The crypto market has evolved into a dynamic landscape with various trading opportunities. One area that has gained a lot of traction is the Crypto Futures and derivatives market. With cryptocurrencies like Bitcoin and Ethereum taking center stage, investors and traders are delving into Futures contracts tied to these digital assets in search of potential profits.

Is your wallet green? Check out the Bitcoin Profit Calculator

The behavior of traders for the king coin

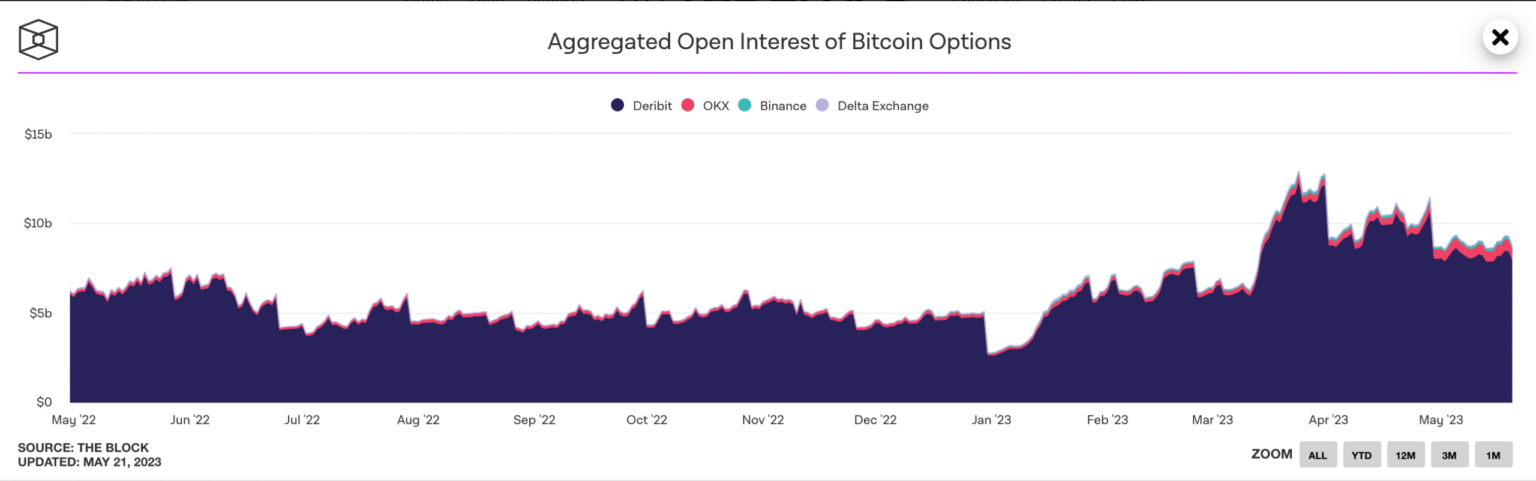

According to data from Glassnode, Open interest for BTC Futures contracts hit a one-month high on the Huobi stock exchange. However, the interest in Bitcoin options trading was not limited to just the Huobi exchange. Data from TheBlock suggested that open interest had increased on most Bitcoin exchanges.

For context, Open Interest in the context of cryptocurrencies refers to the total number of active Futures contracts that have not yet been settled or closed. It serves as a crucial metric for assessing market participation and the potential liquidity within the crypto futures market.

At the time of writing, a total of $8.72 billion BTC options were traded on various exchanges.

Source: The Block

The vast majority of most of these transactions took place on Deribit. At the time of writing, Deribit was responsible 90.91% of all Open Interest coming from centralized exchanges.

Although the Open Interest in Bitcoin increased, the volume of Bitcoin options on the exchanges started to decrease. Over the past 3 months, volume for these options fell from $32.17 billion to $13.56 billion.

Source: The Block

Traders see green, but optimists brave the heat

In terms of the liquidations of these positions, it was found that the number of liquidations for BTC Options started to decrease in recent days. Liquidations usually occur when traders are unable to meet margin requirements or maintain sufficient collateral to back their leveraged positions.

Lower stock market liquidations can also be seen as a positive sign for market participants. Mainly because it suggests that traders better manage their positions and avoid significant losses.

Despite the relatively low number of liquidations, there was a significant difference between long liquidations and short liquidations, with the former being significantly larger than the latter. This indicated that the traders who bet on BTC’s price increase took more losses compared to traders who had short positions at the time of writing.

Source: Coinglass

What are Ethereum traders up to?

Not only did BTC see an increase in Open Interest, but Coinglass data also pointed to an increase in Open Interest for Ethereum Futures in recent months. At the time of writing, the Open Interest for ETH across all exchanges was $5.60 billion.

Source: mint glass

In addition, the put-to-call ratio for Ethereum fell during this period. A falling put-to-call ratio suggests that traders are much more optimistic about the future of ETH’s price and expect it to move in a positive trajectory.

Coupled with that, ATM 7 implied volatility for Ethereum options fell to 36.72%. This means that the implied volatility of Ethereum options with a strike price at-the-money (ATM) and an expiration period of 7 days has decreased.

A decrease in implied volatility suggests that the market is observing a decrease in the expected size of price swings for Ethereum over the specified time frame. This drop in implied volatility can be interpreted as a decrease in uncertainty or a perception of a more stable market environment for Ethereum Options.

Source: The Block

Another indicator of a potential drop in volatility for Ethereum Options is the falling variance premium for Ethereum. In recent weeks, the variance premium for Ethereum has fallen from 17 to 14.

Realistic or not, here is the market cap of ETH in terms of BTC

This showed that the difference between the implied volatility (expected future price volatility) and the actual realized volatility of Ethereum decreased. A decrease in the variance premium suggests that market expectations of future price movements are more aligned with historical levels of volatility.

Source: The Block

HODLers’ vision

However, things can quickly go the wrong way. BTC and ETH have seen their MVRV ratios rise in recent weeks. The rise in MVRV ratios suggested that most of these addresses were profitable. The profitability of their businesses could incentivize the addresses to sell.

If the holders respond to this incentive by selling, it could lower the prices of both cryptos in the future.

Source:Santiment