- Bitcoin’s $90,000 support remains strong after December’s sell-off, pointing to underlying market resilience

- Institutional profit-taking has cooled, with Bitcoin ETF inflows falling from $14 billion to $6.6 billion per month

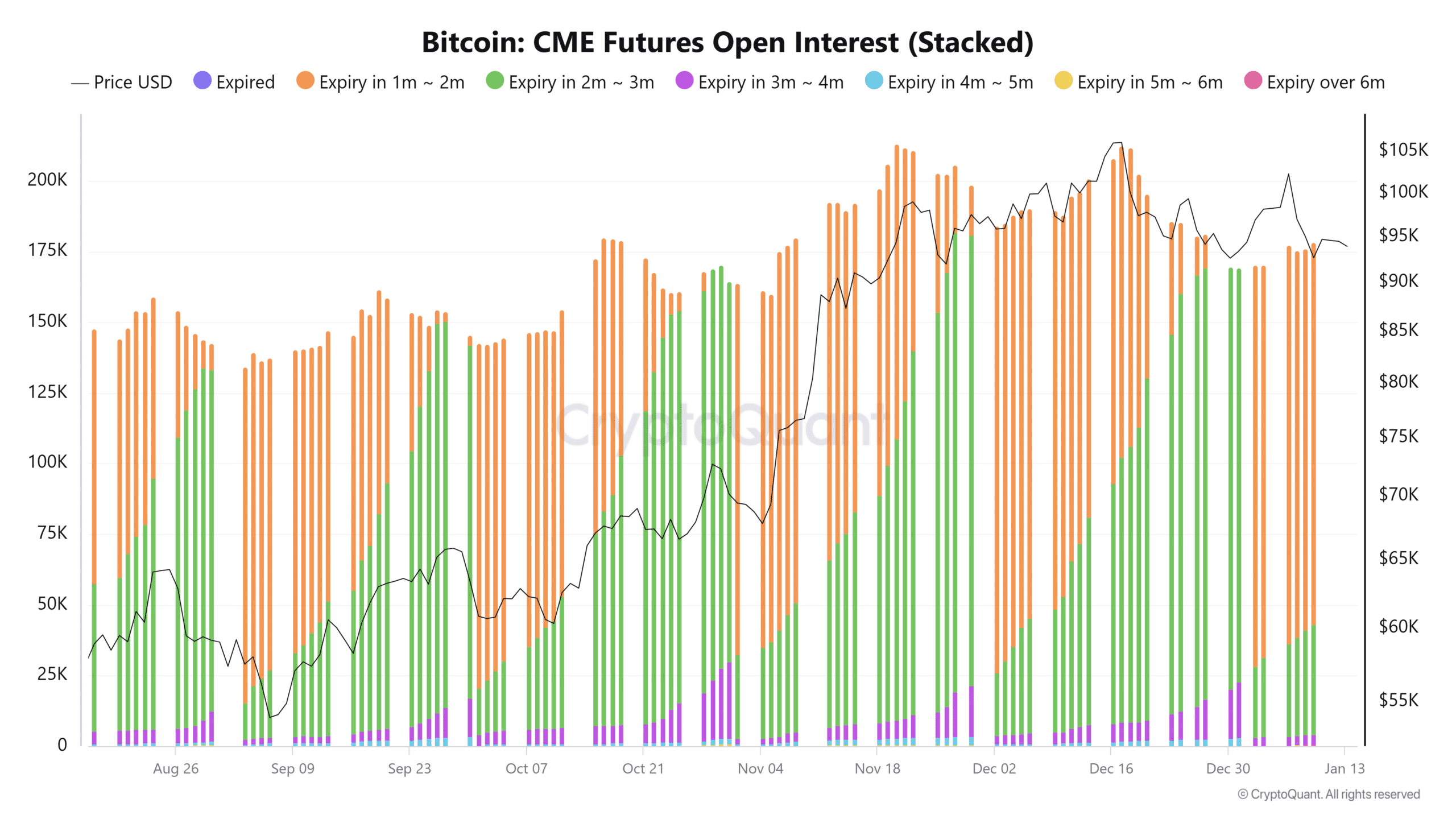

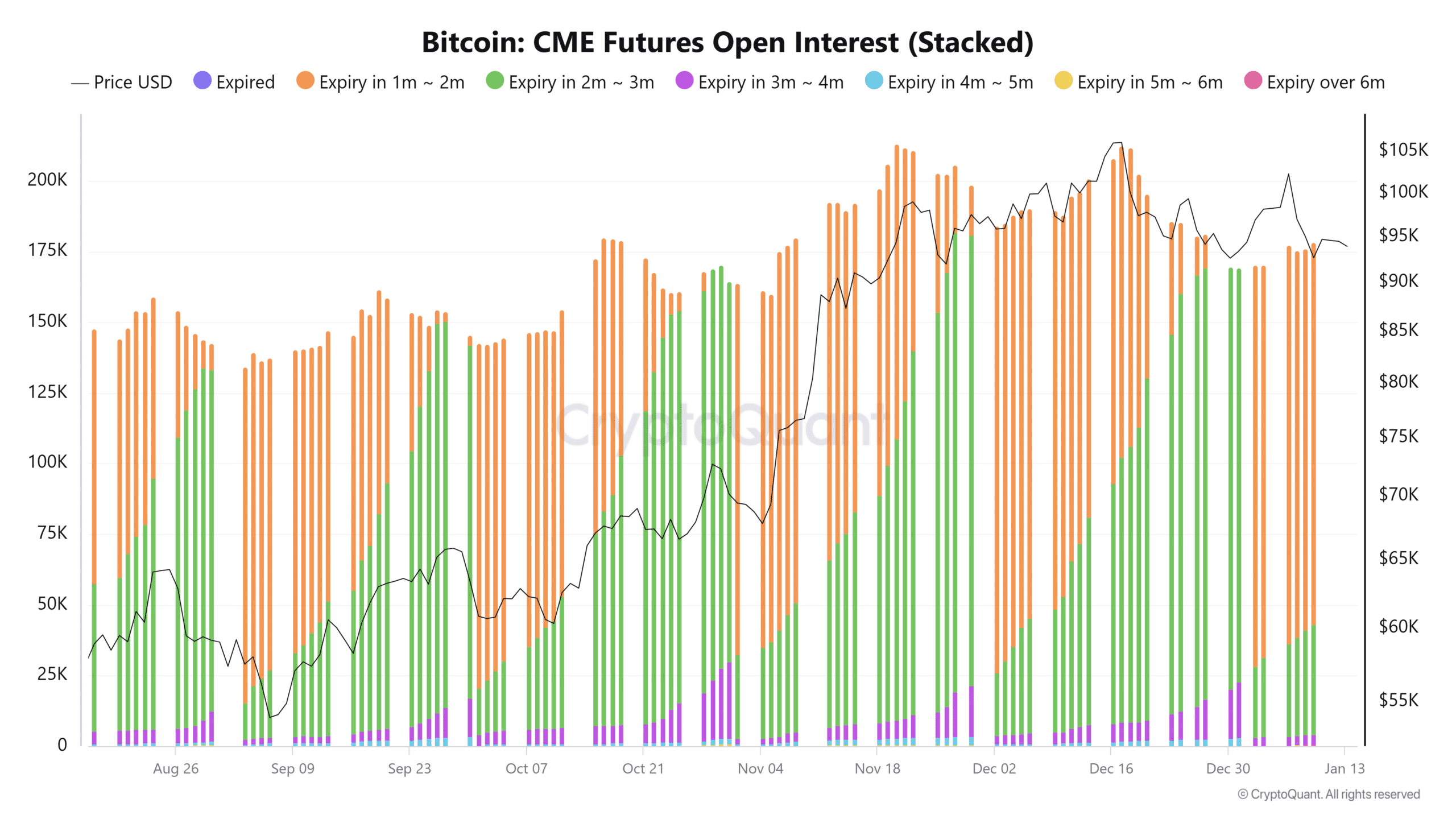

Seasonality has never been kind to Bitcoin [BTC] end of December. The sell-side avalanche tends to spill over into January, and 2025 is no exception. Institutional profit-taking has taken its toll, with open interest on CME contracts falling 13%. ETFs have also seen their net inflows cool, from $14 billion a month to $6.6 billion, as institutions lock in their profits.

Despite this, Bitcoin has held steady around the critical support at $90,000. The heavy selling pressure of December – $200 million in daily outflows – has subsided, leaving January stuck at the neutral line. The resilience signals underlying strength, but is it enough for Bitcoin to defy the odds?

The $90,000 support is holding

After a volatile December marked by relentless sell-side pressure and daily outflows peaking at $200 million, the market entered January with renewed stability. The critical support level at $90,000, formed by institutional inflows, is now a sign of resilience amid declining volatility.

Source: Cryptoquant

At the time of writing, Open Interest, which has fallen 13% since its peak in November, highlighted a wave of profit-taking among institutional investors. The sharp decline in the number of contracts nearing expiration at the end of December correlated with the sell-off, indicating risk aversion as market uncertainty escalated.

Moreover, the unwinding of longer-dated futures indicated cautious sentiment beyond the short-term horizon. This contraction in activity meant institutions hedged their positions, rather than aggressively engaging in upside bets.

Bitcoin’s price suggested that the $90,000 level has become a psychological anchor. A break below this threshold could spark renewed momentum on the sell side, but current resilience signals support from both institutional hedgers and retail participants. While outflows have slowed, the cautious optimism has yet to translate into significant upside momentum, leaving the market in a delicate balance.

Key indicators: MVRV and sell-side risk ratio

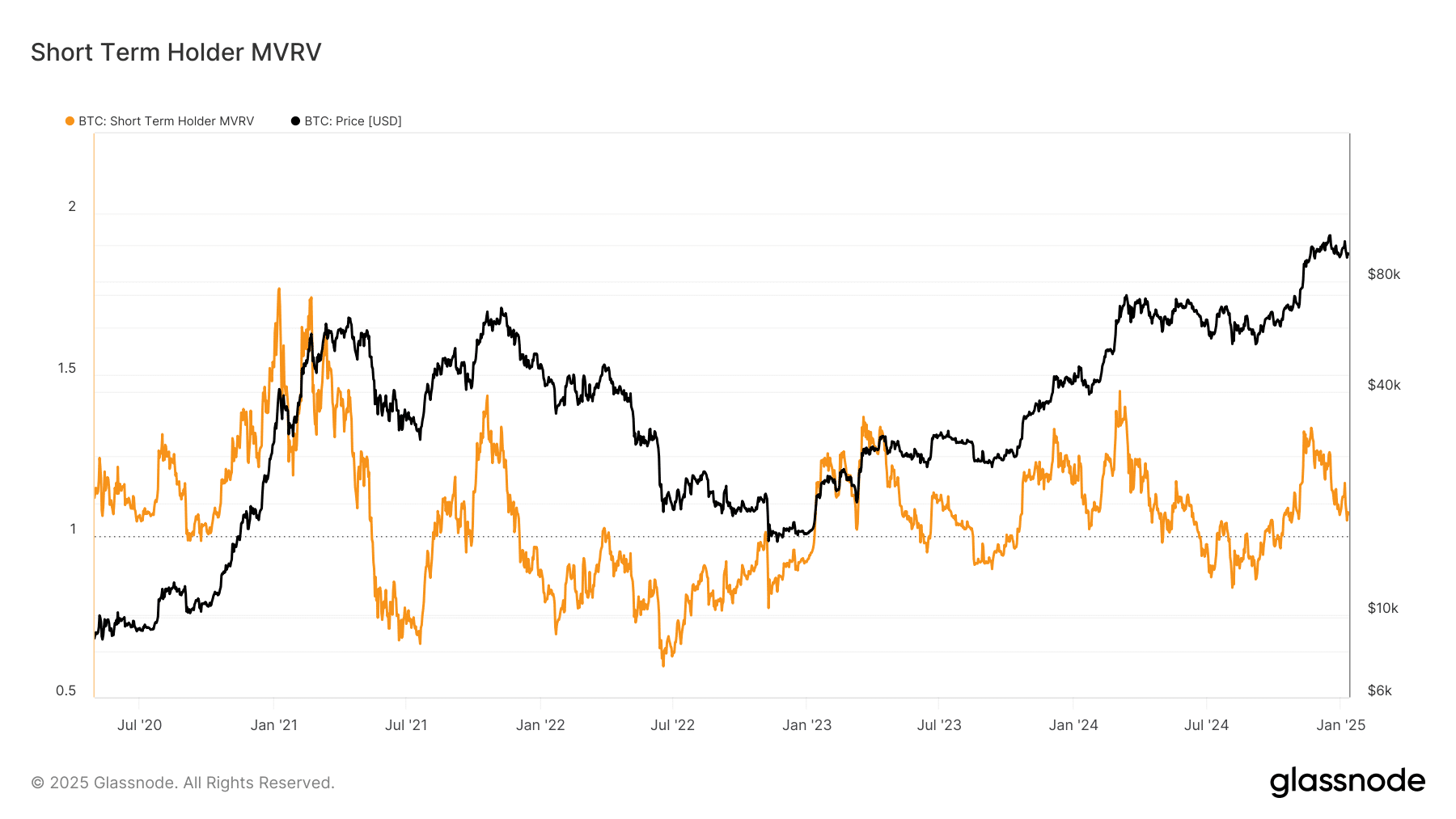

Source: Glassnode

The STH MVRV ratio revealed an intriguing dynamic. Short-term holders, whose costs average around $88,000, have yet to feel the pressure of uncontrollable losses.

However, the gap between 1.08 and 1 reflects a delicate balance – one that could turn bearish if Bitcoin were to break its $90,000 support. On the contrary, closing this gap could act as a springboard for upward momentum.

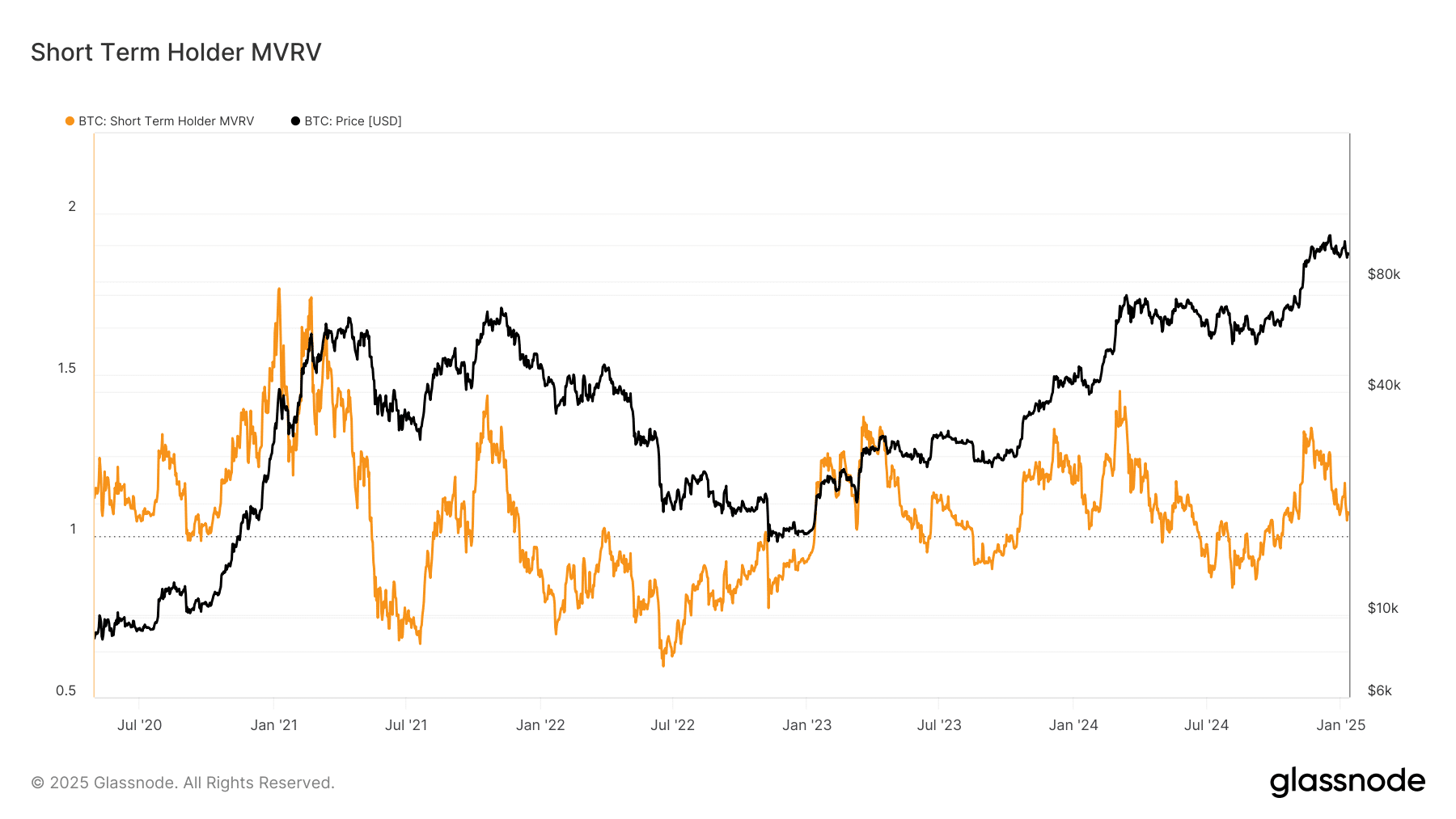

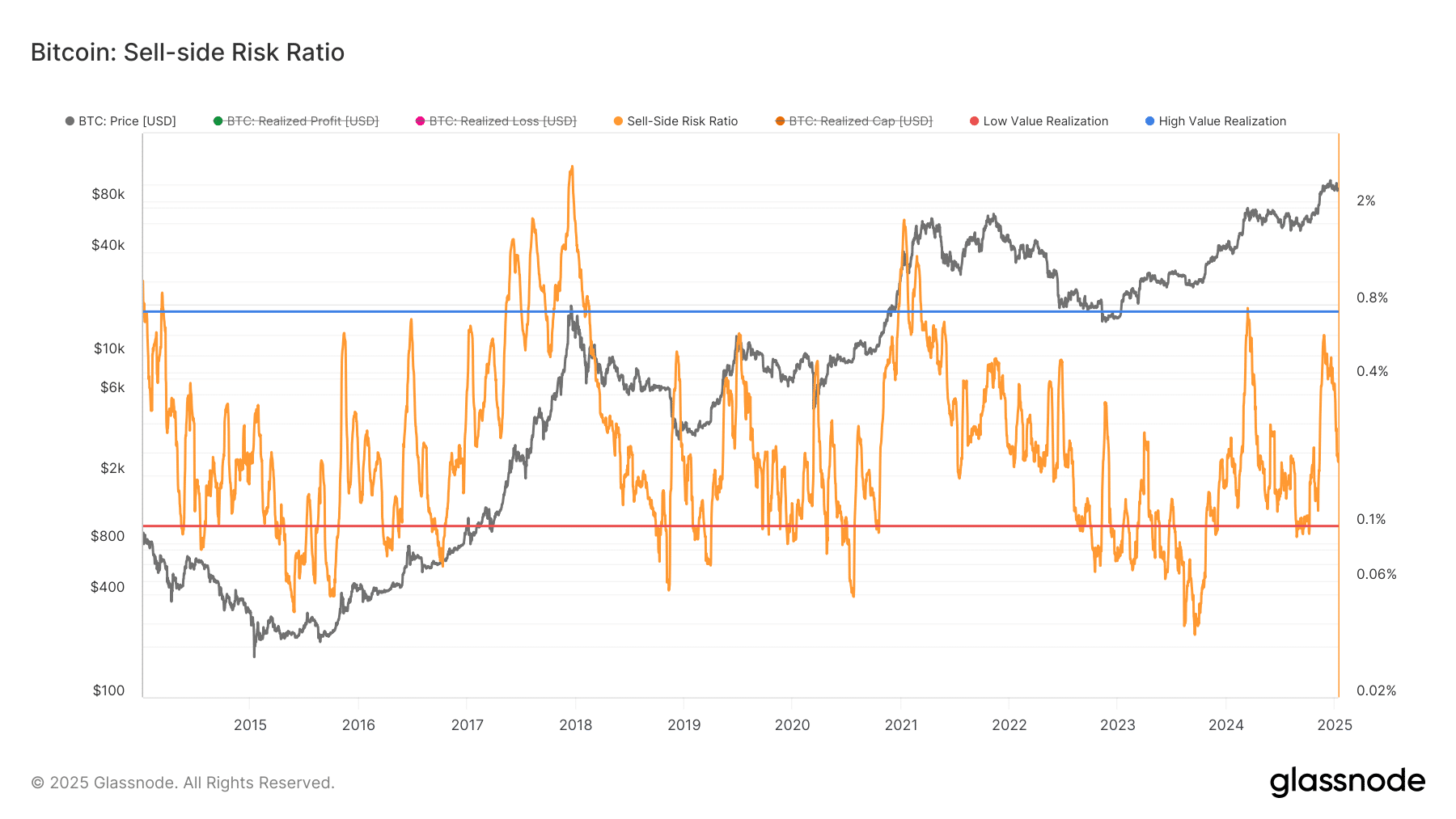

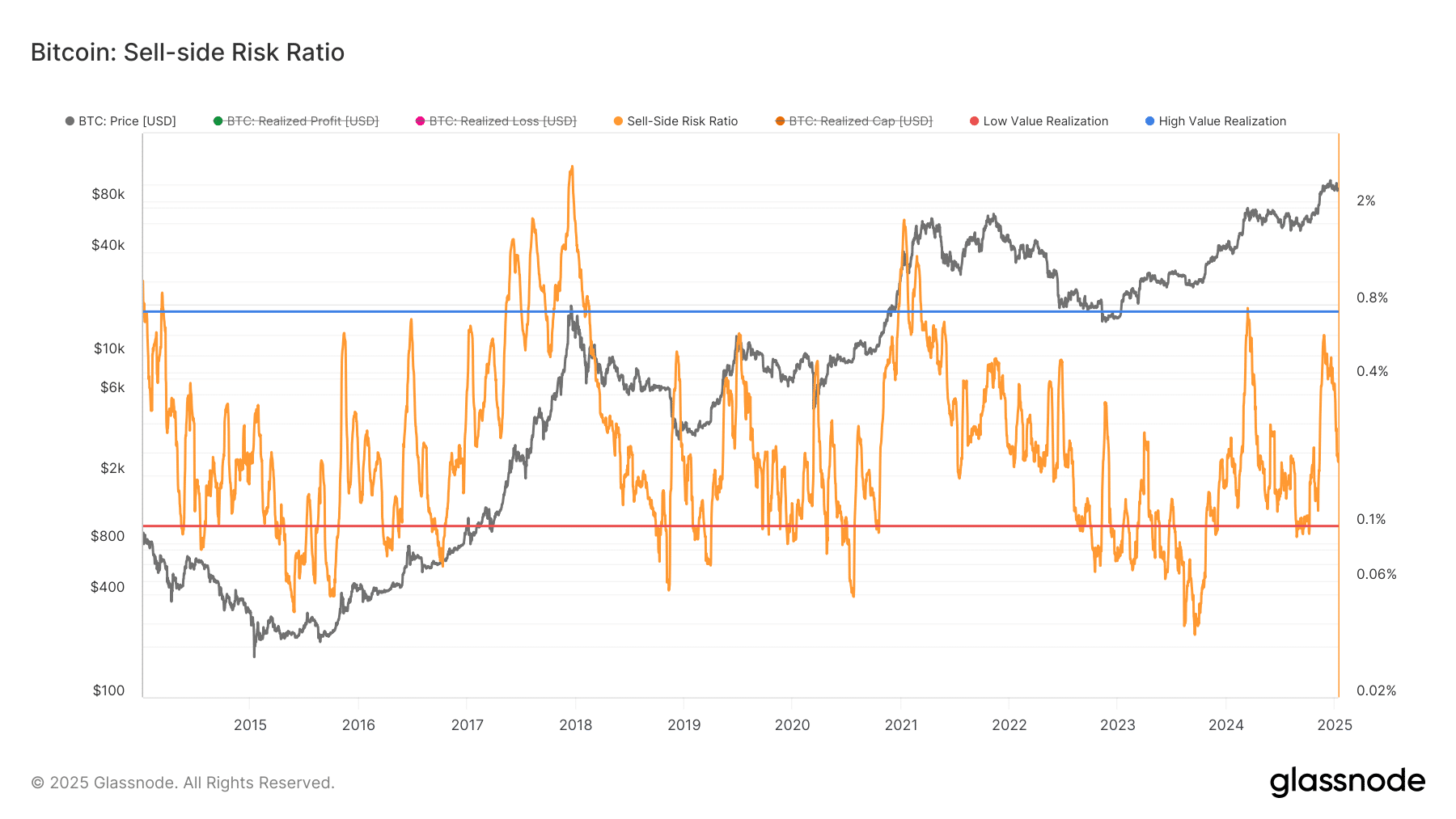

Source: Glassnode

The Sell-side Risk Ratio chart reinforced Bitcoin’s precarious positioning. Historically, increased sell risk has been correlated with increased volatility and bearish sentiment, especially during periods of institutional profit taking. The recent decline in the ratio is consistent with the declining outflows observed in January – a sign of easing selling pressure.

However, the proximity to the lower threshold highlighted Bitcoin’s sensitivity to further downside pressure if the $90,000 support weakens. Conversely, continued resilience could prompt renewed bullish activity, driven by short-term bonds closing their cost basis gap.

Is Bitcoin Waiting for a Catalyst?

Bitcoin appears to be in a holding pattern, with support stretching out in anticipation of a decisive push. Macro catalysts – such as economic data, monetary policy changes or institutional announcements – could dictate the next step.

The STH MVRV ratio hinted that short-term holders are close to their cost basis, leaving room for a bullish catalyst to push Bitcoin above $90,000. Meanwhile, the sell-side risk ratio suggested that selling pressure is easing. Yet Bitcoin remains vulnerable if demand does not materialize soon.

Investor behavior remains cautiously optimistic. Currency inflows and outflows hovering around $12 billion daily provide a foundation for liquidity, but Spot ETFs lack the momentum to make a breakthrough.

For now, Bitcoin is walking a fine line. Whether it falls towards $88,000 to reset market sentiment or finds new demand to scale further, the coming weeks will be critical in determining its direction.