On October 2, Mike McGlone, Commodity Strategist at Bloomberg, took to social media emphatically are concerned about the condition of the cryptocurrency market.

Despite Bitcoins (BTC) recent surge, McGlone highlighted a troubling trend and raised the possibility of a cryptocurrency recession.

Factors Behind Crypto Market Recession Risk

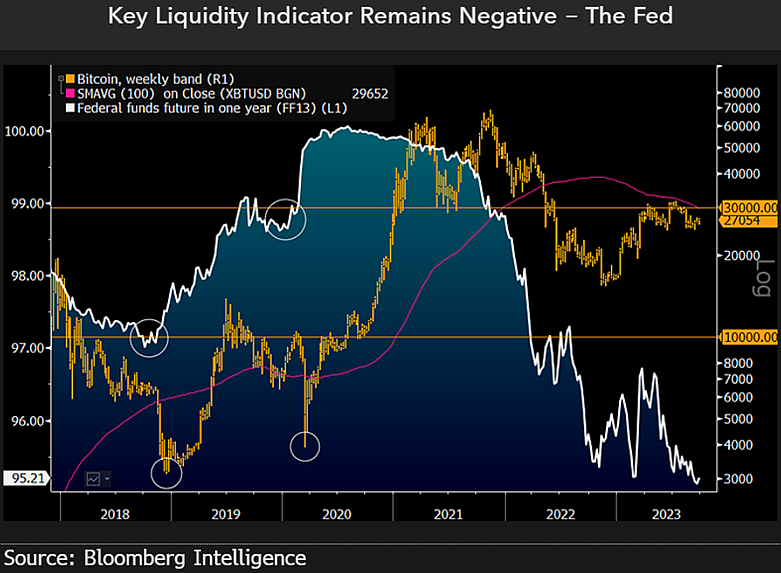

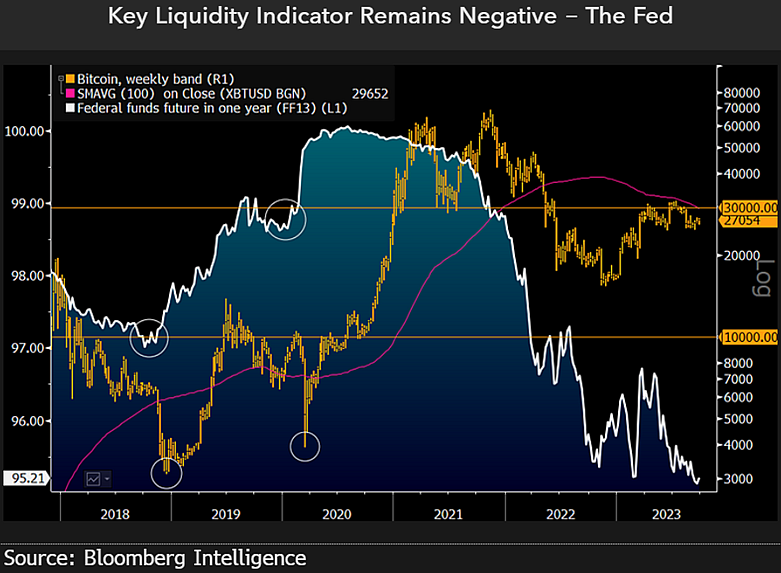

McGlone pointed out the concept of “positive beta versus negative liquidity” and its implications for the cryptocurrency market.

Bloomberg’s senior macro strategist suggested the weakness seen in the third quarter of 2023 could be a temporary dip in the recovery or a sign of an impending recession.

According to McGlone, the latter scenario is more likely, given most of the risky assets experienced gains in 2023, but have since been rolled over to the new quarter.

The strategist also drew attention to the actions of central banks worldwide, noting that many are tightening monetary policy despite signs of contraction in the United States and Europe.

In addition, McGlone highlighted the ongoing real estate crisis in China, which is causing deflationary consequences. He argued that the relative underperformance of the Bloomberg Galaxy Crypto Index (BGCI) could reflect changing conditions for an asset class that has thrived in a zero interest rate environment.

McGlone drew historical parallels and mentioned Bitcoin’s previous price declines Federal Reserve (Fed) is running, implying that cryptocurrencies can serve as leading indicators of broader market liquidity. McGlone suggested that a resurgence in liquidity may be necessary to support the crypto market.

Bitcoin Maximalist identifies key factors for remarkable market growth

In addition to McGlone’s prediction, increased regulatory oversight and implementing strict regulations by governments and regulators can have a significant impact on the cryptocurrency market.

United States regulators have been actively cracking down on the crypto market, causing delays in what was expected to be a bullish run. Lawsuits filed in 2023 and signals of continued regulatory action from the U.S. Securities and Exchange Commission (SEC) have created uncertainty and restrictive regulations that could dampen investor sentiment and contract the market.

Additionally, economic factors are contributing to concerns about a possible recession in the digital asset ecosystem. Cryptocurrencies are interconnected with the broader economic landscape, meaning that global recessions, changes in monetary policy, inflation or deflation could affect the cryptocurrency market, potentially leading to a recession.

On the other hand, some view the largest cryptocurrencies as safe havens during significant downturns in the world’s largest economies. Bitcoin maximalists, including ‘The Bitcoin Therapist’, assisted by artificial intelligence (AI), have identified key factors necessary for Bitcoin and the overall market to achieve remarkable growth.

These factors include mass adoption, global economic uncertainty, institutional investment, limited supply, increased transaction volume, technological improvements, regulatory clarity, positive market sentiment, halving events and a global currency crisis.

While progress has been made on factors such as global economic uncertainty, limited supply, increased transaction volume, technological improvements and halving events, achieving mass adoption, institutional investment, regulatory clarity, positive market sentiment and a global currency crisis still ongoing.

The strategist’s comments underscore the cautious sentiment surrounding cryptocurrencies despite recent positive moves in Bitcoin’s price.

McGlone’s analysis suggests that the cryptocurrency market could face significant headwinds due to changing economic conditions, central bank policies and potential liquidity issues.

Featured image from Shutterstock, chart from TradingView.com