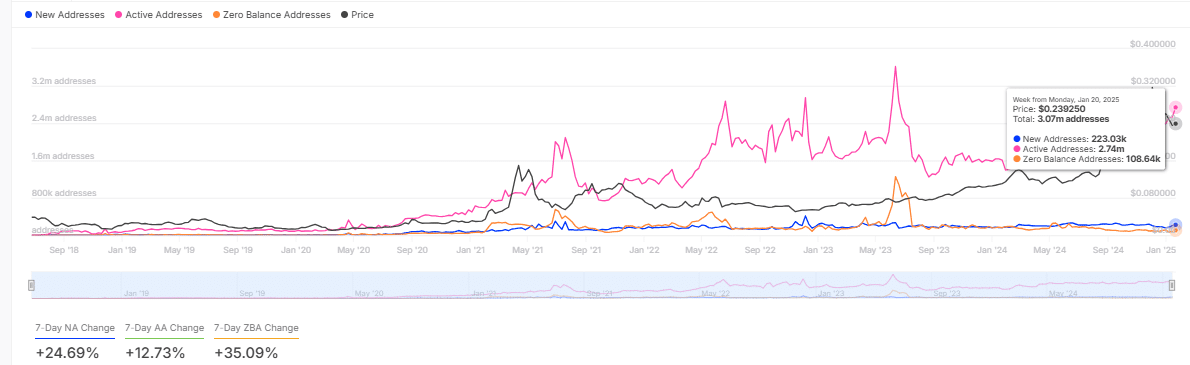

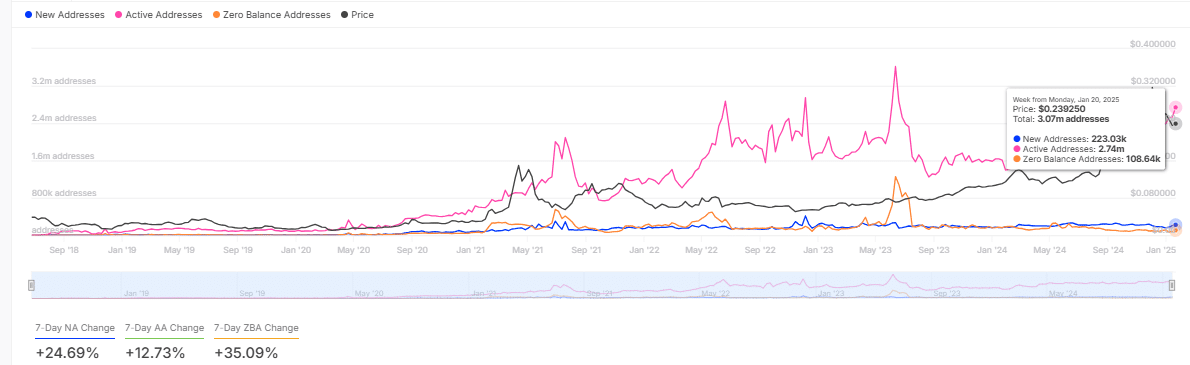

- Tron increased by 24.69% and 12.73% in new and active addresses respectively, indicating increasing user engagement.

- World Liberty Finance acquired 10.8 million TRX for $2.65 million USDT.

Tron [TRX] has recently been in the spotlight due to remarkable developments in the chain and strategic acquisitions. Its increasing adoption and activity reflected price movements.

The recent high-profile purchases by World Liberty Finance (WLFi) have fueled market speculation.

On-chain data has revealed a steady increase in the number of TRX active addresses, which recently reached 2.47 million. This increase matched the price increase, which reached $0.239 during the same period.

It is striking that the number of new addresses has increased by 24.69% in the past week, indicating greater interest in the network. This growth indicates strong network adoption, likely driven by positive market sentiment and renewed use cases.

Source: Into The Block

Interestingly, zero-balance addresses also grew by 35.09%, indicating a wave of speculative interest.

While the data points to healthy adoption, the price correlation points to potential short-term profit-taking. If active addresses maintain this pace, TRX could achieve sustainable growth.

However, a slowdown could signal future price consolidation.

Trump’s WLFi Acquisition of TRX Despite Cautious Sentiment

World Liberty Finance’s acquisition of 10.8 million TRX for $2.65 million USDT demonstrates the growing institutional interest in Tron.

WLFi’s total assets now stand at 30.1 million TRX, valued at $7.36 million.

This fits in with their broader strategy, as they also bought $47 million worth of ETH, wBTC and $4.7 million each of AAVE, LINK, TRX and ENA to celebrate the inauguration of Donald J. Trump as the 47th President of the United States. States to commemorate.

These high-quality acquisitions underline the confidence in TRX and its ecosystem. This influx of institutional capital could lead to further price increases in the short term.

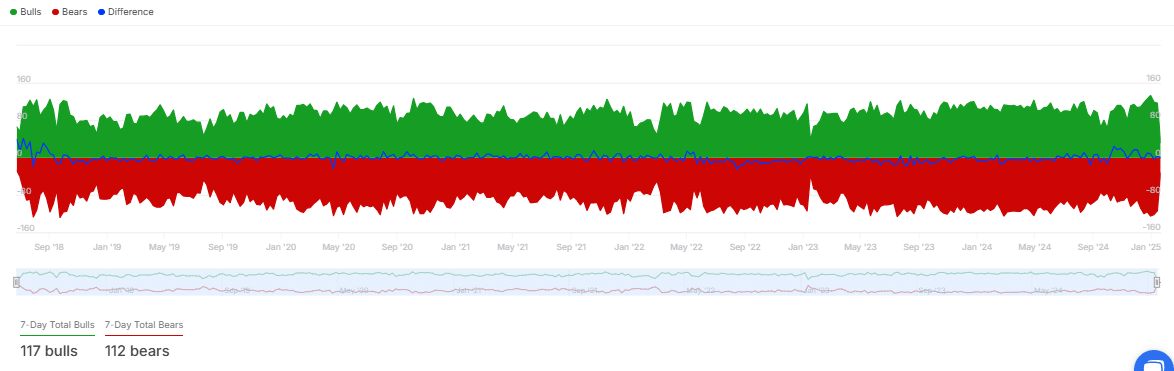

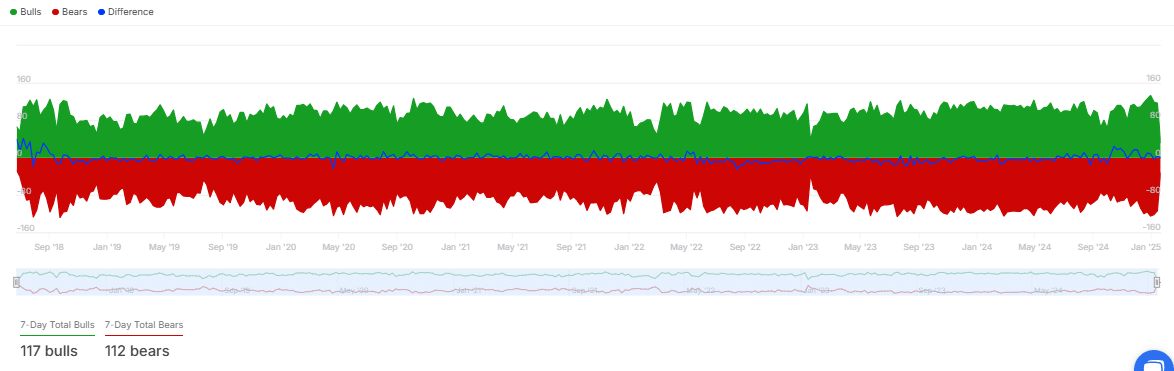

Despite the bullish sentiment driven by WLFi’s acquisitions and rising active addresses, the TRX bulls-versus-bears metric suggests a balanced but cautious outlook.

The latest data shows that there are 117 bulls compared to 112 bears, indicating a narrow margin for bullish traders. This small difference implies that market participants remain divided on TRX’s next move.

Source: Into The Block

Historically, similar patterns have preceded short-term volatility, as neither side decisively dominates the market.

If bulls gain momentum, TRX could move towards higher resistance levels. Conversely, a stronger presence of bears could lead to a price correction.

Will TRX maintain its bullish momentum?

The broader question remains whether TRX, buoyed by WLFi’s strategic purchases and rising underwriting rates, can maintain its bullish momentum.

While the token’s price movement and on-chain metrics are positively aligned, external factors such as macroeconomic conditions and Bitcoin’s dominance can influence its trajectory.

Read Tron’s [TRX] Price forecast 2025–2026

Historically, tokens associated with high-profile stories have seen short-term gains but struggled with sustainability.

For TRX to maintain its upward momentum, it will require continued institutional support, strong network activity and a favorable market environment.