- A notable reduction in capital inflows into the cryptocurrency market has contributed to the slowdown in the peak season

- Tokens such as BNB and AAVE are expected to maintain their bullish outlook despite the setback

The capitalization of the larger cryptocurrency market has been declining lately, down 2.06% to $3.33 trillion. However, a broader analysis showed a steeper decline of 18.33%, from $3.7 trillion in November to $3.28 trillion on December 24.

Over the past 24 hours, the market’s decline coincided with a 3.3% increase in trading volume, with figures for the same figure reaching $121.84 billion. This indicated that traders’ selling pressure was backed by actual momentum.

Such downward market trends often affect the performance of altcoins, especially since these tokens typically follow the direction of the broader market. According to AMBCrypto’s analysis, the decline in capital inflows has played a crucial role in the ongoing market decline.

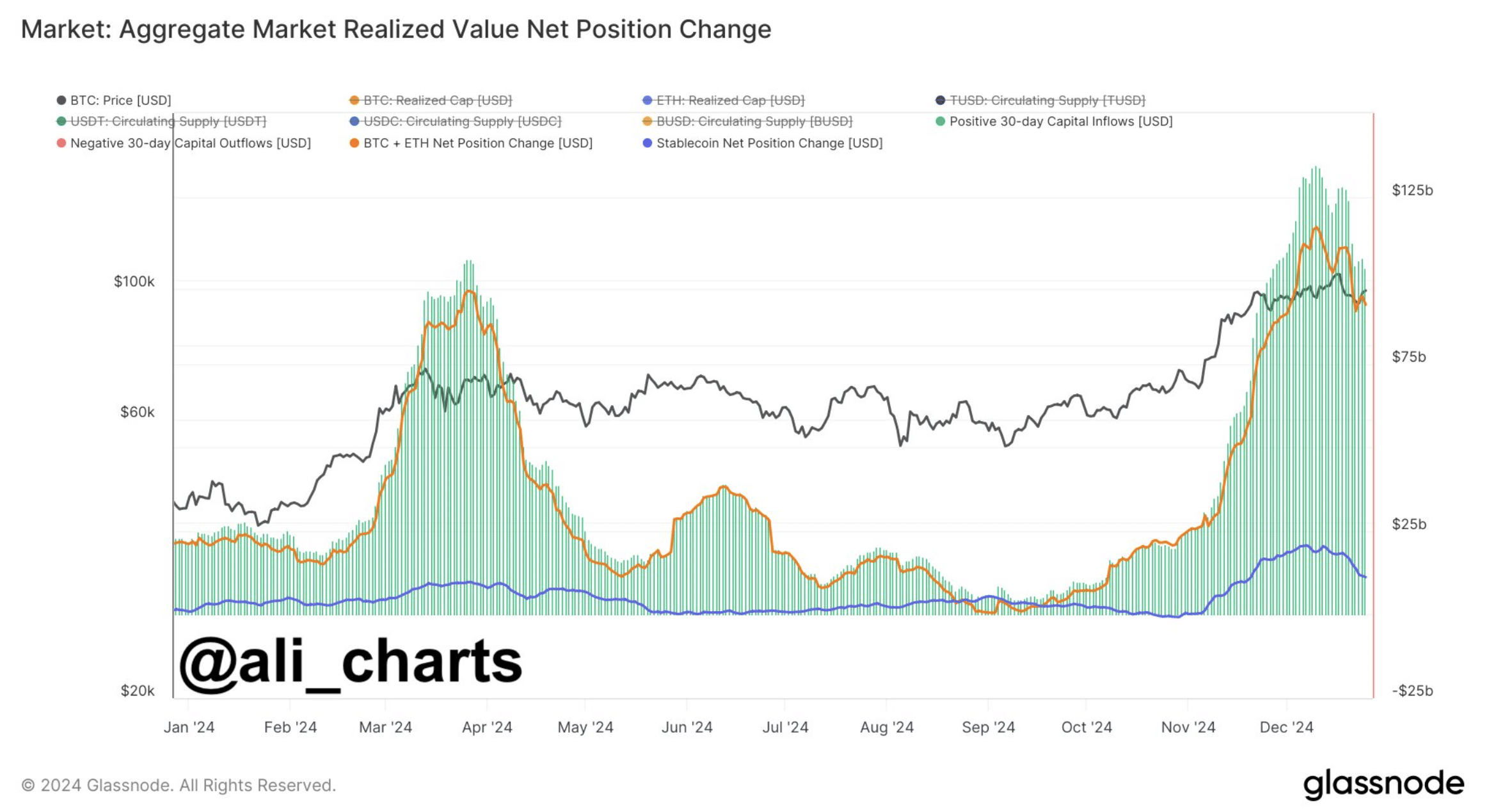

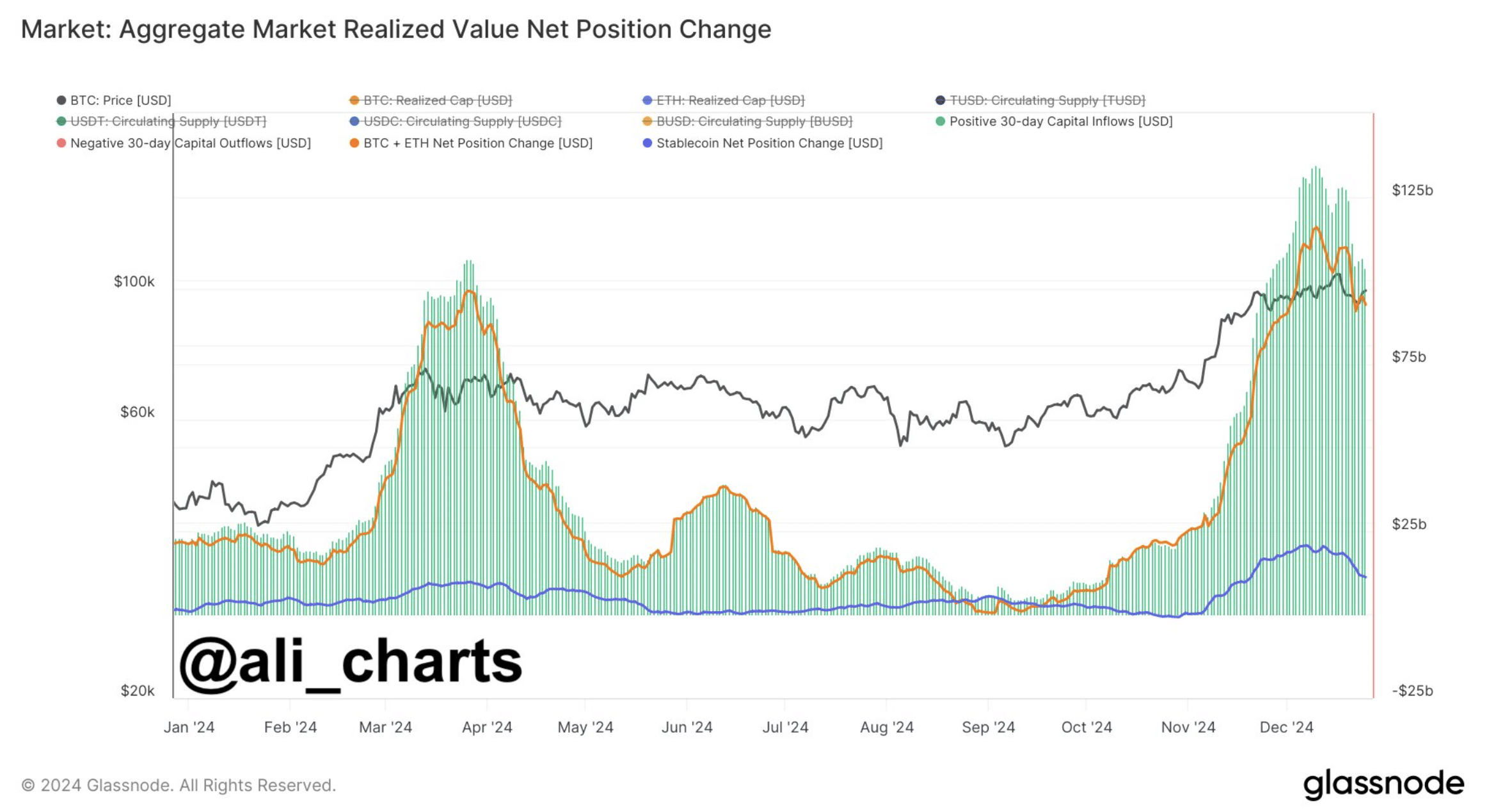

Liquidity flows show a significant decline

According to Glassnode, there has been a notable decline in capital inflows into the cryptocurrency market – a sign of a lack of active investments.

Data from the Aggregate Market Realized Value Net Position Change metric showed that capital inflows, measured in USD, fell from $134 billion on December 10 to $100 billion at the time of writing.

Source:

Such a downturn is usually a sign that the market does not have bullish sentiment for most cryptocurrencies. Instead, investors seem to prefer holding stable assets rather than buying volatile tokens. This would reinforce bearish market sentiment and increase the likelihood of continued declines.

However, despite the overall decline in capital inflows, some tokens can be expected to maintain their bullish momentum and potentially outperform the broader market.

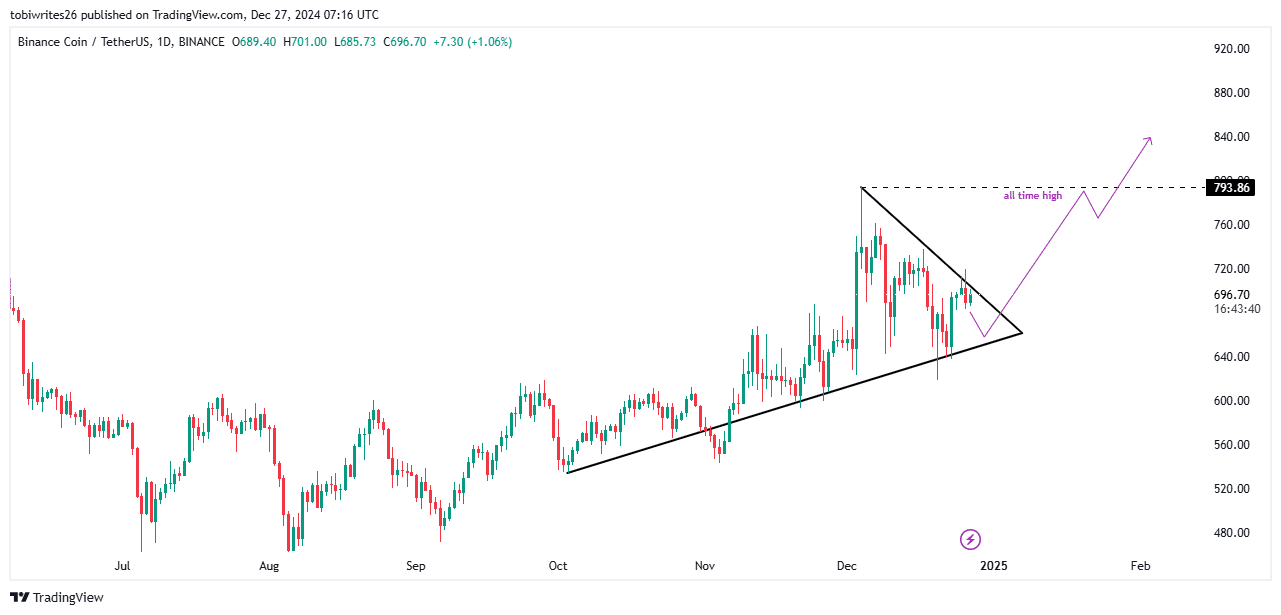

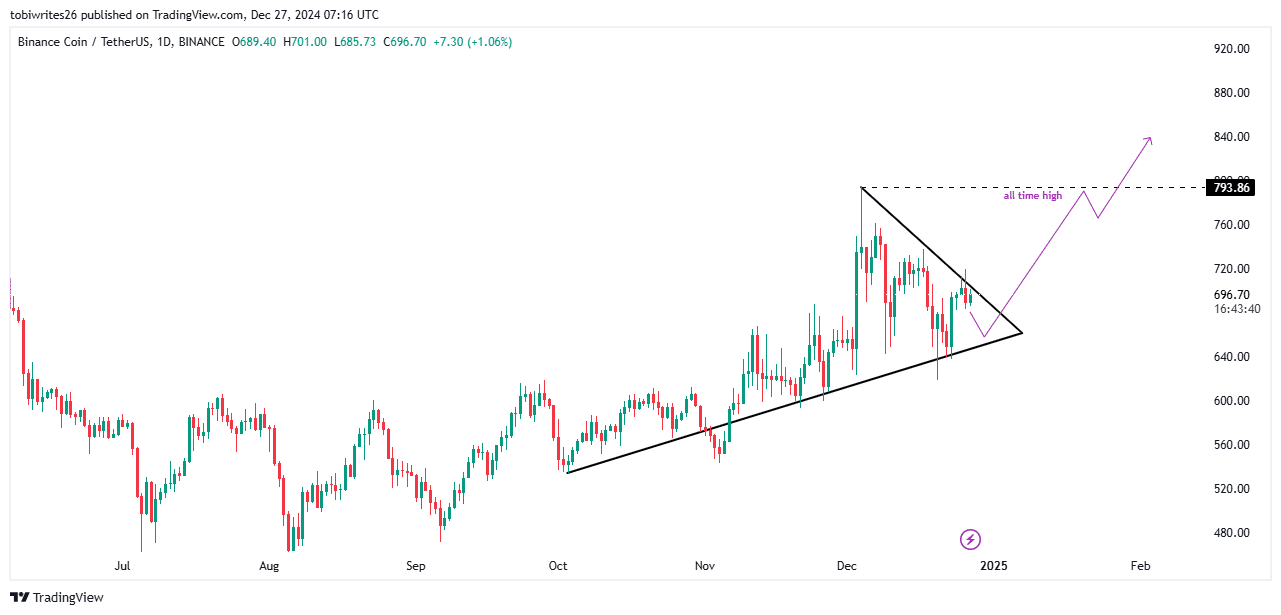

BNB is about to hit a new all-time high

BNB remains one of the best performing cryptocurrency assets of 2024, reaching two all-time highs within the year.

After the previous peak of $691.77 in 2021, BNB surpassed this level in June 2024, reaching $721.80 on the charts. In December 2024, it set a new record, trading at $793.86.

Source: trading view

At the time of writing, BNB appeared to be in an accumulation phase as evidenced by the chart patterns. If the token leaves this phase, it could spark another rally, with a high chance of surpassing its previous high and targeting levels above $800.

AAVE remains structurally bullish

On the price chart, AAVE has maintained its position in the bullish zone. After months of market consolidation, the asset broke through in January, rising 332.78% to $399.85 – a level last seen in 2021.

AAVE set a new record for its Total Value Locked (TVL) on December 17, peaking at $23.19 billion. However, the TVL has since shown a small decline to $20.63 billion. This slight dip suggested that AAVE remains fundamentally bullish, especially as activity on the protocol continues to grow.

Source: DeFiLlama

If the TVL stabilizes or rises, AAVE’s price will likely extend its upward momentum. Especially because it is central to driving the platform’s activities.

An important requirement for the altcoin season

A key condition for achieving an offseason rally is a decline in Bitcoin dominance, a metric that compares Bitcoin’s performance to other altcoins in the market. When Bitcoin dominance is high, it indicates that Bitcoin is outperforming most altcoins. Conversely, lower dominance suggests altcoins are performing stronger.

At the time of writing, CoinMarketCap reported that Bitcoin Dominance fell slightly by 0.18%, to 56.94%.

As Bitcoin dominance remains relatively high, the altseason may be postponed. At least until a more significant drop occurs, potentially bringing it below the 50% mark.