- Compound had a bearish structure on the 1-day graph.

- Nevertheless, an increased purchasing pressure and signs of accumulation meant a price that went up.

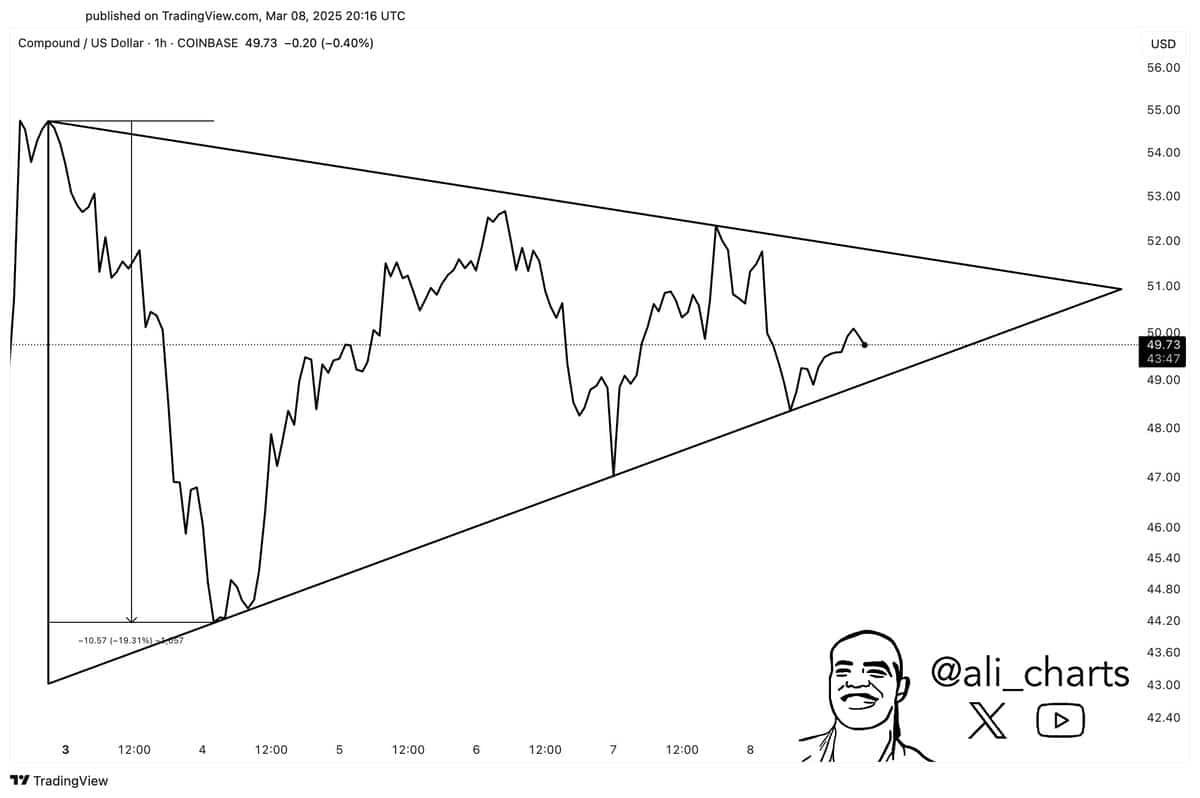

Connection [COMP] Formed a symmetrical triangular pattern, observed popular crypto analyst Ali Martinez in one Post on X (formerly Twitter).

This observation was based on the graph of 1 hour and an outbreak could see a price win of 20%.

Source: Ali on X

Although the price win was promising in the short term, the long -term statistics in the longer chain would also be interesting for investors. Analysis of the active on the higher timetables can also offer useful insights for investors.

Sales pressure on connection in decline

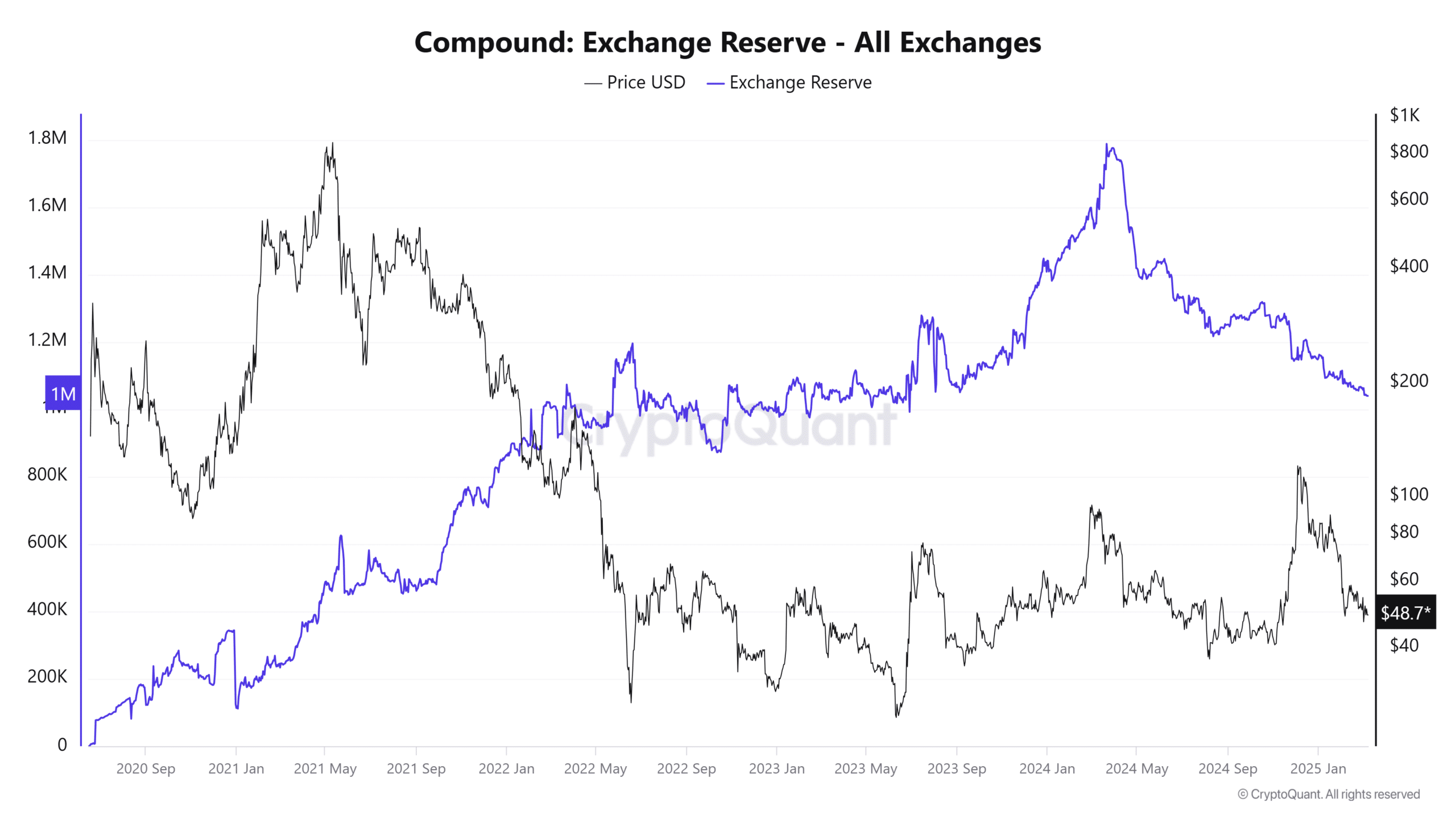

The exchange reserve of an active gives a good indication of whether there is accumulation or distribution.

During the Berenmarkt from 2022 and early 2023, the exchange reserves had a slow layout. It was accompanied by Spikes from Competing from fairs.

These recordings indicate token movements from fairs and probably in cold portfolios, which would be a long -term bullish sign. In 2024 the exchange reserve of Compound fell lower.

This was a strong bullish sign. Even during the fast rally in November the reserves fell. They also continued to fall over the past three months, which can be considered a sign of accumulation.

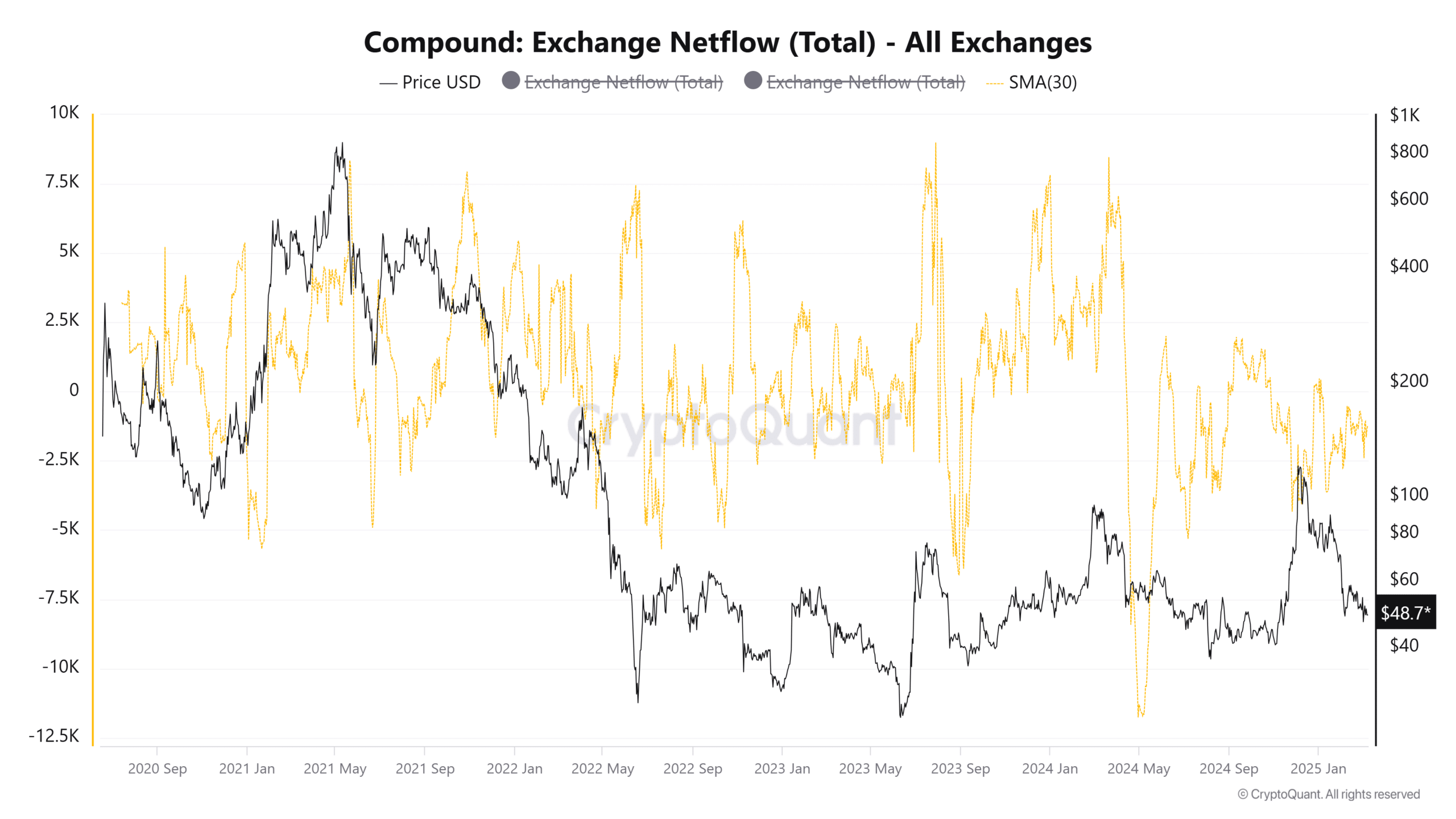

The 30-day SMA of the Exchange Netflows showed that September-Early November 2024 saw a strong influx of complex to exchange.

This reflected rising sales pressure, on average, because coins are moved on fair to sell or to be used as collateral for derivaten transactions with coins.

Since then, the trend has shifted to out. From the second week of January, the Netflows were negative, with at least 1K Compentuurzen most days.

This confirms the exchange of the exchange.

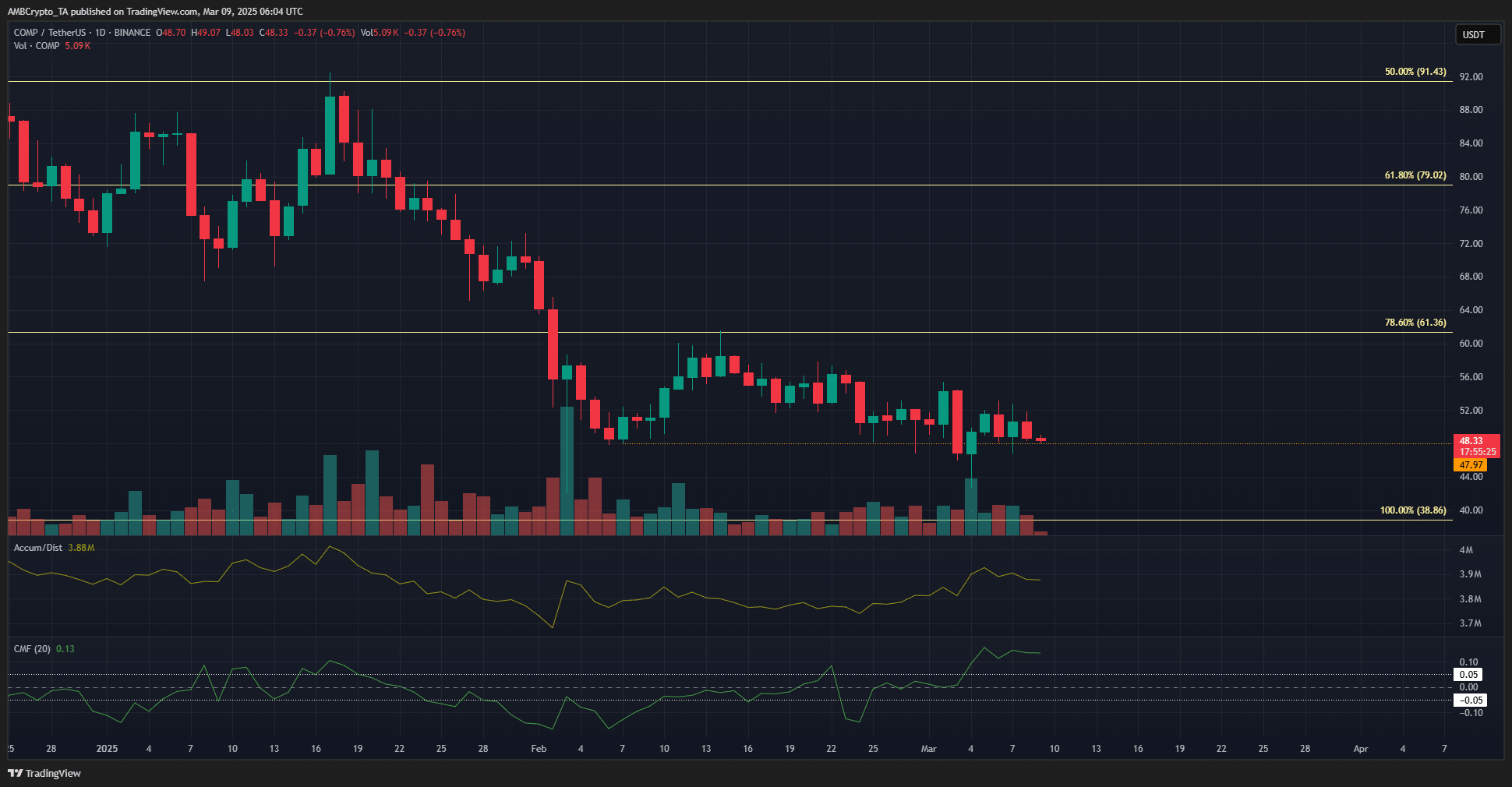

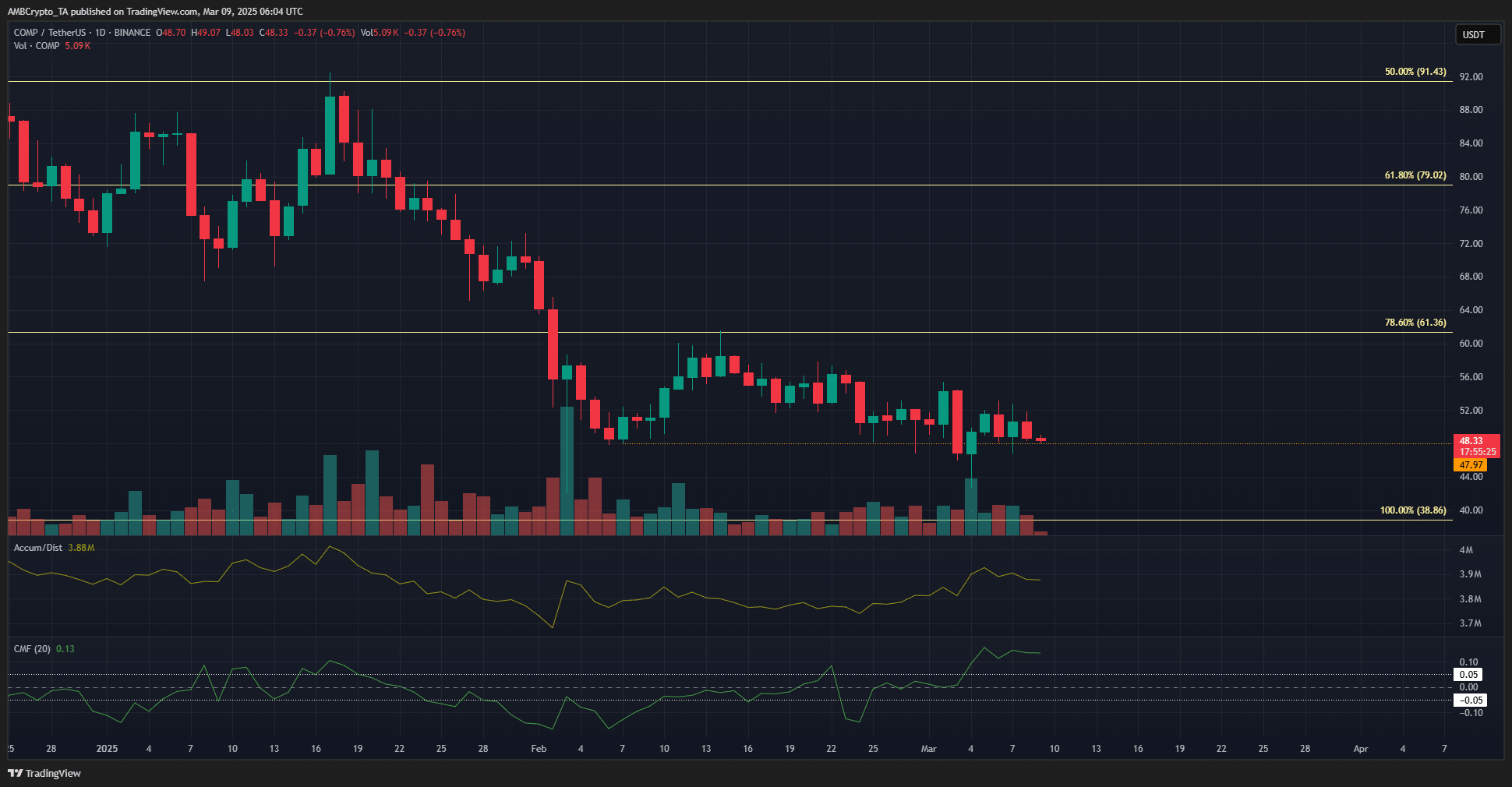

Source: Comp/USDT on TradingView

The Complete Prize Promotion on the daily graph reflected a bearish prospect. Defi-token has not made new higher highs since mid-January. At the time of the press, trade was just above the support level of $ 48.

A drop below $ 46 would signal an imminent bearish movement.

However, the A/D indicator has slowly crawled higher in the last five weeks. The CMF burst above +0.05 to show significant capital influx last week.

Together, the purchasing pressure can generate the composite prices higher.