Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

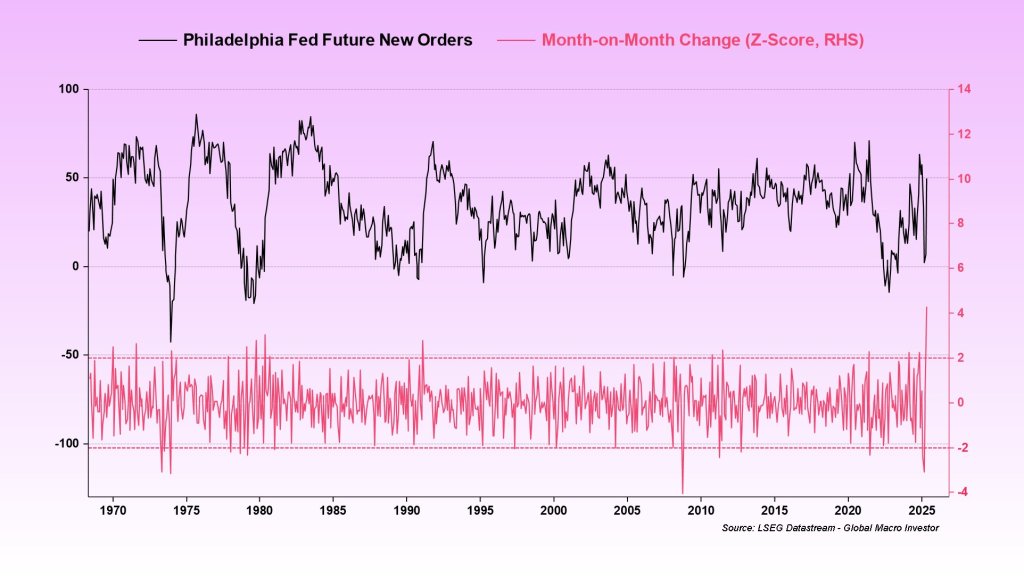

An unprecedented increase in the May Producturing Business Outlook Survey of the Philadelphia Federal Reserve has given the worldwide risk markets for the world and the traders of Crypto activa their clearest macro catalyst of the year. The future diffusion index of new orders jumped through forty points, a movement that Julien Bittel, head of macro research at Global Macro Investor (GMI), called ‘literally’ historical.

Crypto Bulls can look forward to

Bittel’s commentary On X Framed the Print with Statistical Precision: “Philly Fed data for May yesterday – and the future new orders – Index has just written history. Literally. 2008 crisis (-4.1σ).

Bittel then stated the increase in a broader story that his research has animated since the end of last year. “Q1 growth was weak. The reason is simple – the financial circumstances were strongly tightened in Q4. The dollar tore, bond yields rose … a classic tightening phase,” he wrote.

Related lecture

The nearby trigger was in his story “Companies that load inventories before Trump rates and markets the front of inflation story on the front.” That dynamic, he argued, are a repeat of Donald Trump’s first term: “We repeatedly emphasized: this had all the characteristics of the first quarter of 2016 during the first term of Trump. Just like early 2017, which was transmitted in a slower growth momentum in Q1.”

Where 2017 started with doubt and ended in a synchronous global tree, Bittel believes that Rijmts 2025. “The Q1 opposite were turned around in Q2 steel wind,” he lasted. “Everything flows downstream of changes in financial circumstances … The expectations of the purchasing managers – and shifts in thinking ultimately translate themselves into action. Sentiment shifts first. Action follows. It always does. Bullish.”

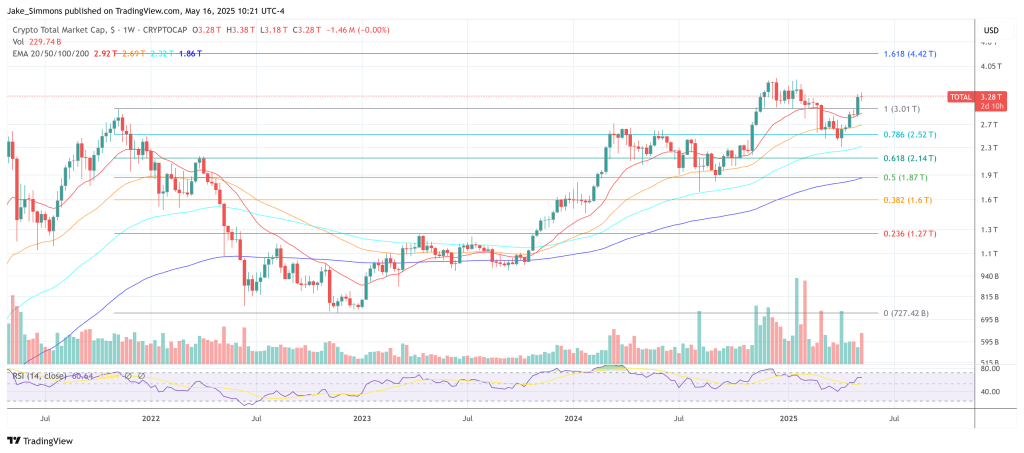

The cryptomarkt reacted muted. Bitcoin has recovered the level of $ 104,000 in early European trade, but lost it later. Ether stabilized almost $ 2,600, and high -beta layer -one tokens such as Solana and Avalanche moved together.

Related lecture

Giancarlo Cudrig, head of markets at the unchangeable, said that the scale of the shock is less important than how positioned investors are for an upward growth surprise. “An upward economic shock like this – +4.3σ about new orders – is rare. But the larger story is market positioning. Active prices are not prepared. The melt -up is the asymmetrical risk. Now it is being hit again.”

Independent analysts market Heretic made a similar remark about X: “When this dropped, the markets didn’t even tie. Because the shift is already moving. This was not news, it was confirmation. That is the real storytelling, when markets a four -sigma turned upside down. It has just started.”

The implications are immediately for crypto investors. A softer dollar and retreating expectations of the real time providers reduce the opportunity costs of keeping non -suitable assets, while the early phase of a reflational turn historically prefers high beta. Bittel’s own playbook is unambiguous: “Sentiment shifts first. Action follows.” As long as that chain reaction continues, the crypto bulls seem to have both math and momentum on their side.

At the time of the press, the total crypto market capitalization was $ 3.28 trillion.

Featured image made with dall.e, graph of tradingview.com