- XRP experienced a 3% price increase in early September, leading to bullish sentiment among analysts.

- Despite the positive outlook, declining active addresses raise questions about the sustainability of this rally.

After a significant drop in August with Ripple [XRP] falling to a low of $0.43 on August 5, the asset appears to be on a different course as September begins.

In recent days, XRP has shown signs of recovery and is currently trading at $0.5668, marking an increase of 3% in the last 24 hours. This price increase offers investors some optimism, especially after the bearish trend at the end of August.

A huge bull run on the horizon?

Several crypto analysts have shared their views on XRP’s recent price action discussions about the potential future movements of the asset.

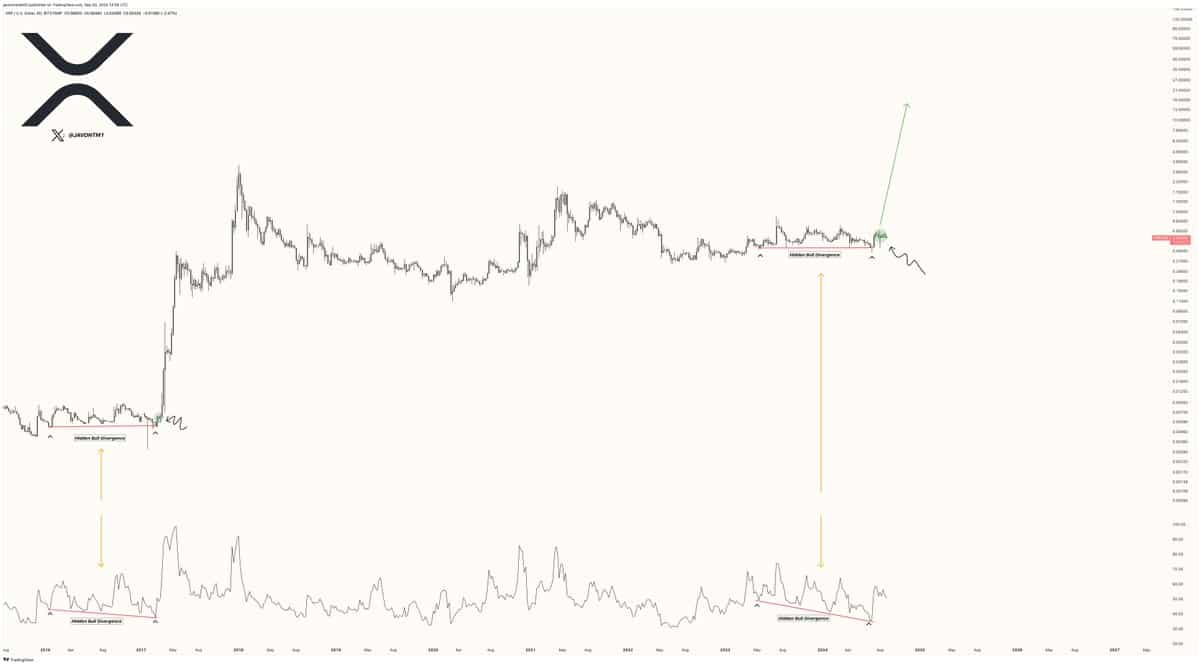

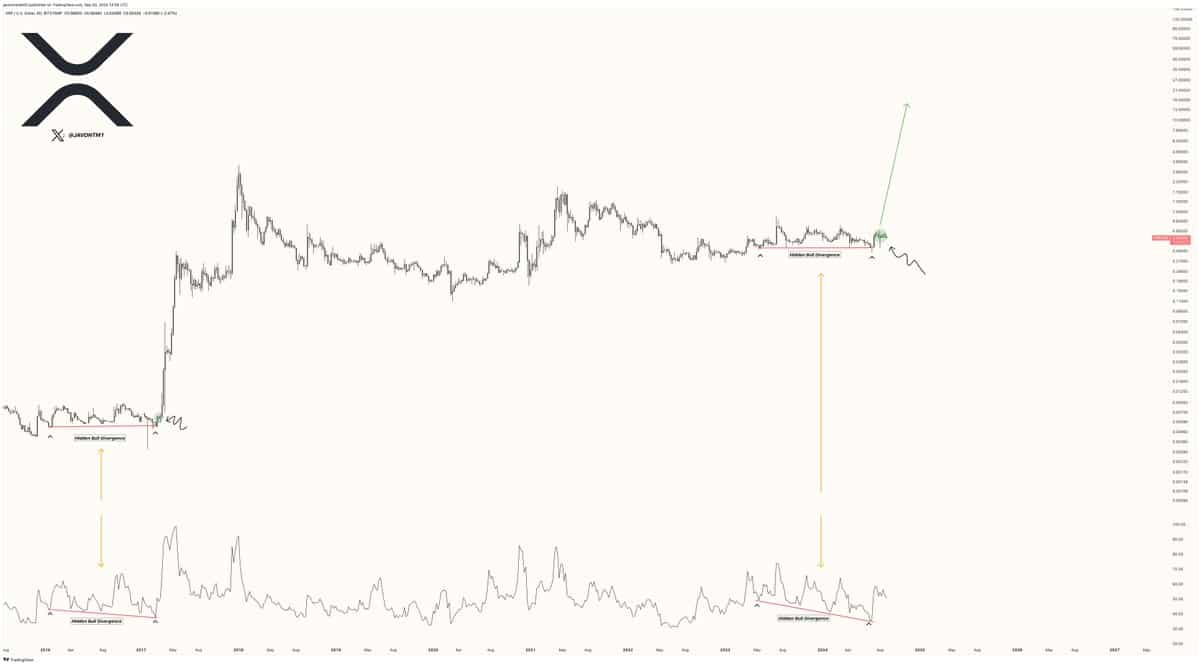

In particular, Javon Marks, a well-known crypto analyst, highlighted the similarities between XRP’s current price movements and the patterns observed before the massive 57,000% increase in 2017-2018.

Marks suggested that XRP could be on the cusp of another significant upswing, one not seen in the past six to seven years.

Source: Javon Marks on X

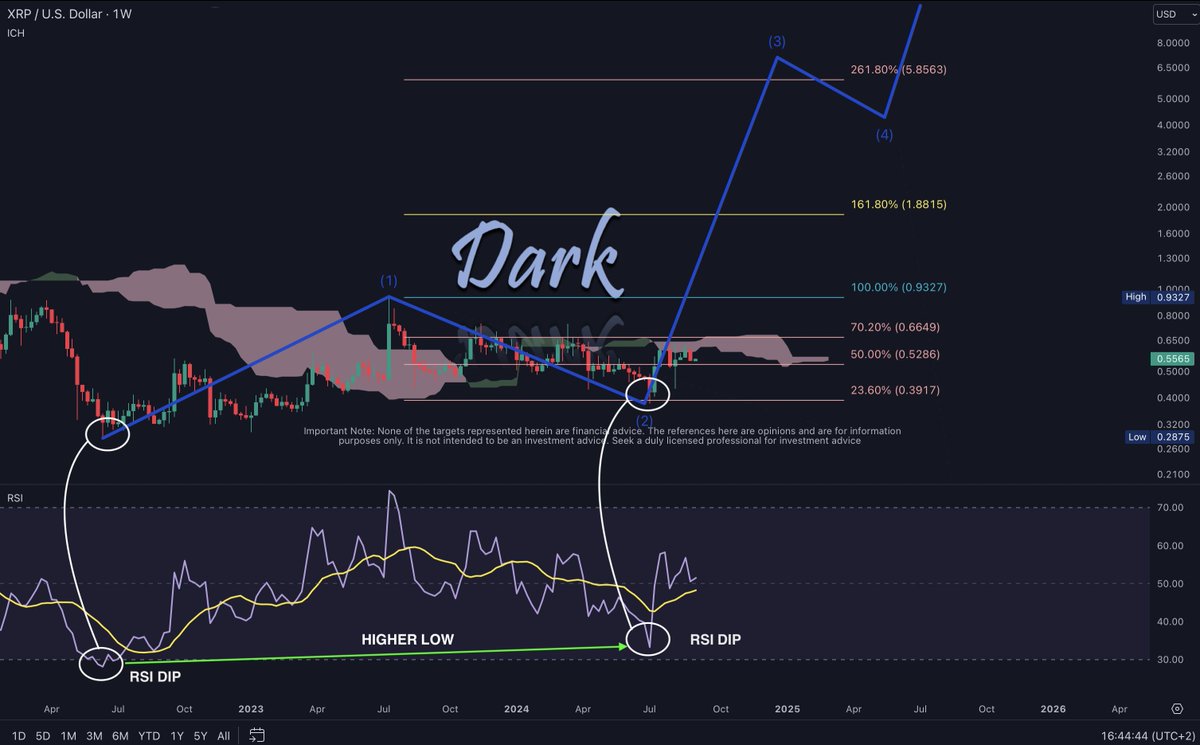

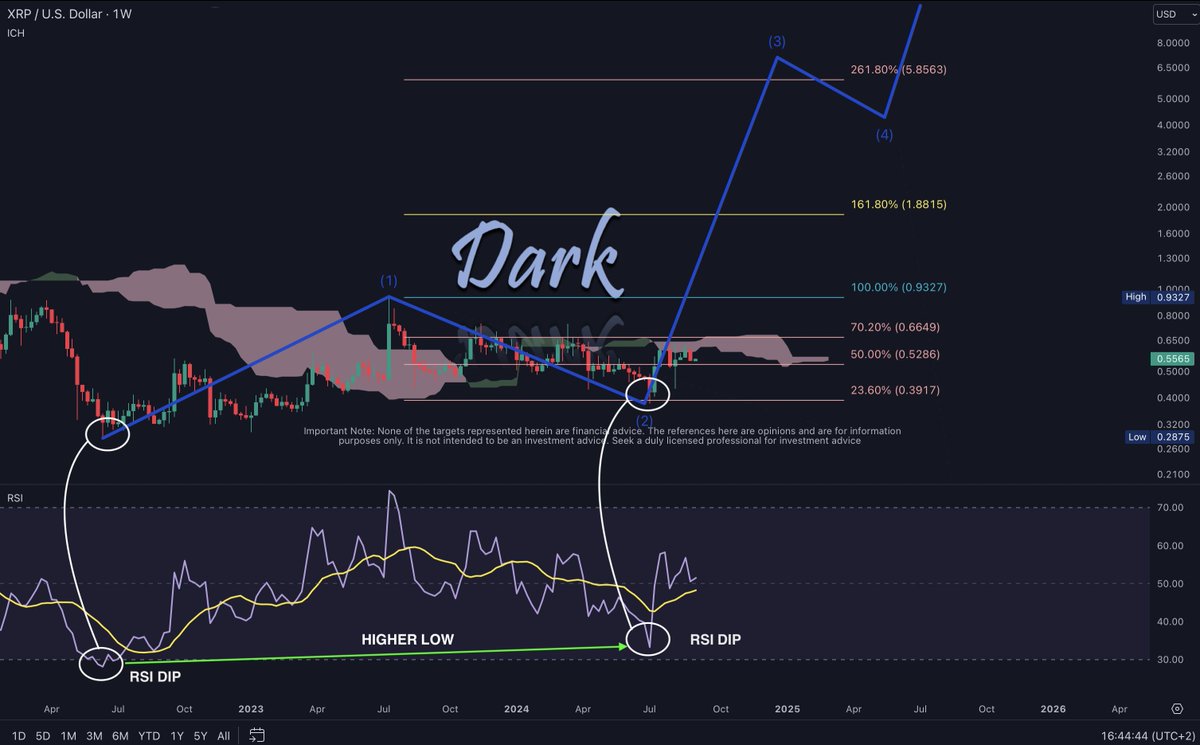

So does another analyst, known by the pseudonym ‘Dark Defender’ shared an optimistic view on XRP. In his recent analysis, he pointed out that XRP is consolidating within a tight range between $0.6649 and $0.3917 for an extended period.

Dark Defender highlighted the importance of the $0.6649 level, which is above the weekly Ichimoku cloud – an important technical indicator in predicting future price movements.

Source: Dark Defender on X

According to him, breaking this level could signal the start of a significant bull run for XRP, potentially pushing the asset towards the Fibonacci level of $18.22 in Wave 3 of the Elliott Wave Theory.

Fundamental view of XRP

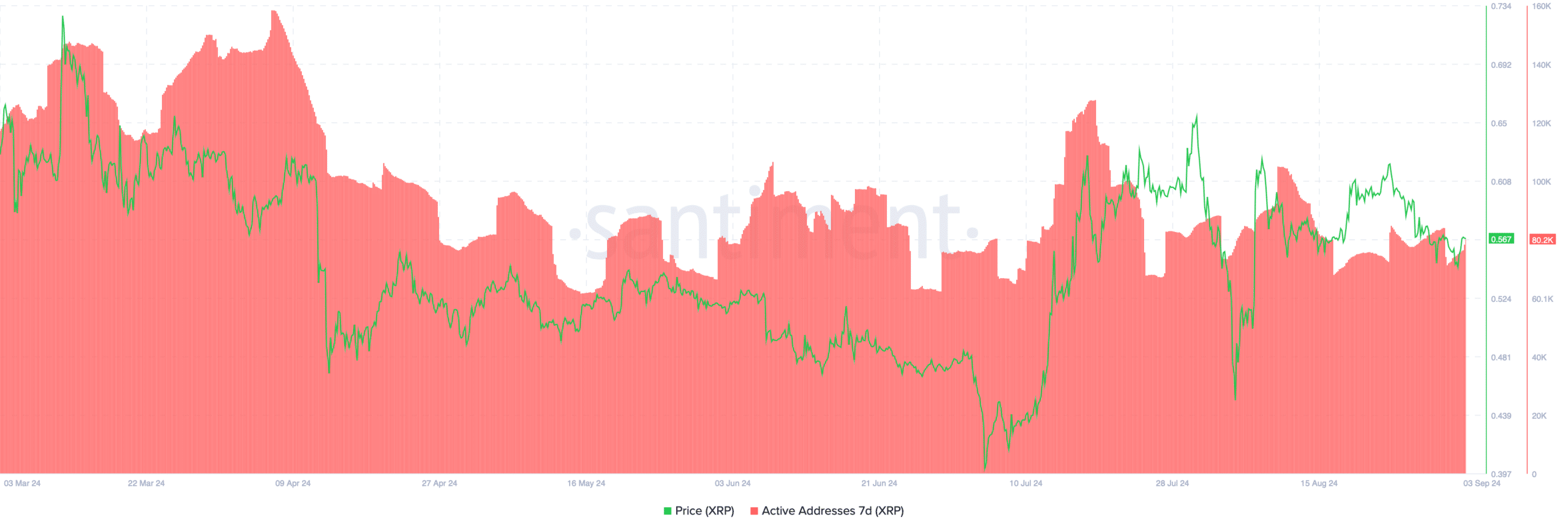

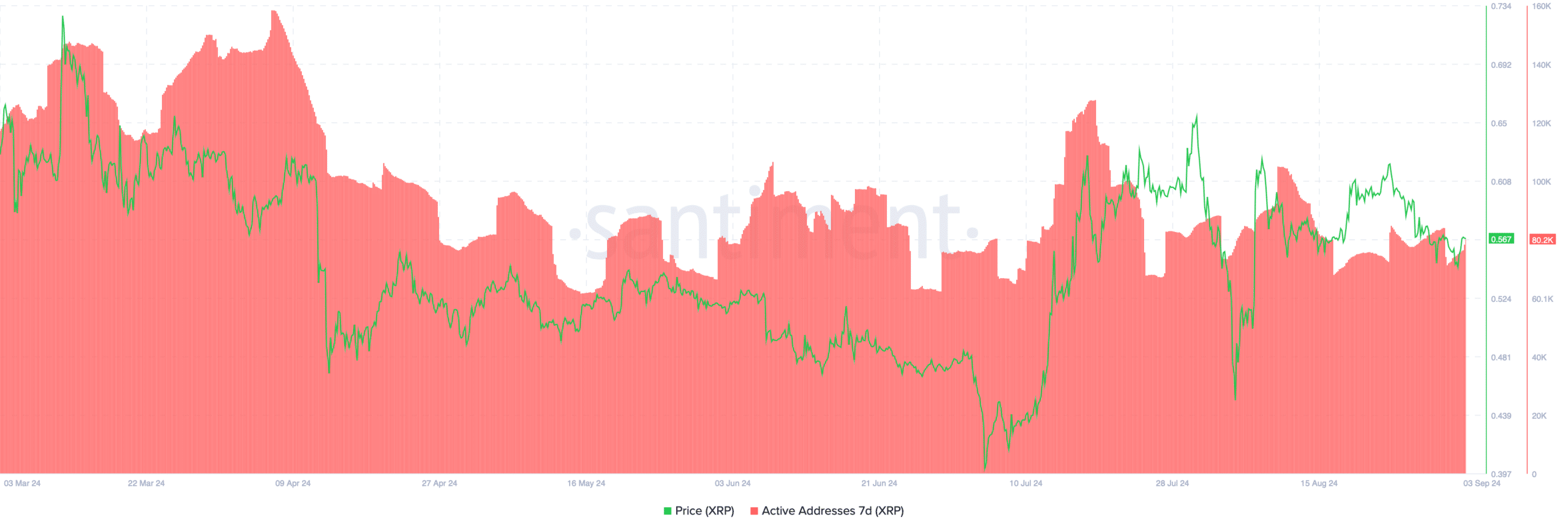

While the technical outlook seems promising, XRP’s fundamental analysis presents a more complex picture. Facts van Santiment has shown a notable decline in XRP active addresses in recent weeks.

Source: Santiment

After a peak of over 105,000 on August 11, the number of active addresses has fallen to approximately 80,200 as of today. This decrease in the number of active addresses could indicate a reduction in user engagement or trading activity, which could put downward pressure on the price of XRP in the short term.

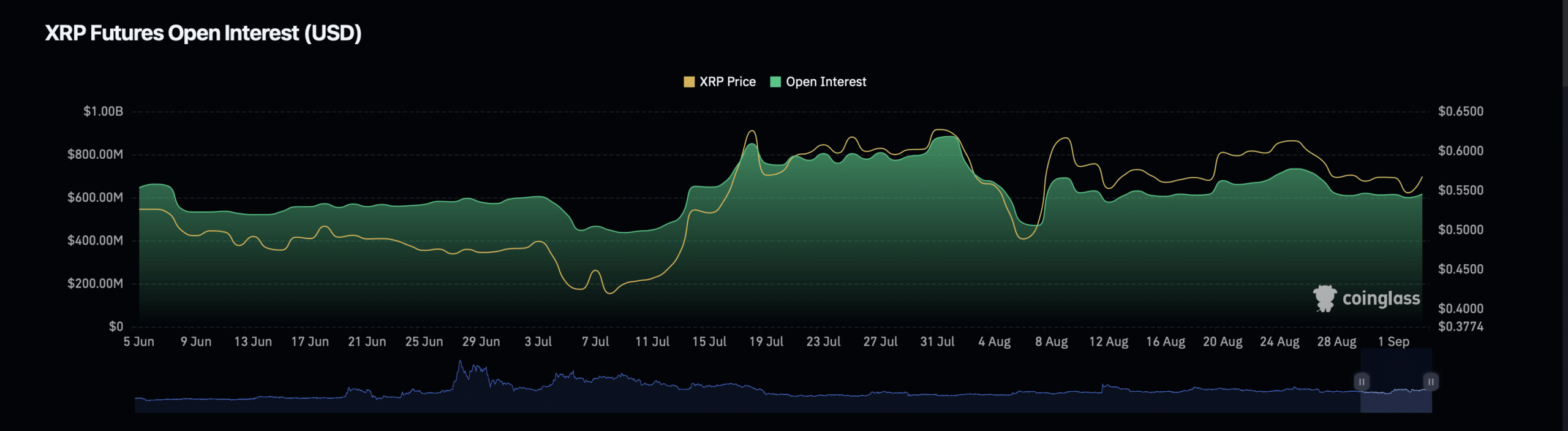

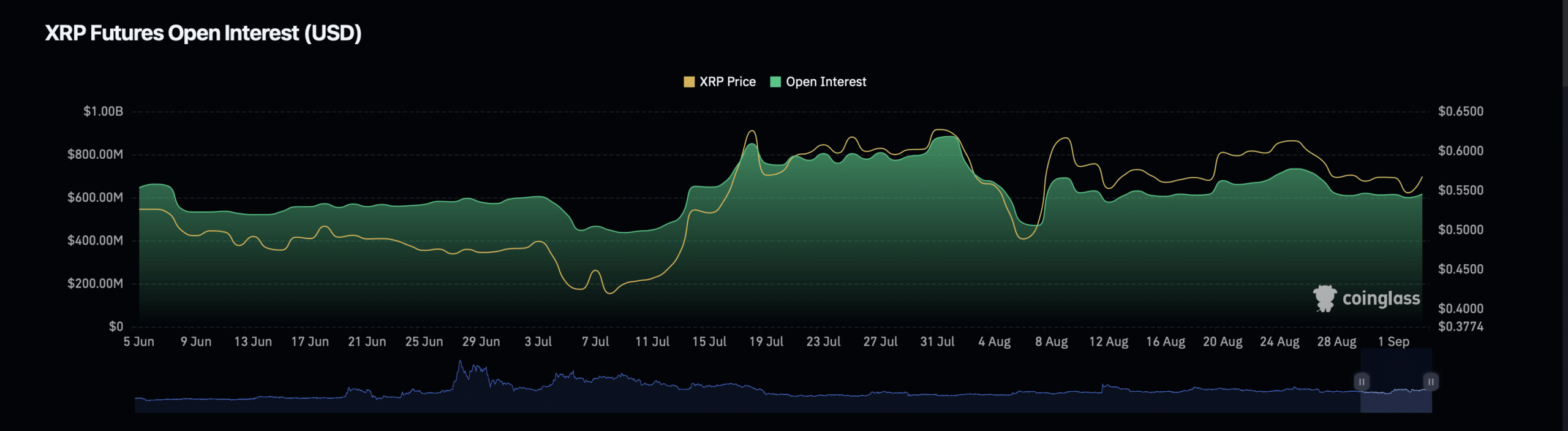

On the other hand, XRP’s open interest – a measure of the total number of derivative contracts outstanding – has risen slightly. to rise by 2.50% to $615.46 million.

Source: Coinglass

Read Ripple’s [XRP] Price forecast 2024-25

However, open interest volume, which reflects the total trading volume in these contracts, fell 12.52% to $721.51 million.

The increase in open interest coupled with a decline in trading volume may indicate that while more contracts are being opened, market participants may be cautious and may anticipate volatility or significant price movement in the near future.