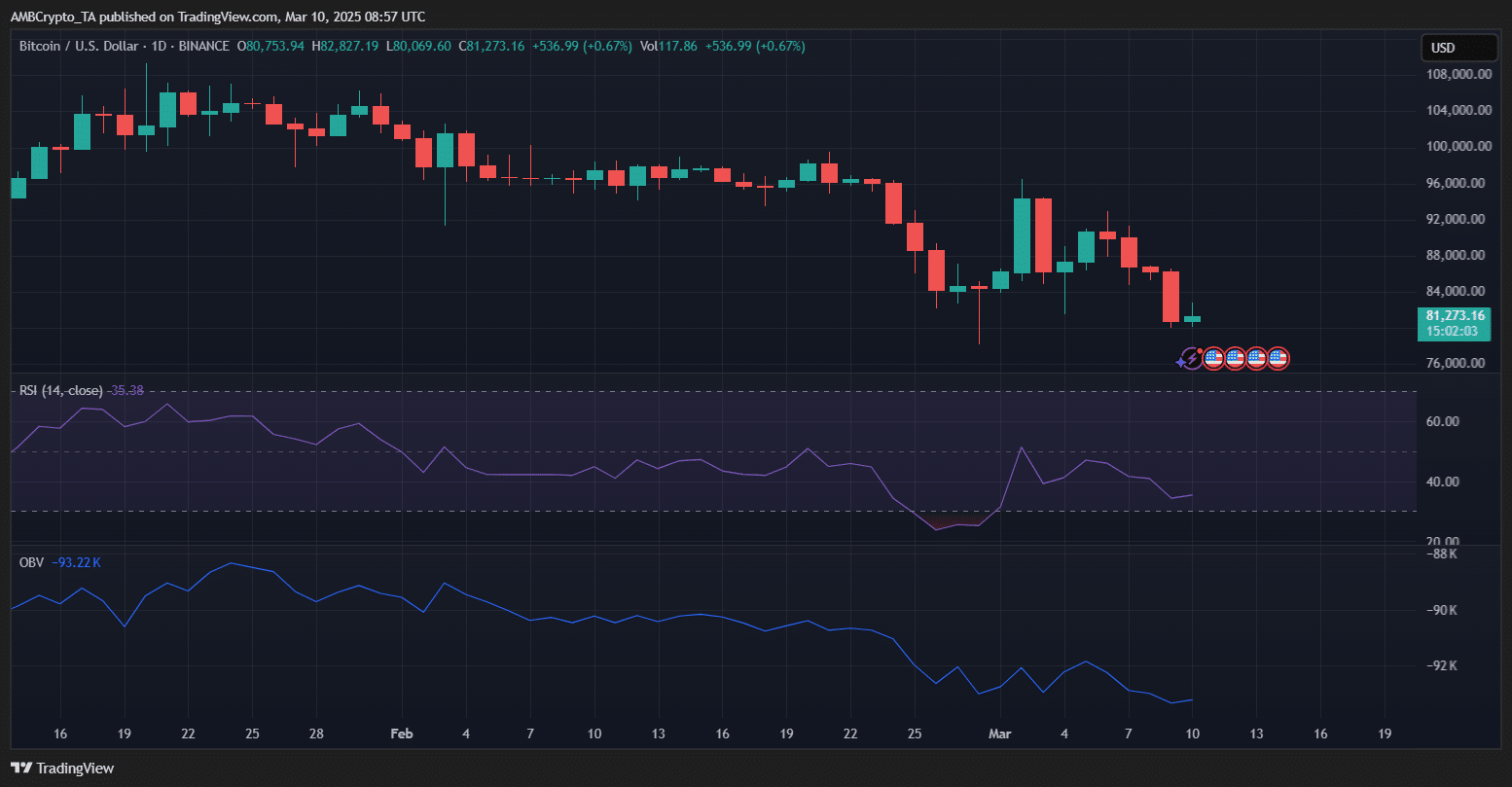

At the time of the press, Bitcoin traded at $ 81,273 and struggled to regain registration after the recent decline. The RSI was 35.38 and signaled over -sold circumstances, which could indicate a potential lighting spring.

However, the downward trend remains intact, with a strong resistance near $ 84,000. The OBV also showed a weak purchasing pressure, indicating a careful sentiment among traders.

If BTC does not exceed $ 80,000, further disadvantage to $ 78,000 can probably be. A break above $ 84,000 can shift the momentum in favor of the bulls.

Source: TradingView