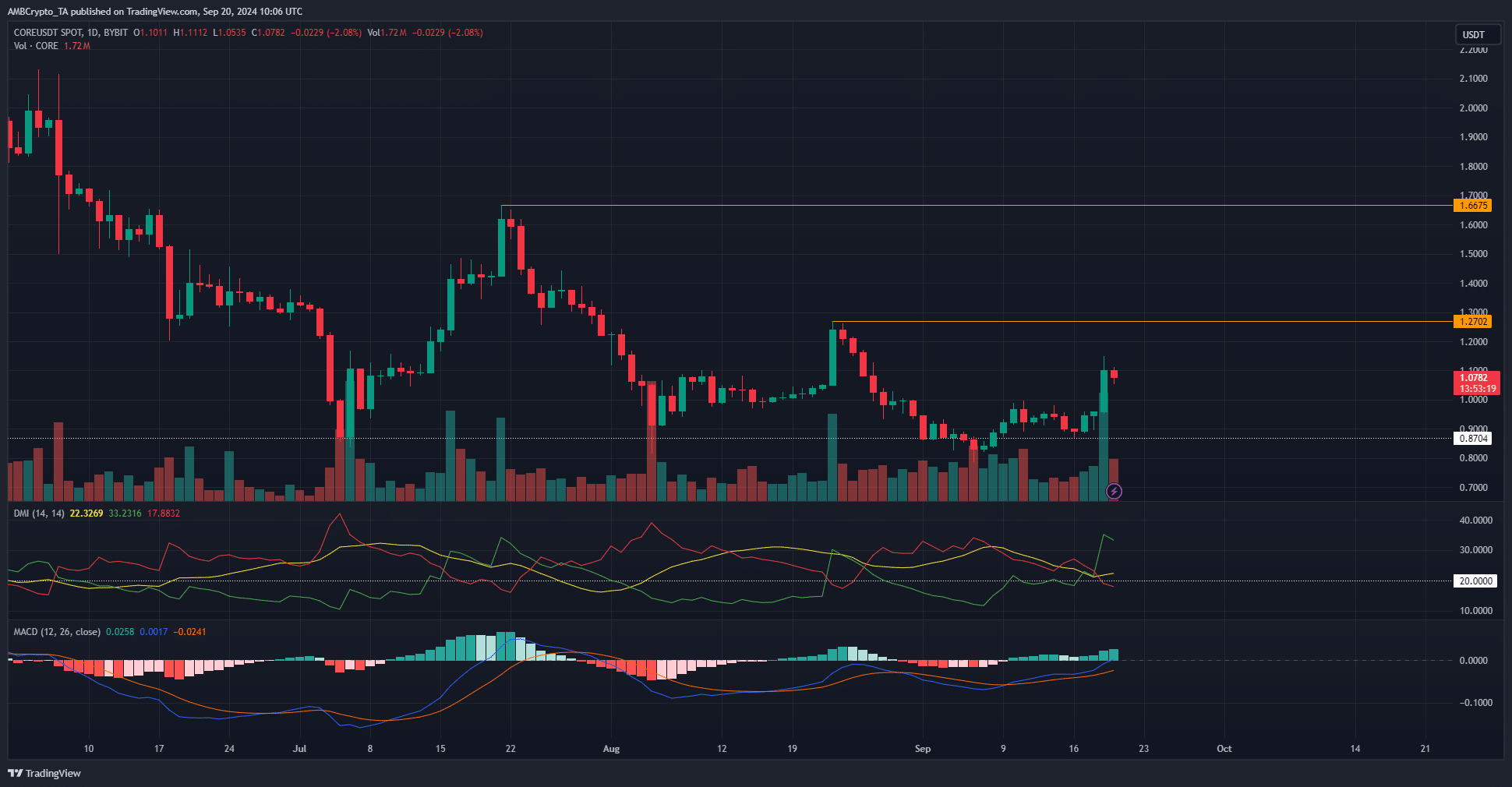

- The market structure of Core Crypto on the daily chart remained bearish.

- The 32% gain posted earlier this week could see a small retrace.

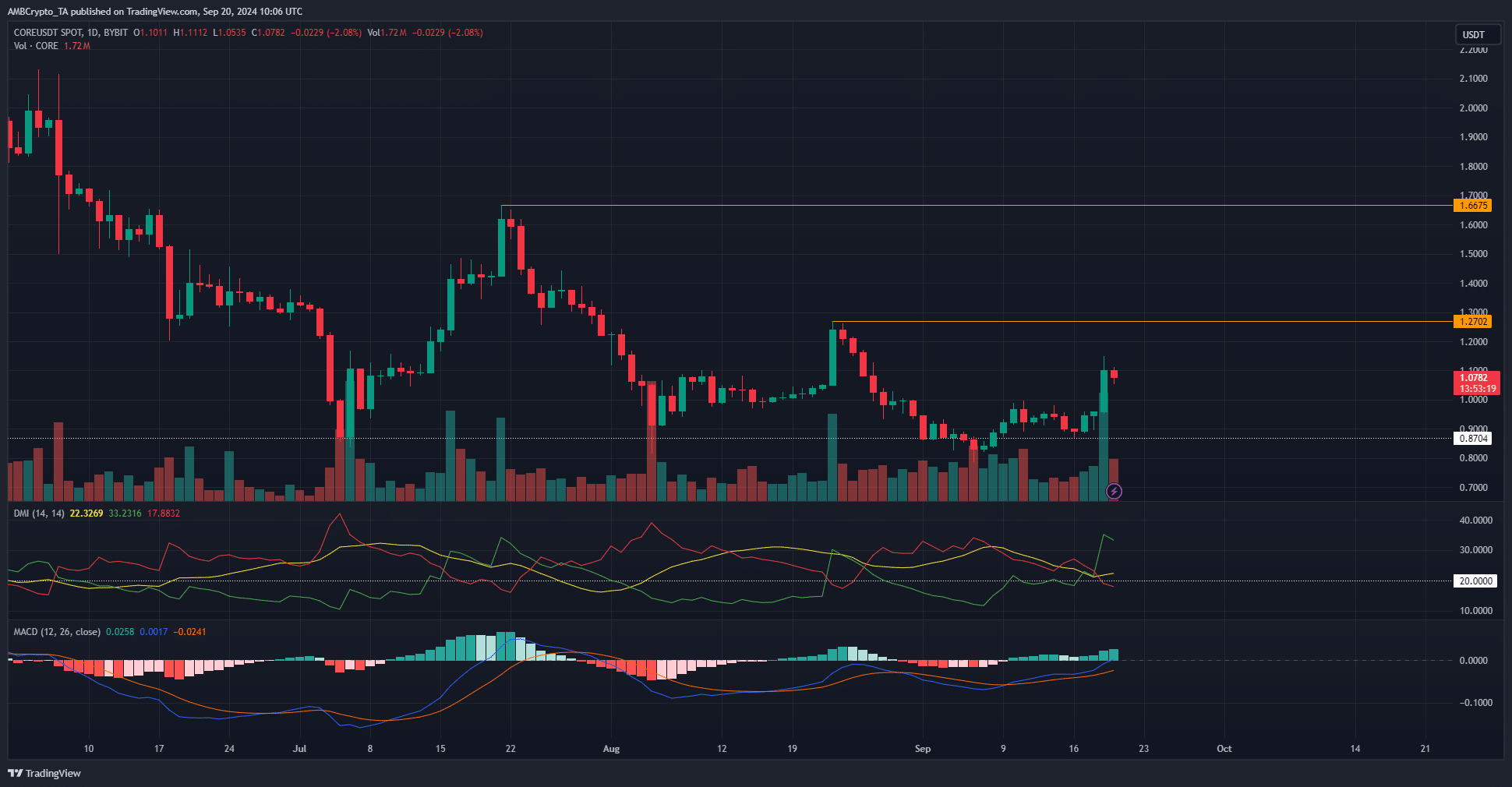

Core [CORE] crypto was once again on a bullish trajectory after breaking past the $1 resistance zone, which was also a psychologically important level. The trend and volume also favored buyers.

A retest of the $1 region would provide a buying opportunity. Another 30% higher could be on the cards for Core crypto.

The long-term downward trend in Core crypto is uninterrupted

Source: CORE/USDT on TradingView

The daily MACD crossed the neutral zero line and showed a shift in momentum. Since September 16, trading volume has steadily increased alongside the price.

This was a positive sign in the short term and increased the chances of more profits.

The Directional Movement Index showed that a bullish trend was starting. The +DI (green) and the ADX (yellow) were both above 20 to reflect a strong uptrend.

The indicators and price action showed a bullish trend in the coming days, but the long-term downward trend has not stopped. A retest of the $1 zone could provide a buying opportunity targeting $1.27.

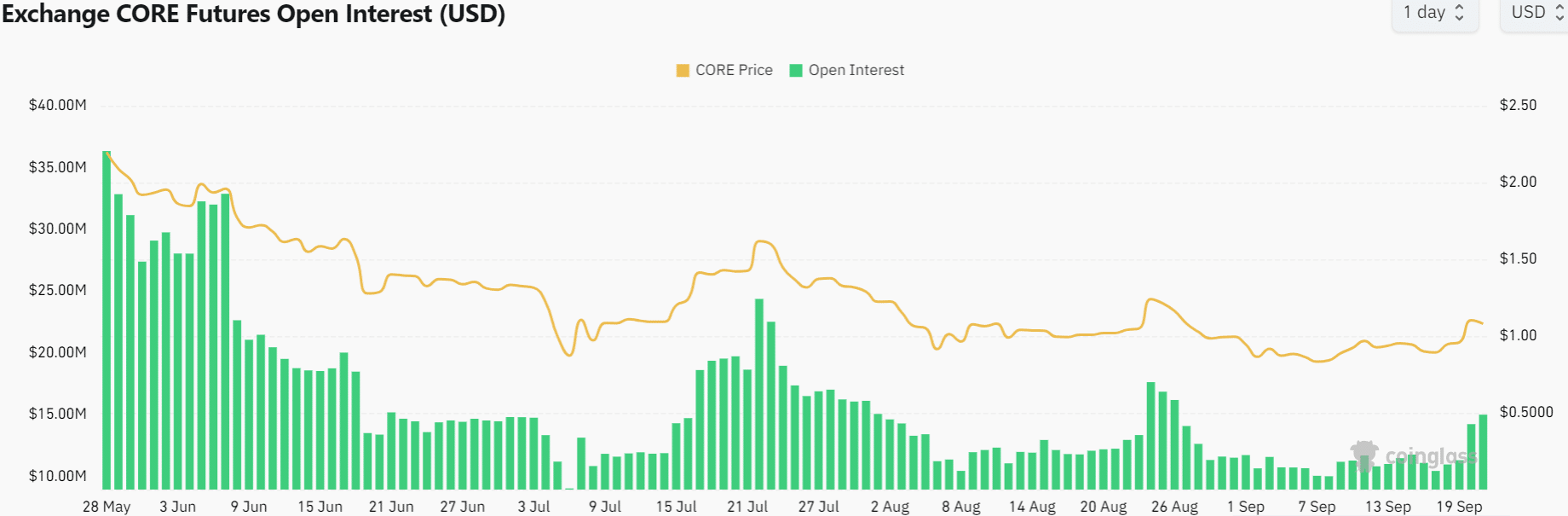

Futures data aligns with bullish outlook

The Open Interest has been in a downward trend since the end of July. It saw an upward spike in the last week of August and saw another increase in recent days.

OI increased from $10.46 million to $15 million from September 17 to 20. This was accompanied by a price gain of 23.25% and showed that speculators were willing to go long.

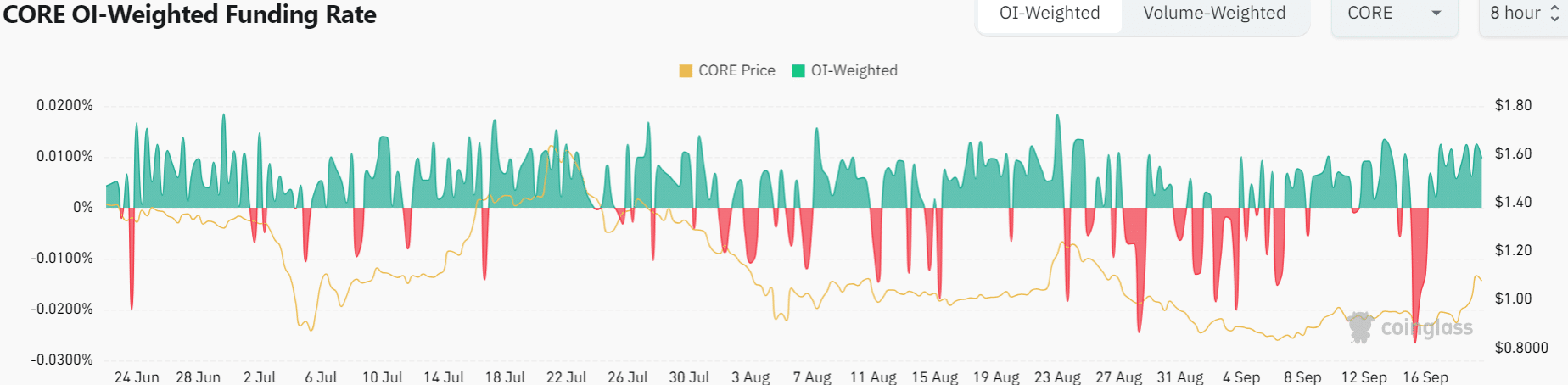

The OI-weighted financing rate fell deep into negative territory on September 16. The next day it rose back into positive territory, and prices also started to recover.

Read Core’s [CORE] Price forecast 2024-25

This showed that speculators were taking long positions.

The Futures data showed that near-term sentiment was bullish. A small dip to $1 presents a buying opportunity that could trigger a price rally to $1.27.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer