- Coinbase has reported revenue of $1.4 billion for the second quarter of 2024.

- The exchange has reported a third profitable quarter.

The growing adoption of cryptocurrencies worldwide and increased institutional investors are causing crypto exchanges to increase revenue despite cryptocurrency volatility.

To this extent, Coinbase, the leading crypto exchange platform in the US, has released Q2 2024 reports. According to the report, the exchange reported profits for the third consecutive quarter.

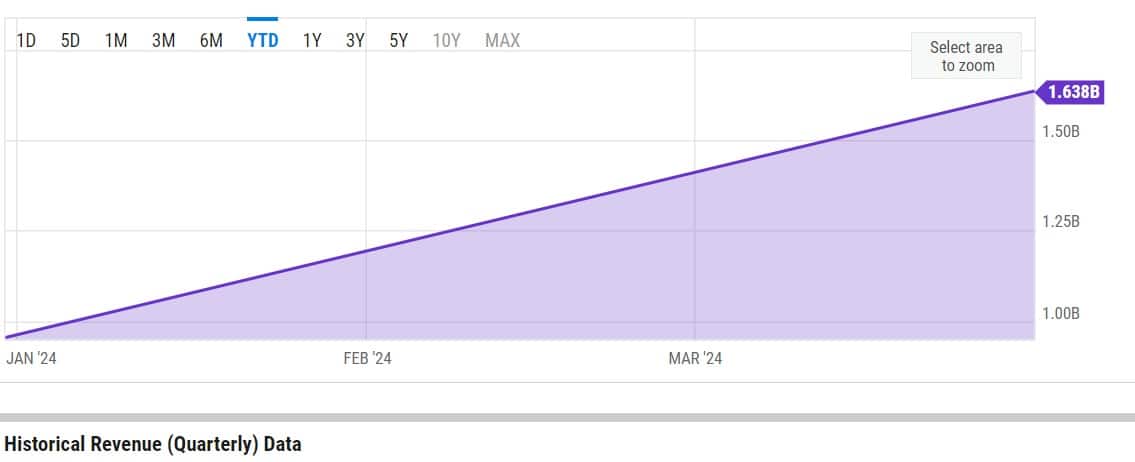

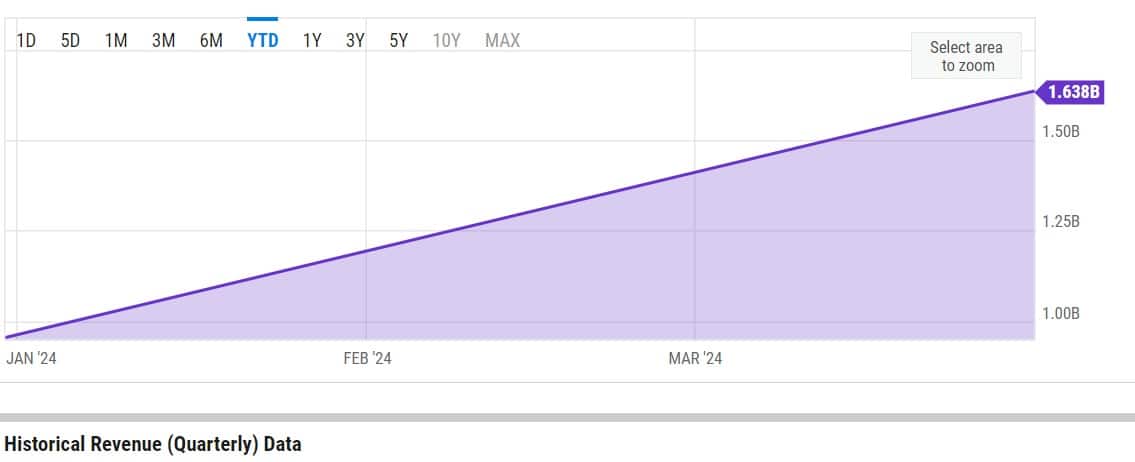

Source: Market Screener

Coinbase reports $1.4 billion in revenue, but 11% revenue decline

In the second quarter of 2024, Coinbase reported $1.4 billion in revenue. However, sales have decreased compared to the previous quarter.

In the first quarter of 2024, the exchange reported $1.6 billion; so the recent $1.4 billion is an 11% decrease from the previous quarter.

Source: Y-graphs

Notably, the exchange’s $1.4 billion in revenue left the exchange with $36 million in net income. Through his official report has Coin base shared that,

“Despite our consecutive sales declines, our profitability was solid in the second quarter. Net income was $36 million and was impacted by $319 million in pre-tax losses on crypto assets related to our investment portfolio. The vast majority of this had not been achieved. “

The report continued,

“These losses represented an after-tax charge of $248 million. Our adjusted EBITDA was $596 million, and our balance sheet remains strong as we ended the second quarter with $7.8 billion in USD resources, an increase of $733 million quarter-over-quarter.”

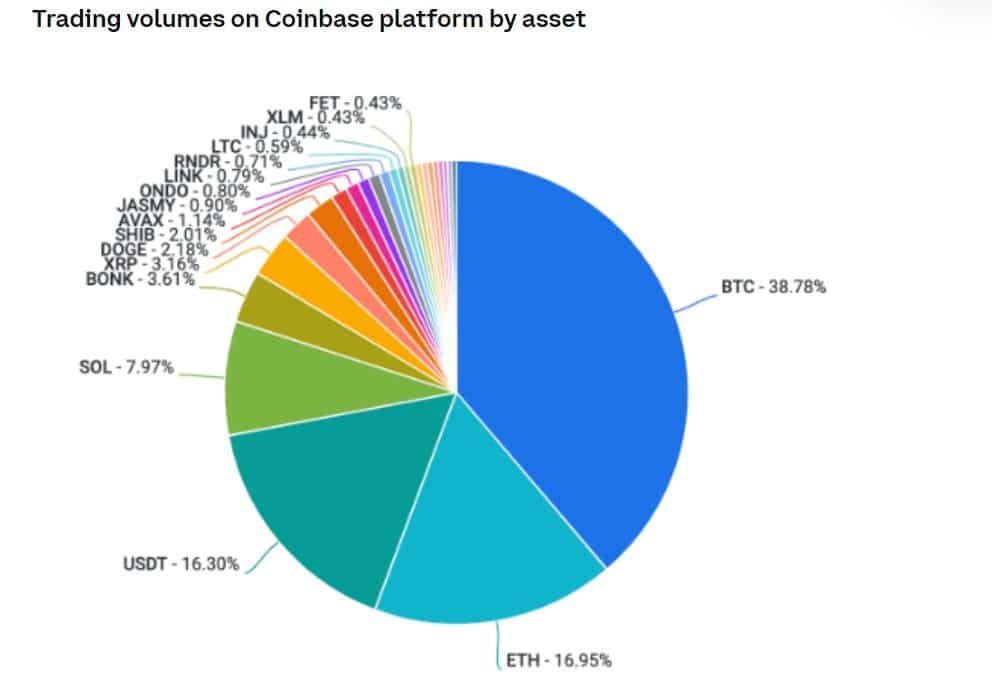

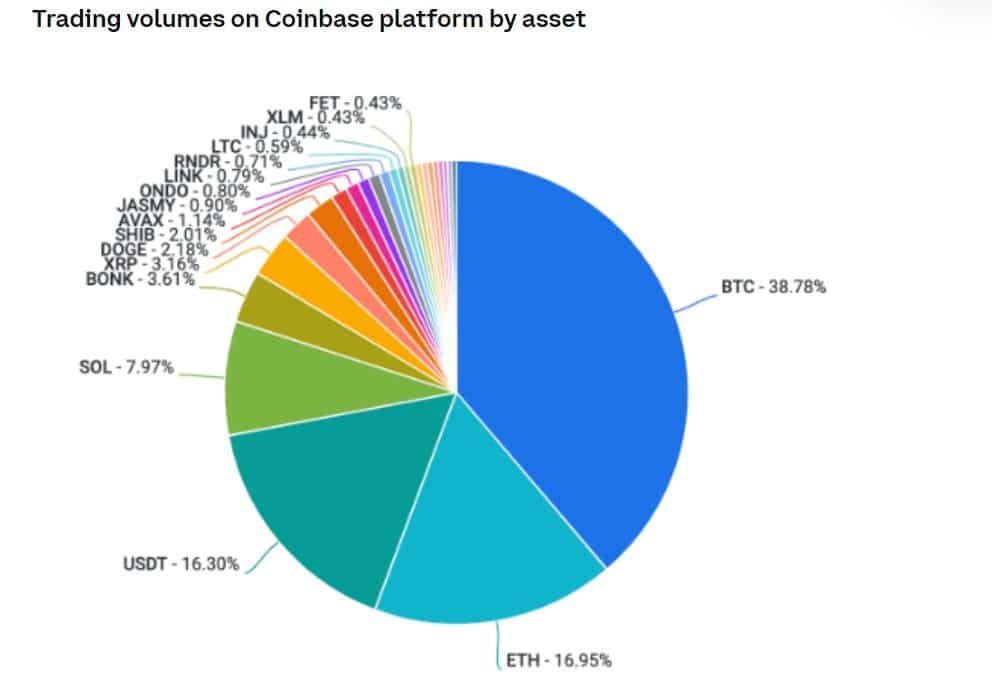

In recent months, the 11% decline in revenue is due to crypto volatility. Likewise, the exchange has also seen lower trading volumes, resulting in declines in revenue.

The exchange reported a 27% decline in revenue to $781 million, but only reported an increase in services revenue to $599 million.

Source: Coinbase

However, the company’s shares are up 64.56% over the past six months, with share prices up 35.54% YTD.

Despite the profitability announcement, the share price in the second quarter report has fallen by 5.22% in the past 24 hours, by 11.72 at the time of writing.

Source: Google Finance

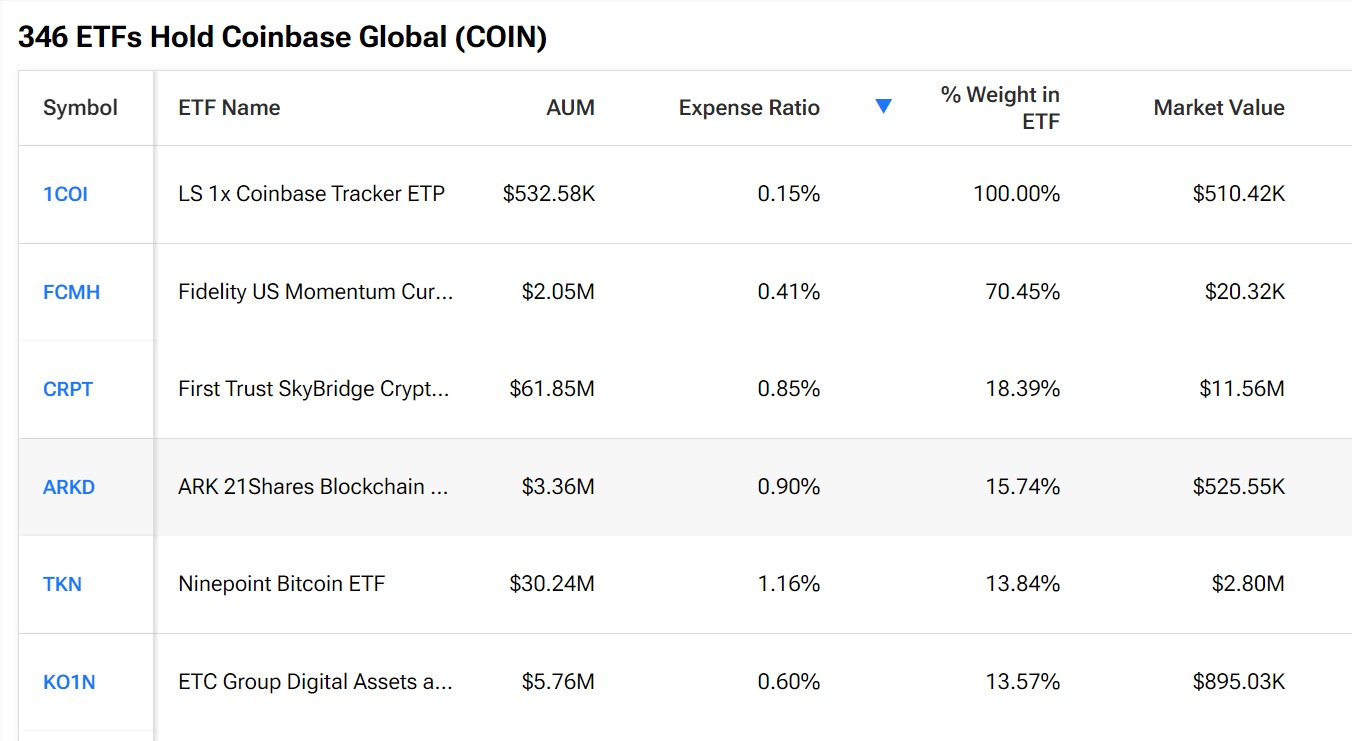

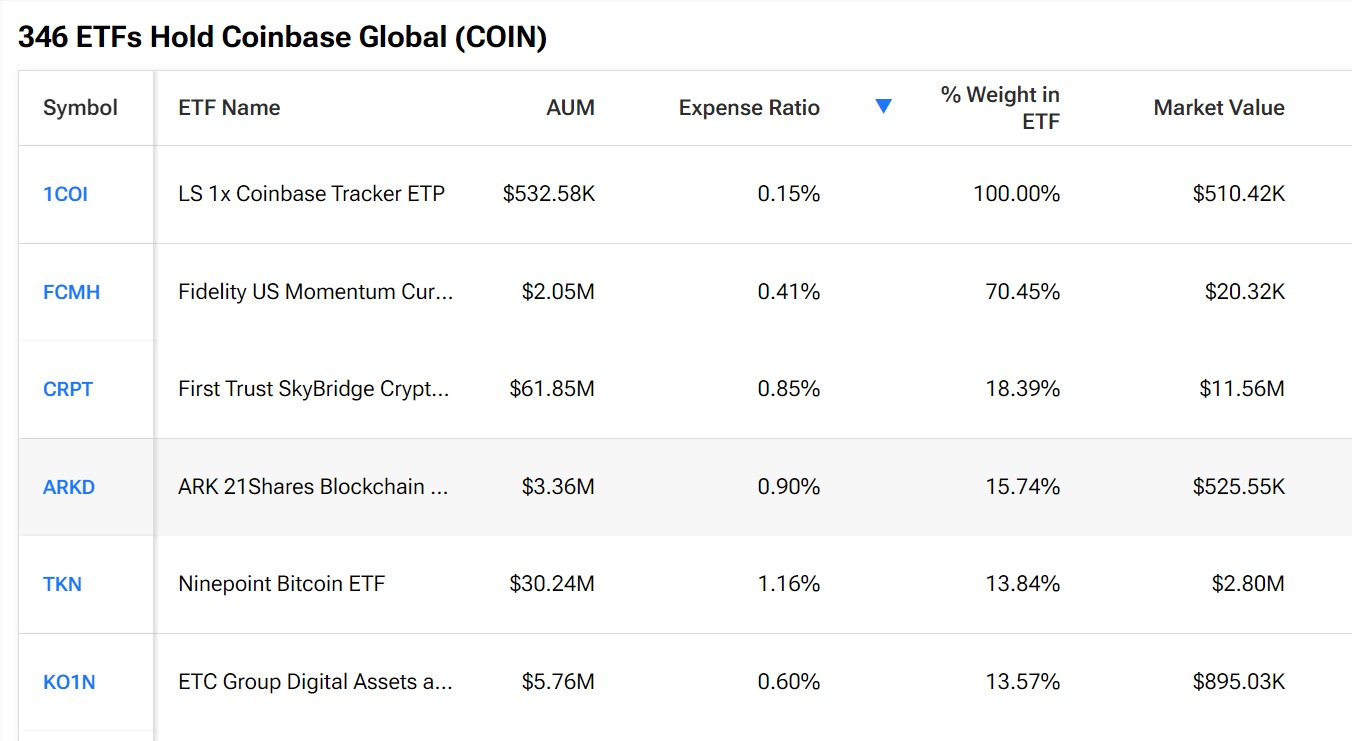

Profits from ETFs

Source: Tipranks

Coinbase is the primary custodian for most ETFs, allowing the exchange to benefit greatly from custody fees. For the uninitiated, Coinbase charges a 0.2% custody fee, making it relatively affordable.

With the rise of spot ETFs, Coinbase is the custodian of 10 Bitcoin [BTC] ETFs and eight Ethereum [ETH] ETFs. This has made the platform dominant in these areas, although it makes up a small portion of Q2 revenue.

Alesia Haas pointed out the importance of ETFs, adding:

“ETFs have been great for our industry. They have truly generated a flywheel of activity within our product platform and deeper engagement across the entire ecosystem.”

Coinbase calls for regulatory clarity

Through the Q2 report, the exchange has taken note of the recent regulatory changes with greater regulatory clarity, which have proven to be beneficial.

Brian Armstrong pointed out the importance of regulatory clarity and the need for clear rules and policies. In his statement he added that,

“90% of institutional investors say regulatory clarity would increase their confidence in investing in crypto. For these reasons, Coinbase will continue to push for clear rules in the courts, in Congress, and in the November elections.”

According to the exchange, the US should therefore provide clarity, as in the case of MICA in Europe.

Armstrong argued that such clarity is essential and will increase institutional investment and the investment of other major investors. The exchange noted that they spent $26 million to provide regulatory clarity in the second quarter.