- Coinbase BTC reserves have fallen since February

- BTC’s price woes over the past week have resulted in more outflows from the spot ETF market

Coinbase Bitcoin [BTC] Reserves have fallen 15% since February, pseudonymous CryptoQuant analyst Burakkesmeci found in a new report. report.

Coinbase BTC Reserve keeps track of the amount of Bitcoins its users hold on the cryptocurrency exchange. It measures everything from the coins users have in their Coinbase wallet, to the coins they deposit into the exchange for trading purposes.

When it falls, coin holders sell their assets or move their BTCs to personal wallets for long-term storage.

According to Burakkesmeci, the four-month decline in Coinbase BTC Reserves is a result of “increased demand due to Spot ETFs.”

State of Play on the Spot BTC ETF Market

At the time of writing, the cumulative BTC volume was held by the issuers, namely BlackRock (IBIT), the Grayscale Bitcoin Trust (GBTC), Fidelity (FBTC), Ark Invest/21Shares (ARKB), Bitwise (BITB), Franklin (EZBC) , Invesco/Galaxy (BTCO) , VanEck (HODL) , Valkyrie (BRRR) , WisdomTree (BTCW) , and Hashdex (DEFI) , totaling $296.32 billion.

According to The Block data dashboardSince this asset class became tradable in January, daily volumes have continued to grow on the charts.

Of all spot BTC ETF issuers, BlackRock currently has the highest assets under management (AuM). At the time of writing, this amounted to $20.49 billion.

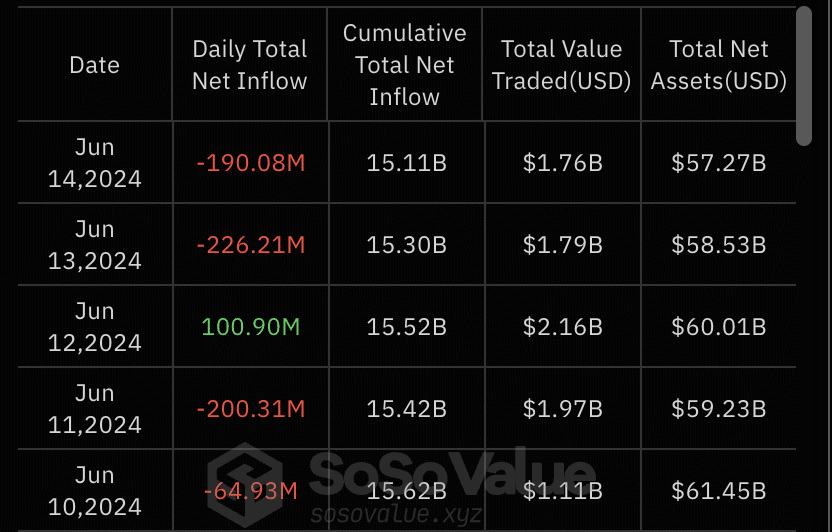

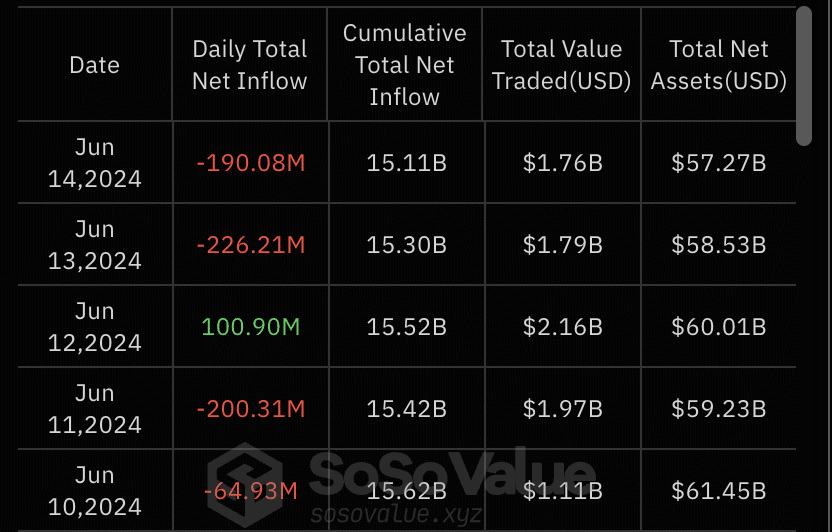

According to sosovalue.xyz ETF dashboardSince June 13, there has been a decline in demand for spot BTC ETFs. On that day, outflows from the market totaled $226.21 million.

This trend continued on June 14, with net outflows from the spot market for BTC ETFs reaching $190.08 million.

AMBCrypto found that Fidelity’s FBTC recorded the largest outflow on the day, with $80 million disappearing from its portfolio. It was followed by Grayscale’s GBTC, which saw outflows totaling $52 million.

Read Bitcoin (BTC) price prediction 2024-2025

According to sosovalue.xyz’s data dashboard, BlackRock’s outflows that day were $7 million.

Since June 10, the spot market for BTC ETFs has recorded outflows on four out of five days. This can be attributed to BTC’s weak performance over the past seven days.

Source: sosovalue.xyz

At the time of writing, the market’s leading cryptocurrency was valued at $66,061. According to CoinMarketCapits value fell by 5% in just 7 days, with BTC now facing significant resistance at the $70,000 price level.