- Circle makes risk averse moves regarding its treasury. Despite high certainties, overall sentiment remains negative.

- USDC’s dominance in the DeFi market is starting to wane and the market cap is falling.

Circle has been in the news lately due to the bankruptcy of the Silicon Valley Bank (SVB). After the collapse and the impact it had on USDC’s market cap and pegging, governance at Circle has become increasingly risk averse.

This was demonstrated by the comments made by Circle CEO Jeremy Allaire in a recent interview. He reportedly disclosed that Circle does not hold US Treasuries due early June. According to Circle’s March audit report$28.8 billion of Circle’s total reserves were held in U.S. Treasury bonds.

So why was this decision made?

Play safe

According to Jeremy, Circle does not want to be exposed to a possible violation of the US government’s ability to pay its debts.

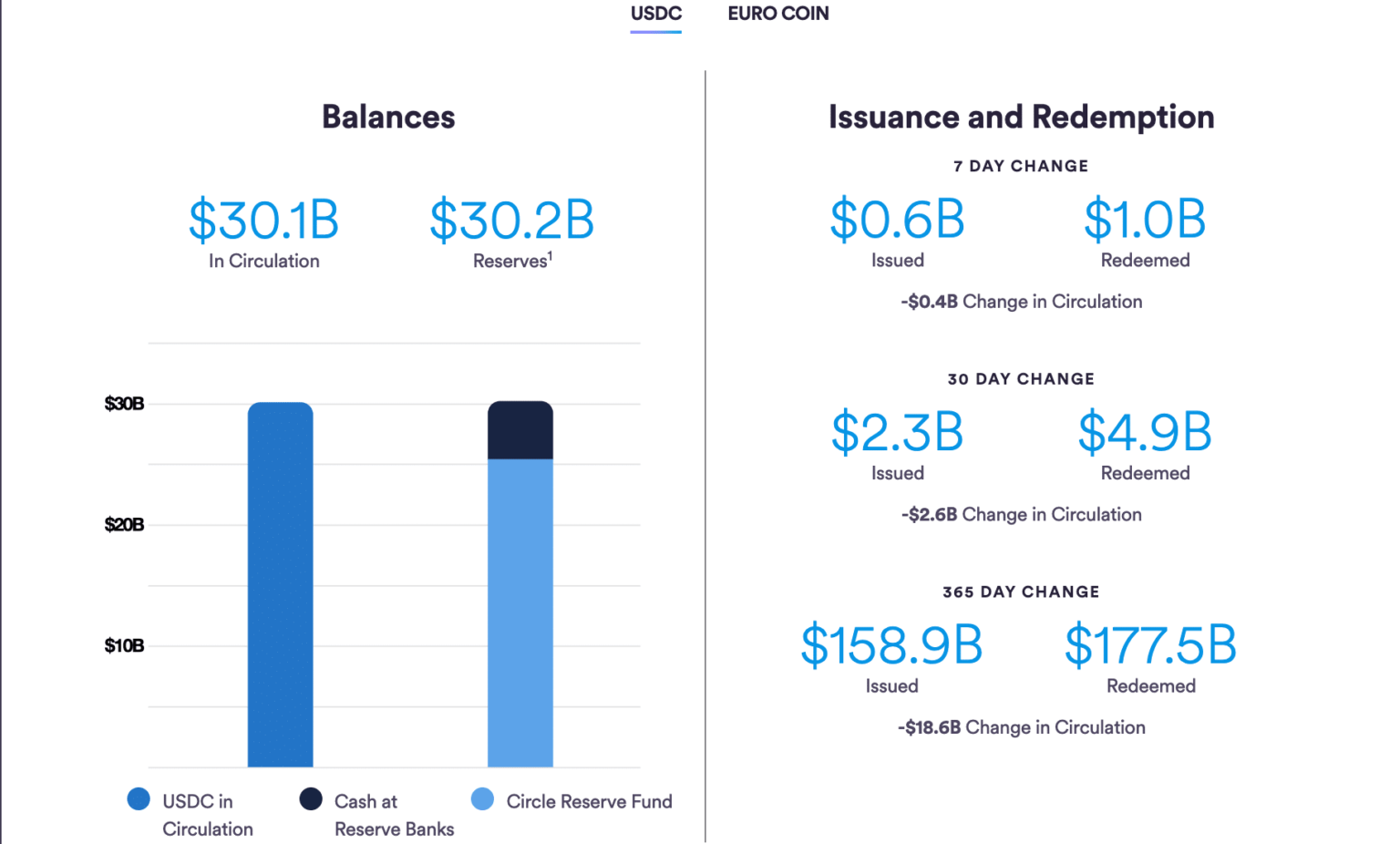

After being hit hard by the fall of SVB, Circle has been extremely careful with the allocation of its funds. At the time of writing, Circle had $30.2 billion in its reserves and $4.8 billion in the banks. Compared to the amount in circulation, Circle has succeeded in collateralizing USDC.

USDC also showed negative net issuance. This indicated that the amount of USDC burned (or withdrawn from circulation) is greater than the amount minted (or created). Essentially, more USDC is being exchanged or withdrawn than is being spent, leading to a decrease in the total supply.

Source: Circle

Despite these factors, overall sentiment around USDC remained negative. Over the past few weeks, weighted sentiment around USDC has turned increasingly negative. This indicated that the crypto community had begun to amplify the negative comments surrounding USDC.

Source: Sentiment

Coupled with that, the stablecoin also witnessed declining interest in the DeFi sector. According to data from Dune Analytics, total DEX swap volume fell significantly from over $15 billion to $1.19 billion.

Source: Dune analysis

In terms of market capitalization, USDC was still lagging as USDT continued to take a large share of the market share. However, both stablecoins saw a decline in terms of network growth, suggesting that new addresses started to lose interest in both stablecoins.

Source: Sentiment