This article is available in Spanish.

In a bold series of posts on X on January 14, prominent crypto analyst Miles Deutscher made a shocking prediction about the long-discussed phenomenon of an altcoin season. His comment quickly caught the attention of crypto analysts, especially as it seemed to challenge rather than reinforce long-standing hopes of a 2021-style altcoin mania.

RIP Crypto Altcoin Season?

Deutscher started his after by acknowledging the renewed conversation within crypto circles about whether there could be another ‘alt season’. He distinguished two different interpretations of the term altcoin season. “Will there ever be another ‘alt season’? I see a lot of discussion about this on the TL,” Deutscher noted. “First, it depends on your definition of ‘alt-season’. If you talk about the index: yes, I expect it to peak again sometime this year.”

Related reading

However, he warned that a repeat of 2021’s euphoric, multi-month upside would be extremely unlikely: “If you’re talking about the multi-month upside mania of 2021, then no. The unique combination of quantitative easing/stimulus and V-shaped stock repricing created conditions that are almost impossible to reproduce. Expecting that is a recipe for disaster. Key word here: ‘expect.’”

Deutscher’s overarching advice emphasized flexibility and preparedness rather than relying on long-term bullish waves. He advocated taking profits on what he expected to be relatively short-lived rotations in altcoins – although he did acknowledge the possibility of a surprise rally: “If there DOES be a bigger ‘alt season’, great. That makes our job a lot easier, and complacency won’t be punished as severely. Go with the idea that the rotation to alts is short-lived (this will force you to take profits). It may not be short-lived, but at least you secure the profit.”

Related reading

He emphasized that prudent strategies should take into account “multiple mini-cycles or periods of narrative outperformance,” underscoring the importance of not hoping for a second coming of market conditions in 2021. Deutscher’s advice ultimately revolved around portfolio construction and proactive trading: “Rather than holding anything and everything, you need to have a more concentrated basket of high-conviction assets. Contrast these companies with a willingness to trade in profitable playgrounds (i.e. AI) – but treat them as transactions, and don’t hold your pockets.”

Deutscher’s comments came in response to a statement from crypto influencer Ansem, who had claimed: “Never again alt szn. There are always areas of extreme outperformance, where people move down the risk curve in cyclical terms, but never to the levels they were before. What is the real reason that BTC.d does not need to rise to the right for ten years?”

While both analysts believe that a 2021-style altcoin season seems highly unlikely, they highlight the opportunities that still exist in this bull run. “Specific assets/sectors will have crazy runs if conditions allow. Rather than owning anything and everything, you need to have a more concentrated basket of high-conviction assets,” concludes Deutscher.

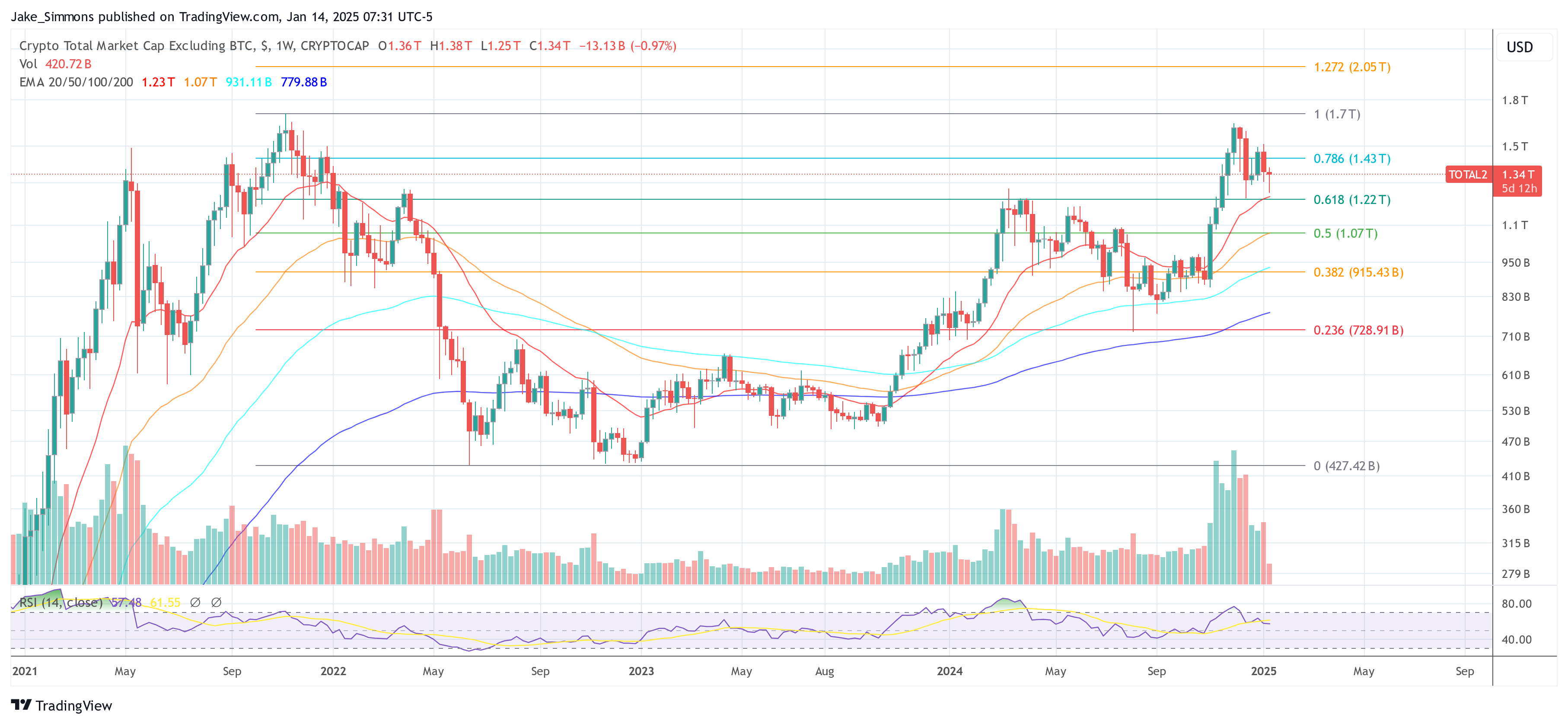

At the time of writing, the total crypto market cap excluding Bitcoin (TOTAL2) was $1.34 trillion.

Featured image created with DALL.E, chart from TradingView.com