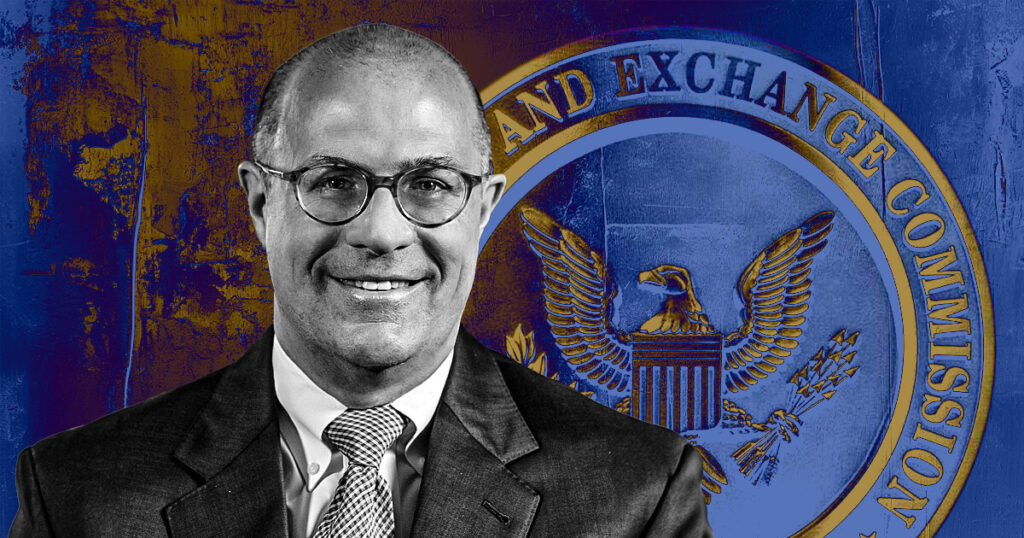

Christopher Giancarlo, former chairman of the Commodity Futures Trading Commission (CFTC). refused rumors that he is being considered as the next chairman of the US Securities and Exchange Commission (SEC).

He also denied rumors that he would be interested in a crypto-related role within the US Treasury Department, adding:

“I’ve made it clear that I’ve cleaned up Gary Gensler’s mess before [at] CFTC and I don’t want to do it again.”

Although he didn’t specify, the ‘mess’ could be related to the SEC’s “regulation by enforcement approach” to the crypto industry, which one of its commissioners has deemed a ‘disaster’.

Giancarlo took over as chairman of the CFTC in August 2017, more than three years and two terms after current SEC Chairman Gary Gensler left the role.

Giancarlo is also known as ‘Crypto Dad’ due to his friendly attitude towards this industry in the US since 2018 when he said that “cryptocurrencies are here to stay.” In 2021, the former CFTC chairman published an autobiography that includes his support for crypto.

He is currently a consultant for the US Digital Chamber of Commerce.

Justified and essential

Gensler recently defended the SEC’s approach during a speech at the Practicing Law Institute’s 56th Annual Securities Regulation Conference, according to a CNBC report.

Gensler emphasized that while Bitcoin is not a security, a substantial portion of the 10,000 other digital assets in circulation likely qualify as securities under U.S. law.

He further argued that this classification places them fully under SEC regulation, reinforcing the need for sellers and intermediaries to register to protect investors and maintain market integrity.

Additionally, the SEC chairman described the regulator’s vigilance as necessary to prevent “significant harm to investors,” citing cases where poorly monitored digital assets had failed to demonstrate lasting utility or stability.

He warned that the industry’s lax regulatory oversight was exposing investors to risks. He suggested the SEC’s tough stance was justified and essential to protect the public.

Since Gensler took over in 2021, the SEC has filed numerous lawsuits against crypto companies, including major exchanges like Kraken, Binance, Ripple, and Coinbase. Many within and outside the sector have criticized the regulator’s actions, claiming it has failed to provide regulatory clarity to the sector.