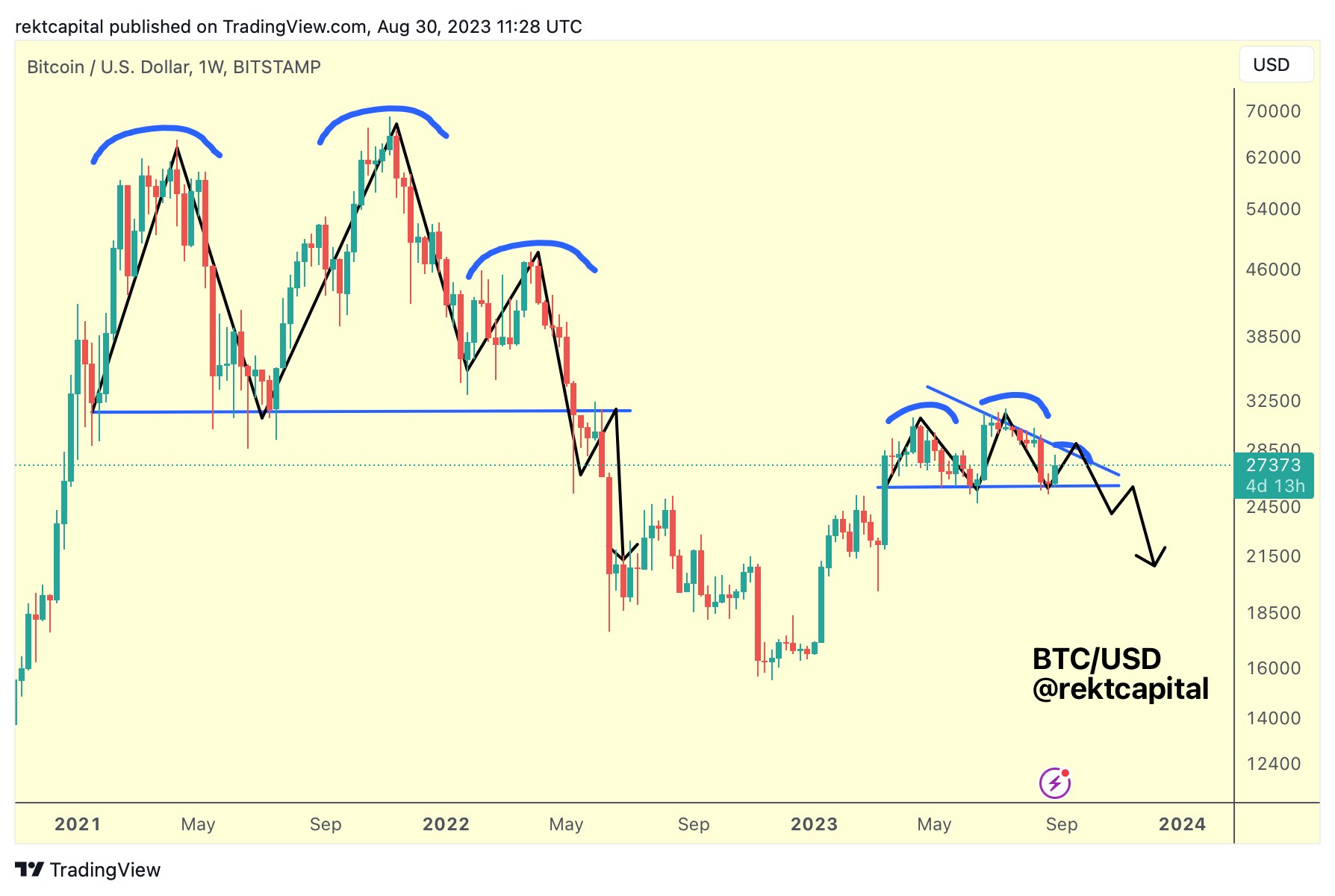

A closely watched analyst warns that Bitcoin (BTC) is forming a bearish pattern last seen just before the crypto king collapse in late 2021.

Pseudonymous analyst Rekt Capital tells his 350,800 followers on the social media platform X that Bitcoin is very close to the breakup of a bearish double top pattern.

According to the crypto strategist, a sell-off with a higher volume would trigger the breakdown process.

“BTC is about to validate its double top formation.

A breakthrough in seller volume and a convincing loss of ~$26,000 followed by its turning into new resistance would confirm the collapse.”

Zooming out, Rekt Capital says Bitcoin appears to be reflecting the price action of late 2021, when BTC ended its last bull market after breaking a double top pattern.

“In 2021, BTC formed two clear tops, similar to a double top, before forming the third top at a lower high.

At this point, BTC appears to have formed two clear tops again, similar to a double top, with a potential third top at a lower high.”

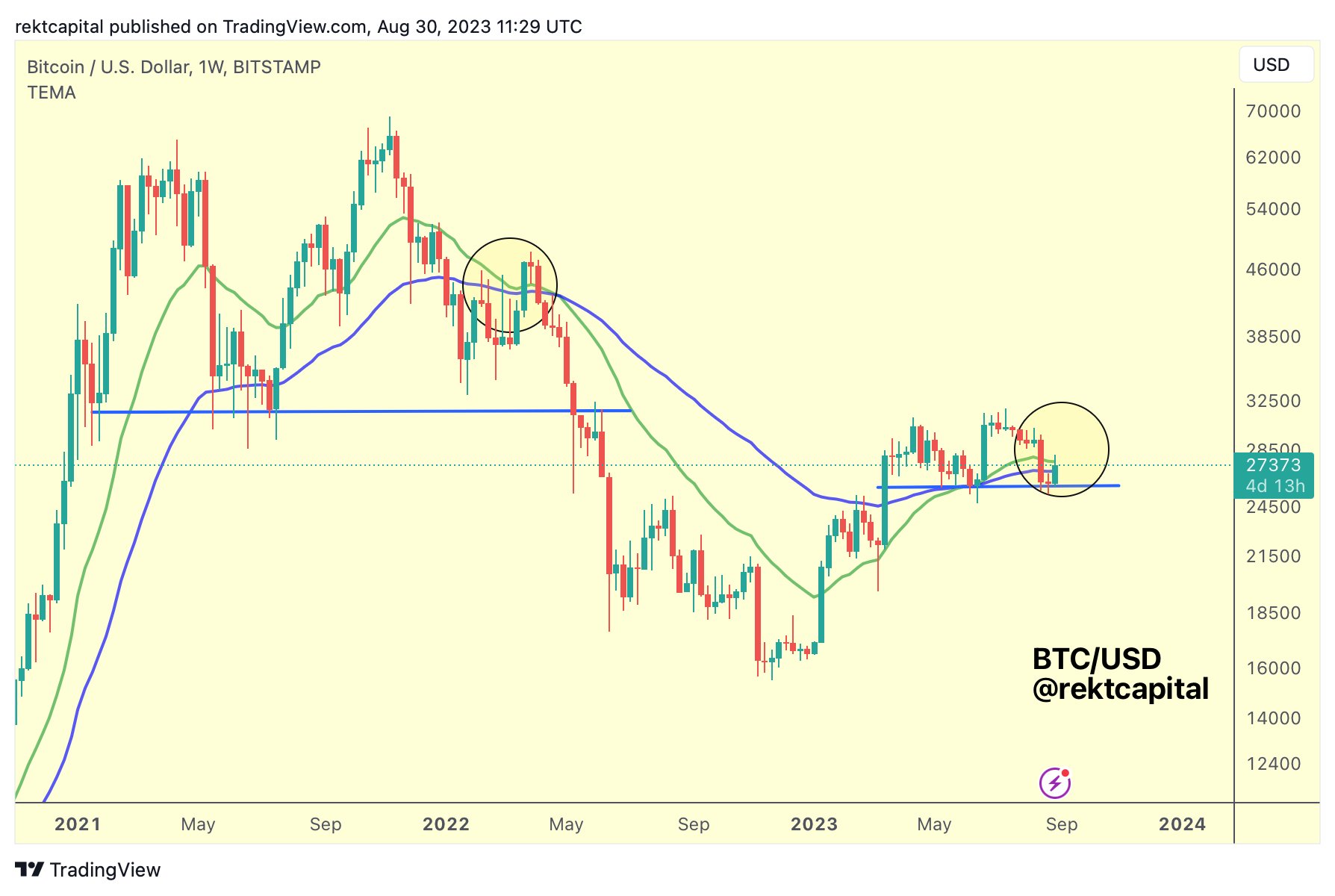

Rekt Capital says the similarities extend beyond BTC price action. The crypto strategist emphasizes that major moving averages now act as resistance for BTC, just as they did in 2021.

“Because BTC is experiencing resistance on the bull market moving averages, which are around $27,000-$28,000.

These BTC moving averages are the green 21-week EMA (exponential moving average) and the blue 50-week EMA.

They act as resistance, just like they did in 2021.”

The analyst goes on to say that he expects Bitcoin to bounce once more before collapsing and witnessing a profound corrective move near the USD 20,000 price area.

“The BTC 2021 fractal suggests that BTC could soon reach its third high at a lower high before being rejected there and eventually losing the ~$26,000 support.

After that, the fractal suggests that BTC would bounce, but only to turn around $26,000 into new resistance before rejecting lower.

At the time of writing, Bitcoin is worth $25,850.

Don’t miss a single beat – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/ConceptCafe/Chuenmanuse