- Coinbase introduced its Wrapped Bitcoin on Solana.

- Meanwhile, SOL is approaching its ATH.

Coinbase has launched Coinbase Wrapped BTC [cbBTC] on the Solana [SOL] blockchain.

The wrapped asset is designed as an SPL token and is fully backed 1:1 by Bitcoin [BTC] and kept safely in Coinbase’s custody.

In one statement on X (formerly Twitter), Coinbase emphasized the importance of this step, saying:

“This is the first token Coinbase has released on Solana, and with it we are excited to provide easy access to BTC.”

integration of cbBTC into Solana

Coinbase’s introduction of cbBTC on the Solana blockchain follows this announcement during the Solana Breakpoint event in Singapore at the end of September.

It’s worth noting that cbBTC joins a growing selection of packaged Bitcoin tokens on Solana, such as tBTC and WBTC (via Wormhole), along with emerging assets such as zBTC from Zeus Network and sBTC from Stacks.

This Bitcoin-backed token will play a crucial role in Solana’s decentralized finance (DeFi) landscape, providing new opportunities for liquidity and collateral in credit protocols.

From launch, cbBTC will be supported by prominent Solana-based DeFi platforms.

This included Jupiter Exchange, Meteora AG, Kamino Finance, Jito Labs, Phoenix, Drift Protocol, Raydium, Orca, Save Finance, Manifest and Loopscale Labs.

Interestingly enough, 2024 was quite favorable for Solana on the DeFi front.

According to the latter facts from Artemis, Solana’s Total Value Locked (TVL) is up 385% YTD. At the time of writing this amounted to $6.8 billion.

cbBTC’s $1 billion milestone

Although cbBTC has now entered Solana, this is not its debut. The token was initially launched on Ethereum [ETH] and Coinbase’s Layer 2 network, Base.

Furthermore, cbBTC only reached $1 billion in market capitalization in nine weeks, a milestone that preceded Solana’s launch.

Despite being a relatively new player, cbBTC has already secured its position as the sixth largest wrapped asset CoinMarketCap.

Among BTC-backed assets, it trails only Wrapped Bitcoin [WBTC].

How does SOL perform?

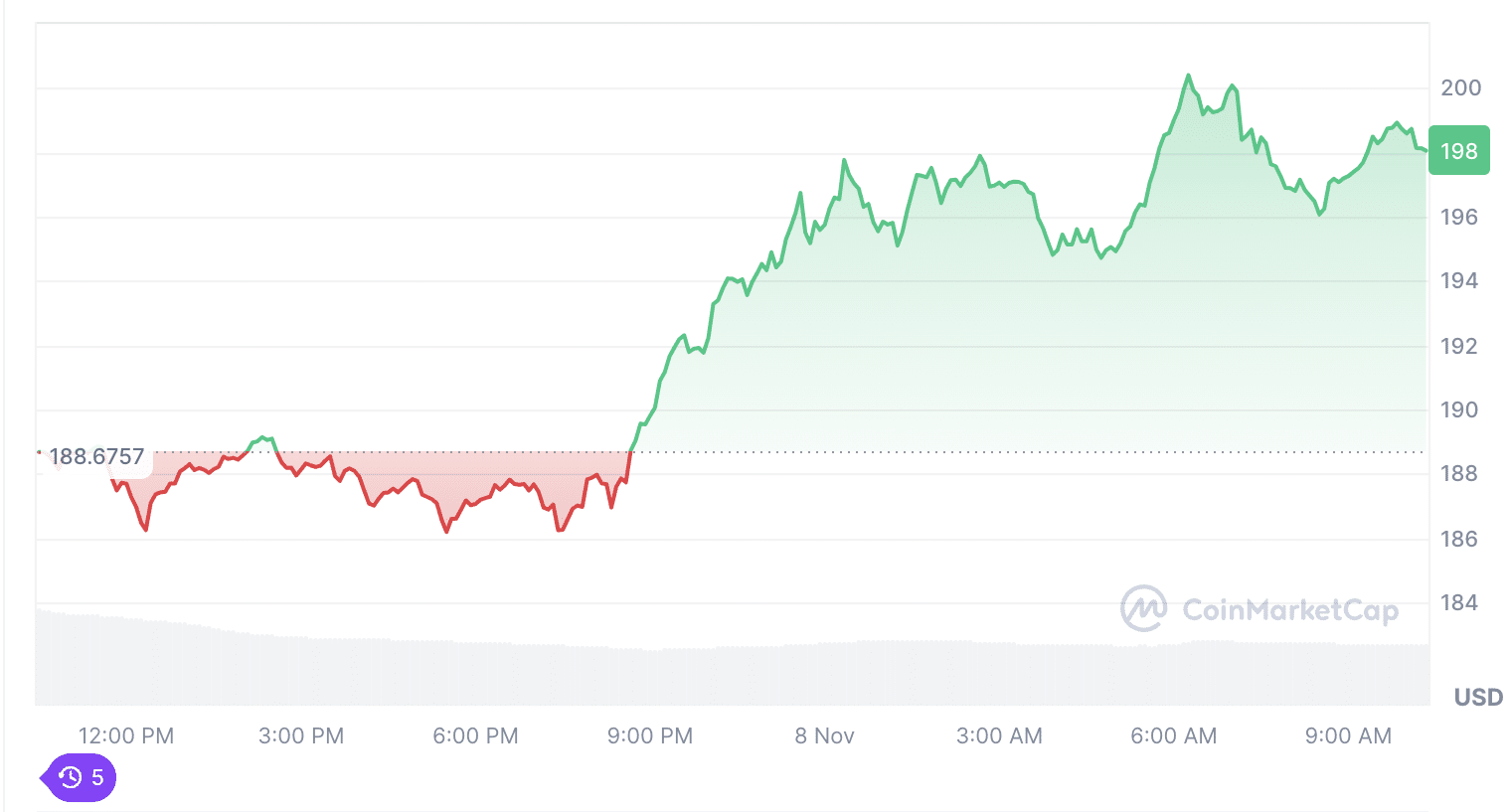

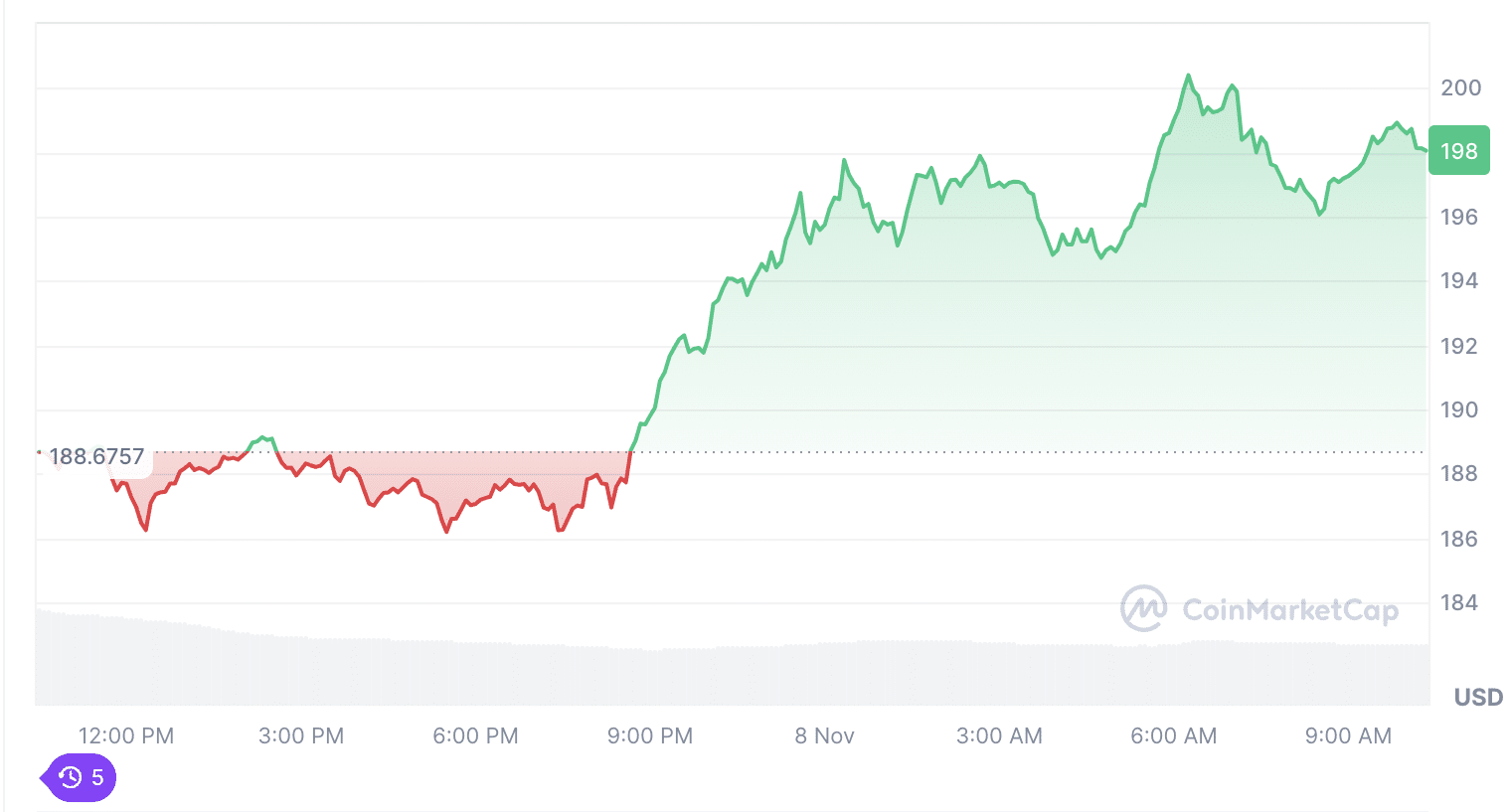

Meanwhile, SOL has risen by double digits over the past seven days, driven by BTC’s bull run.

At the time of writing, SOL was trading at $198, about 23% lower than its all-time high (ATH).

If noted by CoinMarketCap, the altcoin saw a daily increase of 5.04% and an impressive gain of 18.55% over the past week. The coin’s market capitalization also rose to $93.53 billion at the time of writing.

Source: CoinMarketCap

The 24-hour trading volume was $4.77 billion, although this reflected a decline of 35%.

Read Solana’s [SOL] Price forecast 2024–2025

Despite this decline, SOL’s value and recent price increase demonstrated its continued momentum.

The integration of cbBTC and other innovative assets continues to strengthen Solana’s position in the crypto market.