- DAG crypto rose 20% in one day but faced buyer exhaustion.

- Will the rally stall and trigger a price drop amid muted market interest?

Constellation [DAG]the self-proclaimed revolutionary in scaling blockchains, rose 20% on November 18.

The rally pushed DAG to a five-month high of $0.05, a key support in the first quarter that turned into resistance in the second half.

At the time of writing, the strong buying pressure from earlier in the week was waning, as evidenced by the long upper candlestick wick; what is the next step for DAG?

What’s next for DAG’s price?

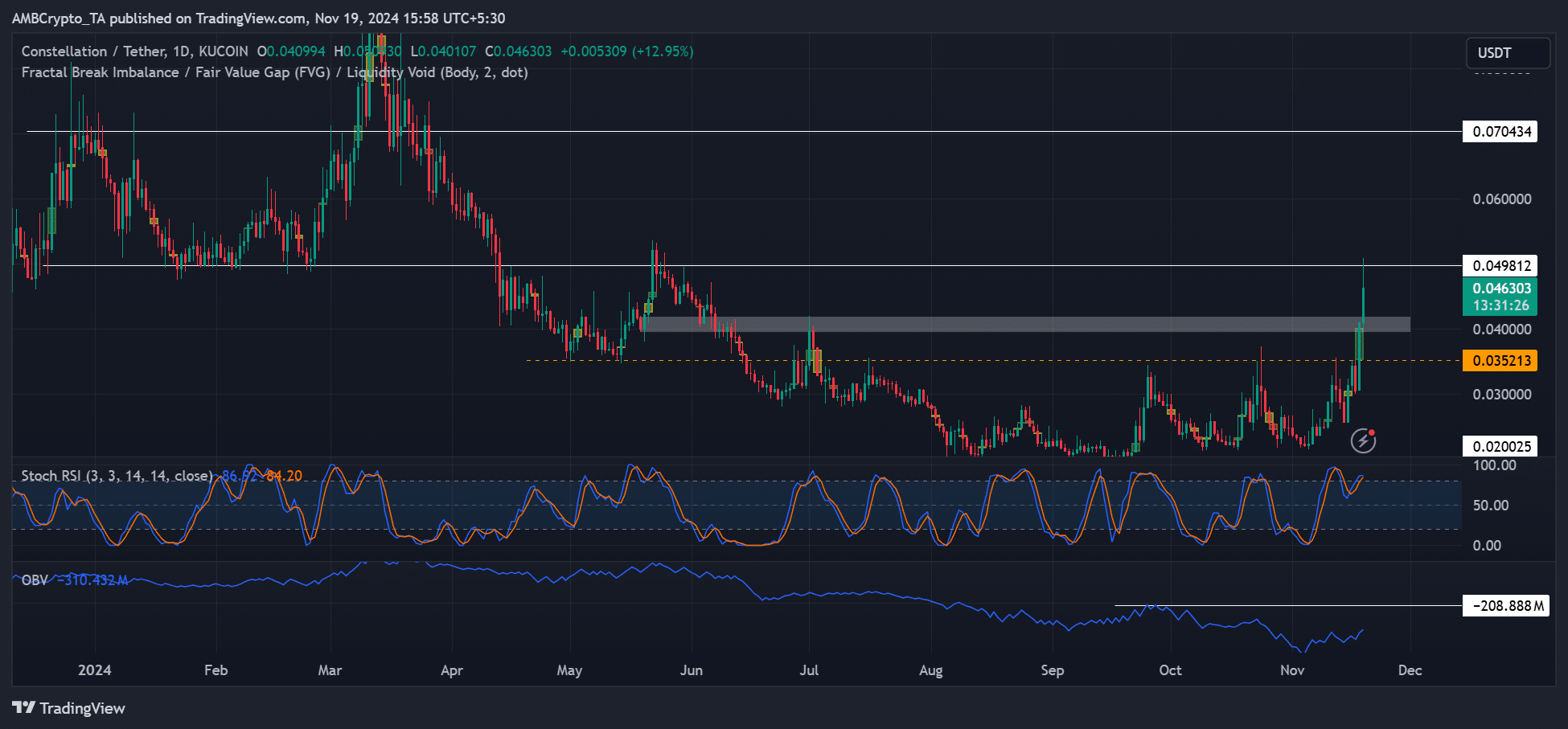

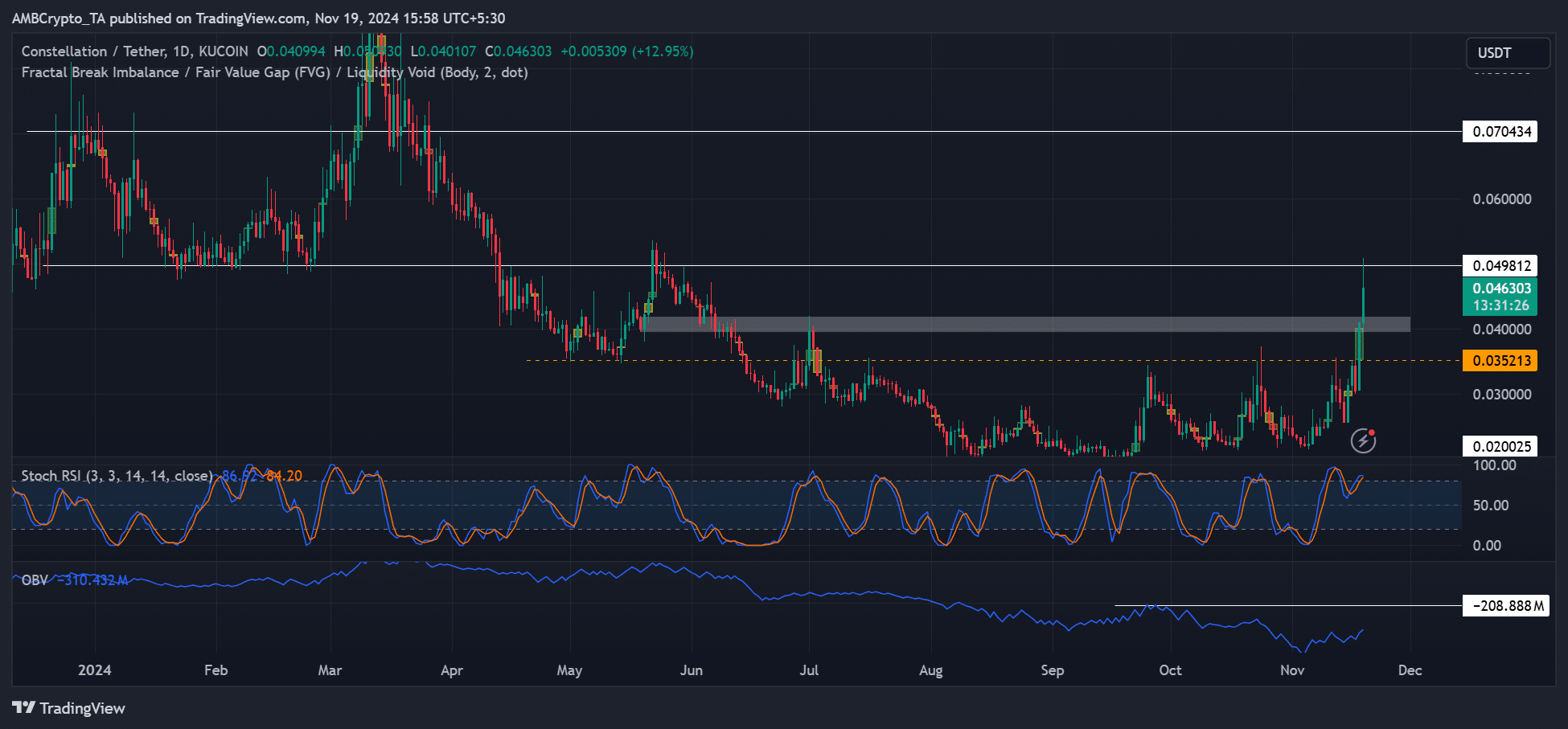

Source: DAGUSDT, TradingView

On the daily price charts at the time of writing, buyer exhaustion was clearly visible, as evidenced by a slight price rejection at the $0.05 support level in Q1 2024. The level acted as strong resistance during the price recovery in May.

If a similar scenario occurs again in November, DAG could retreat to $0.04 or $0.035, key support levels that softened the price decline in May.

However, given the additional room for a price rally as evidenced by the OBV (On-Balance Volume), DAG could retarget or even break the $0.05 roadblock.

If so, late bulls could attempt to reenter the market at the above-mentioned levels, keeping an eye on the $0.05 roadblock or the $0.07 upper resistance level.

The two targets could yield a potential gain of 35% and 77% if DAG exploits the two bullish targets.

DAG’s network activity increased enormously

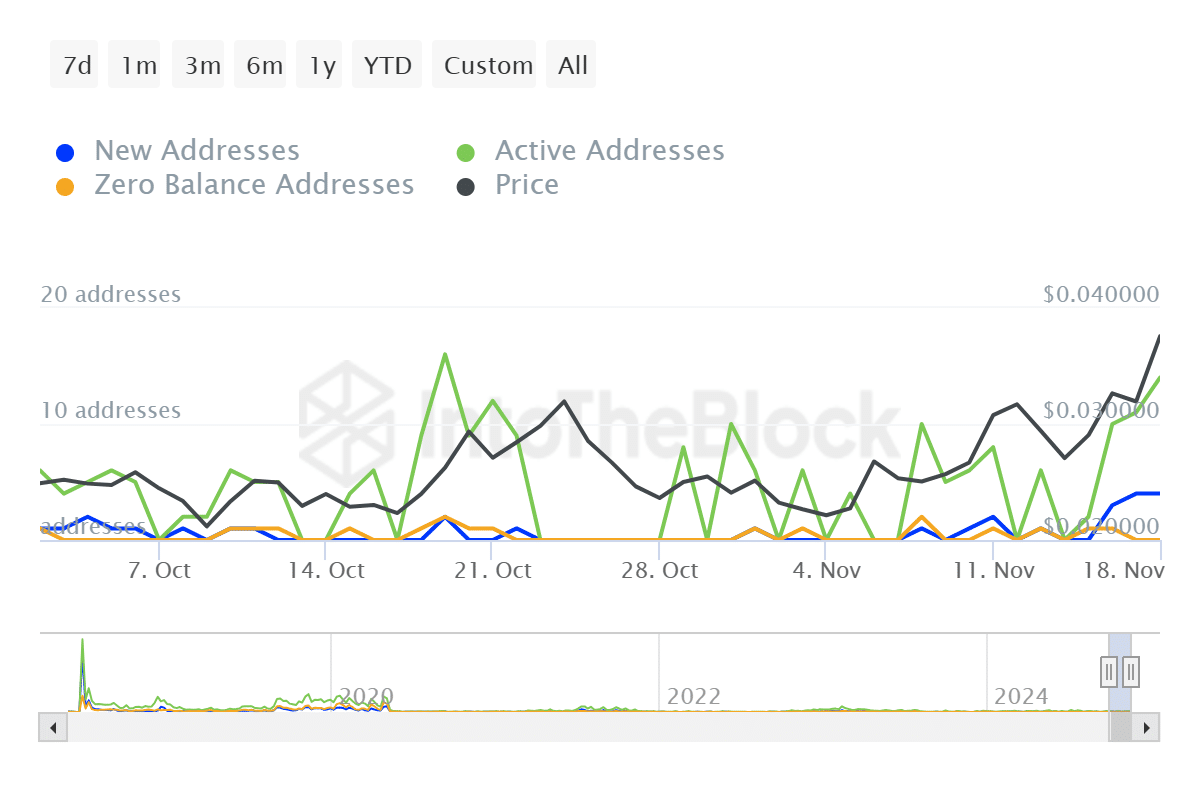

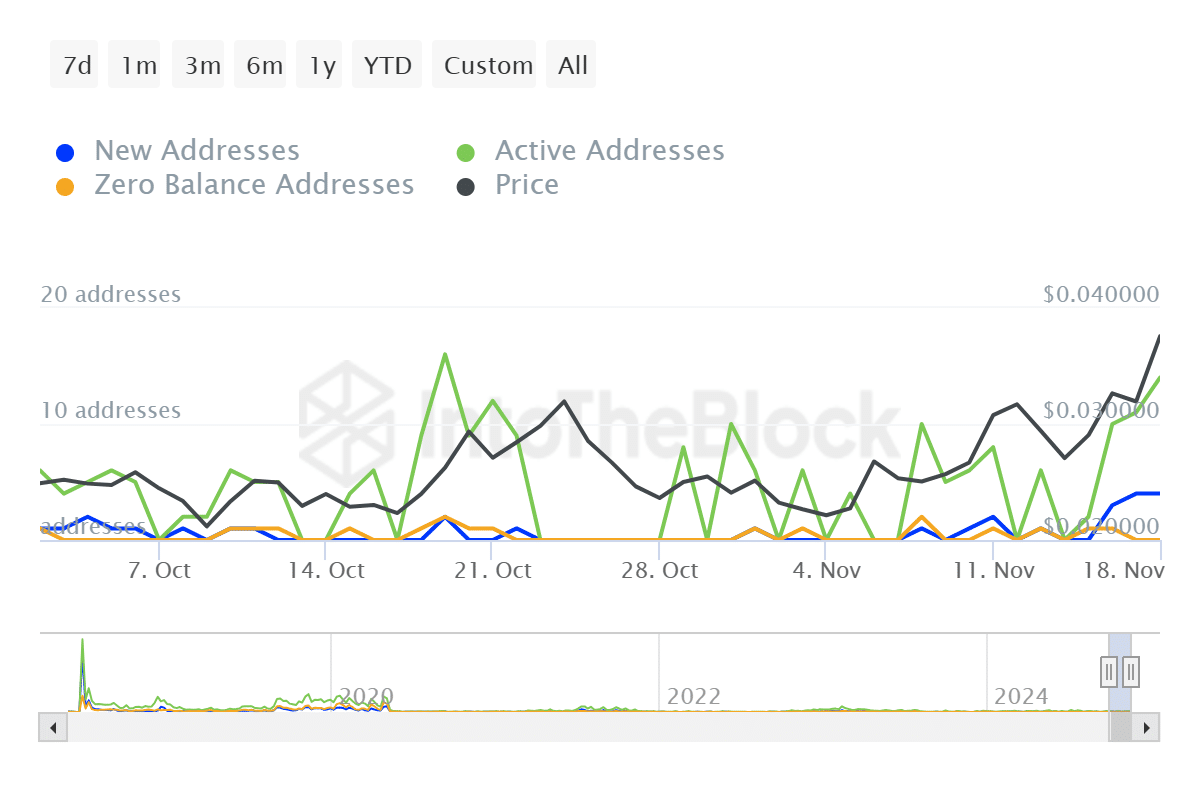

Source: Into The Block

Last week’s price rally was also marked by a spike in network activity. The number of active addresses almost doubled, but was far too small (about 20 addresses).

Interestingly, there was a slight spike in the number of new addresses, which later declined (blue line), indicating that not as many users joined the DAG rally via FOMO.

Read Constellation [DAG] Price prediction 2024-2025

This limited market interest could be a setback to a strong rally past the $0.05 roadblock.

In short, buyer exhaustion at DAG could strengthen the $0.05 hurdle, but a potential pullback could provide buying opportunities for late bulls.

![Constellation [DAG] Crypto Cools Down After Up 20% in 24 Hours – What’s Next?](https://bitcoinplatform.com/wp-content/uploads/2024/11/Dag-crypto-FI.jpg)